Answered step by step

Verified Expert Solution

Question

1 Approved Answer

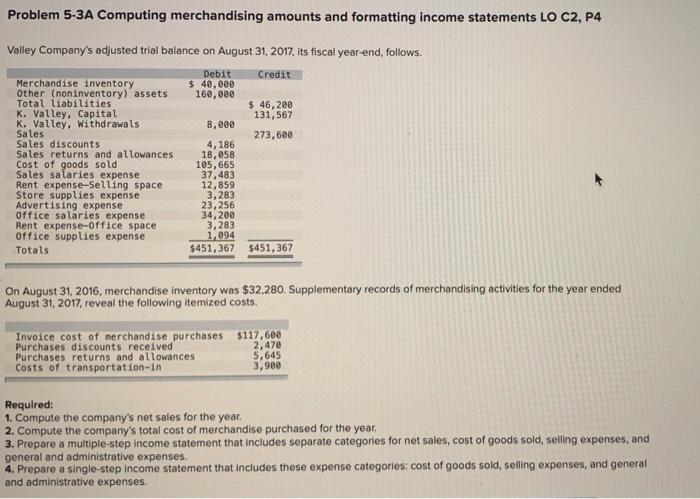

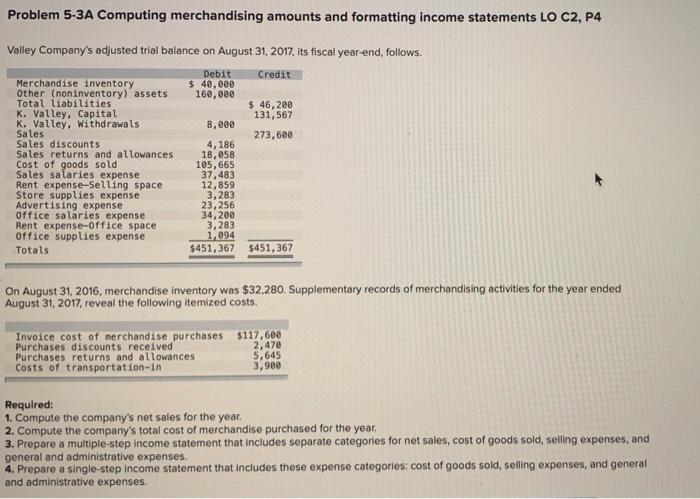

help Problem 5-3A Computing merchandising amounts and formatting income statements LO C2, P4 Volley Company's adjusted trial balance on August 31, 2017, its fiscal year-end,

