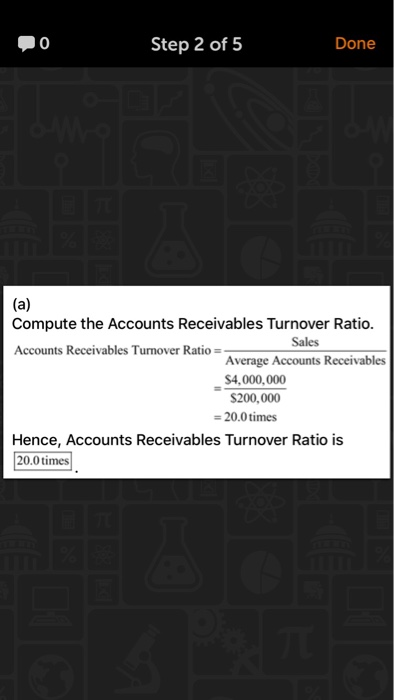

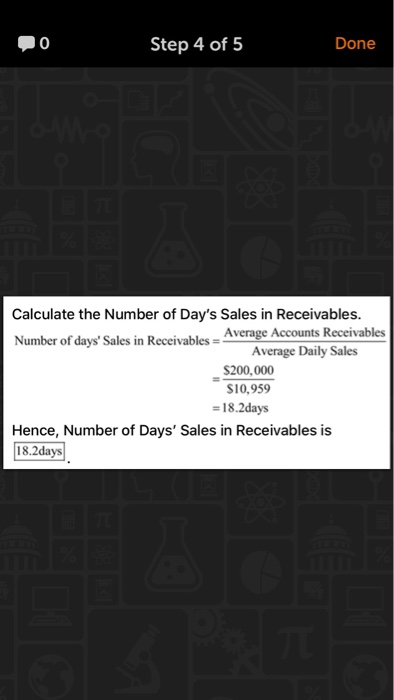

Help problem 17-4B

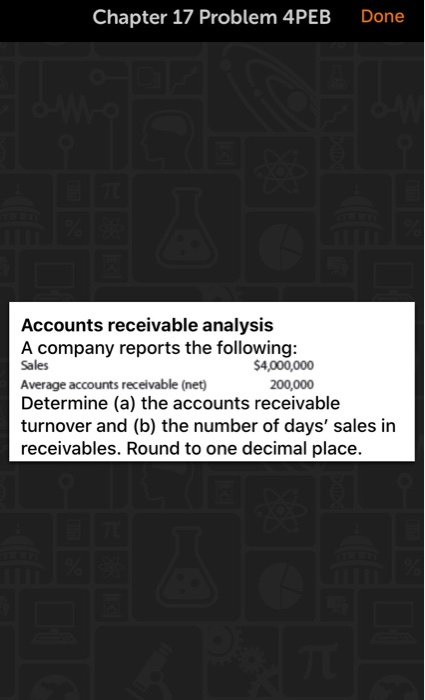

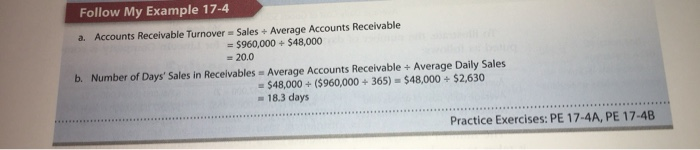

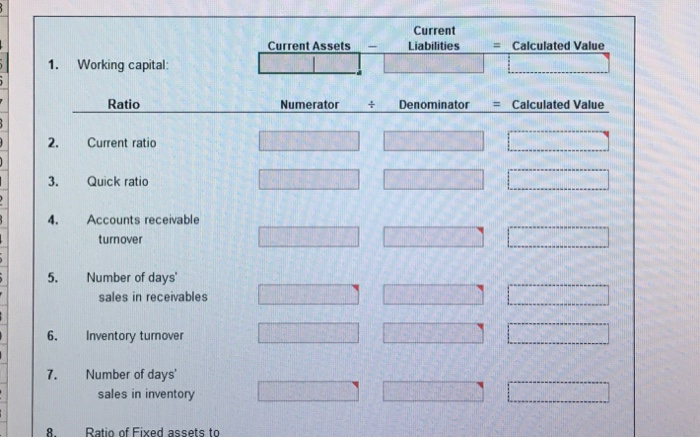

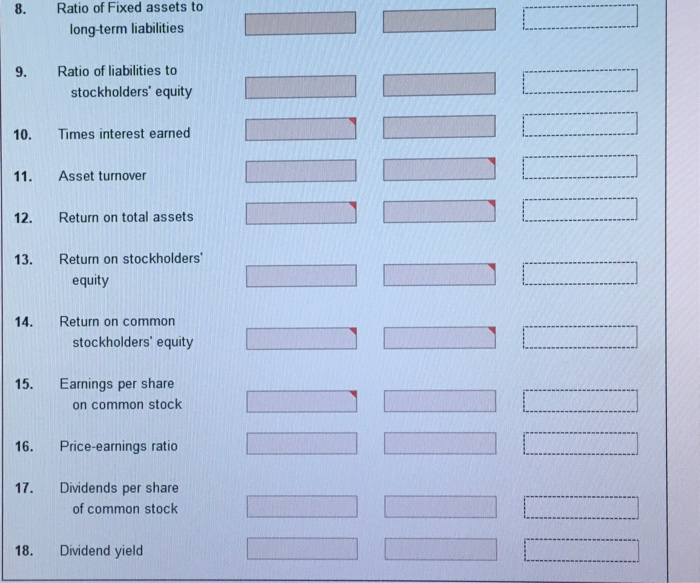

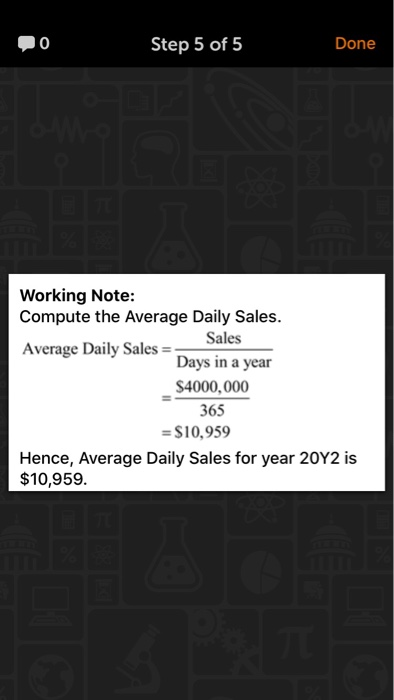

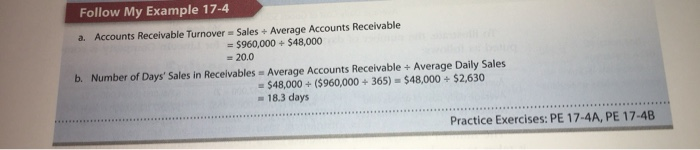

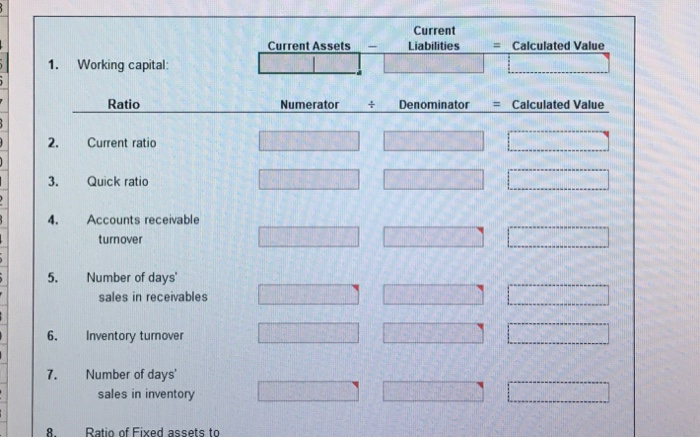

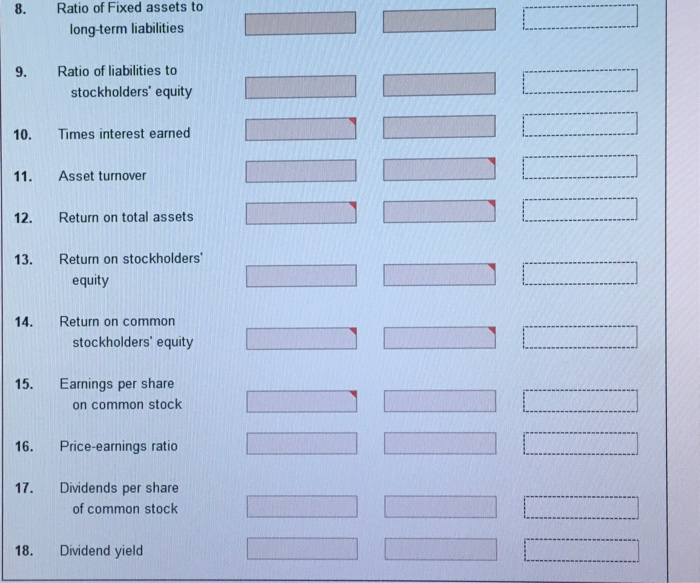

Chapter 17 Problem 4PEB Done Accounts receivable analysis A company reports the following: Sales $4,000,000 Average accounts receivable (net) 200,000 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round to one decimal place. Follow My Example 17-4 a. Accounts Receivable Turnover Sales + Average Accounts Receivable = $960,000+ $48,000 20.0 b. Number of Days' Sales in Receivables - Average Accounts Receivable + Average Daily Sales = $48,000 + ($960,000 + 365) = $48,000 + $2,630 - 18.3 days Practice Exercises: PE 17-4A, PE 17-4B Current Liabilities Current Assets Calculated Value 1. Working capital Ratio Numerator + Denominator Calculated Value 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables UU JU TUM 6. Inventory turnover 7. Number of days' sales in inventory 8. Ratio of Fixed assets to 8. Ratio of Fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders' equity UTILITOINTI IIDILIDIII 14. Return on common stockholders' equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield 10 Step 1 of 5 Done Accounts Receivable Turnover Ratio: It is an activity ratio which computes the number of times, company converts its account receivables into liquid cash during a particular period. It is determined by dividing the amount of Credit Sales with Average Accounts Receivables during the period. 