Answered step by step

Verified Expert Solution

Question

1 Approved Answer

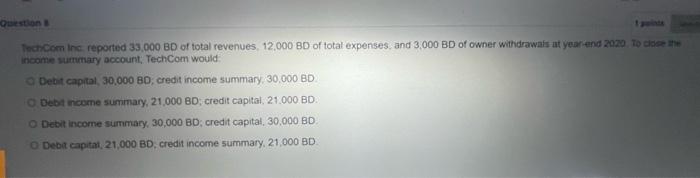

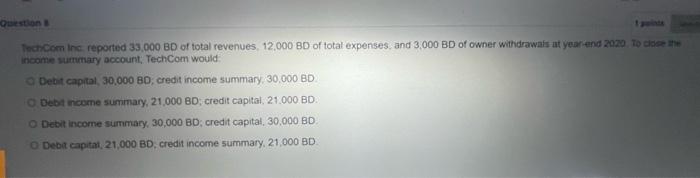

help please Question B TechCom Inc. reported 33,000 BD of total revenues, 12,000 BD of total expenses, and 3,000 BD of owner withdrawals at year-end

help please

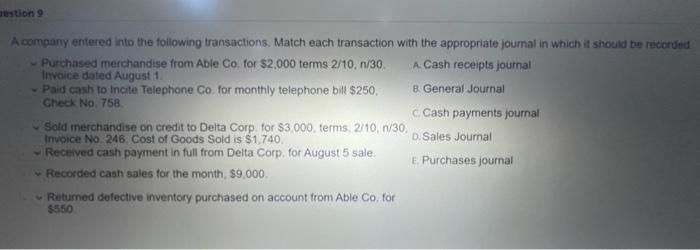

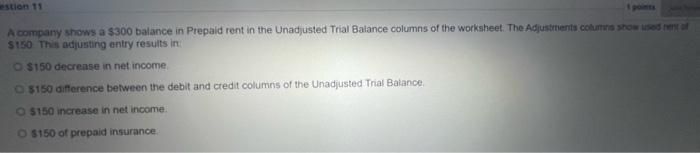

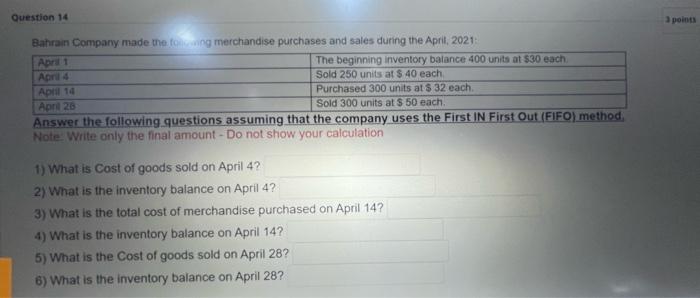

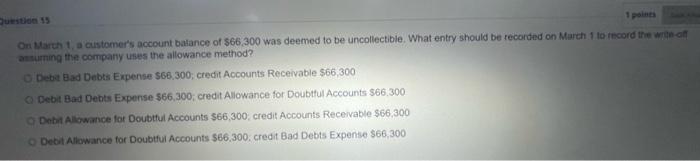

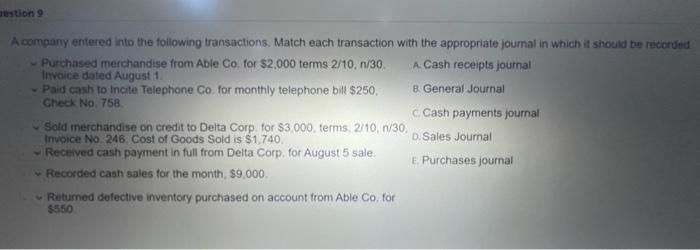

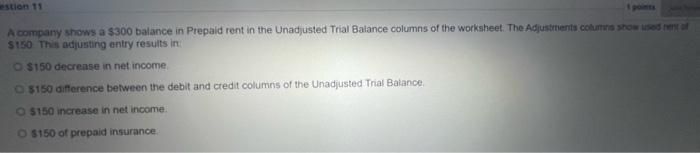

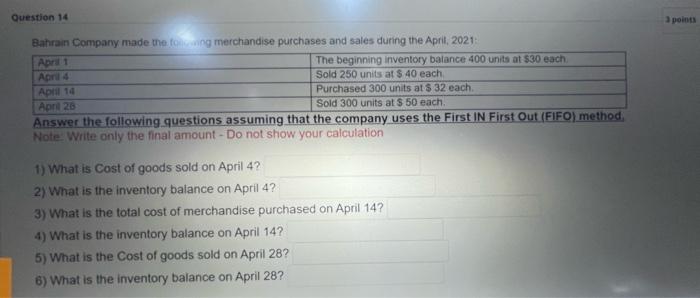

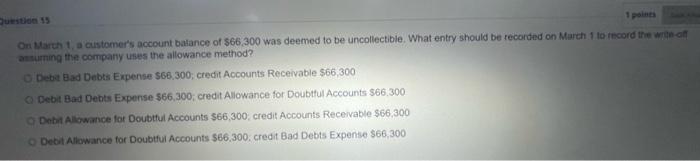

Question B TechCom Inc. reported 33,000 BD of total revenues, 12,000 BD of total expenses, and 3,000 BD of owner withdrawals at year-end 2020. To close the income summary account, TechCom would Debit capital, 30,000 BD, credit income summary. 30,000 BD. O Debit income summary, 21,000 BD: credit capital, 21.000 BD. O Debit income summary, 30,000 BD; credit capital, 30,000 BD. O Debit capital, 21,000 BD, credit income summary, 21,000 BD gestion 9 A company entered into the following transactions. Match each transaction with the appropriate journal in which it should be recorded A. Cash receipts journal - Purchased merchandise from Able Co. for $2,000 terms 2/10, n/30. Invoice dated August 1. B. General Journal - Paid cash to incite Telephone Co. for monthly telephone bill $250, Check No. 758 C. Cash payments journal Sold merchandise on credit to Delta Corp. for $3,000, terms, 2/10, n/30. Invoice No. 246. Cost of Goods Sold is $1,740. D. Sales Journal -Received cash payment in full from Delta Corp. for August 5 sale. E. Purchases journal Recorded cash sales for the month, $9,000. Returned