Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help please! thanks QUESTION 9 (2.0 points) Bill received an extension to file his 2020 tax return and filed the return on June 10, 2021.

Help please! thanks

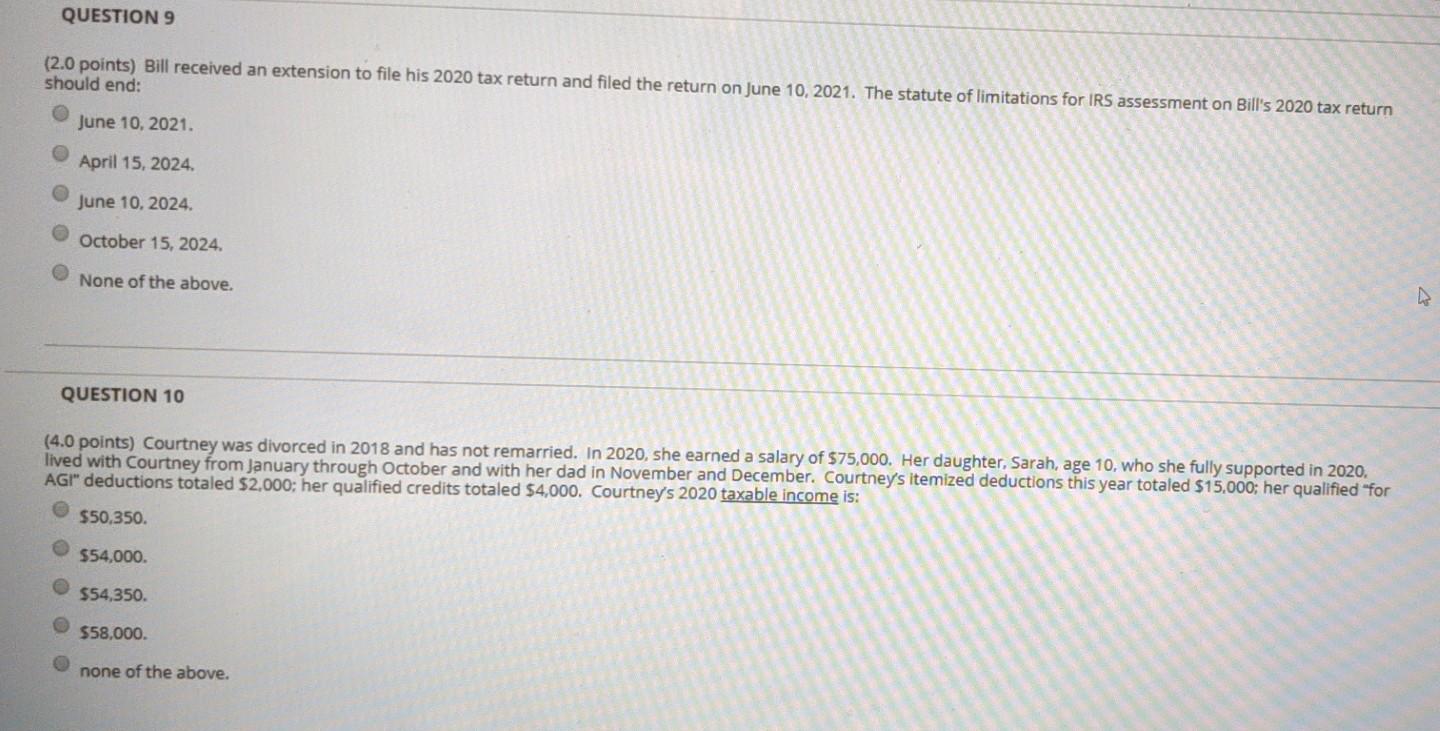

QUESTION 9 (2.0 points) Bill received an extension to file his 2020 tax return and filed the return on June 10, 2021. The statute of limitations for IRS assessment on Bill's 2020 tax return should end: June 10, 2021. April 15, 2024 June 10, 2024. October 15, 2024. None of the above. QUESTION 10 (4.0 points) Courtney was divorced in 2018 and has not remarried. In 2020, she earned a salary of $75,000. Her daughter, Sarah, age 10, who she fully supported in 2020, lived with Courtney from January through October and with her dad in November and December. Courtney's itemized deductions this year totaled $15,000; her qualified "for AGI" deductions totaled $2,000; her qualified credits totaled $4,000. Courtney's 2020 taxable income is: $50,350. $54,000. $54,350. $58.000. none of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started