Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please Exercise 4.4 (Algo) Contrast ABC and Conventional Product Costs [LO4-4] Pacifica Industrial Products Corporation makes two products, Product H and Product L. Product

help please

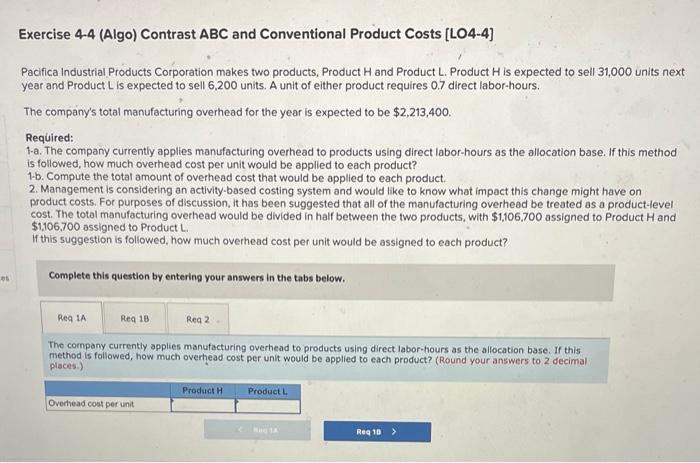

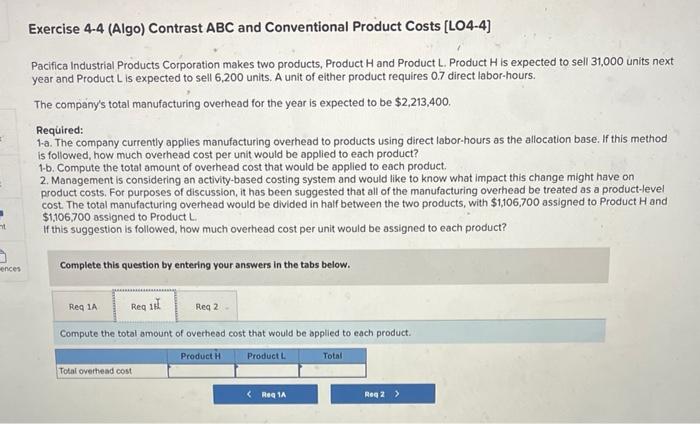

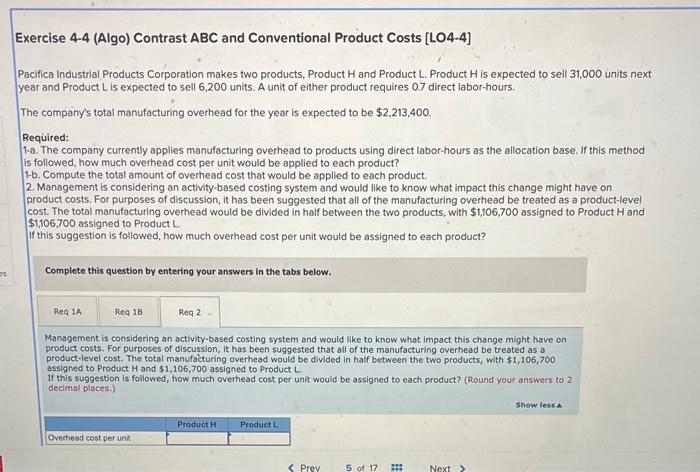

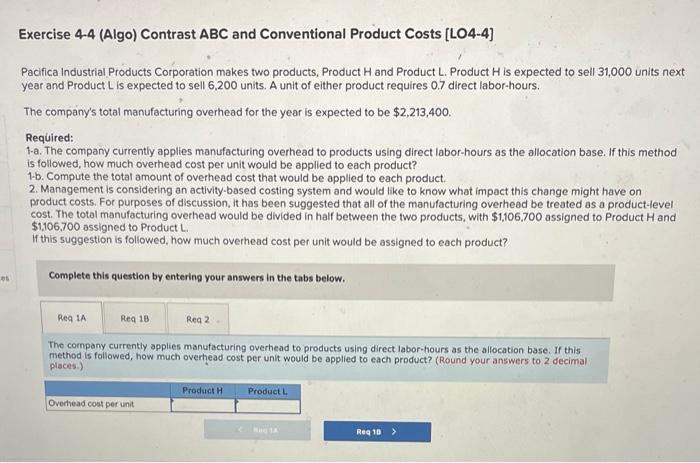

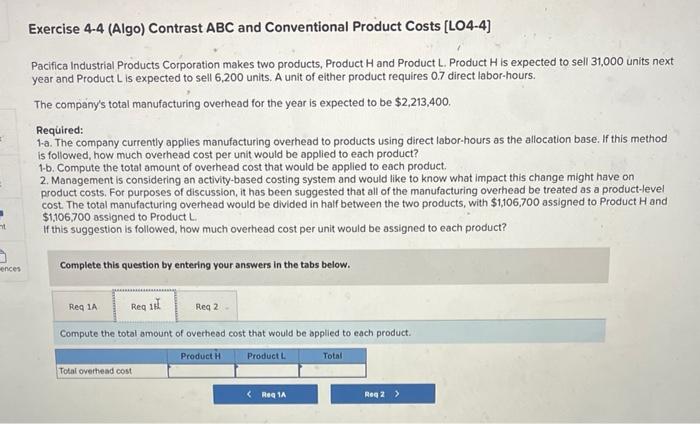

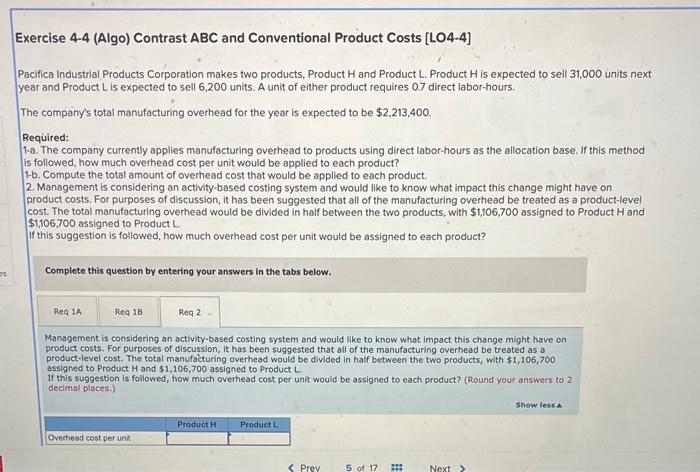

Exercise 4.4 (Algo) Contrast ABC and Conventional Product Costs [LO4-4] Pacifica Industrial Products Corporation makes two products, Product H and Product L. Product H is expected to sell 31,000 units next year and Product L is expected to sell 6,200 units. A unit of either product requires 0.7 direct labor-hours. The company's total manufacturing overhead for the year is expected to be $2,213,400. Required: 1-a. The company currently applies manufacturing overhead to products using direct labor-hours as the allocation base. If this method is followed, how much overhead cost per unit would be applied to each product? 1-b. Compute the total amount of overhead cost that would be applied to each product. 2. Management is considering an activity-based costing system and would like to know what impact this change might have on product costs. For purposes of discussion, it has been suggested that all of the manufacturing overhead be treated as a product-level cost. The total manufacturing overhead would be divided in half between the two products, with $1,106,700 assigned to Product H and $1,106,700 assigned to Product L. If this suggestion is followed, how much overhead cost per unit would be assigned to each product? Complete this question by entering your answers in the tabs below. The company currently applies manufacturing overhead to products using direct labor-hours as the allocation base. If this method is followed, how much overhead cost per unit would be applied to each product? (Round your answers to 2 decimal places.) Exercise 4-4 (Algo) Contrast ABC and Conventional Product Costs [LO4-4] Pacifica Industrial Products Corporation makes two products, Product H and Product L. Product H is expected to sell 31,000 units next year and Product L is expected to sell 6,200 units. A unit of either product requires 0.7 direct labor-hours. The company's total manufacturing ovethead for the year is expected to be $2,213,400. Required: 1.a. The company currently applies manufacturing overhead to products using direct labor-hours as the allocation base. If this method is followed, how much overhead cost per unit would be applied to each product? 