Answered step by step

Verified Expert Solution

Question

1 Approved Answer

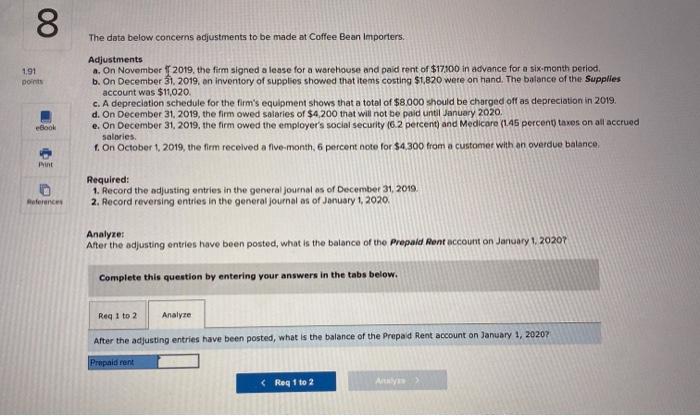

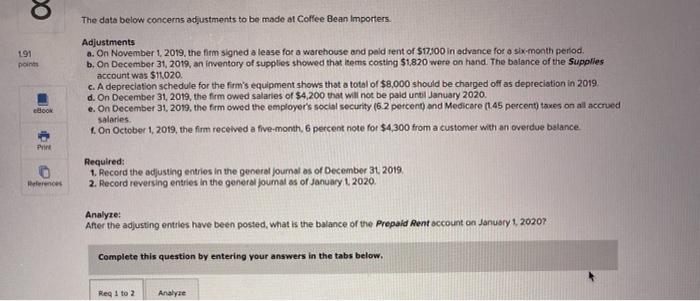

help please! i need to fill all 9 journal entries and the analyse section! 191 points The data below concerns adjustments to be made at

help please! i need to fill all 9 journal entries and the analyse section!

