Help please...

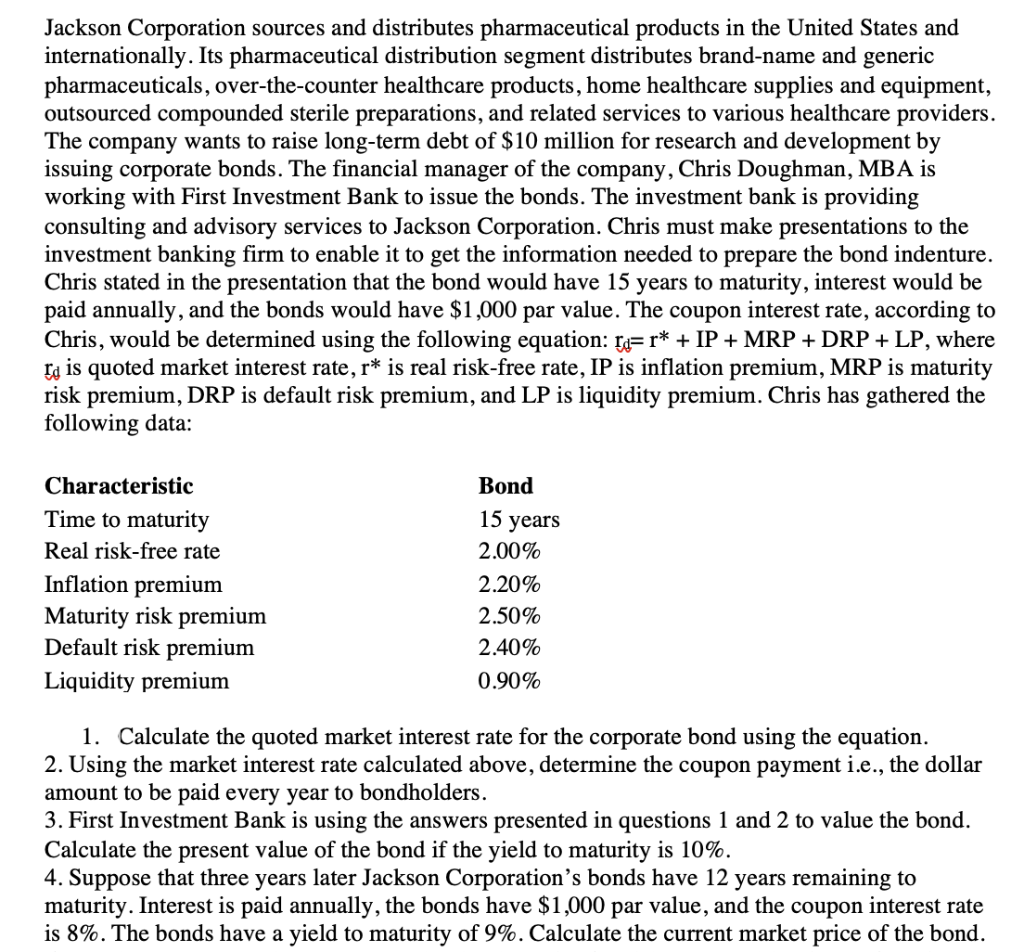

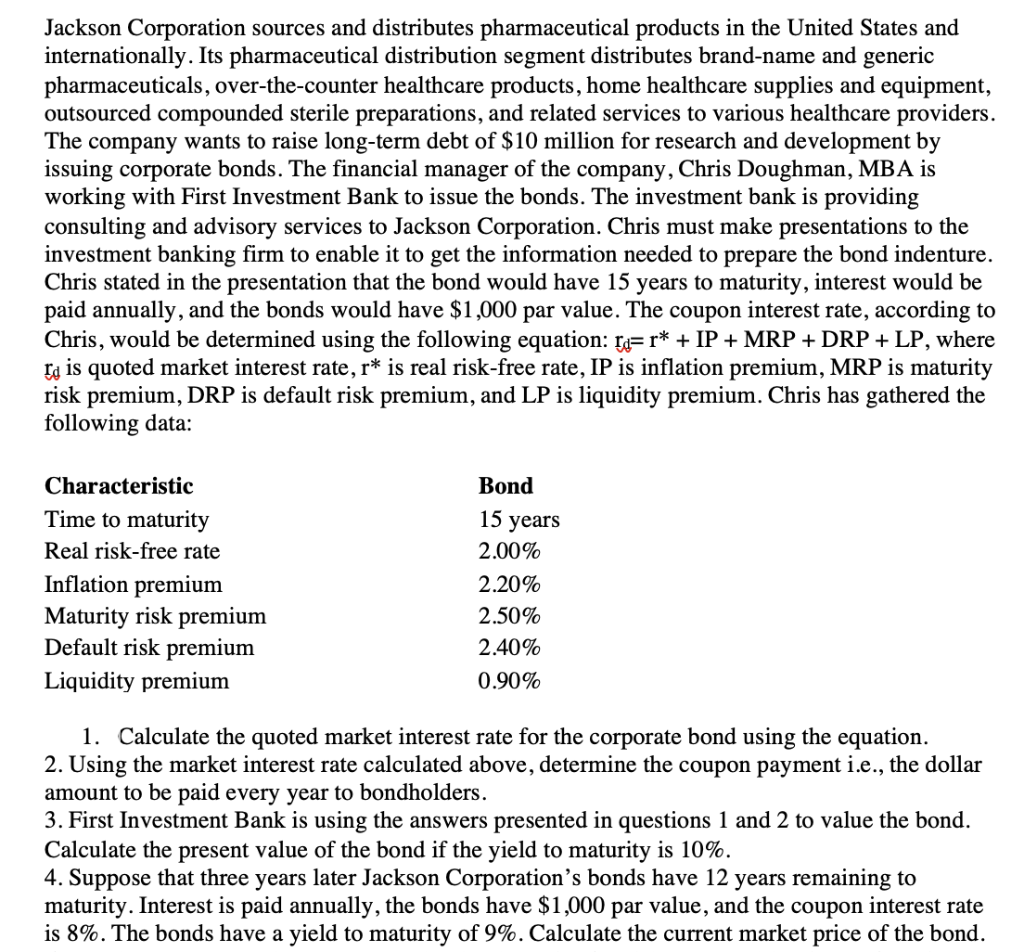

Jackson Corporation sources and distributes pharmaceutical products in the United States and internationally. Its pharmaceutical distribution segment distributes brand-name and generic pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, outsourced compounded sterile preparations, and related services to various healthcare providers. The company wants to raise long-term debt of $10 million for research and development by issuing corporate bonds. The financial manager of the company, Chris Doughman, MBA is working with First Investment Bank to issue the bonds. The investment bank is providing consulting and advisory services to Jackson Corporation. Chris must make presentations to the investment banking firm to enable it to get the information needed to prepare the bond indenture. Chris stated in the presentation that the bond would have 15 years to maturity, interest would be paid annually, and the bonds would have $1,000 par value. The coupon interest rate, according to Chris, would be determined using the following equation: Iq=r* + IP + MRP + DRP + LP, where Id is quoted market interest rate, r* is real risk-free rate, IP is inflation premium, MRP is maturity risk premium, DRP is default risk premium, and LP is liquidity premium. Chris has gathered the following data: Bond 15 years Characteristic Time to maturity Real risk-free rate Inflation premium Maturity risk premium Default risk premium Liquidity premium 2.00% 2.20% 2.50% 2.40% 0.90% 1. Calculate the quoted market interest rate for the corporate bond using the equation. 2. Using the market interest rate calculated above, determine the coupon payment i.e., the dollar amount to be paid every year to bondholders. 3. First Investment Bank is using the answers presented in questions 1 and 2 to value the bond. Calculate the present value of the bond if the yield to maturity is 10%. 