Answered step by step

Verified Expert Solution

Question

1 Approved Answer

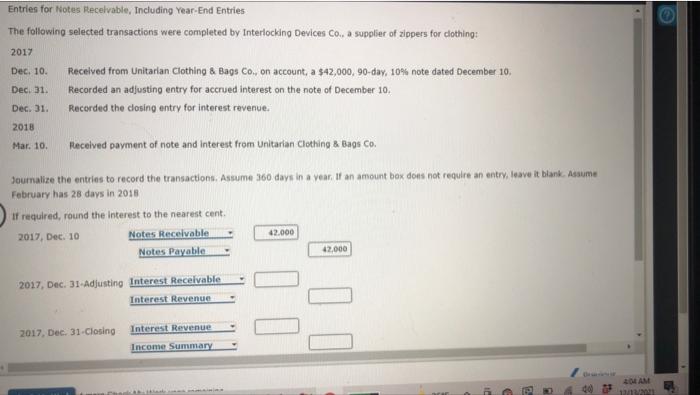

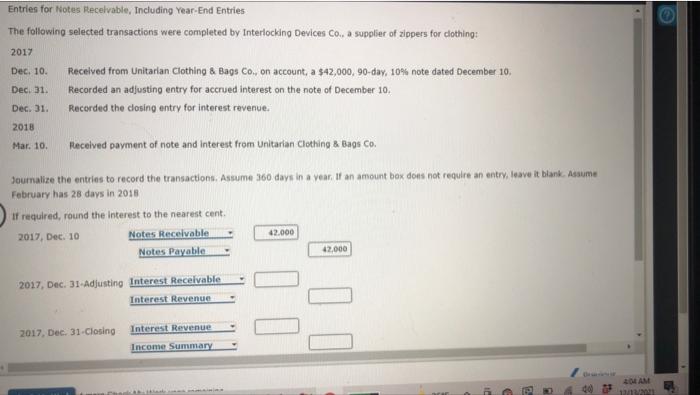

help!! please Entries for Notes Receivable, Including Year-End Entries The following selected transactions were completed by Interlocking Devices com a supolier of zippers for clothing:

