Answered step by step

Verified Expert Solution

Question

1 Approved Answer

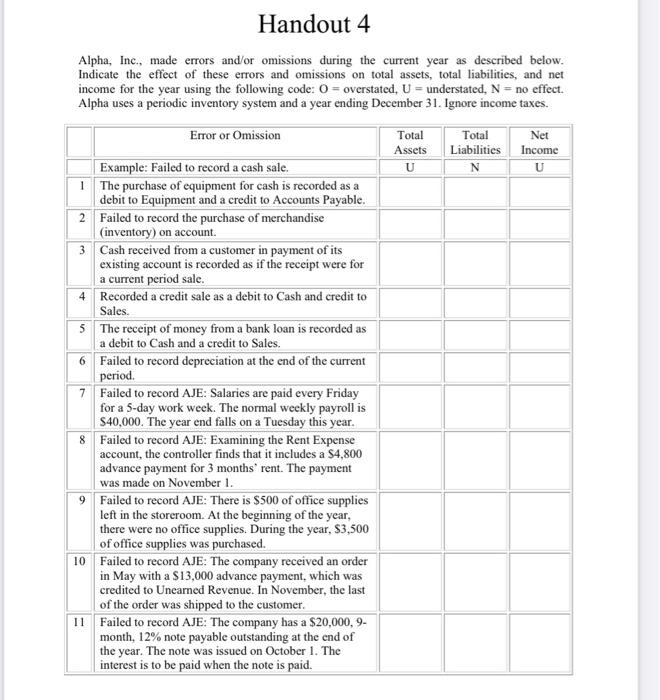

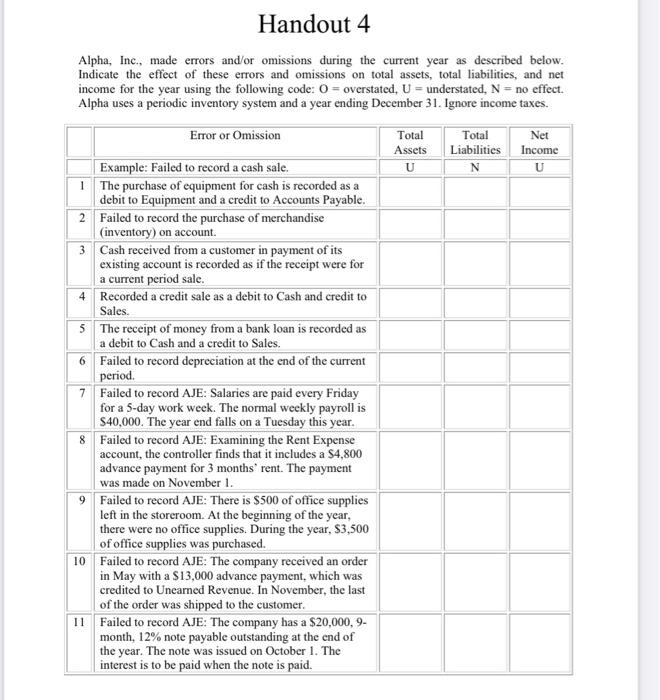

help please solve these over and unders with explaining. Handout 4 Alpha, Inc., made errors and/or omissions during the current year as described below. Indicate

help please solve these over and unders with explaining.

Handout 4 Alpha, Inc., made errors and/or omissions during the current year as described below. Indicate the effect of these errors and omissions on total assets, total liabilities, and net income for the year using the following code: 0 = overstated, U = understated, N = no effect. Alpha uses a periodic inventory system and a year ending December 31. Ignore income taxes. Total Assets U Total Net Liabilities Income N U Error or Omission Example: Failed to record a cash sale. 1. The purchase of equipment for cash is recorded as a debit to Equipment and a credit to Accounts Payable. 2 Failed to record the purchase of merchandise (inventory) on account 3 Cash received from a customer in payment of its existing account is recorded as if the receipt were for a current period sale. 4 Recorded a credit sale as a debit to Cash and credit to Sales. 5 The receipt of money from a bank loan is recorded as a debit to Cash and a credit to Sales. 6 Failed to record depreciation at the end of the current period. 7 Failed to record AJE: Salaries are paid every Friday for a 5-day work week. The normal weekly payroll is $40,000. The year end falls on a Tuesday this year. 8 Failed to record AJE: Examining the Rent Expense account, the controller finds that it includes a $4,800 advance payment for 3 months rent. The payment was made on November 1. 9 Failed to record AJE: There is $500 of office supplies left in the storeroom. At the beginning of the year, there were no office supplies. During the year, S3,500 of office supplies was purchased. 10 Failed to record AJE: The company received an order in May with a $13,000 advance payment, which was credited to Unearned Revenue. In November, the last of the order was shipped to the customer. 11 Failed to record AJE: The company has a $20,000, 9- month, 12% note payable outstanding at the end of the year. The note was issued on October 1. The interest is to be paid when the note is paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started