help please please god bless you thank you so much

problem a

problem b

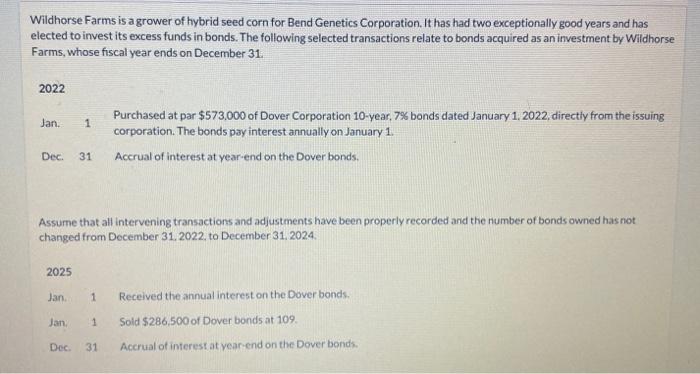

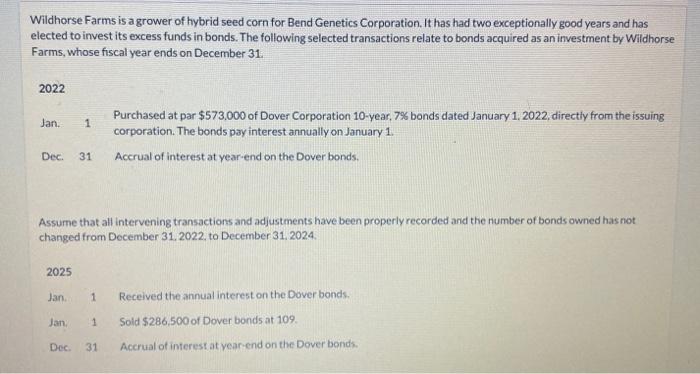

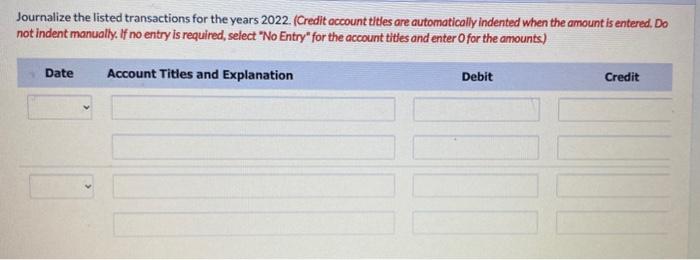

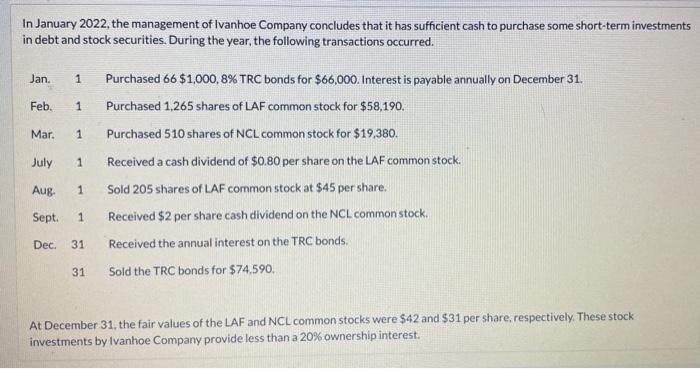

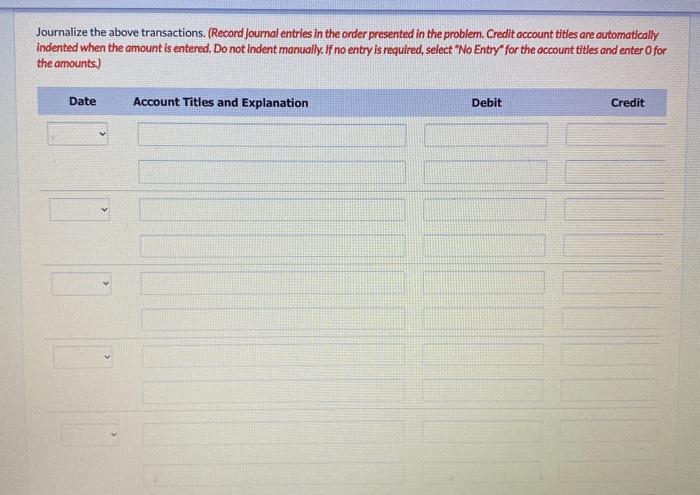

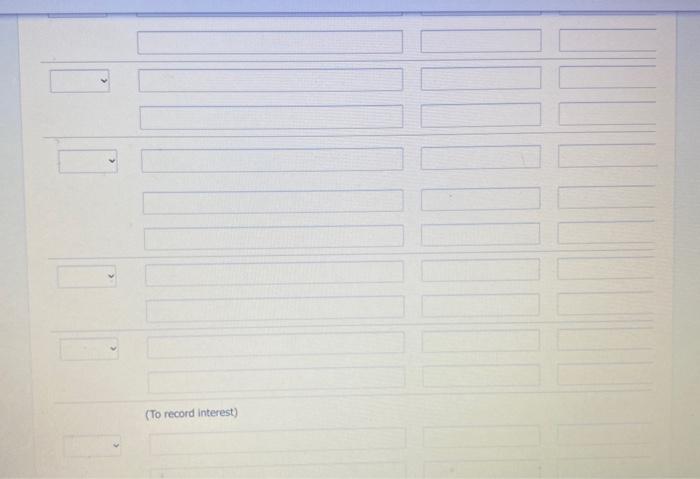

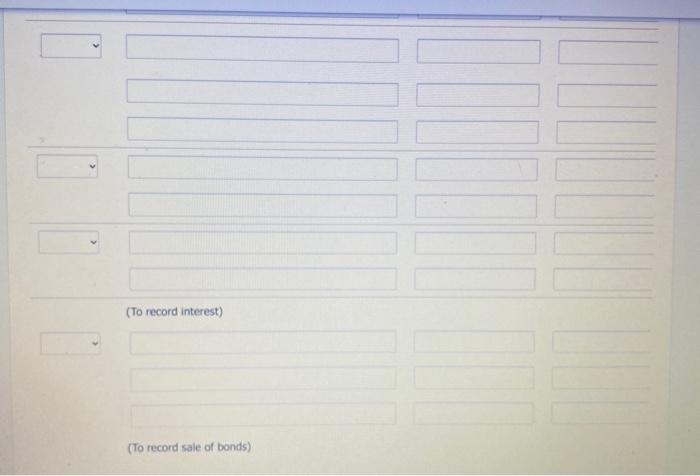

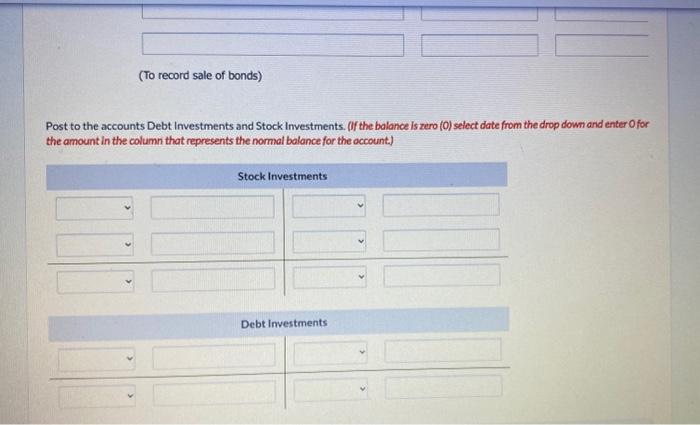

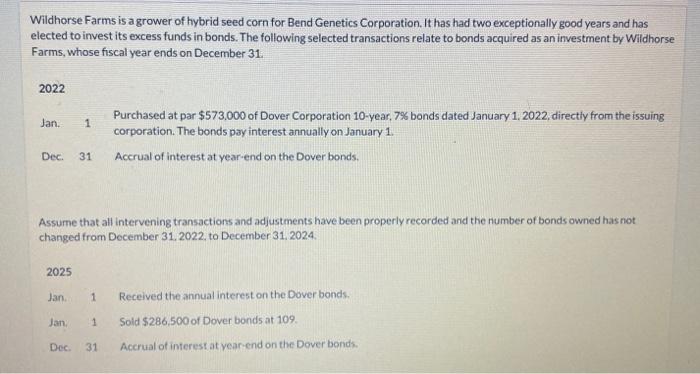

Wildhorse Farms is a grower of hybrid seed corn for Bend Genetics Corporation. It has had two exceptionally good years and has elected to invest its excess funds in bonds. The following selected transactions relate to bonds acquired as an investment by Wildhorse Farms, whose fiscal year ends on December 31 . 2022 Jan. 1 Purchased at par $573,000 of Dover Corporation 10 -year, 7% bonds dated January 1, 2022, directly from the issuing corporation. The bonds pay interest annually on January 1. Dec. 31 Accrual of interest at year-end on the Dover bonds. Assume that all intervening transactions and adjustments have been properly recorded and the number of bonds owned has not changed from December 31,2022 , to December 31,2024. Journalize the listed transactions for the years 2022. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter O for the amounts) In January 2022, the management of Ivanhoe Company concludes that it has sufficient cash to purchase some short-term investments in debt and stock securities. During the year, the following transactions occurred. Jan. 1 Purchased 66$1,000,8% TRC bonds for $66,000. Interest is payable annually on December 31. Feb. 1 Purchased 1,265 shares of LAF common stock for $58,190. Mar. 1 Purchased 510 shares of NCL common stock for $19,380. July 1 Received a cash dividend of $0.80 per share on the LAF common stock. Aug. 1 Sold 205 shares of LAF common stock at $45 per share. Sept. 1 Received $2 per share cash dividend on the NCL common stock. Dec. 31 Received the annual interest on the TRC bonds. 31 Sold the TRC bonds for $74.590. At December 31 , the fair values of the LAF and NCL common stocks were $42 and $31 per share, respectively. These stock investments by Ivanhoe Company provide less than a 20% ownership interest. Journalize the above transactions. (Record joumal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (To record interest) (To record interest) (To record sale of bonds) Post to the accounts Debt Investments and Stock Investments. (If the balance is zero (0) select date from the drop down and enter 0 for the amount in the column that represents the normal balance for the occount.)