help!! please

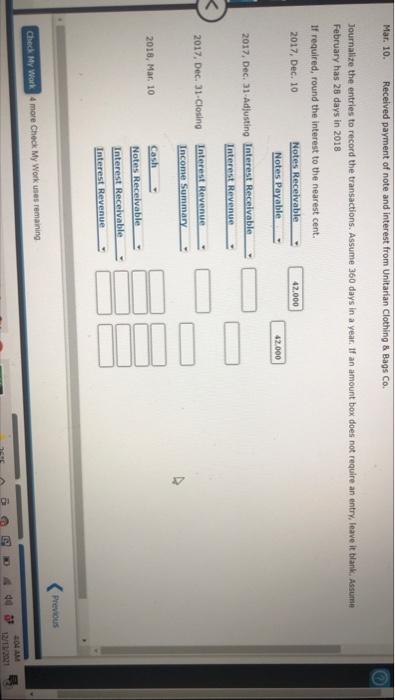

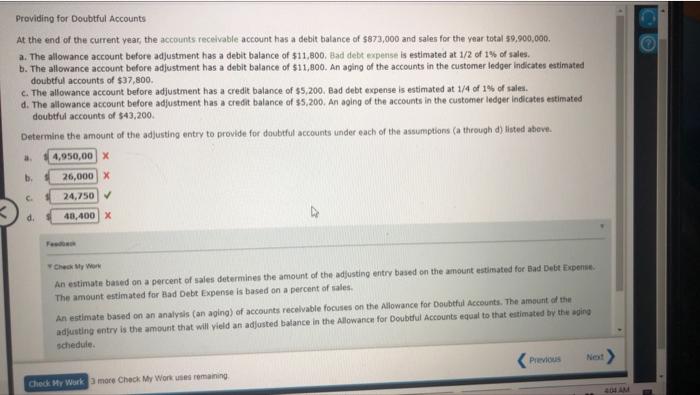

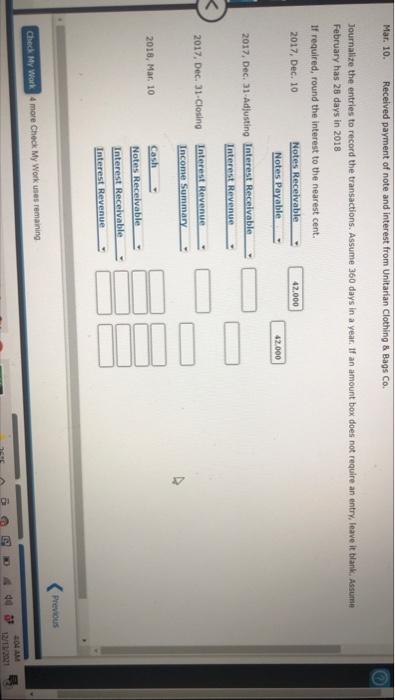

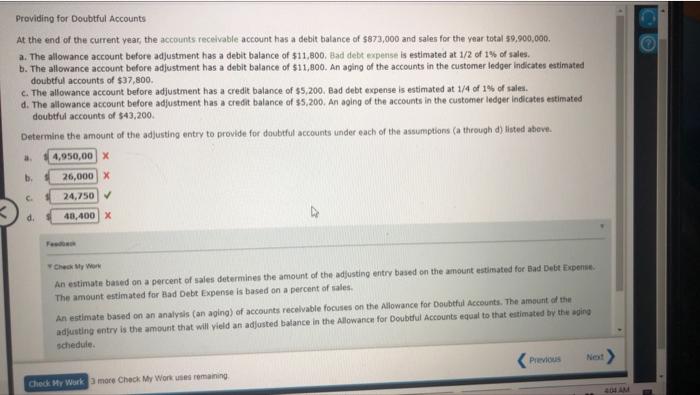

Entries for Notes Receivable, Including Year-End Entries The following selected transactions were completed by Interlocking Devices com a supolier of zippers for clothing: 2017 Received from Unitarian Clothing & Bags Co., on account, a $42,000, 90-day, 10% note dated December 10, Recorded an adjusting entry for accrued interest on the note of December 10. Recorded the closing entry for interest revenue. Dec. 10. Dec 31. Dec. 31. 2018 Mar. 10. Received payment of note and interest from Unitarian Clothing & Bags Co. Journalize the entries to record the transactions. Assume 360 days in a year. If an amount box does not require an entry, leave it blank. Assume February has 28 days in 2018 If required, round the interest to the nearest cent. 2017, Dec. 10 Notes Receivable Notes Payable 42.000 42.000 2017, Dec. 31-Adjusting Interest Receivable Interest Revenue 2017. Dec. 31-Closing Interest Revenue Income Summary Il 400AM 3 R 00 Mar. 10. Received payment of note and interest from Unitarian Clothing & Bags Co. Journalize the entries to record the transactions. Assume 360 days in a year. If an amount box does not require an entry leave it blank. Assume February has 28 days in 2018 if required, round the interest to the nearest cent. 2017, Dec. 10 Notes Receivable 42.000 Notes Payable 42.000 2017. Dec. 31 Adjusting Interest Recelvable Interest Revenue 2017, Dec. 31-Closing Interest Revenue Income Summary 1 l will 1 illll 2018, Mar. 10 Cash Notes Receivable Interest Receivable Interest Revenue Previous Check My Workmore Check My Work unes remaining 10 Providing for Doubtful Accounts At the end of the current year the accounts receivable account has a debit balance of $873,000 and sales for the year total 59,900,000. a. The allowance account before adjustment has a debit balance of $11,800, Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a debit balance of $11,800. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $37,800. c. The allowance account before adjustment has a credit balance of $5,200, Bad debt expense is estimated at 1/4 of 1% of sales. d. The allowance account before adjustment has a credit balance of 5,200. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of 543,200. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) luted above. 4,950,00 X b. 26,000 X 24,750 48,400 x C d. Check My Wor An estimate based on a percent of sales determines the amount of the adjusting entry based on the amount estimated for Bad Debt Expense The amount estimated for Bad Debt Expense is based on a percent of sales, An estimate based on an analysis (an aging) of accounts receivable focuses on the Allowance for Doubtful Accounts. The amount of the adjusting entry is the amount that will yield an adjusted balance in the Allowance for Doubtful Accounts equal to that estimated by the ging schedule Previous Not > Check My Work more Check My Work uses remaining

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started