Answered step by step

Verified Expert Solution

Question

1 Approved Answer

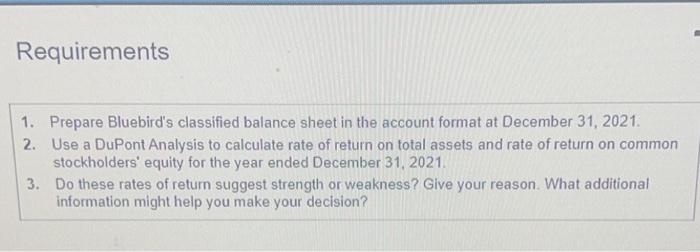

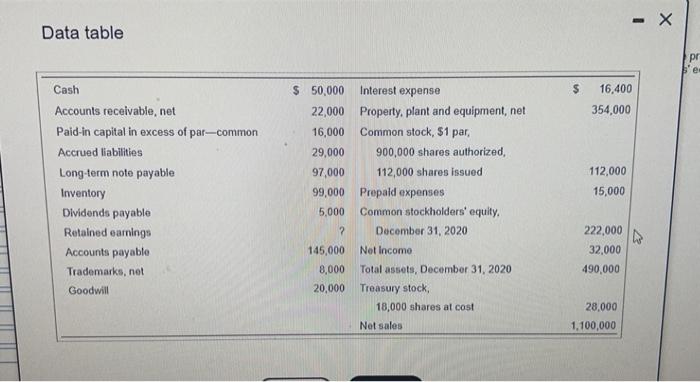

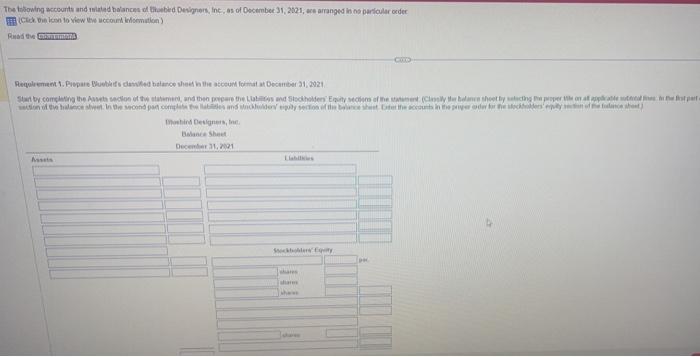

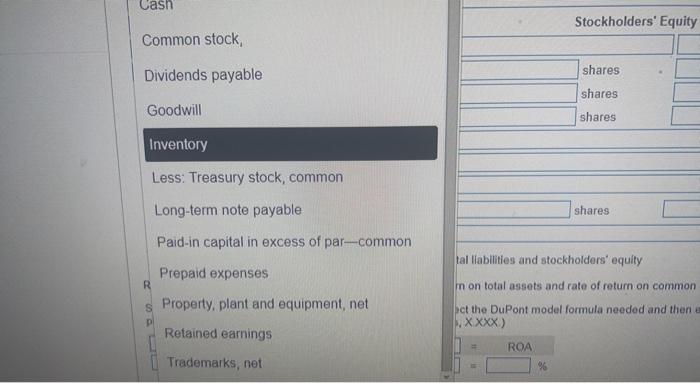

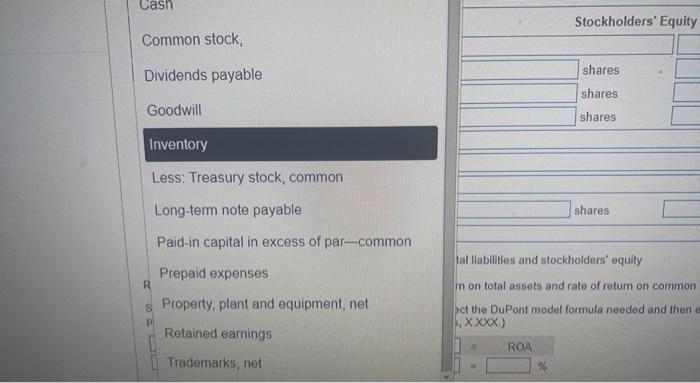

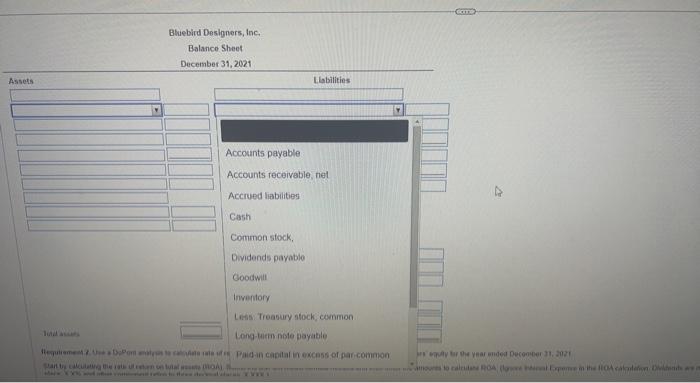

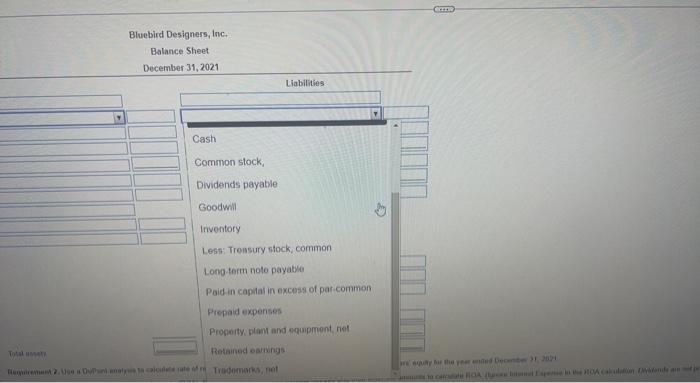

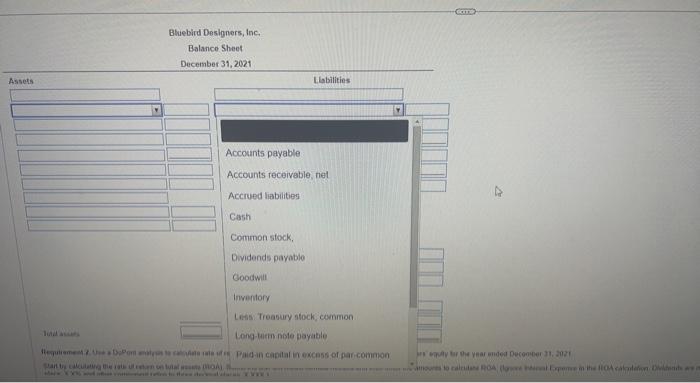

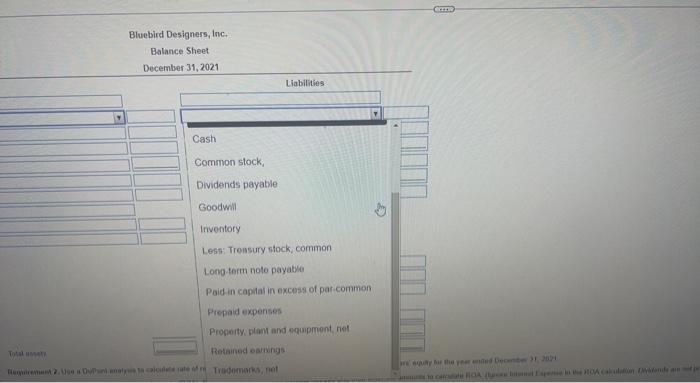

help please due soon(very clear pics) Requirements 1. Prepare Bluebird's classified balance sheet in the account format at December 31, 2021. 2. Use a DuPont

help please due soon(very clear pics)

