Answered step by step

Verified Expert Solution

Question

1 Approved Answer

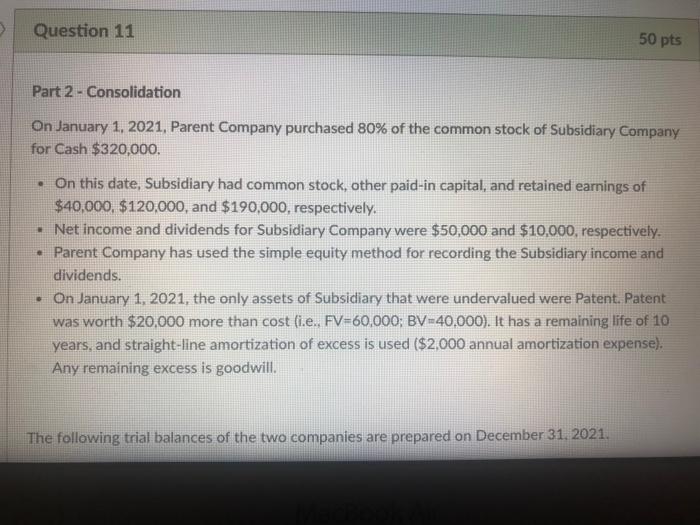

HELP PLEASE!!! Question 11 50 pts Part 2 - Consolidation On January 1, 2021, Parent Company purchased 80% of the common stock of Subsidiary Company

HELP PLEASE!!!

