Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help plz On September 30, 2020, Peace Frog International (PFI) (a U.S.-based company) negotiated a two-year, 2,400,000 Chinese yuan loan from a Chinese bank at

help plz

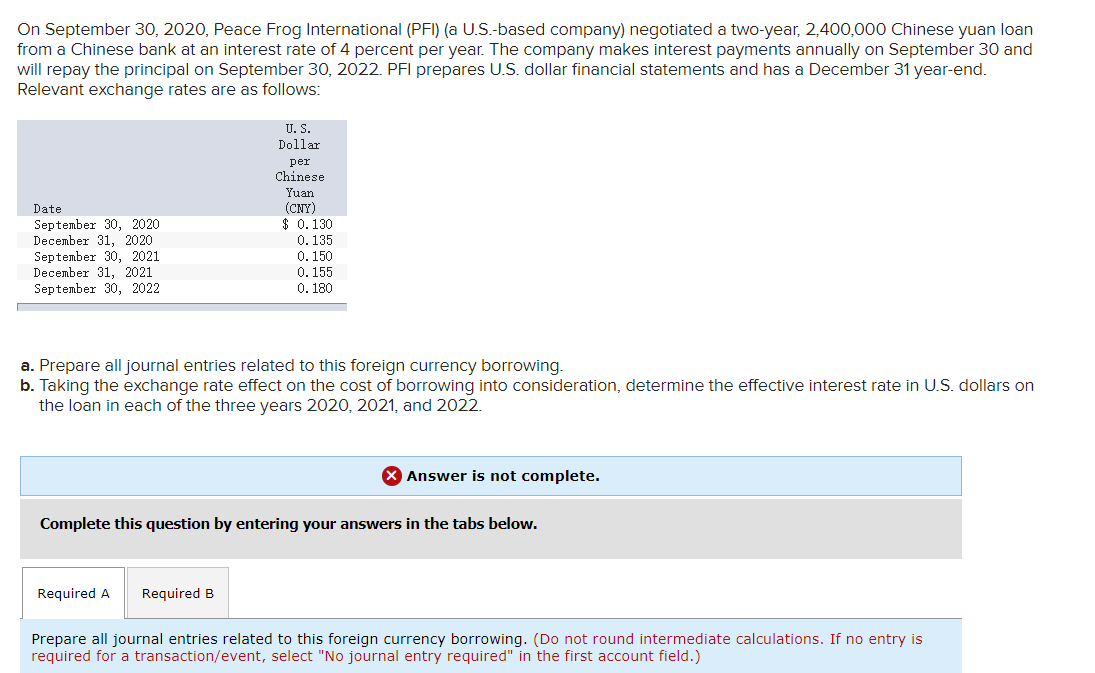

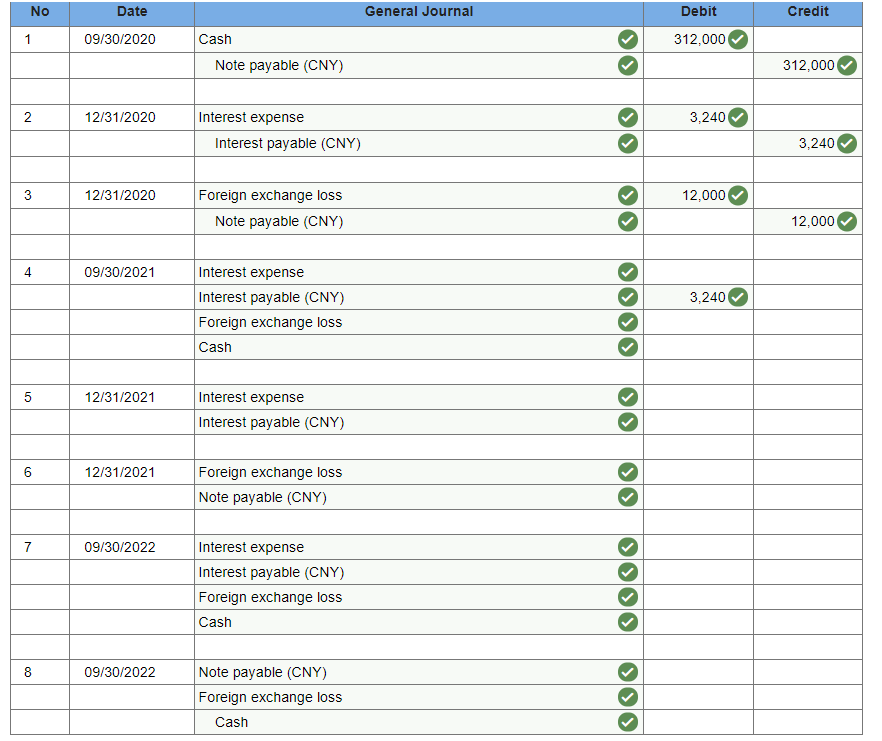

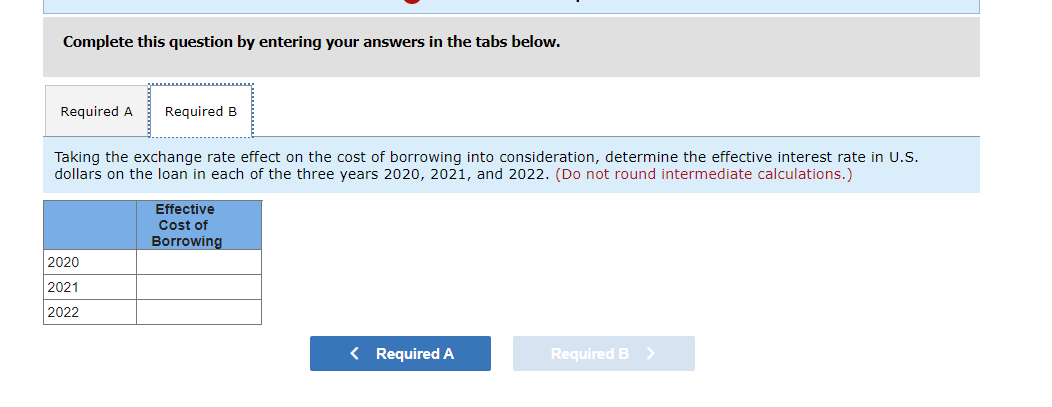

On September 30, 2020, Peace Frog International (PFI) (a U.S.-based company) negotiated a two-year, 2,400,000 Chinese yuan loan from a Chinese bank at an interest rate of 4 percent per year. The company makes interest payments annually on September 30 and will repay the principal on September 30, 2022. PFI prepares U.S. dollar financial statements and has a December 31 year-end. Relevant exchange rates are as follows: U.S. Dollar per Chinese Yuan (CNY) $ 0. 0.135 0.150 0.155 0.180 Date September 30, 2020 December 31, 2020 September 30, 2021 December 31, 2021 September 30, 2022 0.130 a. Prepare all journal entries related to this foreign currency borrowing. b. Taking the exchange rate effect on the cost of borrowing into consideration, determine the effective interest rate in U.S. dollars on the loan in each of the three years 2020, 2021, and 2022. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Prepare all journal entries related to this foreign currency borrowing. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Date General Journal Debit Credit 1 09/30/2020 312,000 Cash Note payable (CNY) 312,000 2 12/31/2020 3,240 Interest expense Interest payable (CNY) 3,240 3 12/31/2020 12,000 Foreign exchange loss Note payable (CNY) 12,000 4 09/30/2021 3,240 Interest expense Interest payable (CNY) Foreign exchange loss Cash 01 12/31/2021 Interest expense Interest payable (CNY) 6 6 12/31/2021 Foreign exchange loss Note payable (CNY) 7 09/30/2022 Interest expense Interest payable (CNY) Foreign exchange loss Cash 8 09/30/2022 Note payable (CNY) Foreign exchange loss Cash Complete this question by entering your answers in the tabs below. Required A Required B Taking the exchange rate effect on the cost of borrowing into consideration, determine the effective interest rate in U.S. dollars on the loan in each of the three years 2020, 2021, and 2022. (Do not round intermediate calculations.) Effective Cost of Borrowing 2020 2021 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started