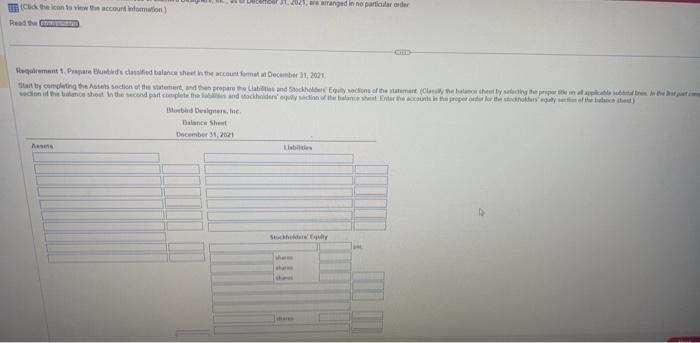

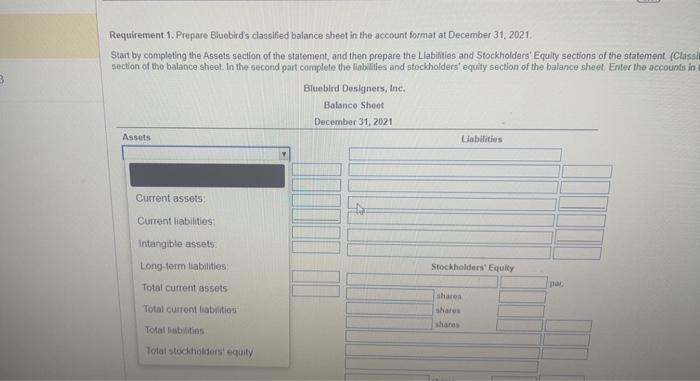

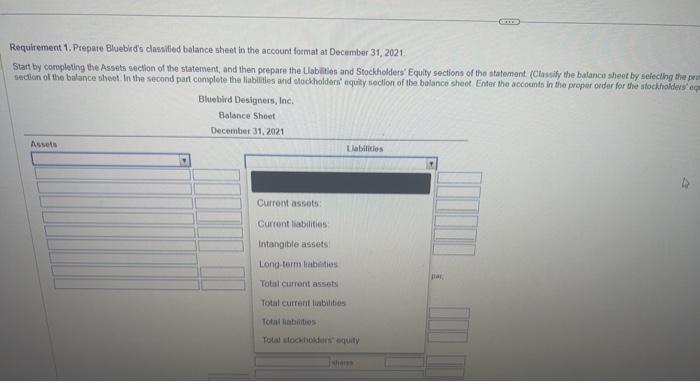

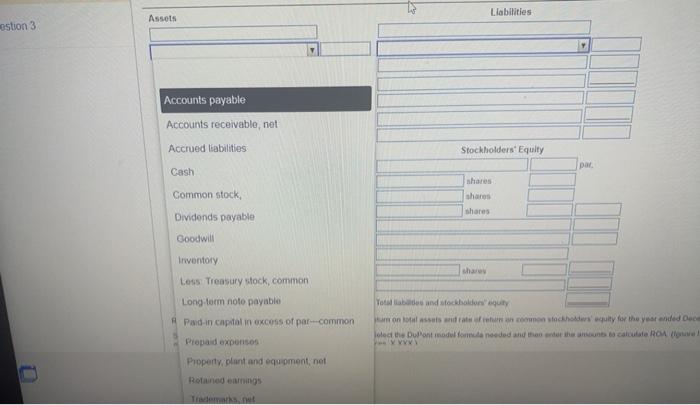

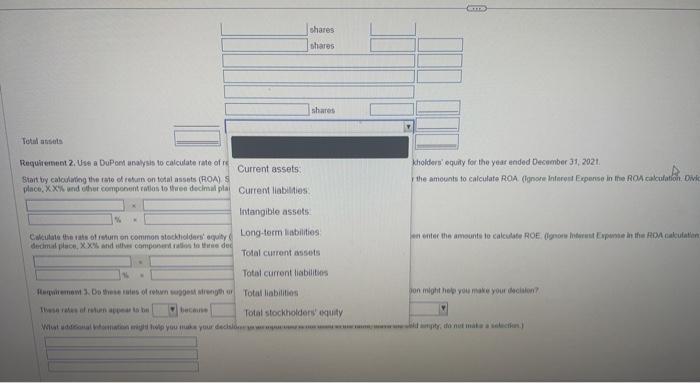

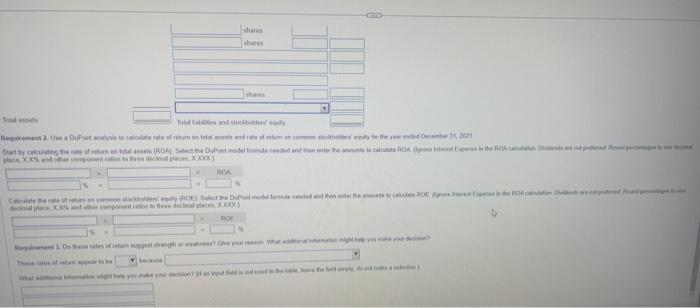

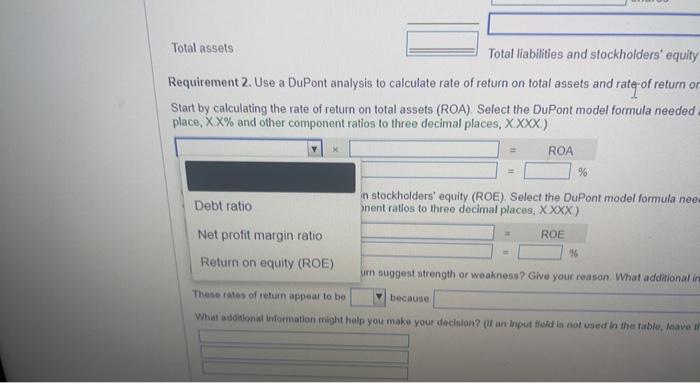

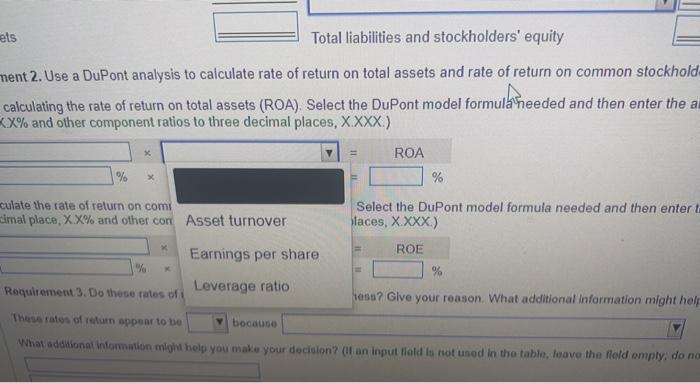

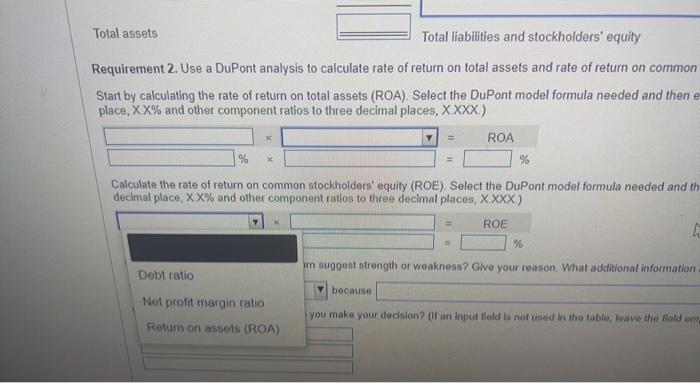

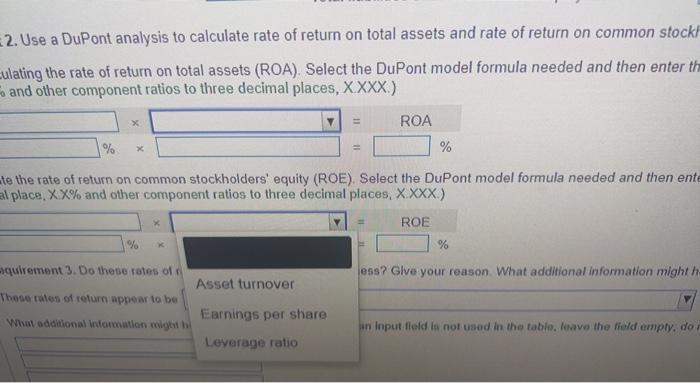

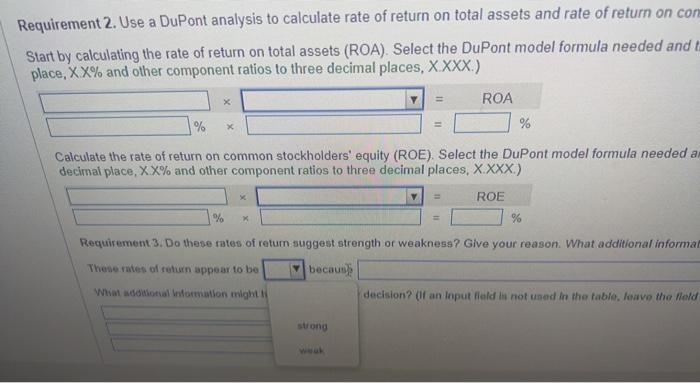

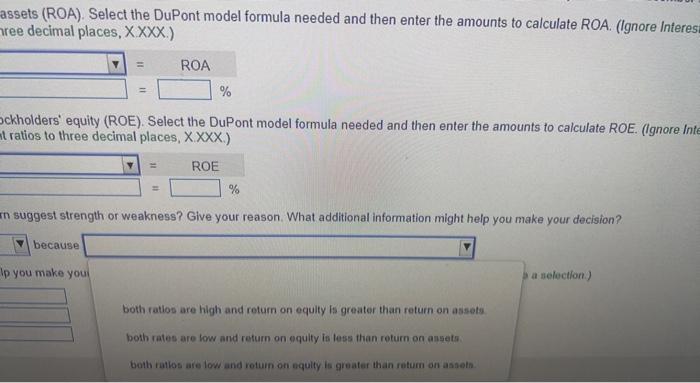

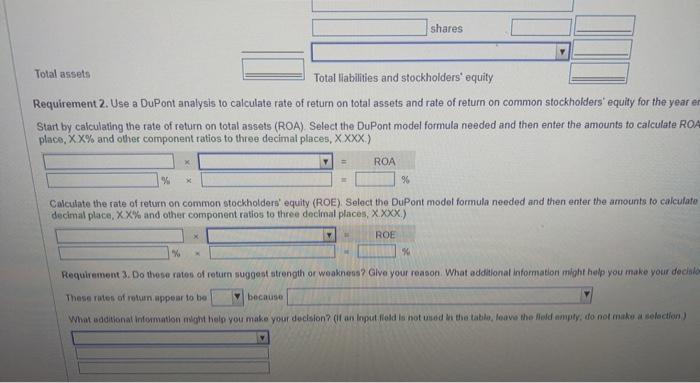

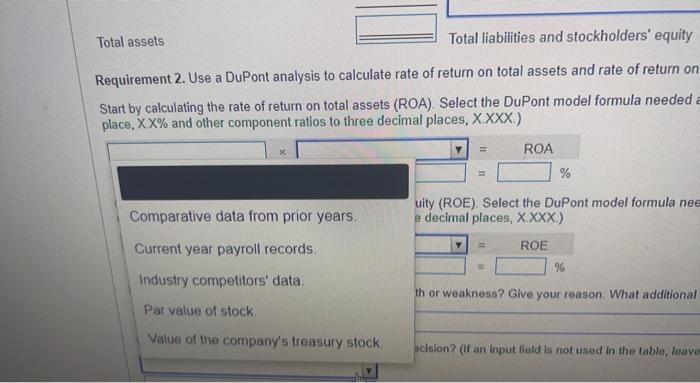

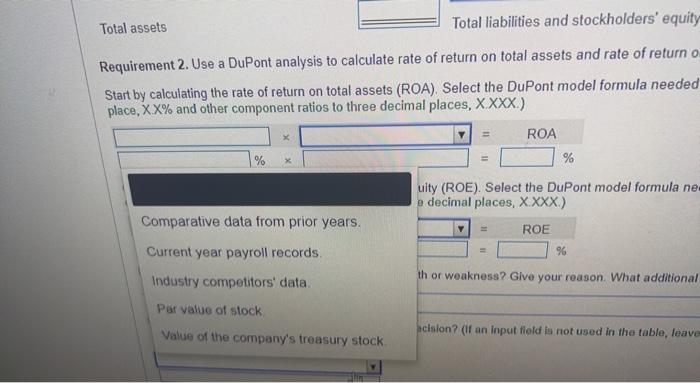

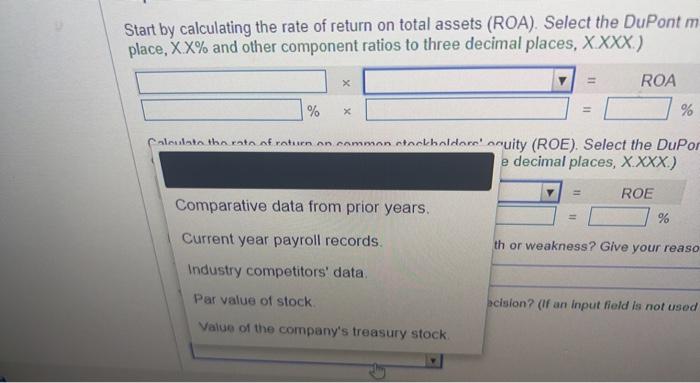

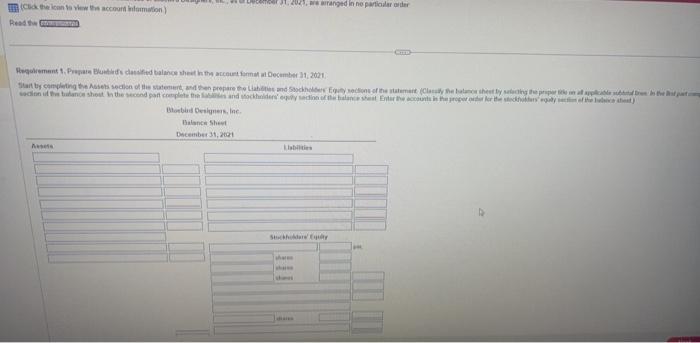

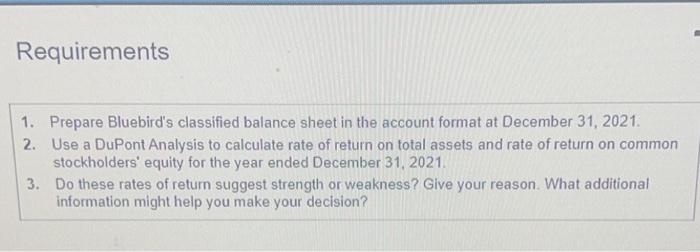

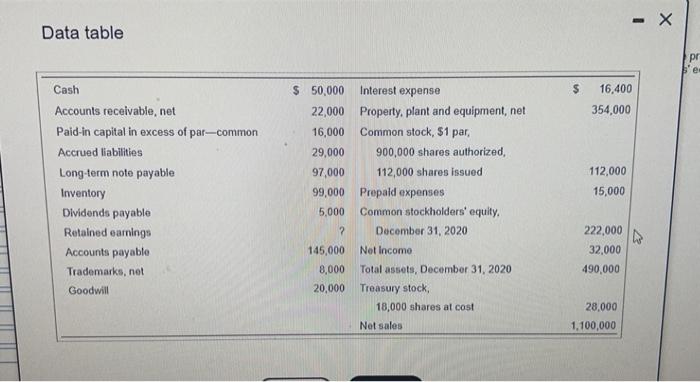

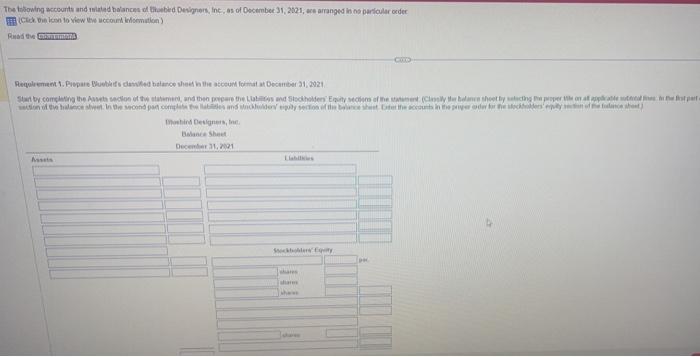

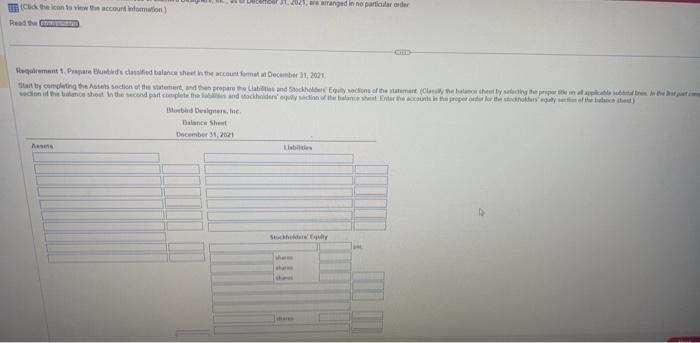

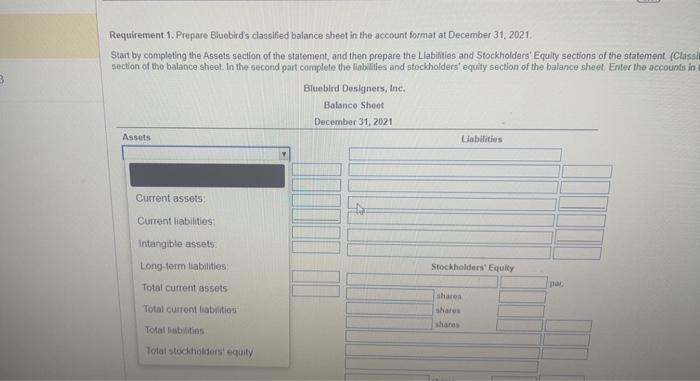

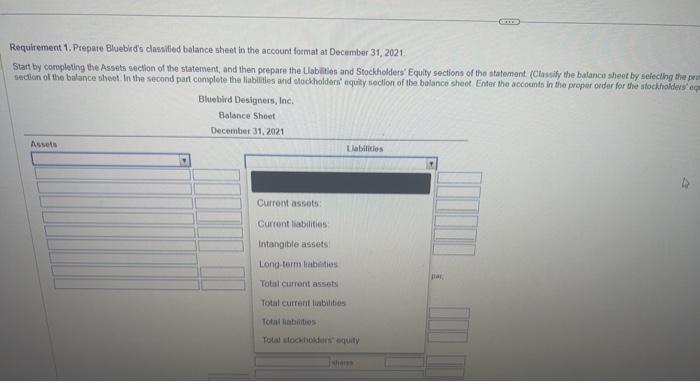

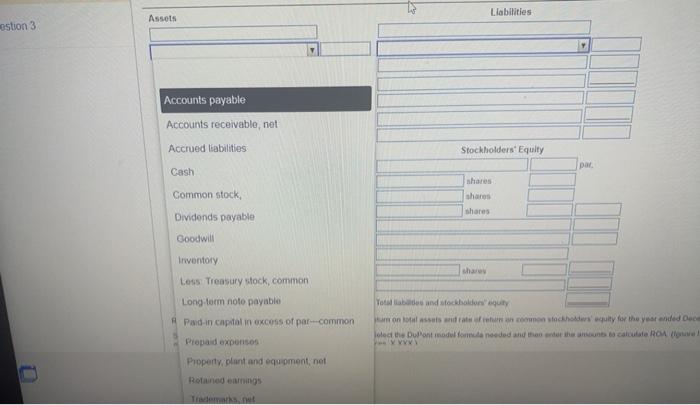

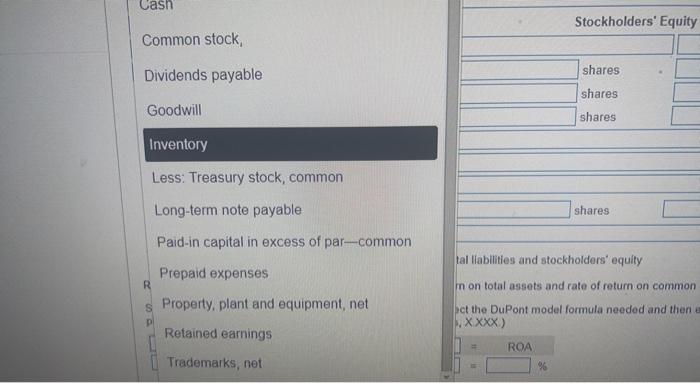

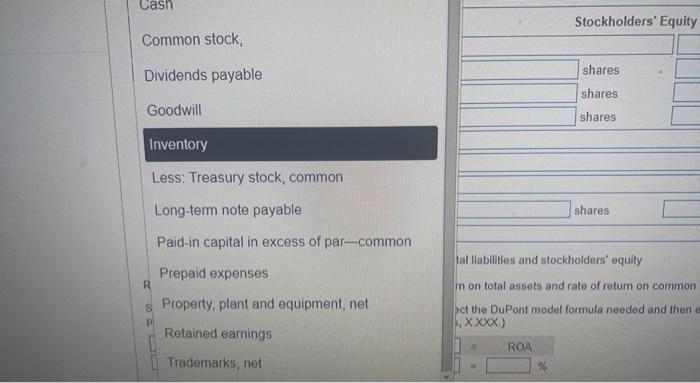

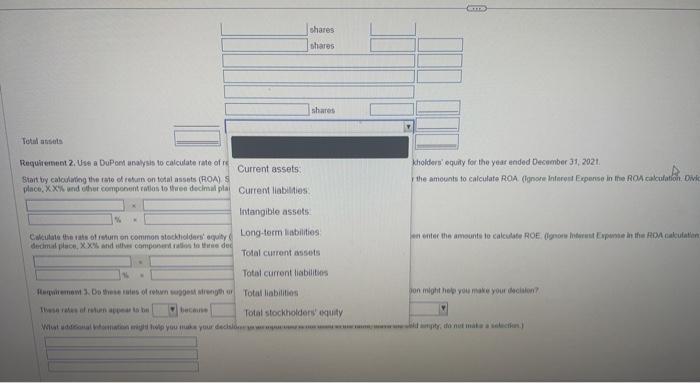

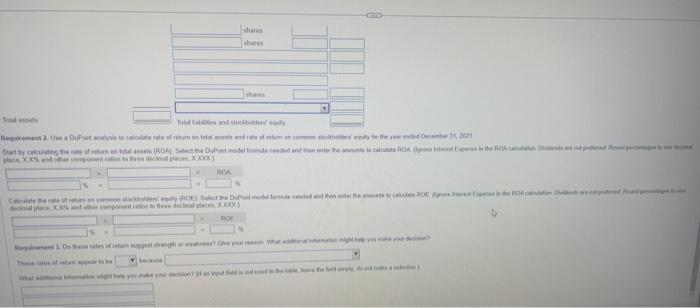

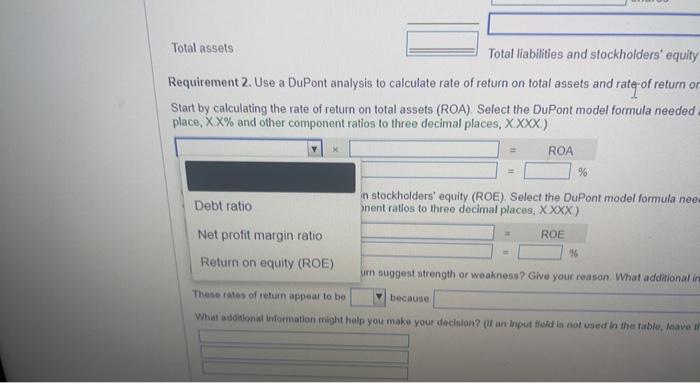

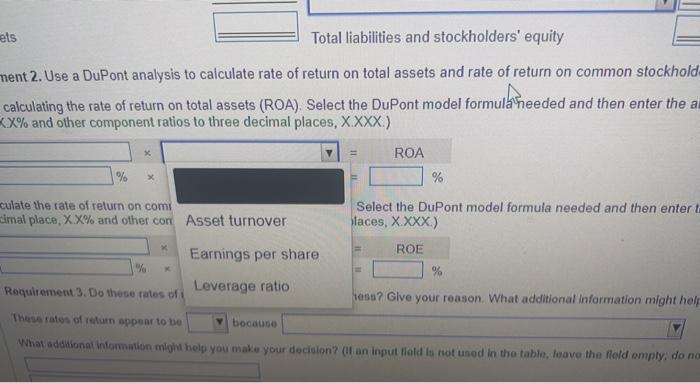

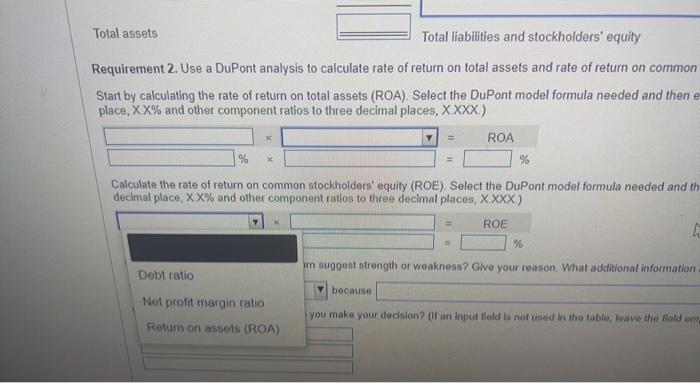

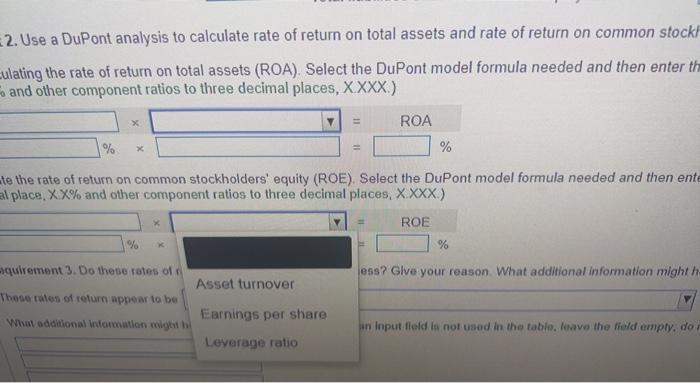

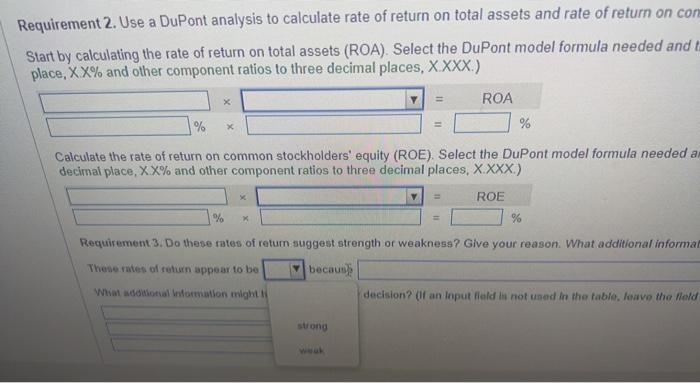

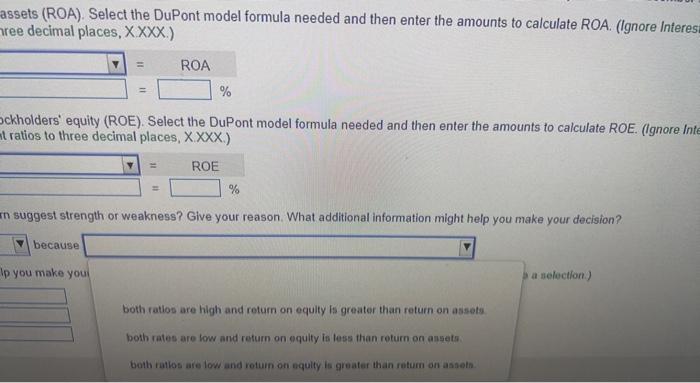

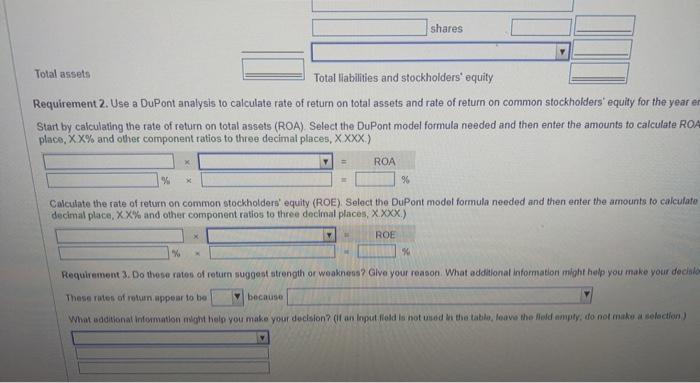

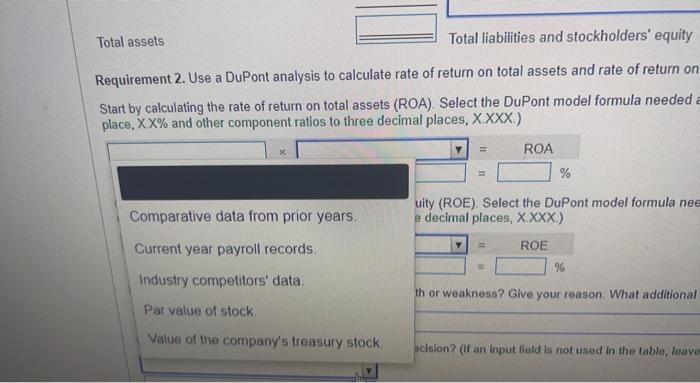

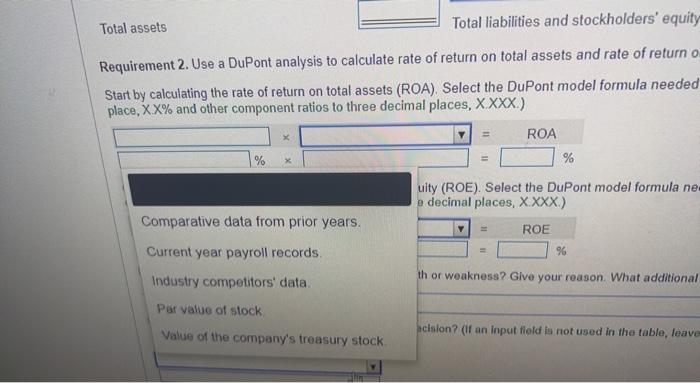

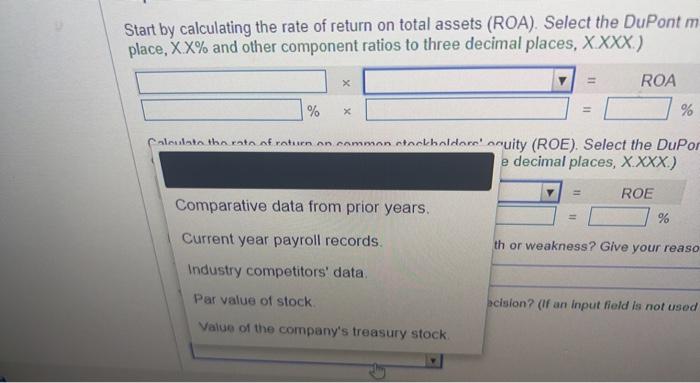

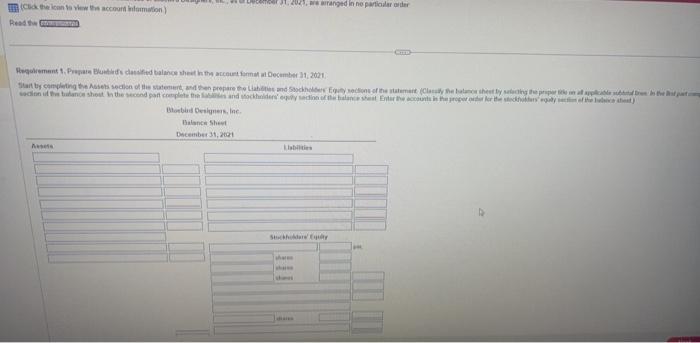