4. Suppose that three years later Jackson Corporations bonds have 12 years remaining to maturity. Interest is paid annually, the bonds have $1,000 par value, and the coupon interest rate is 8%. The bonds have a yield to maturity of 9%. Calculate the current market price of the bond. Jackson Corporation sources and distributes pharmaceutical products in the United States and internationally. Its pharmaceutical distribution segment distributes brand-name and generic pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, outsourced compounded sterile preparations, and related services to various healthcare providers. The company wants to raise long-term debt of $10 million for research and development by issuing corporate bonds. The financial manager of the company, Chris Doughman, MBA is working with First Investment Bank to issue the bonds. The investment bank is providing consulting and advisory services to Jackson Corporation. Chris must make presentations to the investment banking firm to enable it to get the information needed to prepare the bond indenture. Chris stated in the presentation that the bond would have 15 years to maturity, interest would be paid annually, and the bonds would have $1,000 par value. The coupon interest rate, according to Chris, would be determined using the following equation: Iq=r* + IP + MRP + DRP + LP, where Id is quoted market interest rate, r* is real risk-free rate, IP is inflation premium, MRP is maturity risk premium, DRP is default risk premium, and LP is liquidity premium. Chris has gathered the following data: Bond 15 years Characteristic Time to maturity Real risk-free rate Inflation premium Maturity risk premium Default risk premium Liquidity premium 2.00% 2.20% 2.50% 2.40% 0.90% 1. Calculate the quoted market interest rate for the corporate bond using the equation. 2. Using the market interest rate calculated above, determine the coupon payment i.e., the dollar amount to be paid every year to bondholders. 3. First Investment Bank is using the answers presented in questions 1 and 2 to value the bond. Calculate the present value of the bond if the yield to maturity is 10%. 4. Suppose that three years later Jackson Corporations bonds have 12 years remaining to maturity. Interest is paid annually, the bonds have $1,000 par value, and the coupon interest rate is 8%. The bonds have a yield to maturity of 9%. Calculate the current market price of the bond