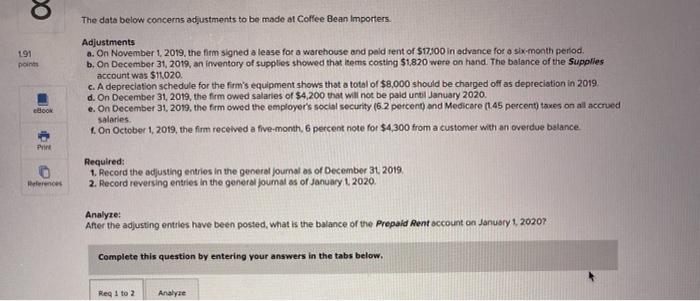

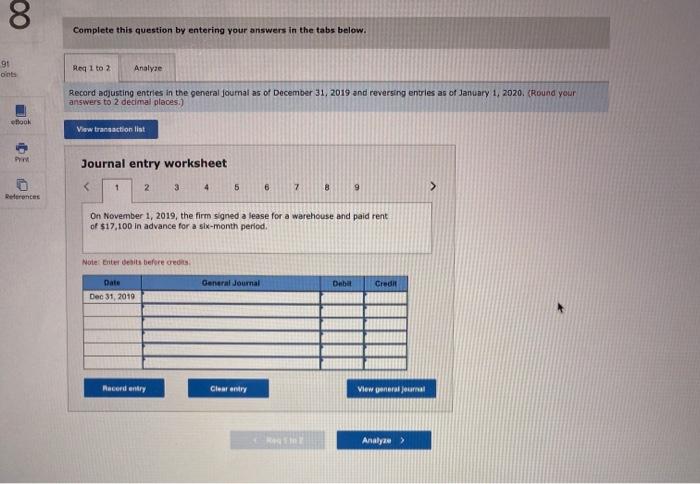

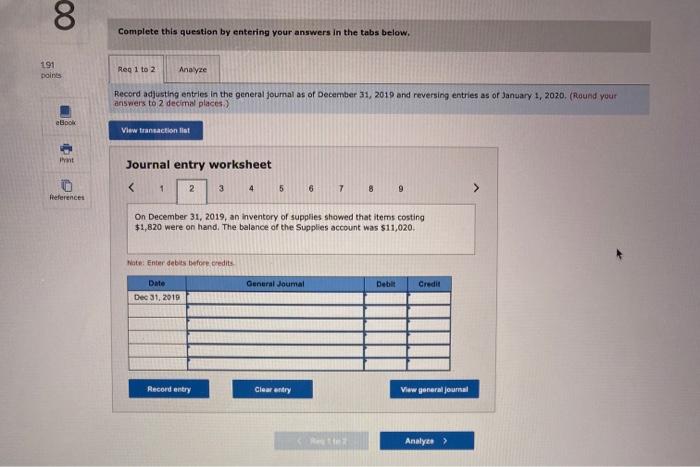

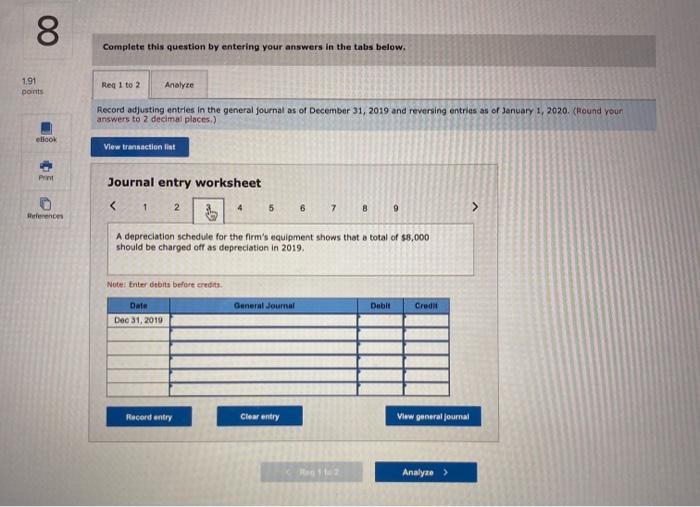

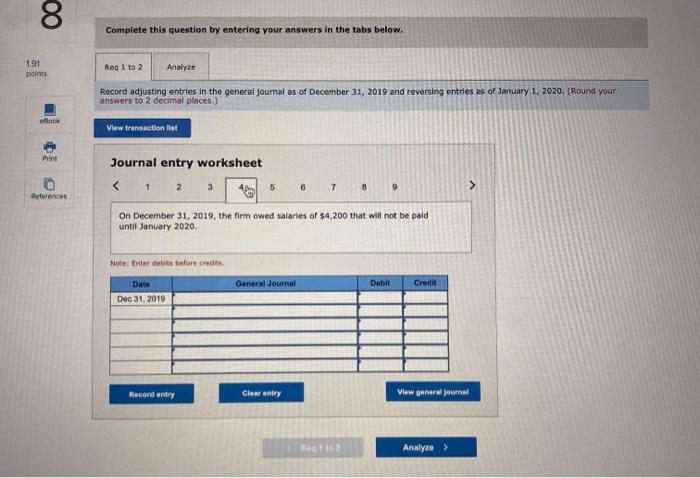

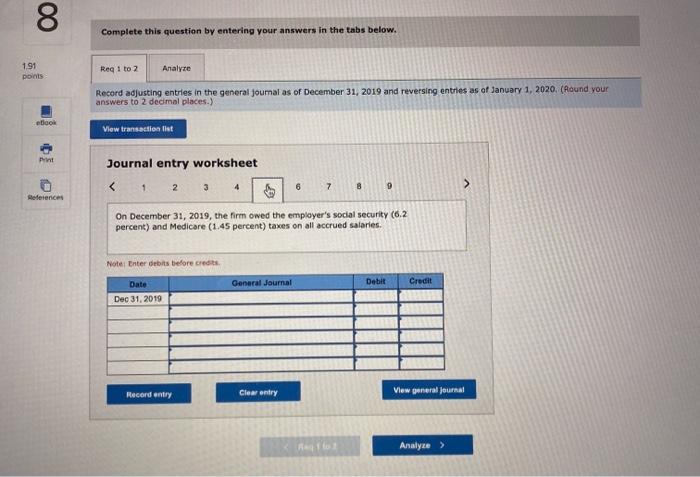

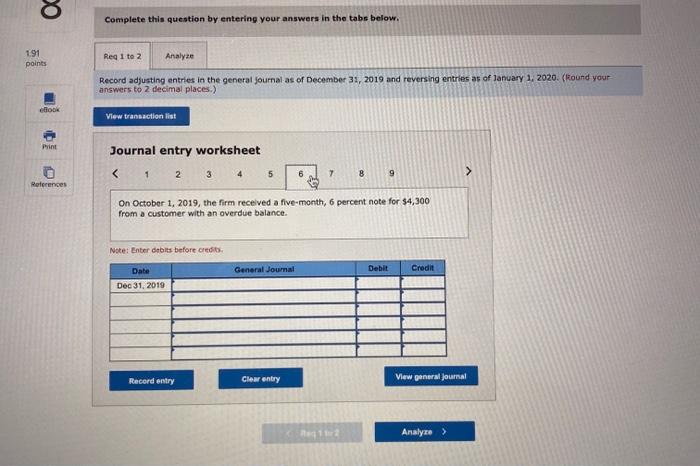

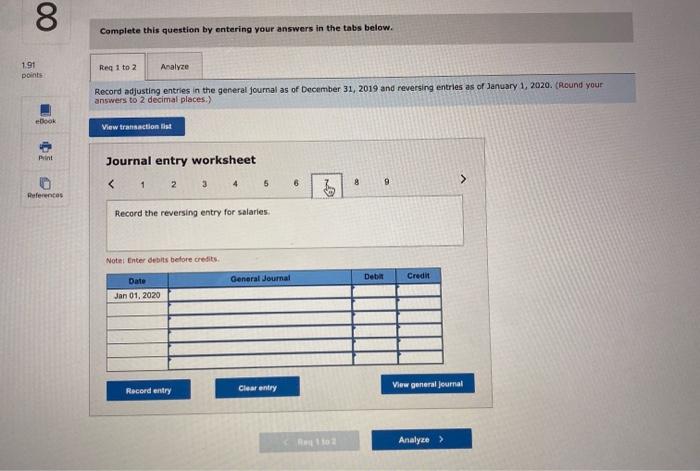

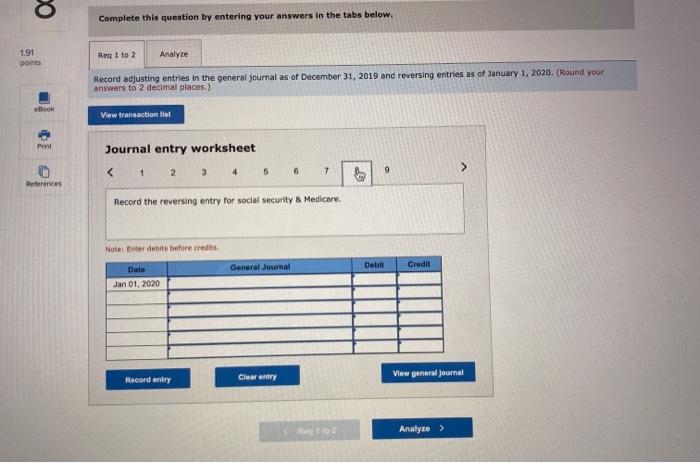

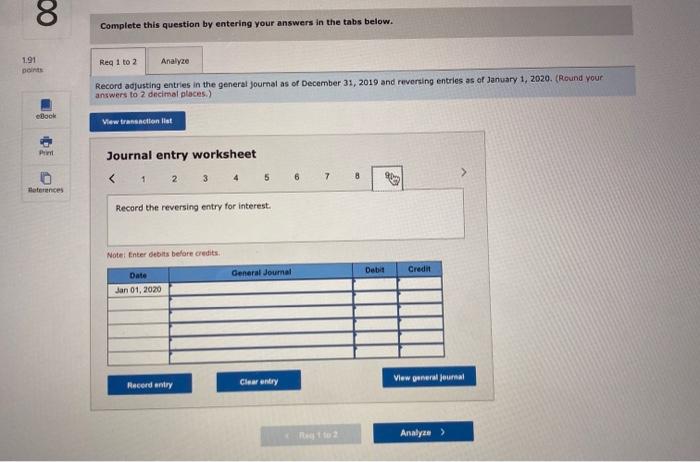

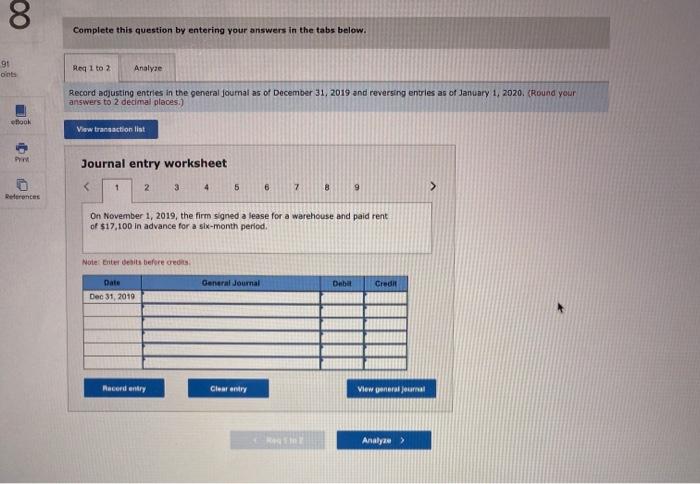

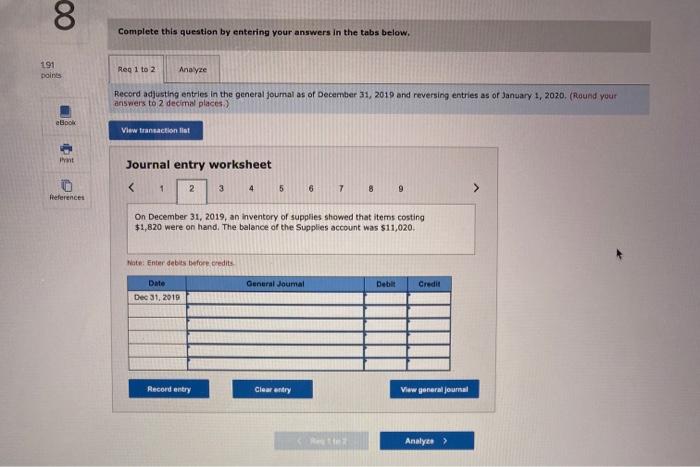

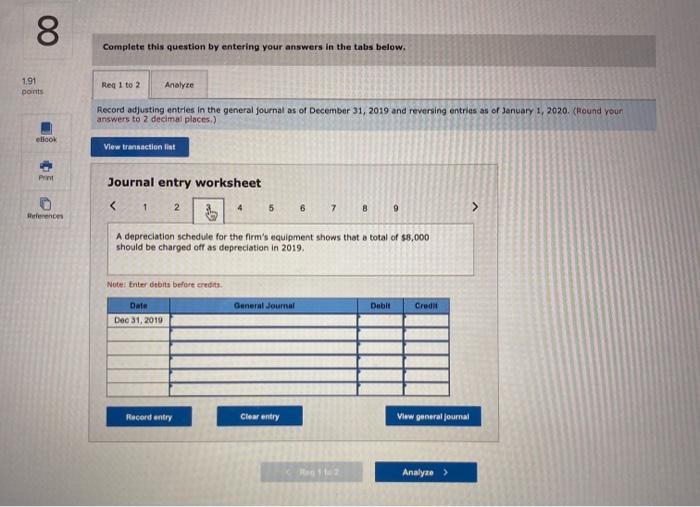

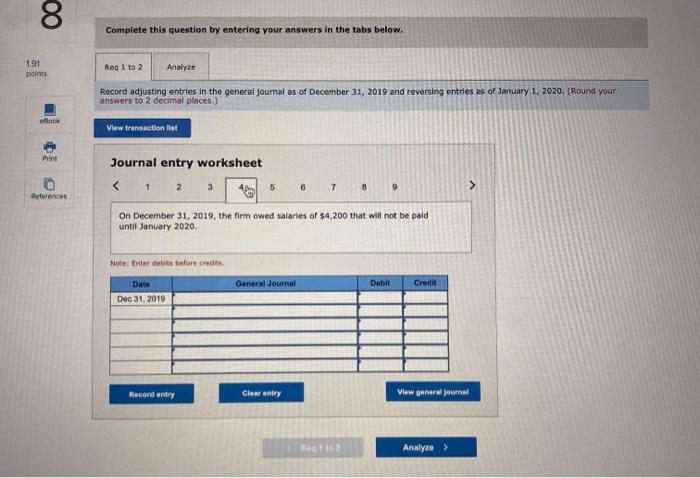

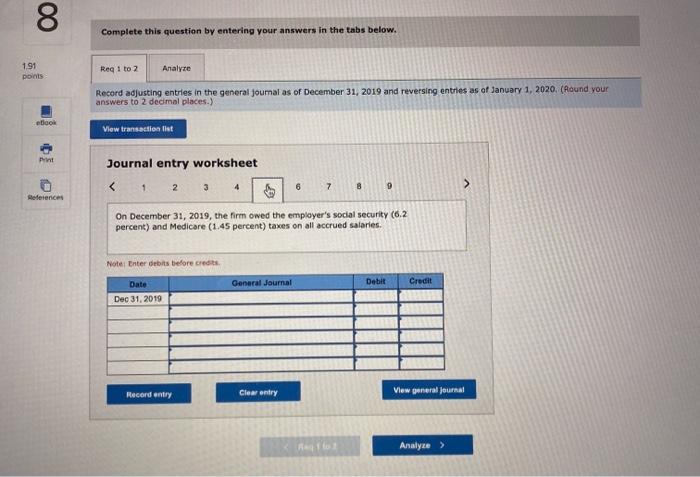

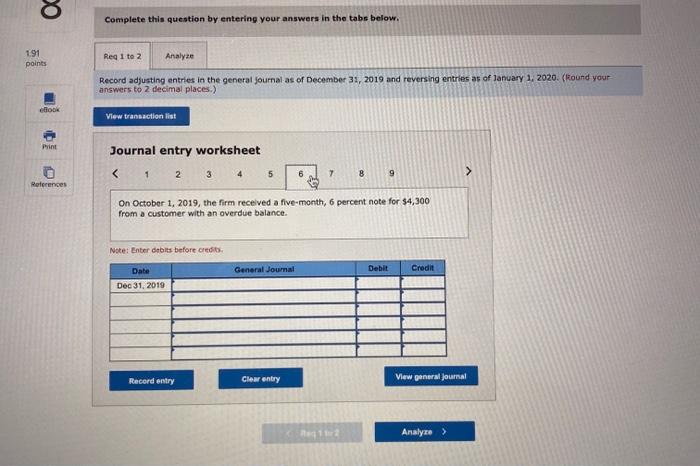

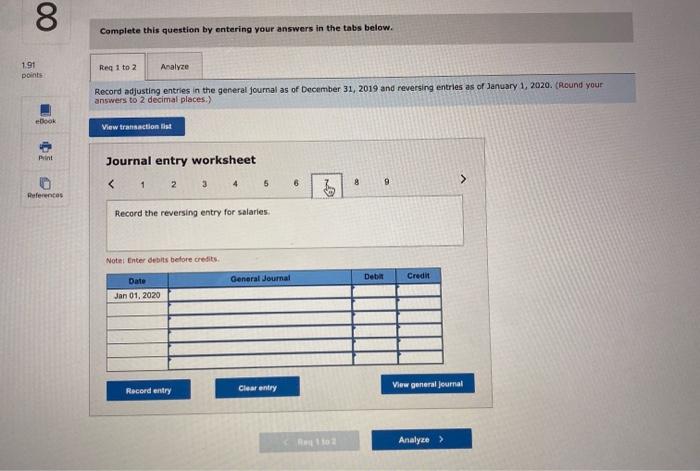

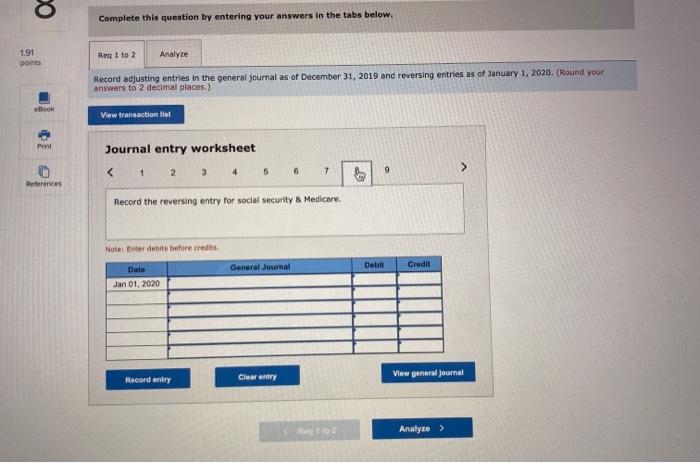

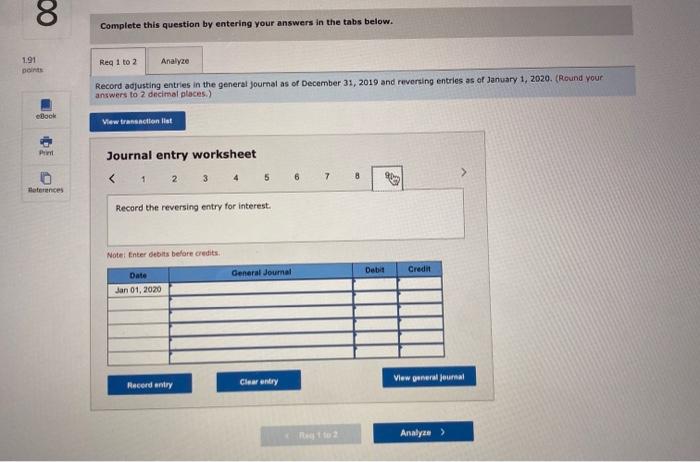

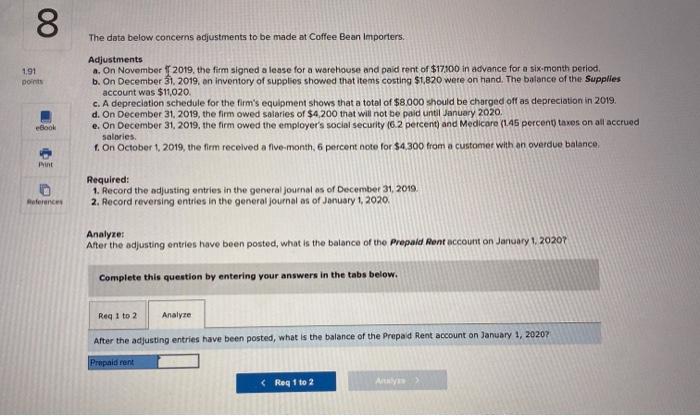

191 points The data below concerns adjustments to be made at Coffee Bean Importers. Adjustments a. On November 1, 2019, the firm signed a lease for a warehouse and peld rent of $17,300 in advance for a six-month period. b. On December 31, 2019, an inventory of supplies showed that items costing $1,820 wore on hand. The balance of the Supplies account was $11.020. c. A depreciation schedule