help please

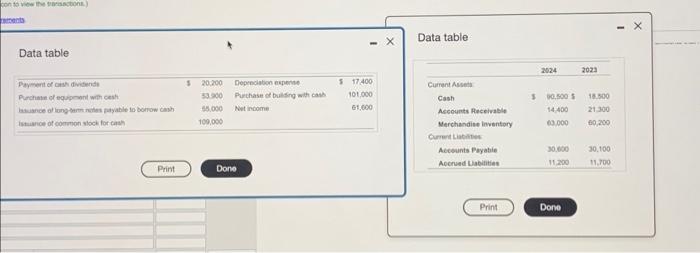

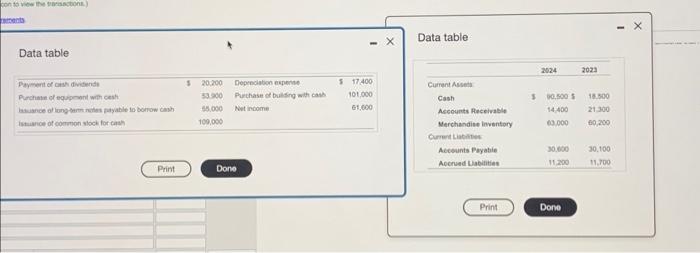

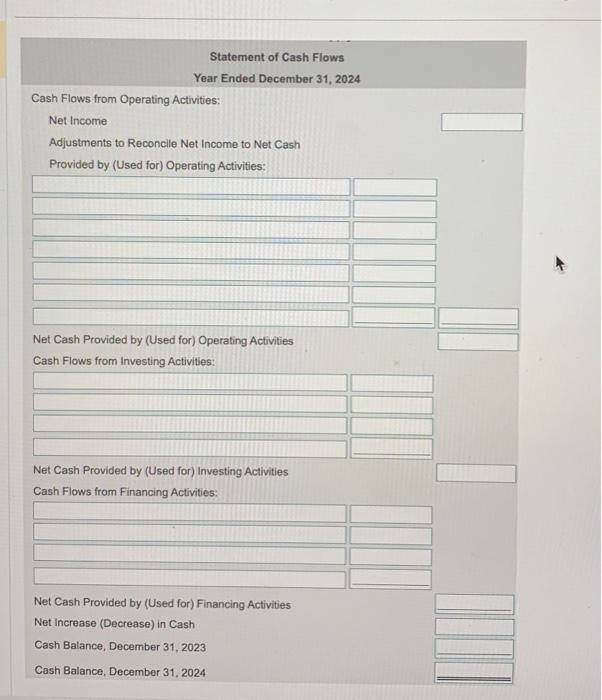

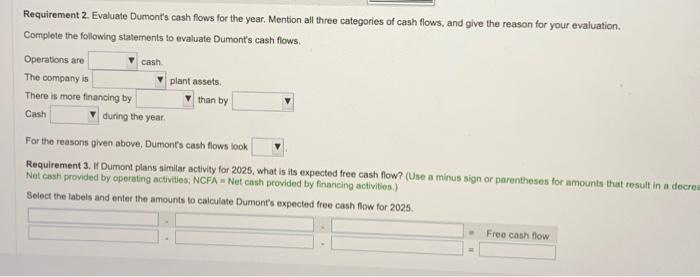

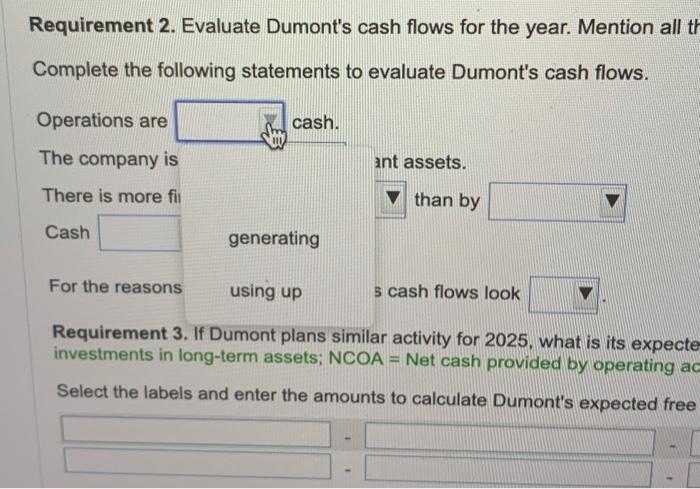

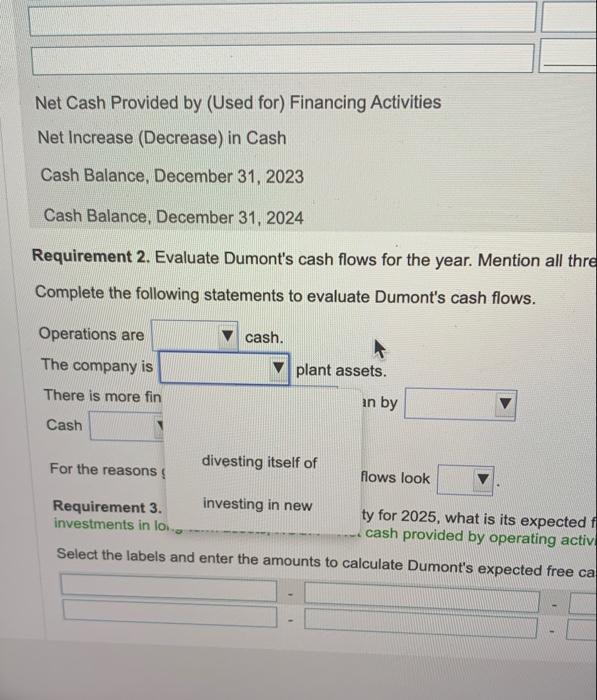

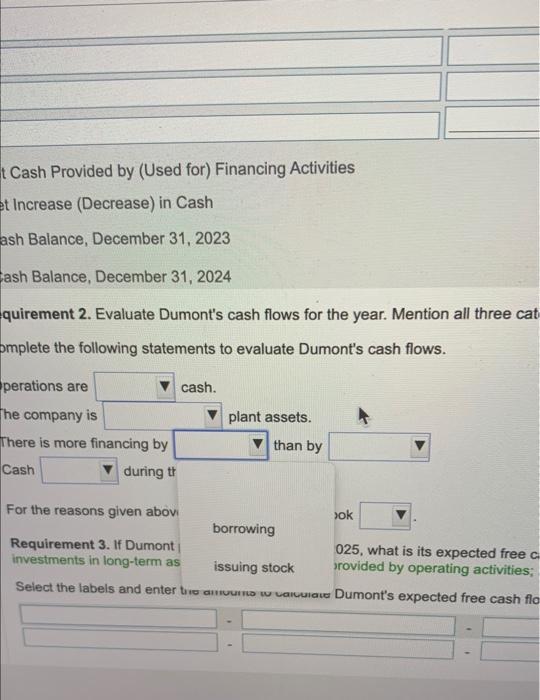

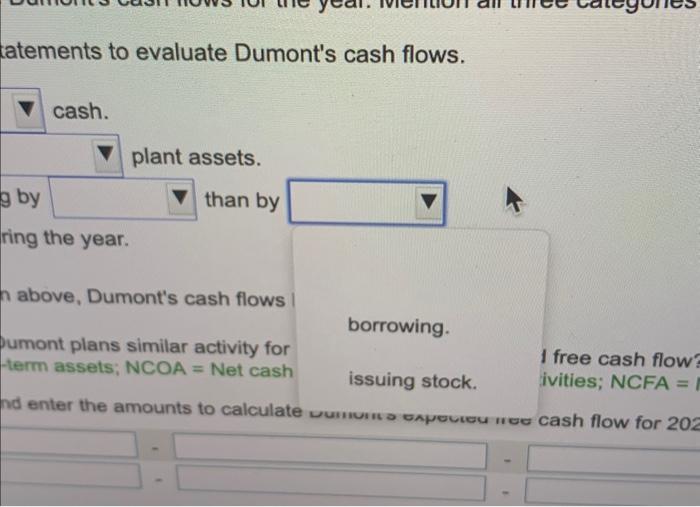

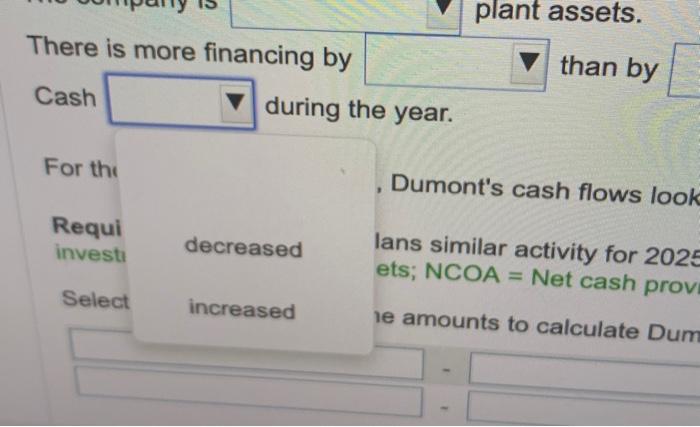

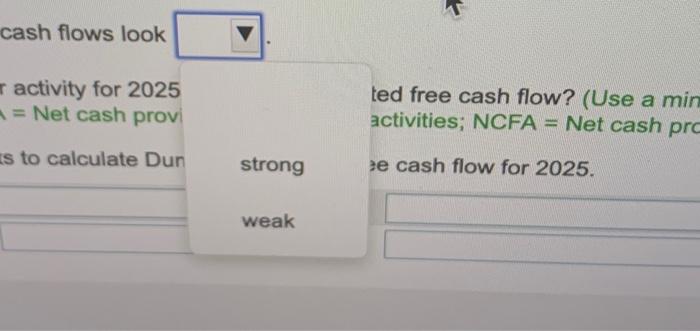

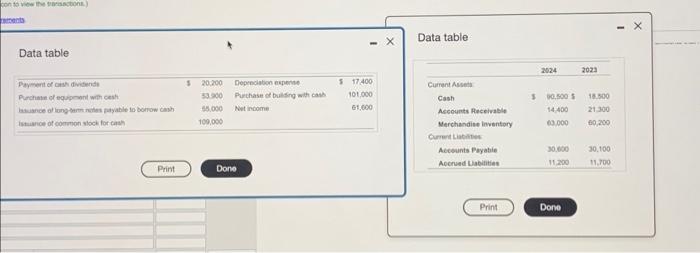

don to vibe ife warascagnis.) Data table Data table Statement of Cash Flows Year Ended December 31, 2024 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net increase (Decrease) in Cash Cash Balance, December 31, 2023 Cash Balance, December 31, 2024 Requirement 2. Evaluate Dumont's cash fows for the year. Mention all three categories of cash flows, and give the reason for your evaluation. Complete the following statements to evaluate Dumont's cash flows. Operations ate cash. The company is plant assets, There is more financing by than by Cash duing the year. For the reasons given above, Dumont's cash flows look Requirement 3. If Dumont plans fimilar activity for 2025. what is its expected free cash flow? (Use a minus sign