Answered step by step

Verified Expert Solution

Question

1 Approved Answer

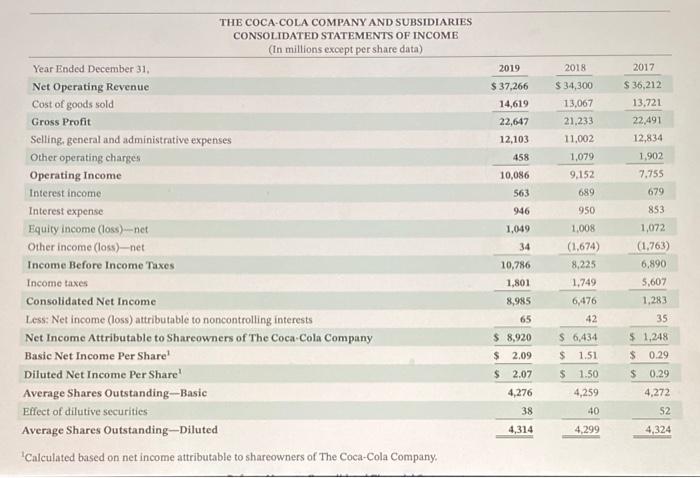

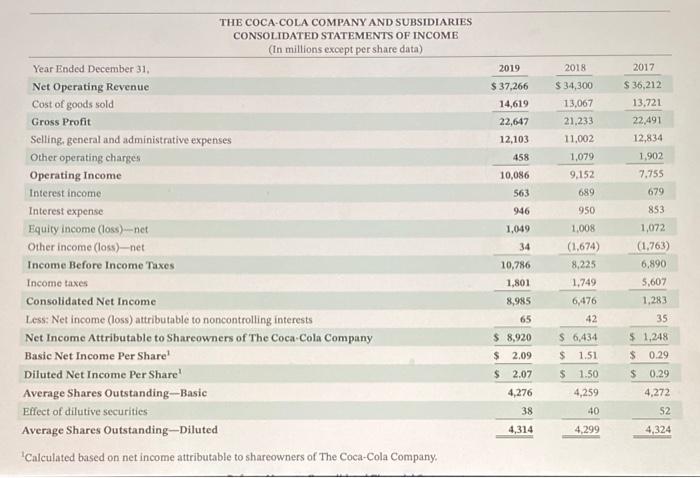

help plss appendix B appendix C PepsiCo, Inc's financial statements are presented in Appendix B. Click here to view Appendix B. Financial statements of The