for the firm's equipment shows that a total of $8,000 should be charged off as depreciation in 2019 d. On December 31, 2019, the firm owed salaries of $4,200 that will not be paid until January 2020. e. On December 31, 2019, the firm owed the employer's social security (6.2 percent) and Medicare (145 percentaxes on all accrued salaries. On October 1, 2019, the firm received a five-month, 6 percent note for $4,300 from a customer with an overdue balance doo Print Required: 1. Record the adjusting entries in the general Journal os of December 31 2019 2. Record reversing entries in the general journal as of January 1, 2020, Heerences Analyze: After the adjusting entries have been posted, what is the balance of the Prepaid Rent account on January 20207 Complete this question by entering your answers in the tabs below. Reg 1 to 2 Analyze 8 Complete this question by entering your answers in the tabs below. 91 onts Req 1 to 2 Analyse Record adjusting entries in the general journal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places.) took View transaction list Journal entry worksheet References On November 1, 2019, the firm signed a lease for a warehouse and paid rent of $17,100 in advance for a six-month period. NoteEnter debits before credits General Journal Debe Credit Date Dec 31, 2019 Record entry Clear entry View general Journal Analye > 8 Complete this question by entering your answers in the tabs below. 191 points Reg 1 to 2 Analyze Record adjusting entries in the general journal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places.) epok View transactional Print Journal entry worksheet References On December 31, 2019, an inventory of supplies showed that items costing $1,820 were on hand. The balance of the Supplies account was $11,020. Note: Enter debts before credits General Joumal Deble Credit Date Dec 31, 2010 Record entry Clear entry View general Journal Reather Analyze > 8 Complete this question by entering your answers in the tabs below. 191 Reg 1 to 2 Analyze points Record adjusting entries in the general Journal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places.) look View transaction lint Print Journal entry worksheet References A depreciation schedule for the firm's equipment shows that a total of $8,000 should be charged off as depreciation in 2019, Notes Enter debits before credits General Journal Debit Cred Date Dec 31, 2019 Record entry Clear entry Vwww general Journal Analyze > 00 Complete this question by entering your answers in the tabs below. 