10 Step 2 of 5 Done (a) Compute the Accounts Receivables Turnover Ratio. Accounts Receivables Turnover Ratio Sales Average Accounts Receivables $4,000,000 $200,000 = 20.0 times Hence, Accounts Receivables Turnover Ratio is 20.0 times 10 Step 3 of 5 Done (b) Number of Days Sales in Receivables: It measures the period within which company converts its accounts receivables into liquid cash. It is determined by dividing Average Accounts Receivables with Average Daily Sales. 10 Step 4 of 5 Done Calculate the Number of Day's Sales in Receivables. Number of days" Sales in Receivables - Average Accounts Receivables Average Daily Sales $200,000 $10,959 = 18.2days Hence, Number of Days' Sales in Receivables is 18.2days 10 Step 5 of 5 Done Working Note: Compute the Average Daily Sales. Sales Average Daily Sales = Days in a year $4000,000 365 = $10,959 Hence, Average Daily Sales for year 20Y2 is $10,959. Chapter 17 Problem 4PEB Done Accounts receivable analysis A company reports the following: Sales $4,000,000 Average accounts receivable (net) 200,000 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round to one decimal place. Follow My Example 17-4 a. Accounts Receivable Turnover Sales + Average Accounts Receivable = $960,000+ $48,000 20.0 b. Number of Days' Sales in Receivables - Average Accounts Receivable + Average Daily Sales = $48,000 + ($960,000 + 365) = $48,000 + $2,630 - 18.3 days Practice Exercises: PE 17-4A, PE 17-4B Current Liabilities Current Assets Calculated Value 