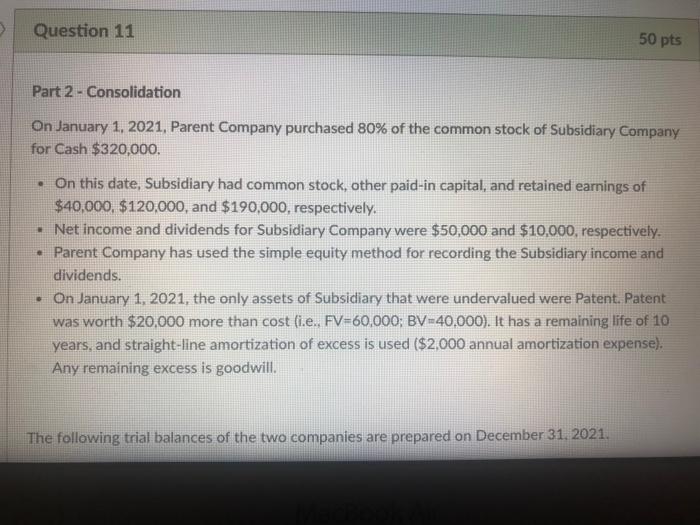

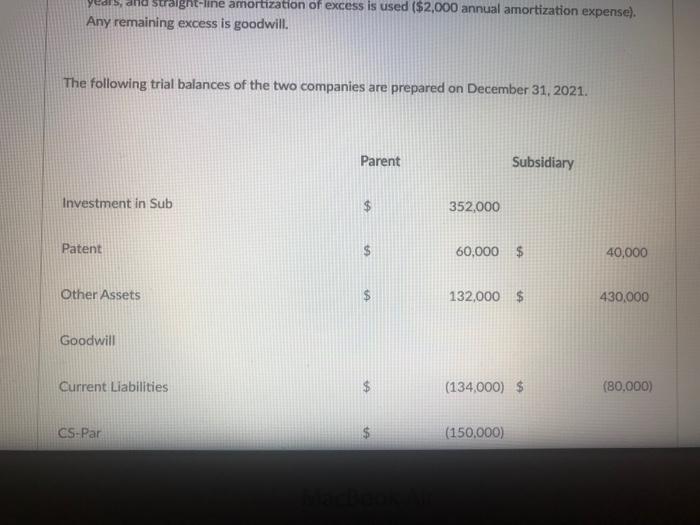

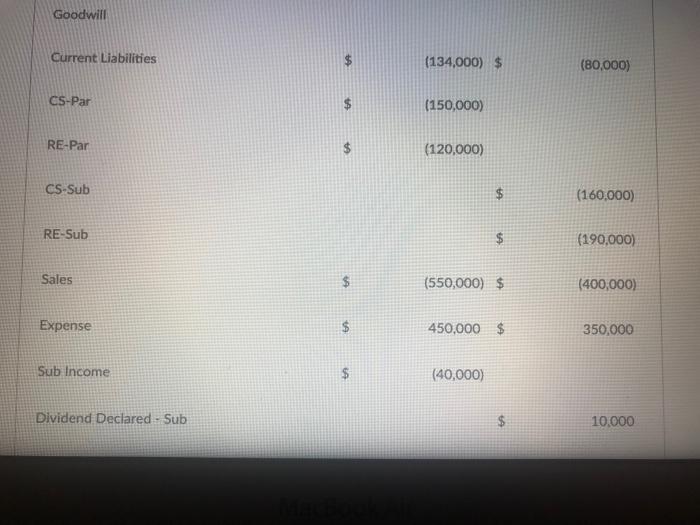

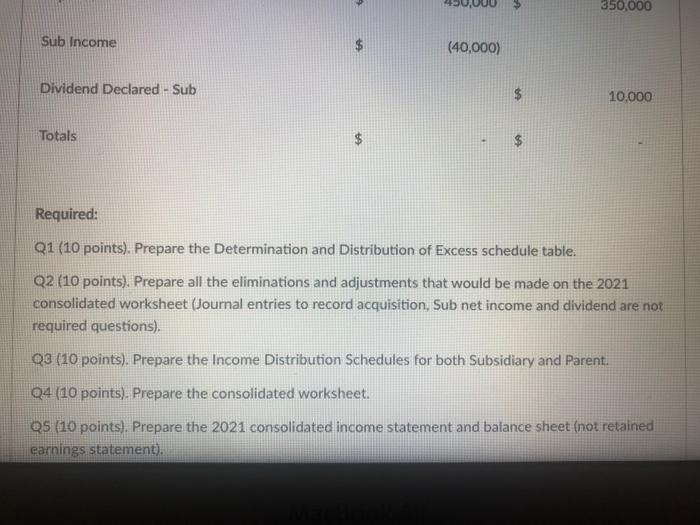

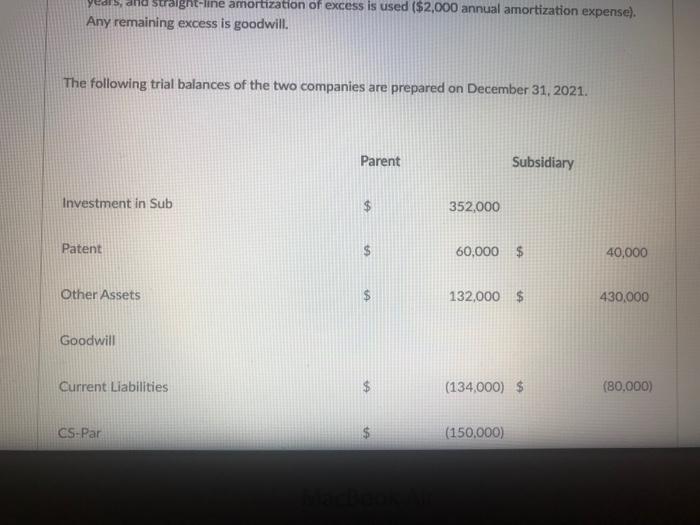

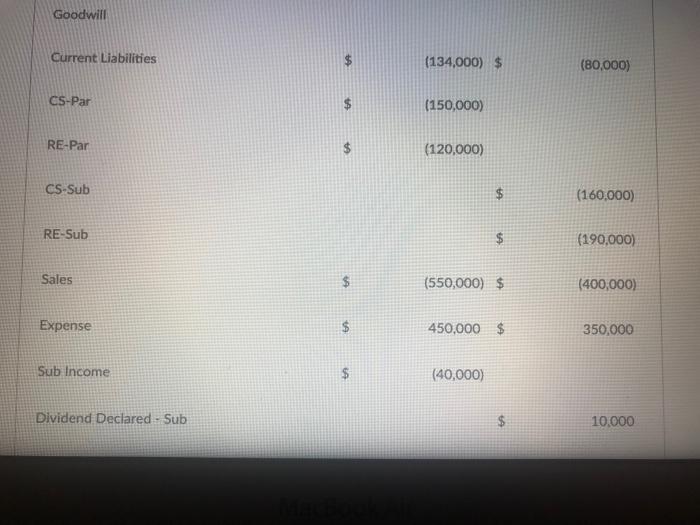

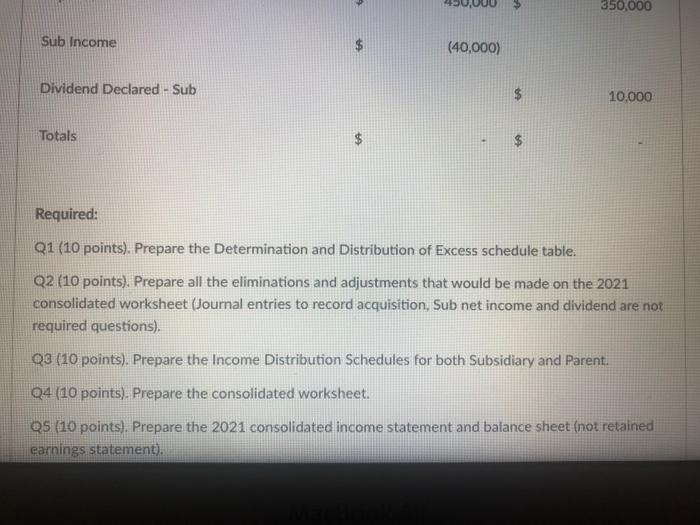

Question 11 50 pts Part 2 - Consolidation On January 1, 2021, Parent Company purchased 80% of the common stock of Subsidiary Company for Cash $320,000. . On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $40,000, $120,000, and $190,000, respectively. Net income and dividends for Subsidiary Company were $50,000 and $10,000, respectively. Parent Company has used the simple equity method for recording the Subsidiary income and dividends. On January 1, 2021, the only assets of Subsidiary that were undervalued were Patent. Patent was worth $20,000 more than cost (i.e., FV=60,000; BV=40,000). It has a remaining life of 10 years, and straight-line amortization of excess is used ($2,000 annual amortization expense). Any remaining excess is goodwill. The following trial balances of the two companies are prepared on December 31, 2021. and straight-line amortization of excess is used ($2,000 annual amortization expense). Any remaining excess is goodwill. The following trial balances of the two companies are prepared on December 31, 2021. Parent Subsidiary Investment in Sub 352,000 Patent 60,000 $ 40,000 Other Assets $ 132,000 $ 430,000 Goodwill Current Liabilities $ (134,000) $ (80,000) CSPar $ (150,000) Goodwill Current Liabilities (134,000) $ (80,000) CS-Par (150,000) RE-Par (120,000) CS-Sub $ (160,000) RE-Sub $ (190,000) Sales $ (550,000) $ (400,000) Expense $ 450,000 $ 350,000 Sub Income $ (40,000) Dividend Declared - Sub $ $ 10.000 350,000 Sub Income $ (40,000) Dividend Declared - Sub 10,000 Totals Required: Q1 (10 points). Prepare the Determination and Distribution of Excess schedule table. Q2 (10 points). Prepare all the eliminations and adjustments that would be made on the 2021 consolidated worksheet (Journal entries to record acquisition, Sub net income and dividend are not required questions). Q3 (10 points). Prepare the Income Distribution Schedules for both Subsidiary and Parent. Q4 (10 points). Prepare the consolidated worksheet. Q5 (10 points). Prepare the 2021 consolidated income statement and balance sheet (not retained earnings statement)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started