!! Help !!

!! Please Show ALL Work !!

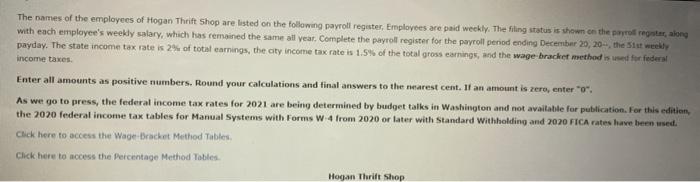

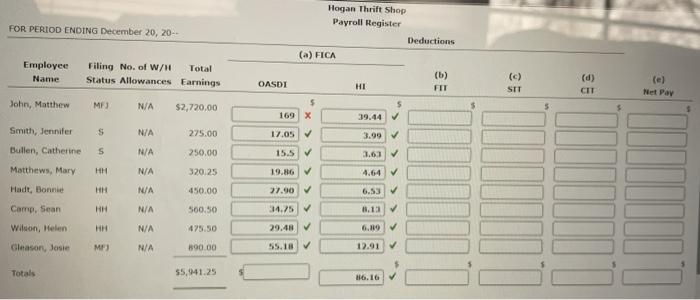

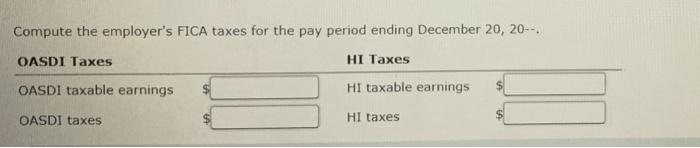

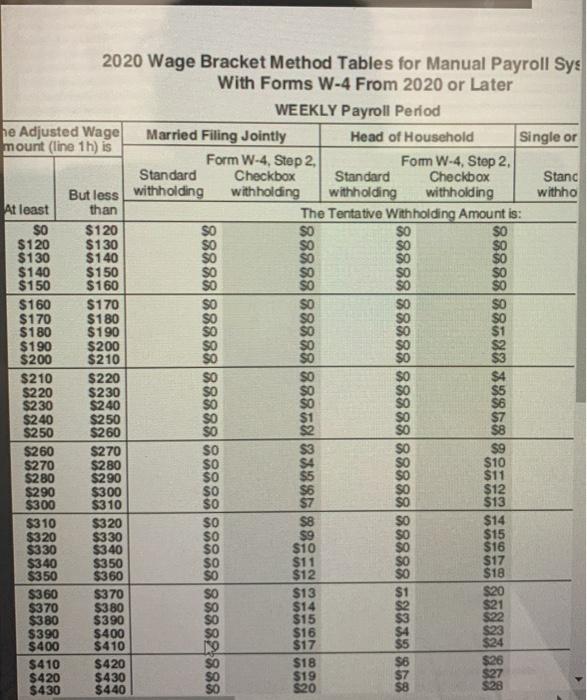

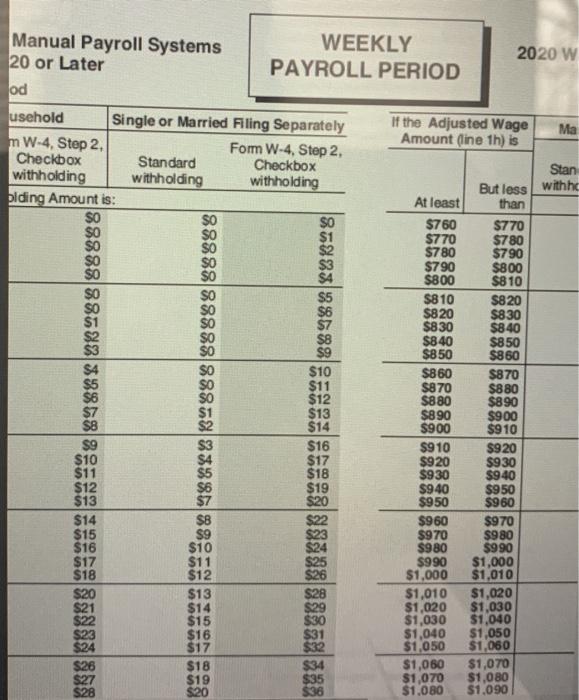

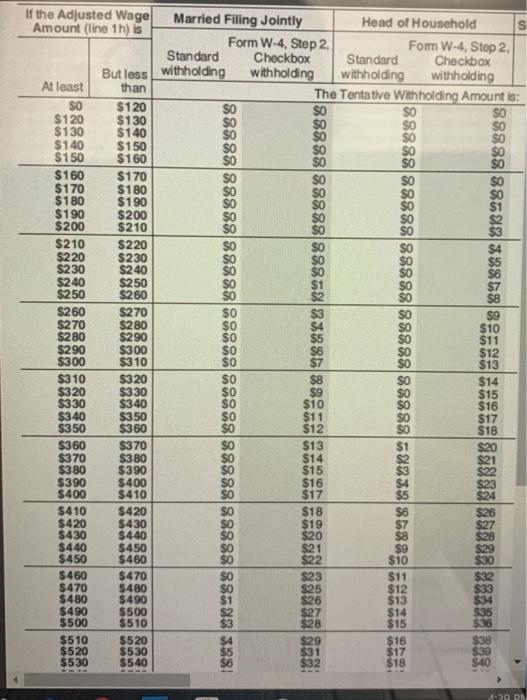

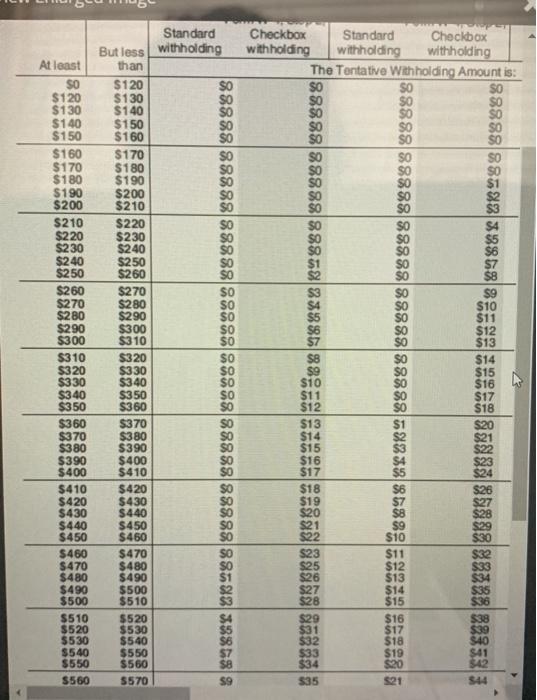

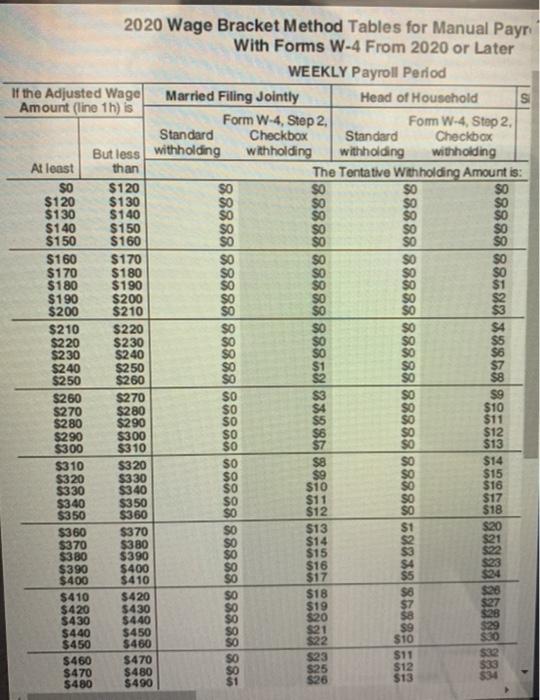

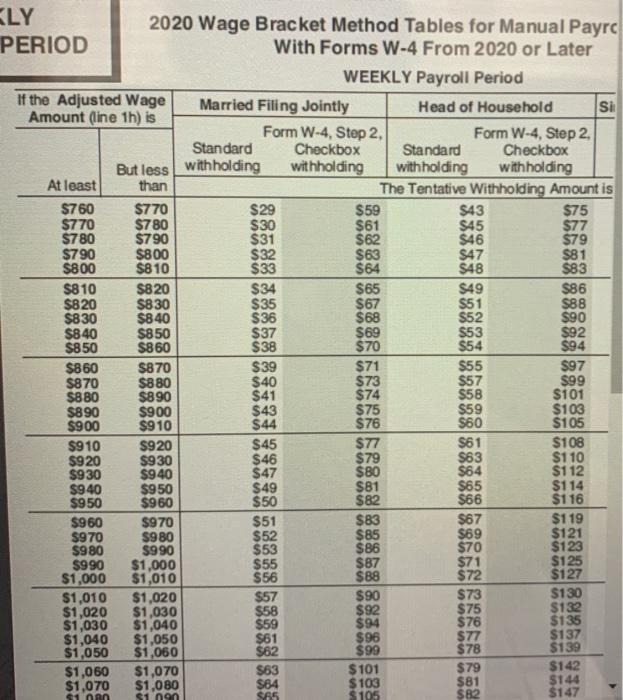

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The filing status is shown on the payroll register, along with each employee's weekly salary, which has remained the same all year. Complete the payroll register for the payroll period ending December 20, 20-- , the 51st weekly payday. The state income tax rate is 2% of total earnings, the city income tax rate is 1.5% of the total gross earnings, and the wage bracket method is used for federal income taxes.

Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent.

If an amount is zero, enter "0"

As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W - 4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used.

!! If the tables are wrong please let me know and I will post the other tables !!

