help plzzzzz

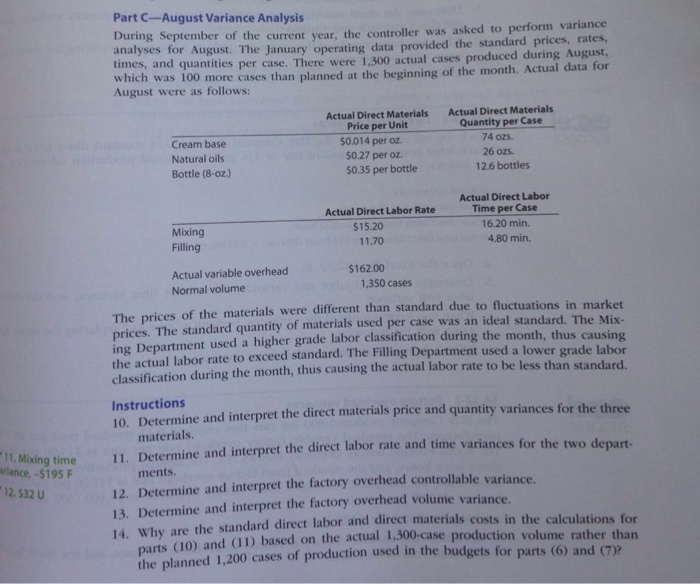

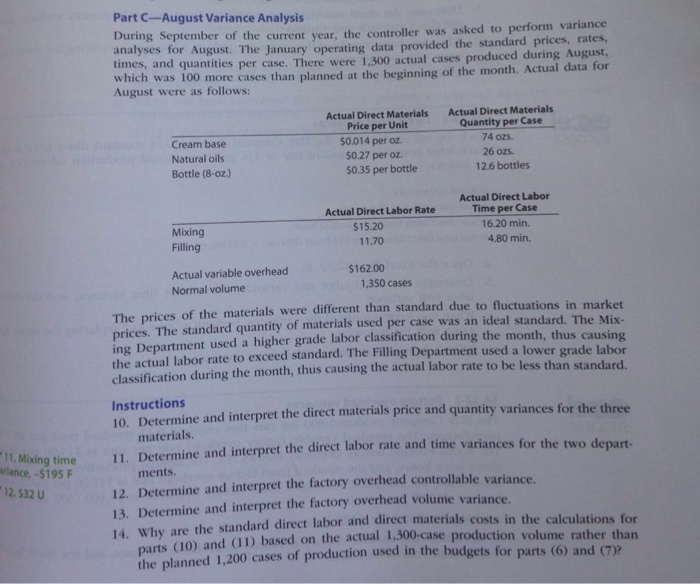

During September of the current year, the controller was asked to perform variance analyses for August. The january operating data provided the standard prices, rates, time, and quantities per case, there were 1,300 actual cases produced during August, which was 100 more cases than planned at the begining of the month. Actual data for August were as follows: The prices of the materials were different than standard due to fluctuation in market prices. the standard quantity of materials used per case was an ideal standard. The Mixing Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filling Department used a lower grade lador classification during the the month, thus causing the actual labor rate to be less then standard. Determine and interpret the direct material price and quantity variances for the three materials Determine and interpret the direct labor rate and time variances for the two departments Determine and interpret the factoey overhead controllable variance. Determine and interpret the factoey overhead volume variance why rae the standard dired labor and direct material costs in the calculations for part(10) and (11) based on the actual 1,300 case production volume rather than the planned 1,200 cases of production used in the budgets for parts (6) and (7)? During September of the current year, the controller was asked to perform variance analyses for August. The january operating data provided the standard prices, rates, time, and quantities per case, there were 1,300 actual cases produced during August, which was 100 more cases than planned at the begining of the month. Actual data for August were as follows: The prices of the materials were different than standard due to fluctuation in market prices. the standard quantity of materials used per case was an ideal standard. The Mixing Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filling Department used a lower grade lador classification during the the month, thus causing the actual labor rate to be less then standard. Determine and interpret the direct material price and quantity variances for the three materials Determine and interpret the direct labor rate and time variances for the two departments Determine and interpret the factoey overhead controllable variance. Determine and interpret the factoey overhead volume variance why rae the standard dired labor and direct material costs in the calculations for part(10) and (11) based on the actual 1,300 case production volume rather than the planned 1,200 cases of production used in the budgets for parts (6) and (7)

help plzzzzz

help plzzzzz