Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please! part A AND B. thank you so much Compony XYZ manufactures a tangible product and selis the product at wholesale. In its first

help please! part A AND B. thank you so much

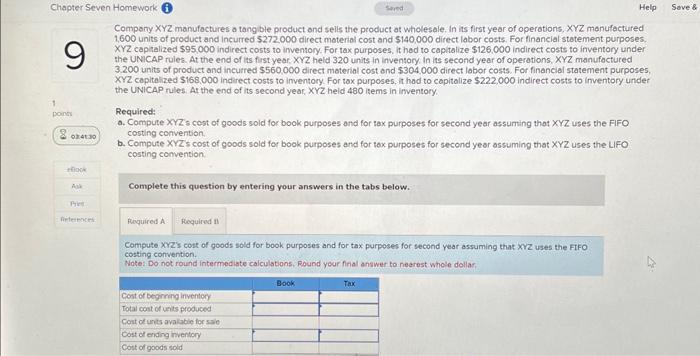

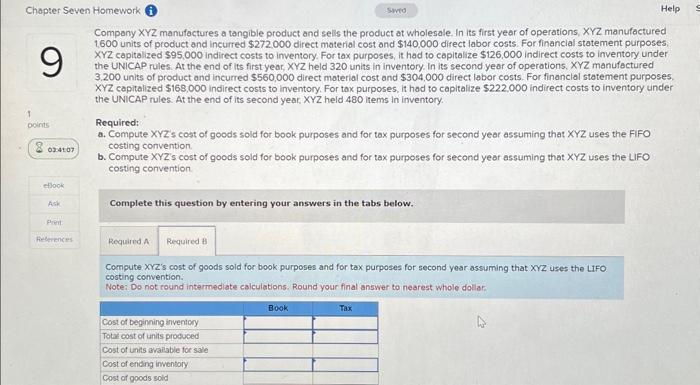

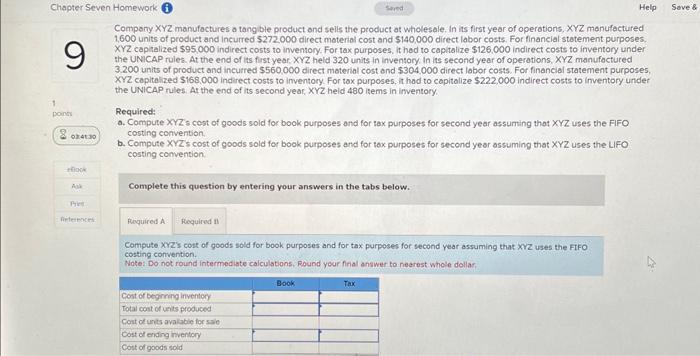

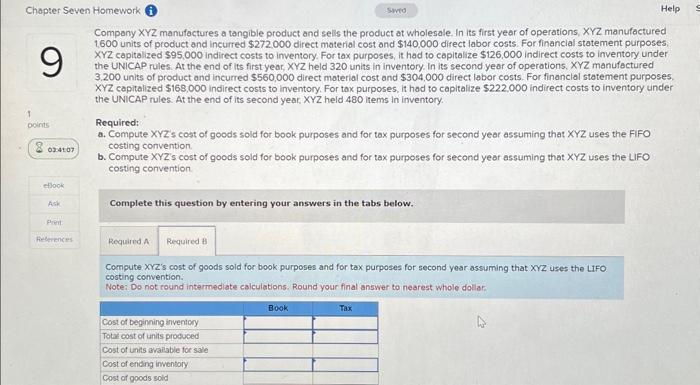

Compony XYZ manufactures a tangible product and selis the product at wholesale. In its first year of operations, XYZ monufactured 1,600 units of product and incurred $272000 direct moterial cost and $140,000 direct labor costs. For financial statement purposes. XYZ captalized $95,000 indirect costs to inventory. For tax purposes, it hed to capitalize $126.000 indirect costs to inventory under the UNICAP rules. At the end of its first year, XYZ heid 320 units in inventory, In its second year of operotions, XYZ manuffactured 3.200 units of product and incurred $560,000 direct material cost and $304.000 direct labor costs. For financial statement purposes, XYZ capitelized $168,000 indirect costs to inventory. For tax purposes, it had to capitalize $222,000 indirect costs to inventory under the UNICAP rules. At the end of its second year, XYZ held 480 isems in irventory. Required: a. Compute XYZ's cest of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the FIFO costing convention. b. Compute XYZ's cost of goods sold for book purposes and for tox purposes for second year assuming that XYZ uses the LIFO costing convention. Complete this question by entering your answers in the tabs below. Compute XVZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XVZ uses the FIFO costing convention. Note: Do not round intermediate calculations, Round your final answer to neerest whole dollar. Company XYZ manufoctures a tangible product and selis the product at wholesale. In its first year of operations, XYZ manufactured 1,600 units of product and incurred $272.000 direct material cost ond $140.000 direct labor costs. For financial statement purposes XYZ capitalized $95,000 indirect costs to inventory. For tax purposes, it had to capitalize $126,000 indirect costs to inventory under the UNICAP rules. At the end of its first year, XYZ held 320 units in inventory. In its second year of operations, XYZ manufoctured 3.200 units of product and incurred $560,000 direct moterial cost and $304,000 direct labor costs. For financial statement purposes. XYZ capitalized $168,000 indirect costs to inventory. For tax purposes, it had to capitalize $222,000 indirect costs to inventory under the UNICAP rules. At the end of its second year, XYZ held 480 items in inventory. Required: a. Compute XYZ' cost of goods sold for book purposes and for tox purposes for second year assuming that XYZ uses the FIFO costing convention. b. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the LIFO costing convention Complete this question by entering your answers in the tabs below. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the LIFO. costing convention. Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started