The names of the employees of Hogan Thrift Shop are listed on the following payroll register, Employees are paid weekly. The filing status is shown on the payrollregtar, along with each employee's weekly salary, which has remained the same all year. Complete the payroll register for the payroll period ending December 20, 20, the Sint Weekly payday. The state income tax rate is 2% of total earnings, the city income tax rate is 1.5% of the total gross earnings, and the wage bracket method is used for feders! income taxes Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. It an amount is zero, entero. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition the 2020 federal income tax tables for Manual Systems with Forms W4 from 2020 or later with Standard Withholding and 2020 FICA rates have been wed. Click here to access the Wage Bracket Method Tables Click here to access the Percentage Method Tables Hogan Thrift Shop FOR PERIOD ENDING December 20, 20- Hogan Thrift Shop Payroll Register Deductions (a) FICA (b) HI FIT Employee Name Filing No. of W/H Total Status Allowances Earnings OASDI (d) CIT SIT Net Pay John, Matthew ME) N/A $2,720.00 5 169 X 5 39.44 N/A 17.05 3.99 Smith, Jennifer Bullen, Catherine 275.00 250.00 S N/A 15.5 3.61 Matthews, Mary N/A 320.25 4.64 19.86 27.90 Hadt, Bonnie HH NIA 450.00 6.53 HH N/A 500.50 34.75 3.1 Camp, Sean Wilson, Helen N/A 475.50 29.48 55.18 Gleason, Josie MF) NA 890.00 12.91 7 Totals 55,941.25 Compute the employer's FICA taxes for the pay period ending December 20, 20- OASDI Taxes HI Taxes OASDI taxable earnings HI taxable earnings OASDI taxes HI taxes 2020 Wage Bracket Method Tables for Manual Payroll Sys With Forms W-4 From 2020 or Later WEEKLY Payroll Period he Adjusted Wage Married Filing Jointly mount (line 1h) is Head of Household Single or Form W-4, Step 2 For W-4, Step 2 Standard Checkbox Standard Checkbox Stanc But less withholding withholding withholding withholding withho At least than The Tentative Withholding Amount is: SO $120 SO $120 $130 $130 $140 $140 $150 $150 $160 $160 $170 $170 $180 $180 $190 $190 $200 $200 $210 $210 $220 $220 $230 $230 $240 $240 $250 $250 $260 $260 $270 $9 $270 $280 $10 $280 $290 $11 $290 $300 $12 $300 $310 $13 $310 $320 $14 $320 $330 $9 $15 $330 $340 $10 $16 $340 $350 $11 $17 $350 $360 $12. $18 $360 $370 $13 $20 $370 $380 $14 $21 $380 $390 $15 $22 $390 $400 $16 $23 $400 $410 $17 $24 $410 $420 $18 $6 $26 $420 $430 $19 $430 $440 $20 $8 $28 *480*2K48888888 8888888888888ngl8x8 81999 88888888888888888888888888888888 *98*LXK8888888888888888888888888 Ma Manual Payroll Systems WEEKLY 2020 W 20 or Later PAYROLL PERIOD od usehold Single or Married Filing Separately If the Adjusted Wage mW-4, Step 2 Amount (line 1h) is Form W-4, Step 2 Checkbox Standard Checkbox Stan withholding withholding withholding But less withhe biding Amount is: At least than $ $0 $760 $770 $770 $780 $780 $790 $790 $800 $800 $810 $810 $820 $820 $830 $830 $8.40 $8.40 $850 $850 $860 $10 $860 $870 SO $11 $870 $880 $12 $880 $890 $13 $890 $900 $14 $900 $910 $ $16 $910 $920 $10 $17 $920 $930 $11 $18 $930 $940 $12 $19 $940 $950 $13 $20 $950 $960 $14 $8 $22 $960 $970 $15 $9 $23 $970 $980 $16 $10 $24 $980 $990 $17 $11 $25 $990 $1,000 $18 $12 $26 $1,000 $1,010 $20 $13 $28 $1,010 $1,020 S21 $14 $29 $1,020 $1,030 $22 $15 $30 $1,030 $1,040 $23 $16 $31 $1,040 $1,050 $24 $17 $32 $1,050 $1,060 $26 $18 $34 $1,080 $1,070 $27 $19 $35 $1,070 $1,080 S28 $20 $36 $1.080 $1.090 88888885883886889 %%986881398888888888888 If the Adjusted Wage Married Filing Jointly Amount (line 1h) is Head of Household S Form W-4, Step 2 For W-4, Step 2 Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $120 $120 $130 $130 $140 $140 $150 $150 $160 $160 $170 $170 $180 $180 $190 1 $190 $200 $200 $210 $210 $220 $220 $230 $230 $240 $240 $250 $250 $260 $260 $270 $9 $270 $280 $10 $280 $290 $11 $290 $300 $12 $300 $310 $13 $310 $320 $8 $14 $320 $330 $9 $15 $330 $340 $10 $16 $340 $350 $11 $17 $350 $360 $12 $18 $360 $370 $13 $370 $380 $14 $380 $390 $15 $390 $400 $16 $400 $410 $17 $410 $420 $18 $420 $430 $19 $7 $430 $440 $20 $8 $440 $450 $21 9 $29 $450 $460 $22 10 $30 $460 $470 $23 $11 $32 $470 $480 $25 $12 $33 $480 $490 $26 $13 $34 $490 $500 $27 $14 $35 $500 $510 $3 $28 $15 $36 $510 $520 $29 $16 $38 $520 $530 $5 $31 $17 $39 $530 $540 $32 $18 $40 1868 K988888888888888888888888888888888 KORK8%98%88648888888888888 28*98 SKUK 98888888888888888888888888 Bis 8&98888898888888 420 ON Checkbox Standard Checkbox withholding withholding withholding The Tentative Withholding Amount is: *8*986*** 8888888 88989481398888888888888 Standard But less withholding than $120 $130 $140 $150 $160 $170 $180 $190 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 $410 $420 $430 $4.40 $450 $460 $470 $480 $490 $500 $510 $520 $530 $540 $550 $560 $8 $570 59 At least SO $120 $130 $140 $150 $160 $170 $180 $190 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 $410 $420 $430 $440 $450 $460 $470 $480 $490 $500 $510 $520 $530 $540 $550 S560 * *98** *19888888888888888888888888888888888 $ $10 $11 $12 $13 $14 $15 $16 $17 S18 $20 21 $22 $23 $24 $9 $10 $11 $12 $13 $14 $15 $16 $17 $18 $19 $20 $21 $22 $23 $25 $26 $27 $28 $29 $31 $32 $33 $34 535 38848438698888888888888888888888888 S27 $28 $29 $30 $11 $12 $13 $14 $ $ $ $33 $34 $35 $38 $39 $40 $41 $42 $44 2020 Wage Bracket Method Tables for Manual Payr With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Amount (line 1h) is Head of Household Form W-4, Step 2 Fom W-4, Step 2 Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $120 $0 $120 $130 $ $130 $140 $140 $150 $150 $160 $160 $170 $170 $180 $180 $190 $190 $200 $200 $210 $210 $220 $220 $230 $230 $240 $240 $250 $250 $260 $8 $260 $270 $9 $270 $280 $10 $280 $290 $11 $290 $300 $12 $300 $310 $13 $310 $320 $ $14 $320 $330 $9 $15 $330 $340 10 $16 $3.40 $350 $11 $17 $350 $360 $12 $18 $360 $370 $13 $ $20 $370 $380 $14 $380 $390 $15 $390 $400 $16 $400 $410 $17 $410 $420 $18 $420 $430 $19 7 $430 $440 $20 $29 $440 $450 $21 $450 $460 $22 $10 30 $460 $23 $32 $470 $11 $470 $25 $480 $12 $33 $480 $490 $1 $26 $13 $34 988 8888888888888888888888888888 68848882698888888888888 8848882698888888888888888888888888 . KLY 2020 Wage Bracket Method Tables for Manual Payrc PERIOD With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household SI Amount (line 1h) is Form W-4, Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding At least than The Tentative Withholding Amount is $760 $770 $29 $59 $43 $75 $770 $780 $30 $61 $45 $77 $780 $790 $31 $62 $46 $79 $790 $800 $32 $63 $47 $81 $800 5810 $33 $64 $48 $83 $810 $820 $34 $65 $49 $86 $820 $830 $35 $67 $51 88 $830 $840 $36 $68 $52 $90 $840 $850 $37 $69 $53 $92 $850 $860 $38 $70 $54 $94 $860 $870 $39 $71 $55 597 $870 $880 $40 $73 $57 $99 $880 $890 $41 $74 $58 $101 $890 $900 $43 $75 $59 $103 $900 $910 $44 $76 $60 $105 $910 $920 $45 $77 $61 $108 $920 $930 $46 $79 $63 $110 $930 $940 $47 $80 $64 $112 $940 $950 $49 $81 $65 $114 $950 $960 $50 $82 $66 $116 $960 $970 $51 $83 $67 $119 $970 $980 $52 $85 $69 $121 $980 $990 $53 $86 $70 $123 $990 $1,000 $55 $87 $71 $125 $1,000 $1,010 $56 $88 $72 $127 $1,010 $1,020 $57 $90 $73 $130 $1,020 $1,030 $58 $92 $75 $132 $1,030 $1,040 $59 $94 $76 $135 $1,040 $1,050 $61 $96 $77 $137 $1,050 $1,060 $62 $99 $78 $139 $1,060 $1,070 $63 $ 101 $79 $142 $1,070 $1,080 $84 $ 103 $81 $144 $1 non S 105 $82 $147 $1 S65 The names of the employees of Hogan Thrift Shop are listed on the following payroll register, Employees are paid weekly. The filing status is shown on the payrollregtar, along with each employee's weekly salary, which has remained the same all year. Complete the payroll register for the payroll period ending December 20, 20, the Sint Weekly payday. The state income tax rate is 2% of total earnings, the city income tax rate is 1.5% of the total gross earnings, and the wage bracket method is used for feders! income taxes Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. It an amount is zero, entero. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition the 2020 federal income tax tables for Manual Systems with Forms W4 from 2020 or later with Standard Withholding and 2020 FICA rates have been wed. Click here to access the Wage Bracket Method Tables Click here to access the Percentage Method Tables Hogan Thrift Shop FOR PERIOD ENDING December 20, 20- Hogan Thrift Shop Payroll Register Deductions (a) FICA (b) HI FIT Employee Name Filing No. of W/H Total Status Allowances Earnings OASDI (d) CIT SIT Net Pay John, Matthew ME) N/A $2,720.00 5 169 X 5 39.44 N/A 17.05 3.99 Smith, Jennifer Bullen, Catherine 275.00 250.00 S N/A 15.5 3.61 Matthews, Mary N/A 320.25 4.64 19.86 27.90 Hadt, Bonnie HH NIA 450.00 6.53 HH N/A 500.50 34.75 3.1 Camp, Sean Wilson, Helen N/A 475.50 29.48 55.18 Gleason, Josie MF) NA 890.00 12.91 7 Totals 55,941.25 Compute the