Requirements 1. Prepare Bluebird's classified balance sheet in the account format at December 31, 2021. 2. Use a DuPont Analysis to calculate rate of return on total assets and rate of return on common stockholders' equity for the year ended December 31, 2021. 3. Do these rates of return suggest strength or weakness? Give your reason. What additional information might help you make your decision? Data table Rinstetes Requirement 1. Prepare Bluebird's classified balance sheet in the account format at December 31, 2021. Start by completing the Assets section of the statement, and then prepare the Llabilities and Stockholders' Equily sections of the statement. (Cliss: section of the balance sheet In the second part complete the liabrities and stockholders' equity section of the balance sheet. Enter the accounts in Requitement 1. Prepare Bluebird s classifled balance sheet in the account focmat at December 31,2021. tal liabilities and stockhoiders' equity in on total assets and rate of return on common ct the DuPont model formula needed and then t .X(x) tal liabilities and stockhoiders' equity in on total assets and rate of return on common ct the DuPont model formula needed and then t .X(x) Bhiebird Designers, Inc, Requitentent 2. Use a Dupont analysis to calculate rate of re Wholders' equily for the year ended December 31, 2021. the amounts to calculate ROA (ignore interest Experise in the ROA calculation, Divi Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate-of return or Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed. place, X% and other component ratios to three decimal places, XXXX ). These rates of tetuin appeat to be because nent 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on common stockhold calculating the rate of return on total assets (ROA). Select the DuPont model formula heeded and then enter the c X% and other component ratios to three decimal places, X.XXX. Theses ratess of return appear to be because Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on common Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed and then place, X% and other component ratios to three decimal places, XXXX.) Calculate the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed and th decimal place, X% and other component ratios to three decimal places, XXXX.) 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on common stock ulating the rate of return on total assets (ROA). Select the DuPont model formula needed and then enter and other component ratios to three decimal places, X.XXX.) te the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed and then ent Al place, X% and other component ratios to three decimal places, XXX ) quirement 3. Do these rates of ess? Glve your reason. What additional information might h These rates of return wppear to be What sdditional liderwation might Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on con Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed and place, X% and other component ratios to three decimal places, X.XXX.) Calculate the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed a decimal place, XX% and other component ratios to three decimal places, XXX.) assets (ROA). Select the DuPont model formula needed and then enter the amounts to calculate ROA. (Ignore Interes ree decimal places, XXX.) =ROA=% ockholders' equity (ROE). Select the DuPont model formula needed and then enter the amounts to calculate ROE. (Ignore Int It ratios to three decimal places, XXXX ) in suggest strength or weakness? Give your reason. What additional information might help you make your decision? because both ratios are high and retum on equity is greater than return on assets both rates are low and return on equity is less than roturn on ansets. both ratios are low and retuin on equity is greater than rotum on asseth. Requirement2. Use a Dupont analysis to calculate rate of return on total assets and rate of return on common stockholders' equity for the year e Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed and then enter the amounts to calculate RO: place, X% and other component ratios to three decimal places, XXXX.) Calculate the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed and then enter the amounts to calculate decimal place, % and other component ratios to three decimal places, ) Requisement 3. Do these rates of return suggest strength of weaknens? Glve your reason. What additionat information might help you make your decial These rotes of ietuin appear to be because Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed place, X% and other component ratios to three decimal places, X.XXX.) uity (ROE). Select the DuPont model formula nee e decimal places, X XXXX.) th or weakness? Glve your reason. What additional eision? (if an input fald le not used in the table. feave Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return o Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed place, XX% and other component ratios to three decimal places, XXXX ) uity (ROE). Select the DuPont model formula ne a decimal places, X.XXX.) th or weakness? Glve your reason. What additional ecislon? (if an input fleid is not used in the table, leave Start by calculating the rate of return on total assets (ROA). Select the DuPont m place, XX% and other component ratios to three decimal places, XXXX.) Floulatn tha min af maturn an anmman ntanthaldam' aruity (ROE). Select the DuPor e decimal places, XXXX.) th or weakness? Give your reaso Requirements 1. Prepare Bluebird's classified balance sheet in the account format at December 31, 2021. 2. Use a DuPont Analysis to calculate rate of return on total assets and rate of return on common stockholders' equity for the year ended December 31, 2021. 