help please

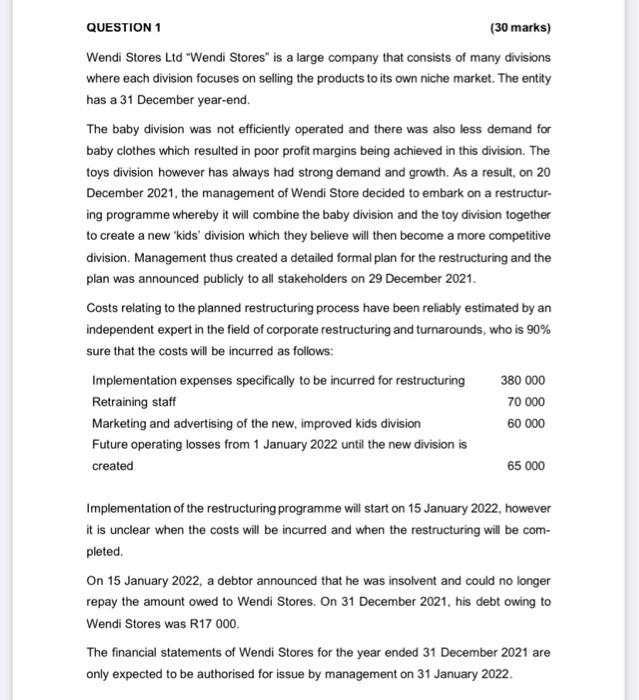

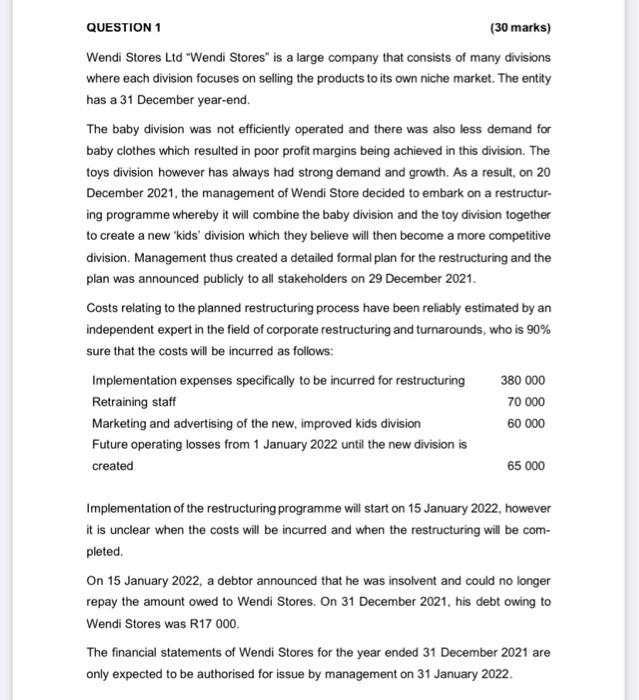

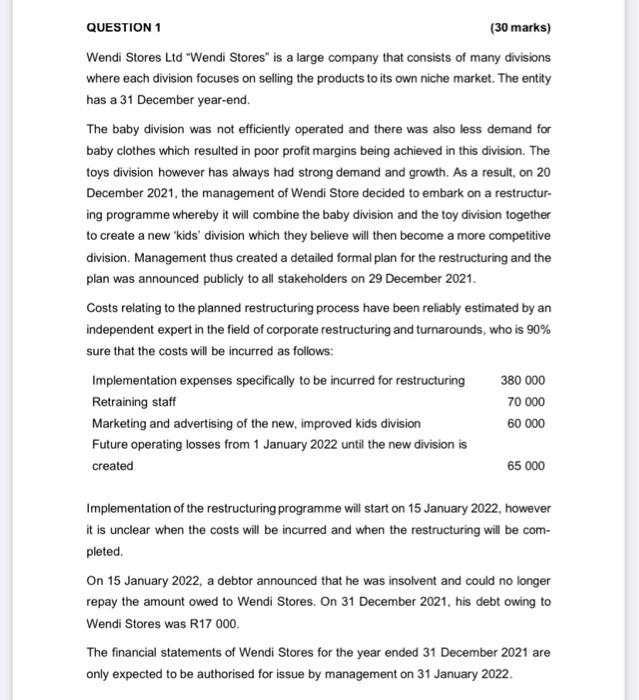

QUESTION 1 (30 marks) Wendi Stores Ltd "Wendi Stores" is a large company that consists of many divisions where each division focuses on selling the products to its own niche market. The entity has a 31 December year-end. The baby division was not efficiently operated and there was also less demand for baby clothes which resulted in poor profit margins being achieved in this division. The toys division however has always had strong demand and growth. As a result, on 20 December 2021, the management of Wendi Store decided to embark on a restructuring programme whereby it will combine the baby division and the toy division together to create a new 'kids' division which they believe will then become a more competitive division. Management thus created a detailed formal plan for the restructuring and the plan was announced publicly to all stakeholders on 29 December 2021. Costs relating to the planned restructuring process have been reliably estimated by an independent expert in the field of corporate restructuring and turnarounds, who is 90% sure that the costs will be incurred as follows: Implementation of the restructuring programme will start on 15 January 2022, however it is unclear when the costs will be incurred and when the restructuring will be completed. On 15 January 2022, a debtor announced that he was insolvent and could no longer repay the amount owed to Wendi Stores. On 31 December 2021, his debt owing to Wendi Stores was R17 000. The financial statements of Wendi Stores for the year ended 31 December 2021 are only expected to be authorised for issue by management on 31 January 2022. REQUIRED: 1.1) Discuss, with reference to IAS 37, whether the costs relating to the planned restructuring process should be recognised as a provision in the records of Wendi Stores. Include in your discussion the amount at which the provision, if any, should be accounted for and why. Clearly provide the applicable definitions and recognition criteria, whereafter you apply the above scenario to the criteria provided. QUESTION 1 (30 marks) Wendi Stores Ltd "Wendi Stores" is a large company that consists of many divisions where each division focuses on selling the products to its own niche market. The entity has a 31 December year-end. The baby division was not efficiently operated and there was also less demand for baby clothes which resulted in poor profit margins being achieved in this division. The toys division however has always had strong demand and growth. As a result, on 20 December 2021, the management of Wendi Store decided to embark on a restructuring programme whereby it will combine the baby division and the toy division together to create a new 'kids' division which they believe will then become a more competitive division. Management thus created a detailed formal plan for the restructuring and the plan was announced publicly to all stakeholders on 29 December 2021. Costs relating to the planned restructuring process have been reliably estimated by an independent expert in the field of corporate restructuring and turnarounds, who is 90% sure that the costs will be incurred as follows: Implementation of the restructuring programme will start on 15 January 2022, however it is unclear when the costs will be incurred and when the restructuring will be completed. On 15 January 2022, a debtor announced that he was insolvent and could no longer repay the amount owed to Wendi Stores. On 31 December 2021, his debt owing to Wendi Stores was R17 000. The financial statements of Wendi Stores for the year ended 31 December 2021 are only expected to be authorised for issue by management on 31 January 2022. REQUIRED: 1.1) Discuss, with reference to IAS 37, whether the costs relating to the planned restructuring process should be recognised as a provision in the records of Wendi Stores. Include in your discussion the amount at which the provision, if any, should be accounted for and why. Clearly provide the applicable definitions and recognition criteria, whereafter you apply the above scenario to the criteria provided