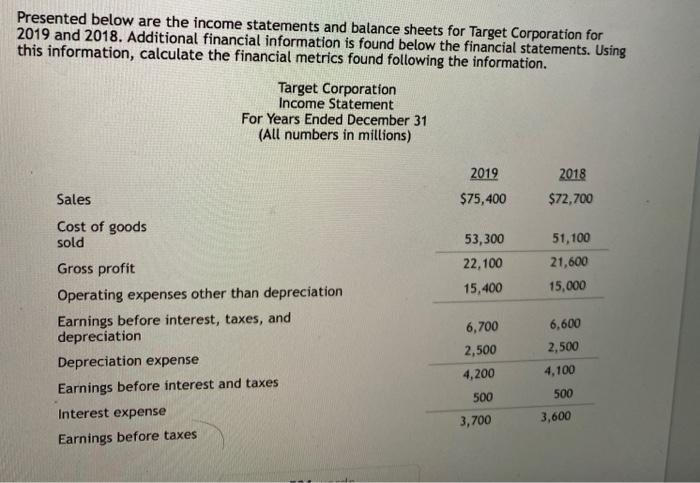

Presented below are the income statements and balance sheets for Target Corporation for 2019 and 2018. Additional financial information is found below the financial

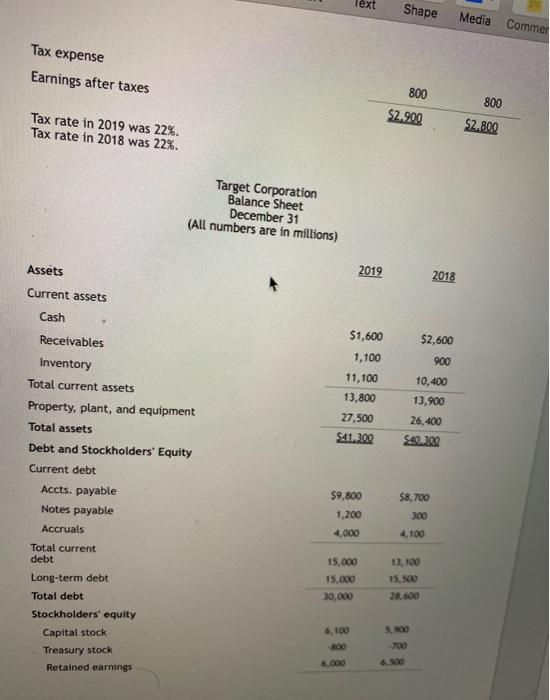

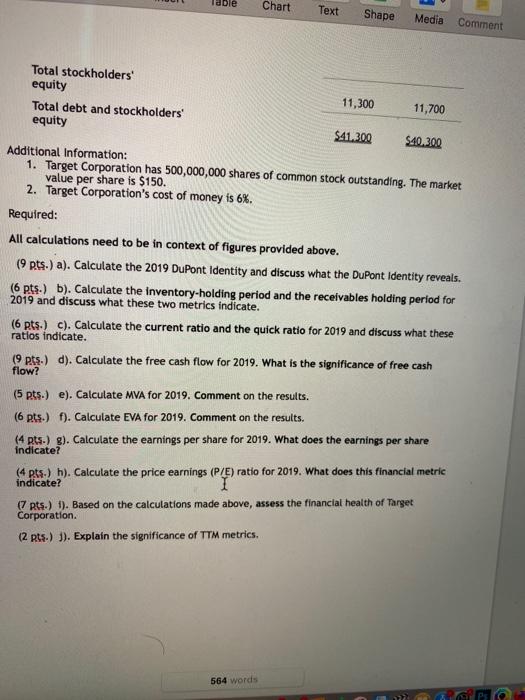

Presented below are the income statements and balance sheets for Target Corporation for 2019 and 2018. Additional financial information is found below the financial statements. Using this information, calculate the financial metrics found following the information. Sales Cost of goods sold Gross profit Target Corporation Income Statement For Years Ended December 31 (All numbers in millions) Operating expenses other than depreciation Earnings before interest, taxes, and depreciation Depreciation expense Earnings before interest and taxes Interest expense Earnings before taxes 2019 $75,400 53,300 22,100 15,400 6,700 2,500 4,200 500 3,700 2018 $72,700 51,100 21,600 15,000 6,600 2,500 4,100 500 3,600 Tax expense Earnings after taxes Tax rate in 2019 was 22%. Tax rate in 2018 was 22%. Assets Current assets Cash . Receivables Inventory Total current assets Property, plant, and equipment Total assets Debt and Stockholders' Equity Current debt Accts. payable Notes payable Accruals Total current debt Target Corporation Balance Sheet December 31 (All numbers are in millions) Long-term debt Total debt Stockholders' equity Capital stock Treasury stock Retained earnings Text 2019 $1,600 1,100 11,100 13,800 27,500 $41.300 6,100 -800 6,000 $9,800 1,200 4,000 15,000 15,000 30,000 Shape Media Commer 800 $2,900 $8,700 300 10,400 13,900 26,400 $40.300 4,100 13,100 6,500 $2,600 900 15.500 28,600 5,900 -700 2018 800 $2.800 Total stockholders' equity Total debt and stockholders' equity Table Chart Text Shape Media Comment 11,300 $41.300 11,700 $40.300 Additional Information: 1. Target Corporation has 500,000,000 shares of common stock outstanding. The market value per share is $150. 2. Target Corporation's cost of money is 6%. Required: All calculations need to be in context of figures provided above. (9 pts-) a). Calculate the 2019 DuPont Identity and discuss what the DuPont Identity reveals. (6 pts-) b). Calculate the inventory-holding period and the receivables holding period for 2019 and discuss what these two metrics indicate. (6 pts.) c). Calculate the current ratio and the quick ratio for 2019 and discuss what these ratios indicate. (9 pts.) d). Calculate the free cash flow for 2019. What is the significance of free cash flow? 564 words (5 pts.) e). Calculate MVA for 2019. Comment on the results. (6 pts.) f). Calculate EVA for 2019. Comment on the results. (4 pts.) g). Calculate the earnings per share for 2019. What does the earnings per share indicate? (4 pts.) h). Calculate the price earnings (P/E) ratio for 2019. What does this financial metric indicate? I (7 pts.) 1). Based on the calculations made above, assess the financial health of Target Corporation. (2 pts.) j). Explain the significance of TTM metrics.

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

g EPS for 2019 is calculated as follows EPS net income of the company Dividend to the preferre...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started