3. Do these rates of return suggest strength or weakness? Give your reason. What additional information might help you make your decision? Data table Rinstetes Requirement 1. Prepare Bluebird's classified balance sheet in the account format at December 31, 2021. Start by completing the Assets section of the statement, and then prepare the Llabilities and Stockholders' Equily sections of the statement. (Cliss: section of the balance sheet In the second part complete the liabrities and stockholders' equity section of the balance sheet. Enter the accounts in Requitement 1. Prepare Bluebird s classifled balance sheet in the account focmat at December 31,2021. tal liabilities and stockhoiders' equity in on total assets and rate of return on common ct the DuPont model formula needed and then t .X(x) tal liabilities and stockhoiders' equity in on total assets and rate of return on common ct the DuPont model formula needed and then t .X(x) Bhiebird Designers, Inc, Requitentent 2. Use a Dupont analysis to calculate rate of re Wholders' equily for the year ended December 31, 2021. the amounts to calculate ROA (ignore interest Experise in the ROA calculation, Divi Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate-of return or Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed. place, X% and other component ratios to three decimal places, XXXX ). These rates of tetuin appeat to be because nent 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on common stockhold calculating the rate of return on total assets (ROA). Select the DuPont model formula heeded and then enter the c X% and other component ratios to three decimal places, X.XXX. Theses ratess of return appear to be because Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on common Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed and then place, X% and other component ratios to three decimal places, XXXX.) Calculate the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed and th decimal place, X% and other component ratios to three decimal places, XXXX.) 