employer's FICA taxes for the pay period ending December 20, 20- OASDI Taxes HI Taxes OASDI taxable earnings HI taxable earnings OASDI taxes HI taxes 2020 Wage Bracket Method Tables for Manual Payroll Sys With Forms W-4 From 2020 or Later WEEKLY Payroll Period he Adjusted Wage Married Filing Jointly mount (line 1h) is Head of Household Single or Form W-4, Step 2 For W-4, Step 2 Standard Checkbox Standard Checkbox Stanc But less withholding withholding withholding withholding withho At least than The Tentative Withholding Amount is: SO $120 SO $120 $130 $130 $140 $140 $150 $150 $160 $160 $170 $170 $180 $180 $190 $190 $200 $200 $210 $210 $220 $220 $230 $230 $240 $240 $250 $250 $260 $260 $270 $9 $270 $280 $10 $280 $290 $11 $290 $300 $12 $300 $310 $13 $310 $320 $14 $320 $330 $9 $15 $330 $340 $10 $16 $340 $350 $11 $17 $350 $360 $12. $18 $360 $370 $13 $20 $370 $380 $14 $21 $380 $390 $15 $22 $390 $400 $16 $23 $400 $410 $17 $24 $410 $420 $18 $6 $26 $420 $430 $19 $430 $440 $20 $8 $28 *480*2K48888888 8888888888888ngl8x8 81999 88888888888888888888888888888888 *98*LXK8888888888888888888888888 Ma Manual Payroll Systems WEEKLY 2020 W 20 or Later PAYROLL PERIOD od usehold Single or Married Filing Separately If the Adjusted Wage mW-4, Step 2 Amount (line 1h) is Form W-4, Step 2 Checkbox Standard Checkbox Stan withholding withholding withholding But less withhe biding Amount is: At least than $ $0 $760 $770 $770 $780 $780 $790 $790 $800 $800 $810 $810 $820 $820 $830 $830 $8.40 $8.40 $850 $850 $860 $10 $860 $870 SO $11 $870 $880 $12 $880 $890 $13 $890 $900 $14 $900 $910 $ $16 $910 $920 $10 $17 $920 $930 $11 $18 $930 $940 $12 $19 $940 $950 $13 $20 $950 $960 $14 $8 $22 $960 $970 $15 $9 $23 $970 $980 $16 $10 $24 $980 $990 $17 $11 $25 $990 $1,000 $18 $12 $26 $1,000 $1,010 $20 $13 $28 $1,010 $1,020 S21 $14 $29 $1,020 $1,030 $22 $15 $30 $1,030 $1,040 $23 $16 $31 $1,040 $1,050 $24 $17 $32 $1,050 $1,060 $26 $18 $34 $1,080 $1,070 $27 $19 $35 $1,070 $1,080 S28 $20 $36 $1.080 $1.090 88888885883886889 %%986881398888888888888 If the Adjusted Wage Married Filing Jointly Amount (line 1h) is Head of Household S Form W-4, Step 2 For W-4, Step 2 Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $120 $120 $130 $130 $140 $140 $150 $150 $160 $160 $170 $170 $180 $180 $190 1 $190 $200 $200 $210 $210 $220 $220 $230 $230 $240 $240 $250 $250 $260 $260 $270 $9 $270 $280 $10 $280 $290 $11 $290 $300 $12 $300 $310 $13 $310 $320 $8 $14 $320 $330 $9 $15 $330 $340 $10 $16 $340 $350 $11 $17 $350 $360 $12 $18 $360 $370 $13 $370 $380 $14 $380 $390 $15 $390 $400 $16 $400 $410 $17 $410 $420 $18 $420 $430 $19 $7 $430 $440 $20 $8 $440 $450 $21 9 $29 $450 $460 $22 10 $30 $460 $470 $23 $11 $32 $470 $480 $25 $12 $33 $480 $490 $26 $13 $34 $490 $500 $27 $14 $35 $500 $510 $3 $28 $15 $36 $510 $520 $29 $16 $38 $520 $530 $5 $31 $17 $39 $530 $540 $32 $18 $40 1868 K988888888888888888888888888888888 KORK8%98%88648888888888888 28*98 SKUK 98888888888888888888888888 