Help please!

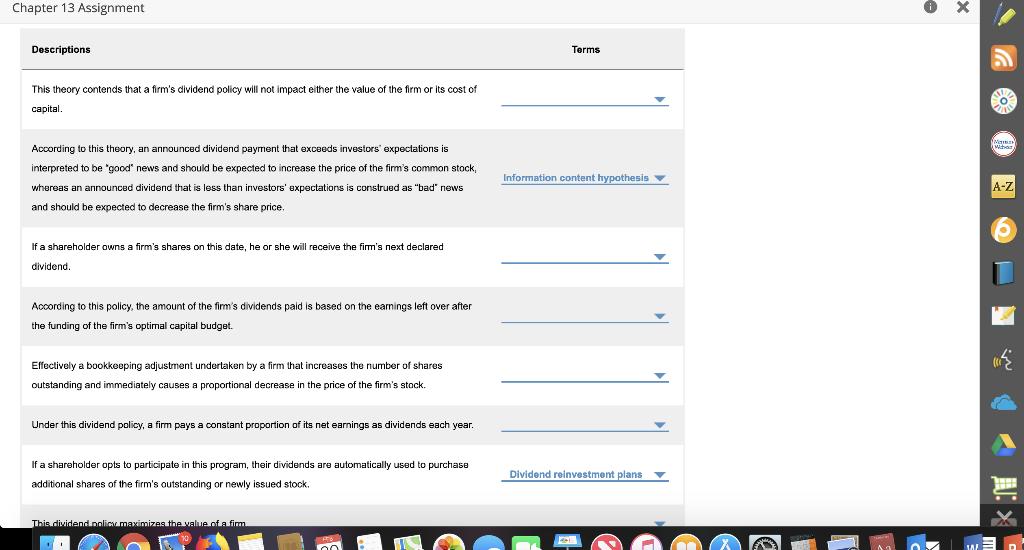

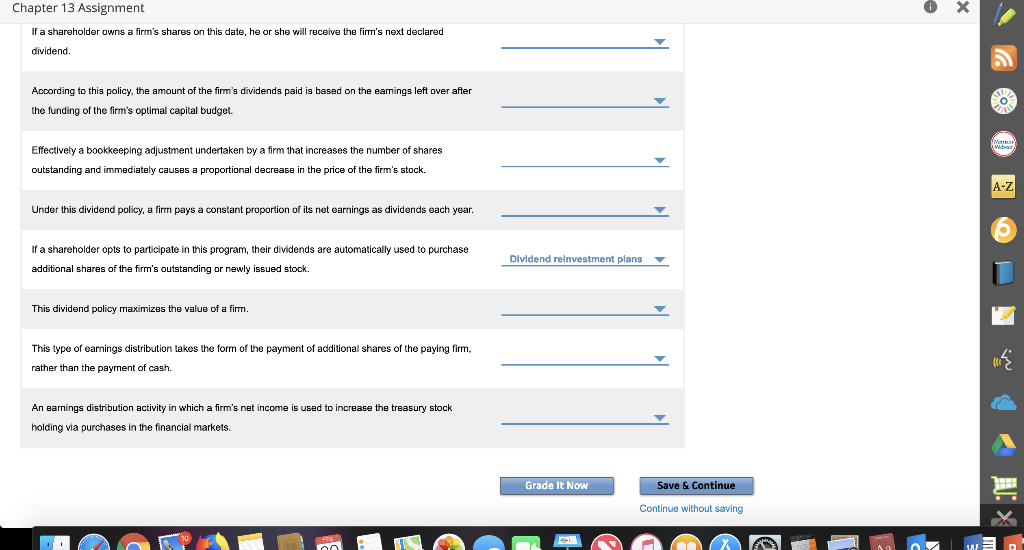

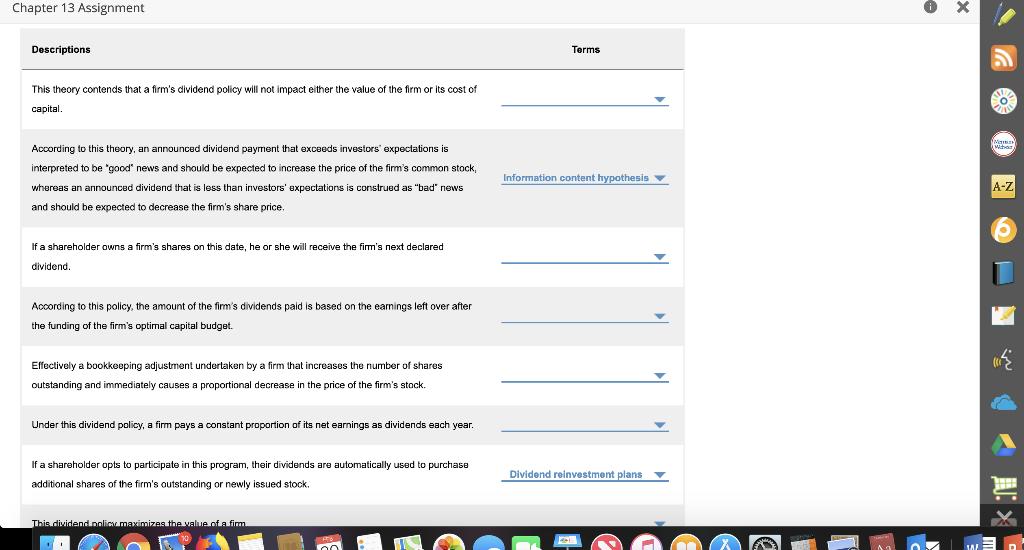

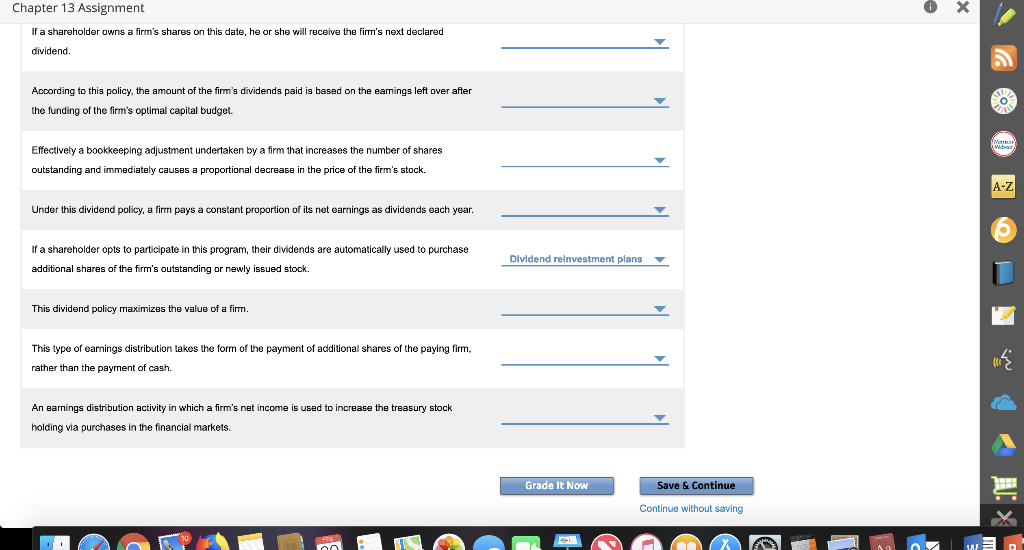

Chapter 13 Assignment Descriptions Terms This theory contends that a firm's dividend policy will not impact either the value of the firm or its cost of capital According to this theory, an announced dividend payment that exceeds investors' expectations is interpreted to be 'good" news and should be expected to increase the price of the firm's common stock, whereas an announced dividend that is less than investors' expectations is construed as "bad" news and should be expected to decrease the firm's share price Information content hypothesisY A-Z If a shareholder owns a firm's shares on this date, he or she will receive the fim's next declared dividend According to this policy, the amount of the fim's dividends paid is based on the earnings left over after the funding of the firm's optimal capital budget. Effectively a bookkeeping adjustment undertaken by a firm that increases the number of shares outstanding and immediately causes a proportional decrease in the price of the firm's stock. Under this dividend policy, a firm pays a constant proportion of its net earnings as dividends each year If a shareholder opts to participate in this program, their dividends are automatically used to purchase Dividend reinvestment plans additional shares of the firm's outstanding or newly issued stock Chapter 13 Assignment Descriptions Terms This theory contends that a firm's dividend policy will not impact either the value of the firm or its cost of capital According to this theory, an announced dividend payment that exceeds investors' expectations is interpreted to be 'good" news and should be expected to increase the price of the firm's common stock, whereas an announced dividend that is less than investors' expectations is construed as "bad" news and should be expected to decrease the firm's share price Information content hypothesisY A-Z If a shareholder owns a firm's shares on this date, he or she will receive the fim's next declared dividend According to this policy, the amount of the fim's dividends paid is based on the earnings left over after the funding of the firm's optimal capital budget. Effectively a bookkeeping adjustment undertaken by a firm that increases the number of shares outstanding and immediately causes a proportional decrease in the price of the firm's stock. Under this dividend policy, a firm pays a constant proportion of its net earnings as dividends each year If a shareholder opts to participate in this program, their dividends are automatically used to purchase Dividend reinvestment plans additional shares of the firm's outstanding or newly issued stock