Answered step by step

Verified Expert Solution

Question

1 Approved Answer

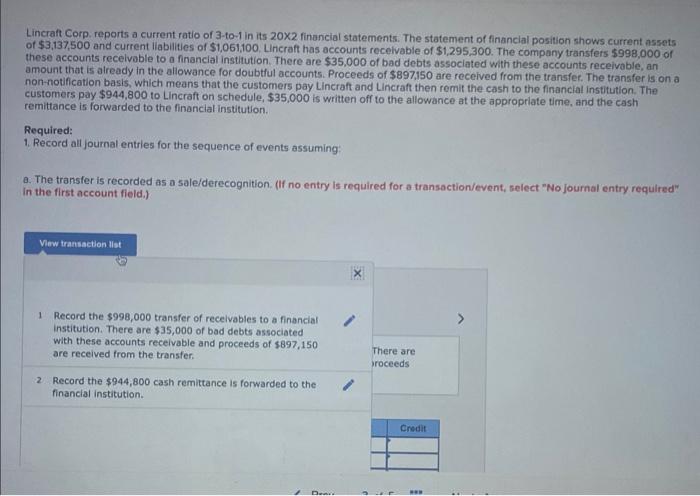

help please Lincraft Corp. reports a current ratio of 3to1 in its 202 finencial statements. The statement of financial position shows current assets of $3,137,500

help please

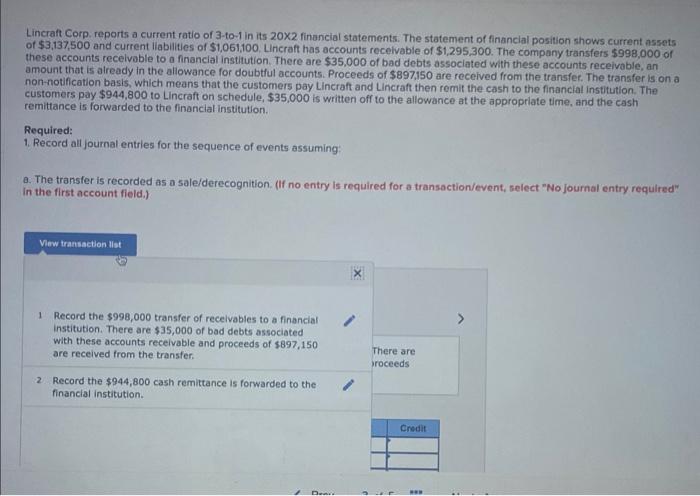

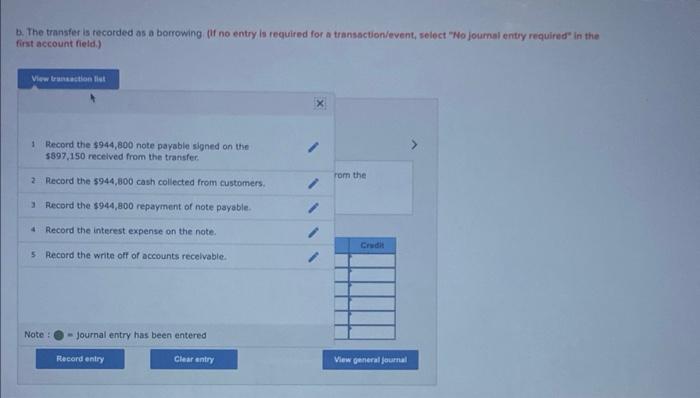

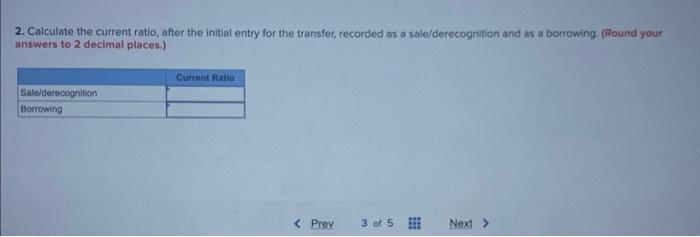

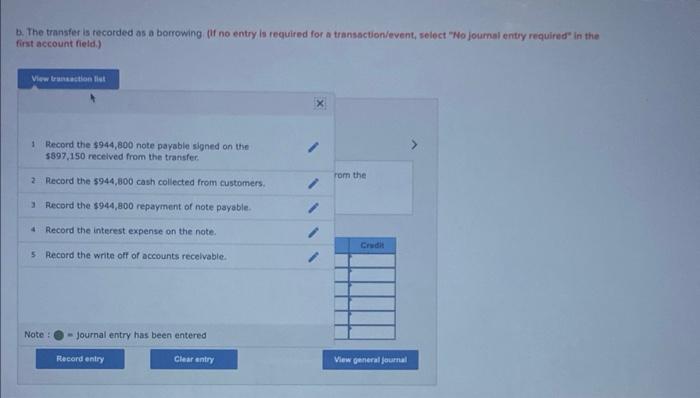

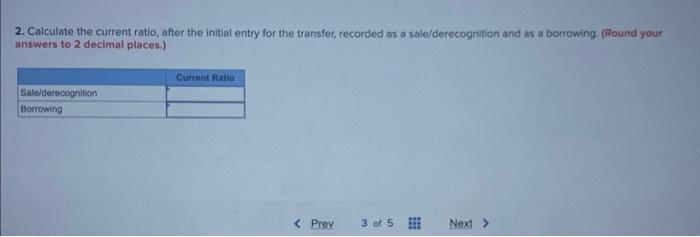

Lincraft Corp. reports a current ratio of 3to1 in its 202 finencial statements. The statement of financial position shows current assets of $3,137,500 and current liabilities of $1,061,100. Lincraft has accounts recelvable of $1,295,300. The company transfers $998,000 of these accounts recelvable to a financial institution. There are $35,000 of bad debts associated with these accounts recelvable, an amount that is already in the aliowance for doubtful accounts. Proceeds of $897,150 are received from the transfer. The transfer is on a non-notification basis, which means that the customers pay Lincraft and Lincraft then remit the cash to the financlal institution. The customers pay $944,800 to Lincraft on schedule, $35,000 is written off to the allowance at the appropriate time, and the cash remittance is forwarded to the financial institution. Required: 1. Record all journal entries for the sequence of events assuming: 8. The transfer is recorded as a sale/derecognition. (If no entry is required for a transaction/event, select "No journal entry requilred" in the first account field.) b. The transfer is tecorded as a borrowing (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field.) 2. Calculate the current ratio, after the initial entry for the transfer, recorded as a sale/derecognition and as a borrowing. (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started