Bis 8&98888898888888 420 ON Checkbox Standard Checkbox withholding withholding withholding The Tentative Withholding Amount is: *8*986*** 8888888 88989481398888888888888 Standard But less withholding than $120 $130 $140 $150 $160 $170 $180 $190 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 $410 $420 $430 $4.40 $450 $460 $470 $480 $490 $500 $510 $520 $530 $540 $550 $560 $8 $570 59 At least SO $120 $130 $140 $150 $160 $170 $180 $190 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 $410 $420 $430 $440 $450 $460 $470 $480 $490 $500 $510 $520 $530 $540 $550 S560 * *98** *19888888888888888888888888888888888 $ $10 $11 $12 $13 $14 $15 $16 $17 S18 $20 21 $22 $23 $24 $9 $10 $11 $12 $13 $14 $15 $16 $17 $18 $19 $20 $21 $22 $23 $25 $26 $27 $28 $29 $31 $32 $33 $34 535 38848438698888888888888888888888888 S27 $28 $29 $30 $11 $12 $13 $14 $ $ $ $33 $34 $35 $38 $39 $40 $41 $42 $44 2020 Wage Bracket Method Tables for Manual Payr With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Amount (line 1h) is Head of Household Form W-4, Step 2 Fom W-4, Step 2 Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $120 $0 $120 $130 $ $130 $140 $140 $150 $150 $160 $160 $170 $170 $180 $180 $190 $190 $200 $200 $210 $210 $220 $220 $230 $230 $240 $240 $250 $250 $260 $8 $260 $270 $9 $270 $280 $10 $280 $290 $11 $290 $300 $12 $300 $310 $13 $310 $320 $ $14 $320 $330 $9 $15 $330 $340 10 $16 $3.40 $350 $11 $17 $350 $360 $12 $18 $360 $370 $13 $ $20 $370 $380 $14 $380 $390 $15 $390 $400 $16 $400 $410 $17 $410 $420 $18 $420 $430 $19 7 $430 $440 $20 $29 $440 $450 $21 $450 $460 $22 $10 30 $460 $23 $32 $470 $11 $470 $25 $480 $12 $33 $480 $490 $1 $26 $13 $34 988 8888888888888888888888888888 68848882698888888888888 8848882698888888888888888888888888 . KLY 2020 Wage Bracket Method Tables for Manual Payrc PERIOD With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household SI Amount (line 1h) is Form W-4, Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding At least than The Tentative Withholding Amount is $760 $770 $29 $59 $43 $75 $770 $780 $30 $61 $45 $77 $780 $790 $31 $62 $46 $79 $790 $800 $32 $63 $47 $81 $800 5810 $33 $64 $48 $83 $810 $820 $34 $65 $49 $86 $820 $830 $35 $67 $51 88 $830 $840 $36 $68 $52 $90 $840 $850 $37 $69 $53 $92 $850 $860 $38 $70 $54 $94 $860 $870 $39 $71 $55 597 $870 $880 $40 $73 $57 $99 $880 $890 $41 $74 $58 $101 $890 $900 $43 $75 $59 $103 $900 $910 $44 $76 $60 $105 $910 $920 $45 $77 $61 $108 $920 $930 $46 $79 $63 $110 $930 $940 $47 $80 $64 $112 $940 $950 $49 $81 $65 $114 $950 $960 $50 $82 $66 $116 $960 $970 $51 $83 $67 $119 $970 $980 $52 $85 $69 $121 $980 $990 $53 $86 $70 $123 $990 $1,000 $55 $87 $71 $125 $1,000 $1,010 $56 $88 $72 $127 $1,010 $1,020 $57 $90 $73 $130 $1,020 $1,030 $58 $92 $75 $132 $1,030 $1,040 $59 $94 $76 $135 $1,040 $1,050 $61 $96 $77 $137 $1,050 $1,060 $62 $99 $78 $139 $1,060 $1,070 $63 $ 101 $79 $142 $1,070 $1,080 $84 $ 103 $81 $144 $1 non S 105 $82 $147 $1 S65