or parentheses for amounts that result in a decre Net cosh provided by operating activities; NCFA w Net cash provided by financing activities.) Select the labels and enter the amounts to caiculate Dumonts expected free cash fow for 2025. Requirement 2. Evaluate Dumont's cash flows for the year. Mention all Complete the following statements to evaluate Dumont's cash flows. Operations are The company is There is more fil Cash For the reasons cash. ant assets. than by generating using up 5 cash flows look 5 cash flows look Requirement 3. If Dumont plans similar activity for 2025, what is its expecte investments in long-term assets; NCOA = Net cash provided by operating ac Select the labels and enter the amounts to calculate Dumont's expected free Cash Balance, December 31, 2023 Cash Balance, December 31, 2024 Requirement 2. Evaluate Dumont's cash flows for the year. Mention all thr Complete the following statements to evaluate Dumont's cash flows. Operations are cash. The company is There is more fin Cash For the reasons divesting itself of flows look Requirement 3. investing in new investments in loi. ty for 2025, what is its expected cash provided by operating acti Select the labels and enter the amounts to calculate quirement 2. Evaluate Dumont's cash flows for the year. Mention all three cat omplete the following statements to evaluate Dumont's cash flows. perations are There is more financing by Cash during tr For the reasons given abovi Requirement 3. If Dumont investments in long-term as cash. plant assets. than by borrowing issuing stock rok 025, what is its expected free c rovided by operating activities; Select the labels and enter tiro arivurio w vaiuriaie Dumont's expected free cash flo ratements to evaluate Dumont's cash flows. cash. plant assets. 9 by than by ring the year. h above, Dumont's cash flows umont plans similar activity for borrowing. -term assets; NCOA = Net cash issuing stock. 1 free cash flow? ivities; NCFA = nd enter the amounts to calculate umiuns oxpeure nee cash flow for 202 plant assets. There is more financing by than by Cash during the year. For thi Dumont's cash flows look Requi lans similar activity for 2025 ets; NCOA = Net cash prov Select decreased increased le amounts to calculate Dum cash flows look activity for 2025 = Net cash provi to calculate Dun ted free cash flow? (Use a min activities; NCFA = Net cash pro ze cash flow for 2025. strong weak