Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help pleaseee depreciation expense journal entry 1) record depreciation expense 2)record entry for sale of taxi and gain on sale City Taxi Service purchased a

help pleaseee

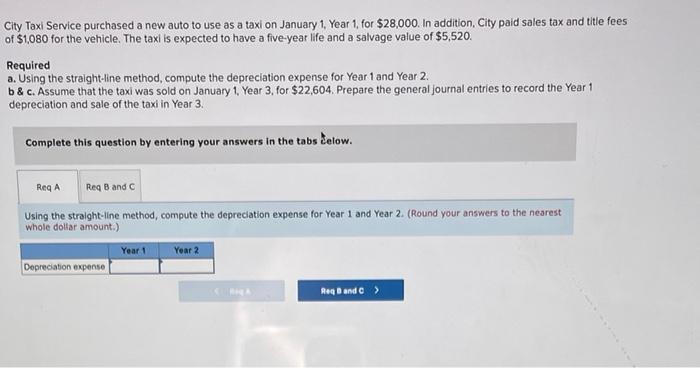

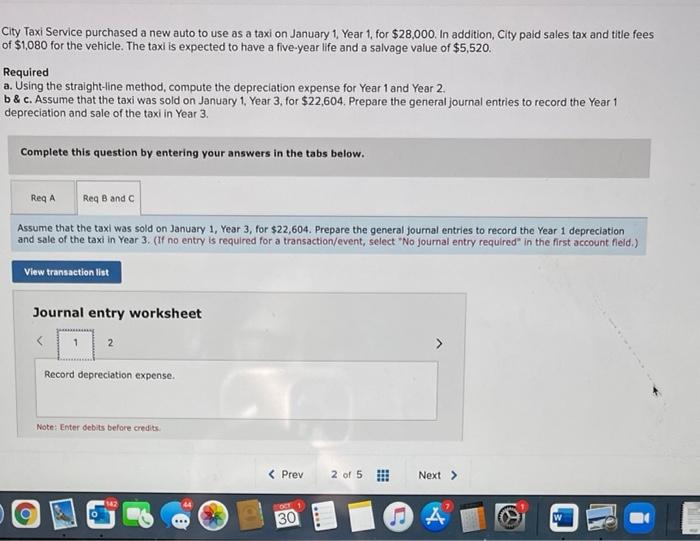

City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $28,000. In addition, City paid sales tax and title fees of $1,080 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $5,520. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. b&c. Assume that the taxi was sold on January 1, Year 3. for $22,604. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. Complete this question by entering your answers in the tabs celow. Req A Reg B and C Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. (Round your answers to the nearest whole dollar amount.) Year 1 Year 2 Depreciation expense ReqB and City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $28,000. In addition, City paid sales tax and title fees of $1,080 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $5,520. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. b&c. Assume that the taxi was sold on January 1. Year 3 for $22,604. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. Complete this question by entering your answers in the tabs below. Req Reg Band Assume that the taxi was sold on January 1, Year 3, for $22,604. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 > Record depreciation expense Note: Enter debits before credits 01 30 A depreciation expense

journal entry

1) record depreciation expense

2)record entry for sale of taxi and gain on sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started