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on common stock ulating the rate of return on total assets (ROA). Select the DuPont model formula needed and then enter and other component ratios to three decimal places, X.XXX.) te the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed and then ent Al place, X% and other component ratios to three decimal places, XXX ) quirement 3. Do these rates of ess? Glve your reason. What additional information might h These rates of return wppear to be What sdditional liderwation might Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on con Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed and place, X% and other component ratios to three decimal places, X.XXX.) Calculate the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed a decimal place, XX% and other component ratios to three decimal places, XXX.) assets (ROA). Select the DuPont model formula needed and then enter the amounts to calculate ROA. (Ignore Interes ree decimal places, XXX.) =ROA=% ockholders' equity (ROE). Select the DuPont model formula needed and then enter the amounts to calculate ROE. (Ignore Int It ratios to three decimal places, XXXX ) in suggest strength or weakness? Give your reason. What additional information might help you make your decision? because both ratios are high and retum on equity is greater than return on assets both rates are low and return on equity is less than roturn on ansets. both ratios are low and retuin on equity is greater than rotum on asseth. Requirement2. Use a Dupont analysis to calculate rate of return on total assets and rate of return on common stockholders' equity for the year e Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed and then enter the amounts to calculate RO: place, X% and other component ratios to three decimal places, XXXX.) Calculate the rate of return on common stockholders' equity (ROE). Select the DuPont model formula needed and then enter the amounts to calculate decimal place, % and other component ratios to three decimal places, ) Requisement 3. Do these rates of return suggest strength of weaknens? Glve your reason. What additionat information might help you make your decial These rotes of ietuin appear to be because Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return on Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed place, X% and other component ratios to three decimal places, X.XXX.) uity (ROE). Select the DuPont model formula nee e decimal places, X XXXX.) th or weakness? Glve your reason. What additional eision? (if an input fald le not used in the table. feave Requirement 2. Use a DuPont analysis to calculate rate of return on total assets and rate of return o Start by calculating the rate of return on total assets (ROA). Select the DuPont model formula needed place, XX% and other component ratios to three decimal places, XXXX ) uity (ROE). Select the DuPont model formula ne a decimal places, X.XXX.) th or weakness? Glve your reason. What additional ecislon? (if an input fleid is not used in the table, leave Start by calculating the rate of return on total assets (ROA). Select the DuPont m place, XX% and other component ratios to three decimal places, XXXX.) Floulatn tha min af maturn an anmman ntanthaldam' aruity (ROE). Select the DuPor e decimal places, XXXX.) th or weakness? Give your reaso

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started