defective inventory purchased on account from Able Co, for $550 estion 11 A company shows a $300 balance in Prepaid rent in the Unadjusted Trial Balance columns of the worksheet. The Adjustments columns show used nent of $150 This adjusting entry results in O $150 decrease in net income O $150 difference between the debit and credit columns of the Unadjusted Trial Balance O $150 increase in net income. O $150 of prepaid insurance. Question 14 Bahrain Company made the forsving merchandise purchases and sales during the April, 2021: April 1 The beginning inventory balance 400 units at $30 each. Sold 250 units at $ 40 each. April 4 April 14 Purchased 300 units at $ 32 each. April 28 Sold 300 units at $ 50 each. Answer the following questions assuming that the company uses the First IN First Out (FIFO) method, Note: Write only the final amount - Do not show your calculation 1) What is Cost of goods sold on April 4? 2) What is the inventory balance on April 4? 3) What is the total cost of merchandise purchased on April 14? 4) What is the inventory balance on April 14? 5) What is the Cost of goods sold on April 28? 6) What is the inventory balance on April 28? 3 points Question 15 1 points On March 1, a customer's account balance of $66,300 was deemed to be uncollectible. What entry should be recorded on March 1 to record the write-off ansuring the company uses the allowance method? O Debe Bad Debts Expense $66.300; credit Accounts Receivable $66,300 O Debit Bad Debts Expense $66,300; credit Allowance for Doubtful Accounts $66,300 Debit Allowance for Doubtful Accounts $66,300, credit Accounts Receivable $66,300 O Debit Allowance for Doubtful Accounts $66,300, credit Bad Debts Expense $66,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started