1. Working capital Ratio Numerator + Denominator Calculated Value 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables UU JU TUM 6. Inventory turnover 7. Number of days' sales in inventory 8. Ratio of Fixed assets to 8. Ratio of Fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders' equity UTILITOINTI IIDILIDIII 14. Return on common stockholders' equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield 10 Step 1 of 5 Done Accounts Receivable Turnover Ratio: It is an activity ratio which computes the number of times, company converts its account receivables into liquid cash during a particular period. It is determined by dividing the amount of Credit Sales with Average Accounts Receivables during the period. 10 Step 2 of 5 Done (a) Compute the Accounts Receivables Turnover Ratio. Accounts Receivables Turnover Ratio Sales Average Accounts Receivables $4,000,000 $200,000 = 20.0 times Hence, Accounts Receivables Turnover Ratio is 20.0 times 10 Step 3 of 5 Done (b) Number of Days Sales in Receivables: It measures the period within which company converts its accounts receivables into liquid cash. It is determined by dividing Average Accounts Receivables with Average Daily Sales. 10 Step 4 of 5 Done Calculate the Number of Day's Sales in Receivables. Number of days" Sales in Receivables - Average Accounts Receivables Average Daily Sales $200,000 $10,959 = 18.2days Hence, Number of Days' Sales in Receivables is 18.2days 10 Step 5 of 5 Done Working Note: Compute the Average Daily Sales. Sales Average Daily Sales = Days in a year $4000,000 365 = $10,959 Hence, Average Daily Sales for year 20Y2 is $10,959