Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please I don't have time help Question 18 (2 points) The two main purposes of an insurer's risk control function are: 1) To provide

help please I don't have time help

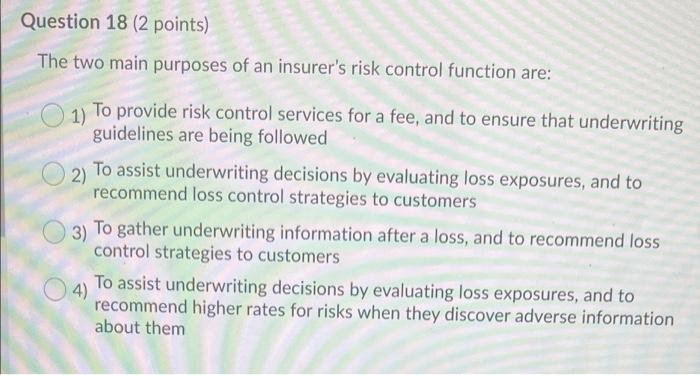

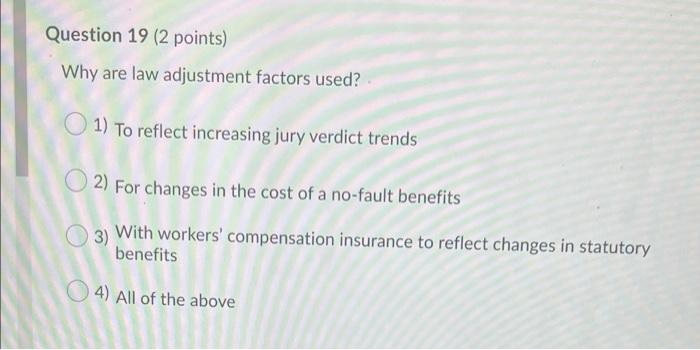

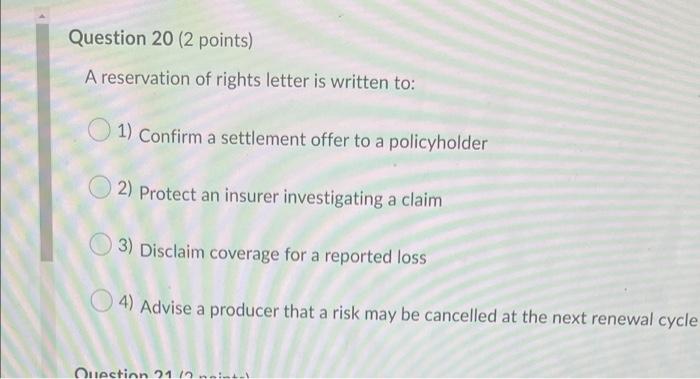

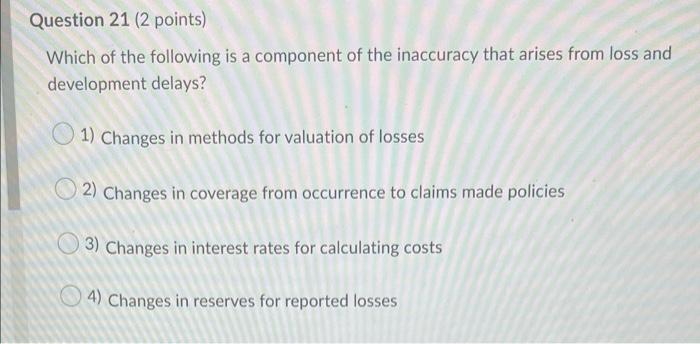

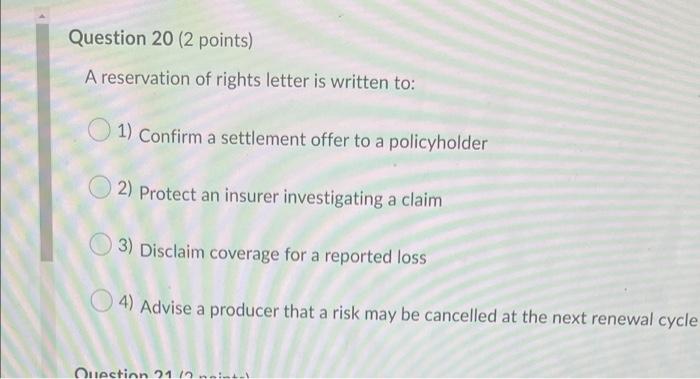

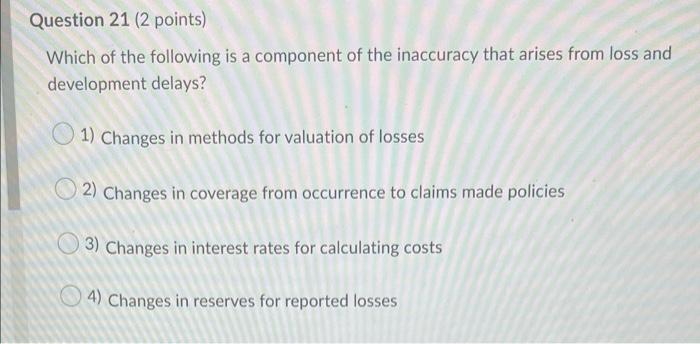

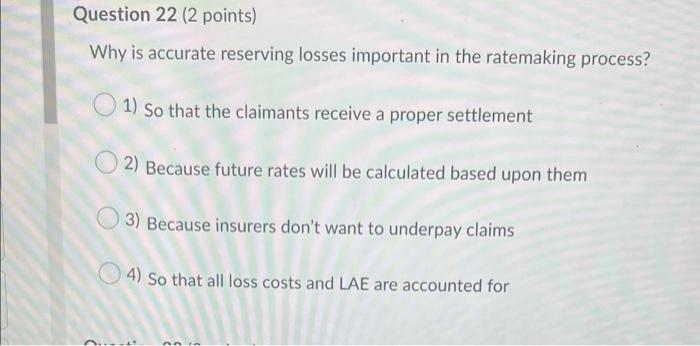

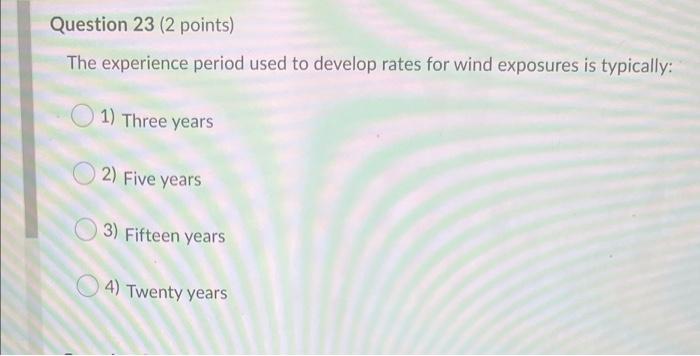

Question 18 (2 points) The two main purposes of an insurer's risk control function are: 1) To provide risk control services for a fee, and to ensure that underwriting guidelines are being followed O2) To assist underwriting decisions by evaluating loss exposures, and to recommend loss control strategies to customers 3) To gather underwriting information after a loss, and to recommend loss control strategies to customers To assist underwriting decisions by evaluating loss exposures, and to 4) recommend higher rates for risks when they discover adverse information about them Question 19 (2 points) Why are law adjustment factors used? 1) To reflect increasing jury verdict trends 2) For changes in the cost of a no-fault benefits 3) With workers' compensation insurance to reflect changes in statutory benefits 4) All of the above Question 20 (2 points) A reservation of rights letter is written to: 1) Confirm a settlement offer to a policyholder O2) Protect an insurer investigating a claim 3) Disclaim coverage for a reported loss 14) Advise a producer that a risk may be cancelled at the next renewal cycle Ouestion 21.12 moin Question 21 (2 points) Which of the following is a component of the inaccuracy that arises from loss and development delays? 1) Changes in methods for valuation of losses 2) Changes in coverage from occurrence to claims made policies 3) Changes in interest rates for calculating costs 4) Changes in reserves for reported losses Question 22 (2 points) Why is accurate reserving losses important in the ratemaking process? 1) So that the claimants receive a proper settlement 2) Because future rates will be calculated based upon them O3) Because insurers don't want to underpay claims 4) So that all loss costs and LAE are accounted for Question 23 (2 points) The experience period used to develop rates for wind exposures is typically: 1) Three years 2) Five years 3) Fifteen years 4) Twenty years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started