191 points Reg 1 to 2 Analyze Record adjusting entries in the general journal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places.) etor View transaction fist Print Journal entry worksheet References On December 31, 2019, the firm owed salaries of $4,200 that will not be paid until January 2020 Note: Enter debits before credits General Journal Debit Credit Date Dec 31, 2010 Record entry Clear entry View general journal Analyze ) 00 Complete this question by entering your answers in the tabs below. 1.91 points Reg 1 to 2 Analyze Record adjusting entries in the general joumal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places.) ebook View transaction list Pit Journal entry worksheet References On December 31, 2019, the firm owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on all accrued salaries. Note Enter debits before credits General Journal Debit Credit Date Dec 31, 2019 Record entry Clear entry View general Journal Relo Analyze > OC Complete this question by entering your answers in the tabs below. 191 points Reg 1 to 2 Analyze Record adjusting entries in the general journal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places.) ook View transaction list Print Journal entry worksheet 00 Complete this question by entering your answers in the tabs below. 191 points Req 1 to 2 Analyze Record adjusting entries in the general journal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places.) eBook View transaction ist Journal entry worksheet 5 6 8 9 References Record the reversing entry for salaries Note Enter debits before credits Det General Journal Date Credit Jan 01, 2020 Record entry Clear entry View general Journal Analyze > Complete this question by entering your answers in the tabs below. 1.91 points Reg 1 to 2 Analyze Record adjusting entries in the general Journal as of December 31, 2019 and reversing entries as of January 1, 2020. (Round your answers to 2 decimal places) eBook View transaction ist Print Journal entry worksheet 4 5 6 7 > 9 References Record the reversing entry for social security & Medicare, Notel ter debits before credits Credit Debit General Journal Date Jan 01, 2020 Record entry Clear entry View general Journal Analyze > 00 The data below concerns adjustments to be made at Coffee Bean Importers 1.91 points Adjustments a. On November | 2019, the firm signed a lease for a warehouse and paid rent of $17100 in advance for a six-month period, b. On December 31, 2019, an inventory of supplies showed that items costing $1,820 were on hand. The balance of the Supplies account was $11,020. c. A depreciation schedule for the firm's equipment shows that a total of $8.000 should be charged off as depreciation in 2019 d. On December 31, 2019, the firm owed salaries of $4,200 that will not be paid until January 2020. e. On December 31, 2019, the firm owed the employer's social security (6.2 percent) and Medicare (145 percentaxes on all accrued salaries 1. on October 1, 2019, the firm received a five month, 6 percent noto for $4 300 from a customer with an overdue balance eBook int Required: 1. Record the adjusting entries in the general joumal os of December 31, 2019. 2. Record reversing entries in the general journal as of January 1, 2020 References Analyze: After the adjusting entries have been posted, what is the balance of the Prepaid Rent account on January 1, 20201 Complete this question by entering your answers in the tabs below. Reg1 to 2 Analyze After the adjusting entries have been posted, what is the balance of the Prepaid Rent account on January 1, 2020 Prepaid rent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started