1-b. Compute the totat amount of overhead cost that would be applied to each product. 2. Management is considering an activity-based costing system and would like to know what impact this change might have on product costs. For purposes of discussion, it has been suggested that all of the manufacturing overhead be treated as a product-level cost. The total manufacturing overhead would be divided in half between the two products, with $1,106,700 assigned to Product H and $1,106,700 assigned to Product L If this suggestion is followed, how much overhead cost per unit would be assigned to each product? Complete this question by entering your answers in the tabs below. Compute the total amount of overhead cost that would be applied to each product. Exercise 4-4 (Algo) Contrast ABC and Conventional Product Costs [LO4-4] Pacifica Industrial Products Corporation makes two products, Product H and Product L. Product H is expected to sell 31,000 units next year and Product L is expected to sell 6,200 units. A unit of either product requires 0.7 direct labor-hours. The company's total manufacturing overhead for the year is expected to be $2,213,400. Required: 1-a. The company currently applies manufacturing overhead to products using direct labor-hours as the allocation base. If this method is followed, how much overhead cost per unit would be applied to each product? 1-b. Compute the total amount of overhead cost that would be applied to each product. 2. Management is considering an activity-based costing system and would like to know what impact this change might have on product costs. For purposes of discussion, it has been suggested that all of the manufacturing overhead be treated as a product-level cost. The total manufacturing overhead would be divided in half between the two products, with $1,106,700 assigned to Product H and $1,106,700 assigned to Product L. If this suggestion is followed, how much overhead cost per unit would be assigned to each product? Complete this question by entering your answers in the tabs below. Management is considering an actlvity-based costing system and would like to know what impact this change might have on product costs. For purposes of discussion, it has been suggested that all of the manufacturing overhead be treated as a product-level cost. The total manufacturing overhead would be divided in half between the two products, with $1,106,700 assigned to Product H and $1,106,700 assigned to Product L. If this suggestion is followed, how much overhead cost per unit would be assigned to each product? (Round your answers to 2. decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started