help plss

appendix B

appendix C

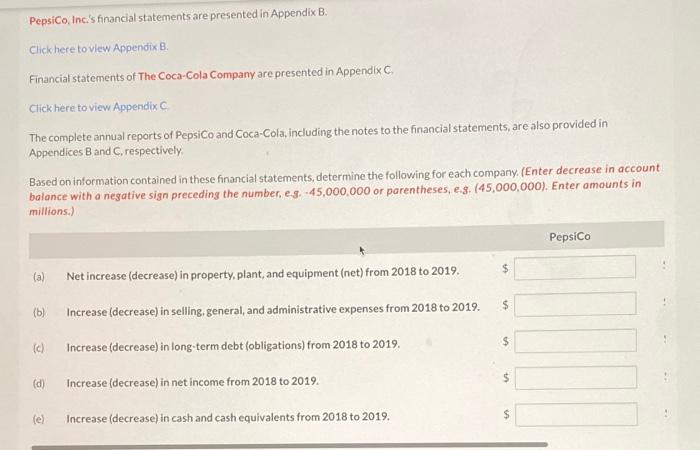

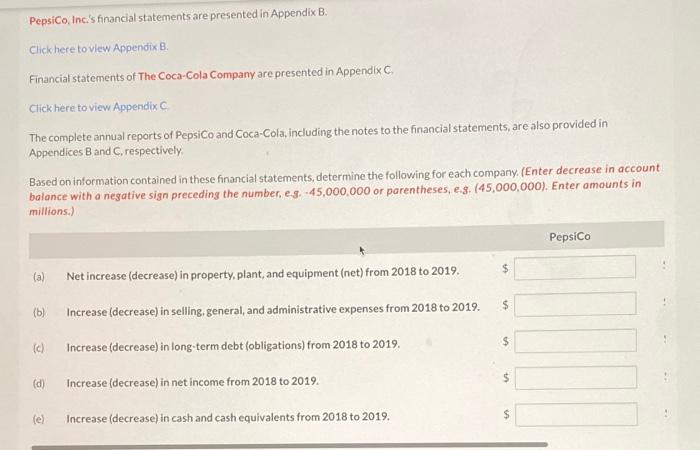

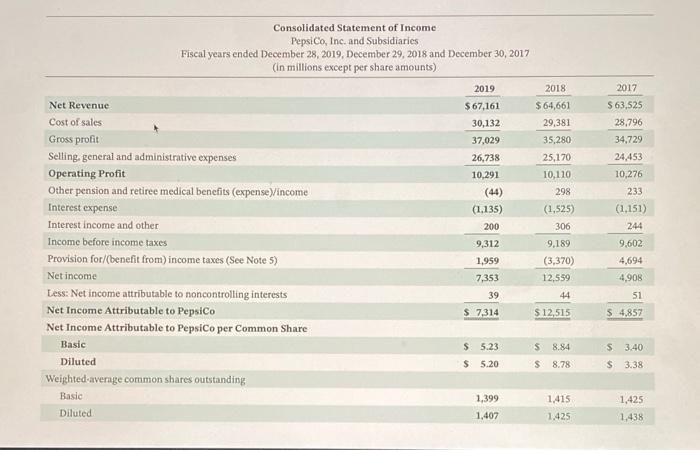

PepsiCo, Inc's financial statements are presented in Appendix B. Click here to view Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C Click here to view Appendix The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements are also provided in Appendices B and C, respectively, Based on information contained in these financial statements, determine the following for each company. (Enter decrease in account balance with a negative sign preceding the number, e.g. -45,000,000 or parentheses, e.3. (45,000,000). Enter amounts in millions.) PepsiCo $ (a) Net increase (decrease) in property, plant and equipment (net) from 2018 to 2019. $ (b) Increase (decrease) in selling, general, and administrative expenses from 2018 to 2019. $ (c) Increase (decrease) in long-term debt (obligations) from 2018 to 2019. $ (d) Increase (decrease) in net income from 2018 to 2019. $ le Increase (decrease) in cash and cash equivalents from 2018 to 2019. 2018 $ 64,661 29,381 35,280 25,170 10,110 298 2017 5 63.525 28,796 34.729 24,453 10,276 233 (44) Consolidated Statement of Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 28, 2019, December 29, 2018 and December 30, 2017 (in millions except per share amounts) 2019 Net Revenue $ 67,161 Cost of sales 30,132 Gross profit 37,029 Selling general and administrative expenses 26,738 Operating Profit 10,291 Other pension and retiree medical benefits (expense)income Interest expense (1.135) Interest income and other Income before income taxes Provision for/(benefit from income taxes (See Note 5) 1,959 Net income 7,353 Less: Net income attributable to non controlling interests Net Income Attributable to PepsiCo $ 7,314 Net Income Attributable to PepsiCo per Common Share Basic S5.23 Diluted $ 5.20 Weighted average common shares outstanding Basic 1.399 Diluted 1,407 (1.525) 306 (1,151) 244 200 9,312 9.189 (3,370) 12.559 44 9,602 4,694 4,908 51 39 $ 12,515 $4,857 S 3.40 $ 8.84 $ 8.78 $ 3.38 1.415 1.425 1,425 1.438 2019 2018 2017 S 36,212 $ 34,300 13,067 $ 37,266 14,619 22,647 12,103 458 21,233 11.002 13,721 22,491 12,834 1,902 7.755 679 10,086 1,079 9,152 689 950 563 946 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (in millions except per share data) Year Ended December 31, Net Operating Revenue Cost of goods sold Gross Profit Selling general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) --net Other income (loss)-net Income Before Income Taxes Income taxes Consolidated Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share! Diluted Net Income Per Share! Average Shares Outstanding--Basic Effect of dilutive securities Average Shares Outstanding-Diluted Calculated based on net income attributable to shareowners of The Coca-Cola Company 1,049 34 10,786 1,801 1,008 (1.674) 8,225 1.749 6,476 8,985 65 853 1,072 (1.763) 6,890 5,607 1.283 35 $ 1.248 $ 0.29 s 0.29 4,272 S2 42 $ 8,920 $ 2.09 $ 6,434 S 1.51 $ 2.07 $ 1.50 4,259 4,276 38 40 4,314 4.299 4,324 PepsiCo, Inc's financial statements are presented in Appendix B. Click here to view Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C Click here to view Appendix The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements are also provided in Appendices B and C, respectively, Based on information contained in these financial statements, determine the following for each company. (Enter decrease in account balance with a negative sign preceding the number, e.g. -45,000,000 or parentheses, e.3. (45,000,000). Enter amounts in millions.) PepsiCo $ (a) Net increase (decrease) in property, plant and equipment (net) from 2018 to 2019. $ (b) Increase (decrease) in selling, general, and administrative expenses from 2018 to 2019. $ (c) Increase (decrease) in long-term debt (obligations) from 2018 to 2019. $ (d) Increase (decrease) in net income from 2018 to 2019. $ le Increase (decrease) in cash and cash equivalents from 2018 to 2019. 2018 $ 64,661 29,381 35,280 25,170 10,110 298 2017 5 63.525 28,796 34.729 24,453 10,276 233 (44) Consolidated Statement of Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 28, 2019, December 29, 2018 and December 30, 2017 (in millions except per share amounts) 2019 Net Revenue $ 67,161 Cost of sales 30,132 Gross profit 37,029 Selling general and administrative expenses 26,738 Operating Profit 10,291 Other pension and retiree medical benefits (expense)income Interest expense (1.135) Interest income and other Income before income taxes Provision for/(benefit from income taxes (See Note 5) 1,959 Net income 7,353 Less: Net income attributable to non controlling interests Net Income Attributable to PepsiCo $ 7,314 Net Income Attributable to PepsiCo per Common Share Basic S5.23 Diluted $ 5.20 Weighted average common shares outstanding Basic 1.399 Diluted 1,407 (1.525) 306 (1,151) 244 200 9,312 9.189 (3,370) 12.559 44 9,602 4,694 4,908 51 39 $ 12,515 $4,857 S 3.40 $ 8.84 $ 8.78 $ 3.38 1.415 1.425 1,425 1.438 2019 2018 2017 S 36,212 $ 34,300 13,067 $ 37,266 14,619 22,647 12,103 458 21,233 11.002 13,721 22,491 12,834 1,902 7.755 679 10,086 1,079 9,152 689 950 563 946 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (in millions except per share data) Year Ended December 31, Net Operating Revenue Cost of goods sold Gross Profit Selling general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) --net Other income (loss)-net Income Before Income Taxes Income taxes Consolidated Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share! Diluted Net Income Per Share! Average Shares Outstanding--Basic Effect of dilutive securities Average Shares Outstanding-Diluted Calculated based on net income attributable to shareowners of The Coca-Cola Company 1,049 34 10,786 1,801 1,008 (1.674) 8,225 1.749 6,476 8,985 65 853 1,072 (1.763) 6,890 5,607 1.283 35 $ 1.248 $ 0.29 s 0.29 4,272 S2 42 $ 8,920 $ 2.09 $ 6,434 S 1.51 $ 2.07 $ 1.50 4,259 4,276 38 40 4,314 4.299 4,324

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started