help

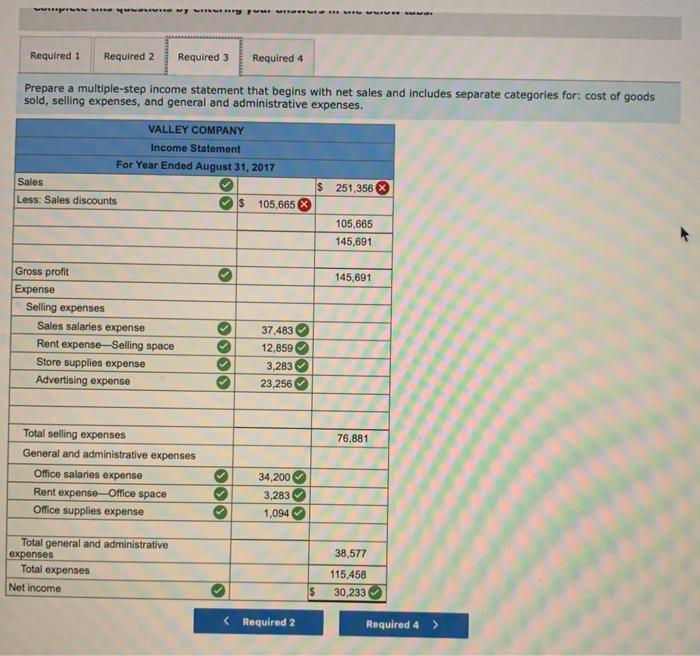

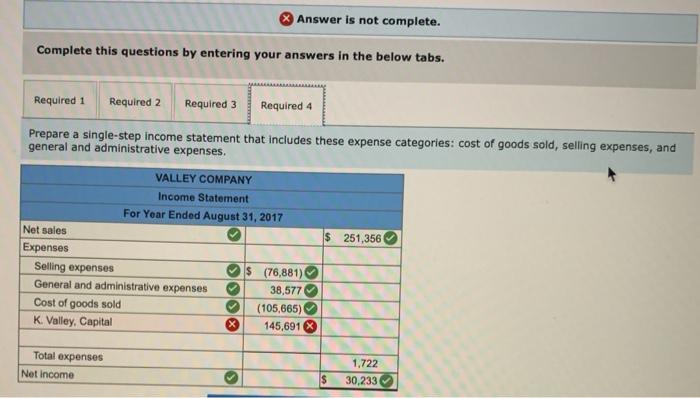

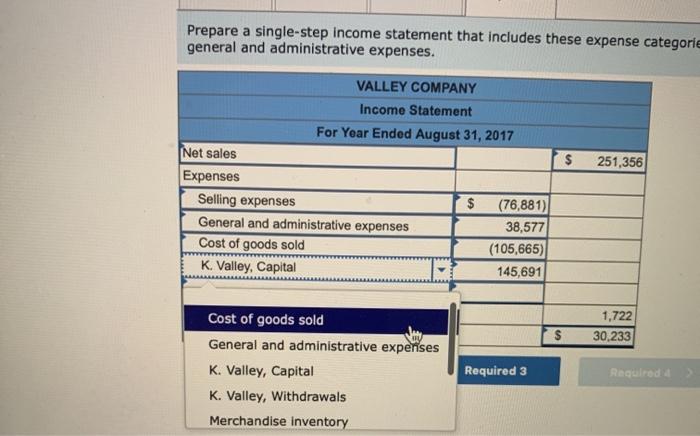

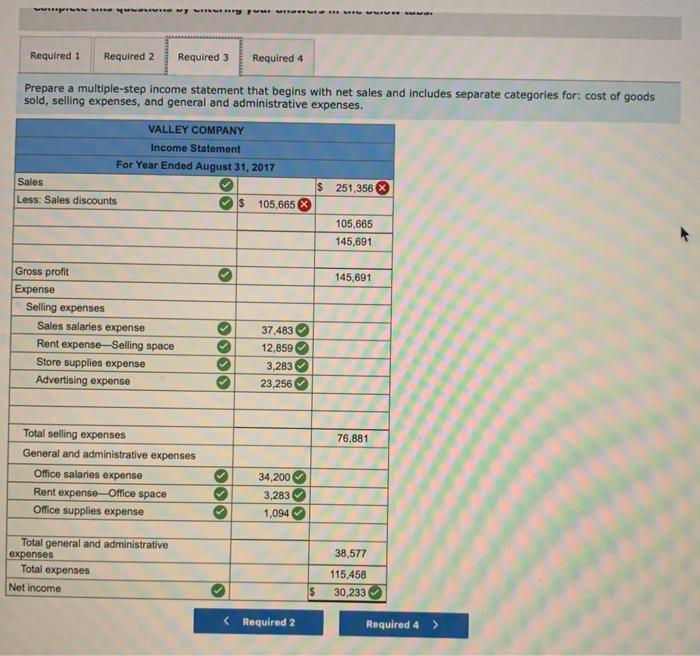

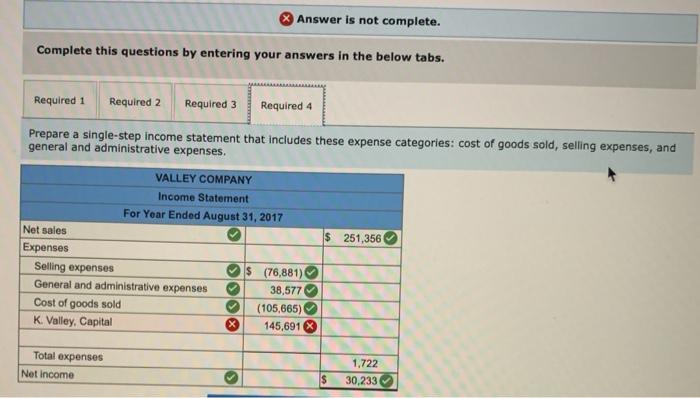

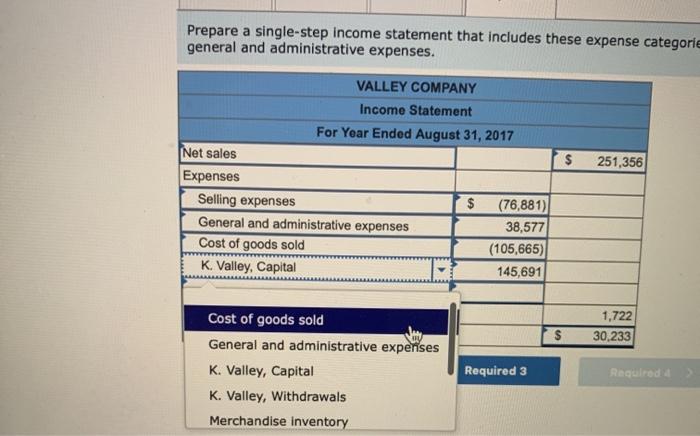

Problem 5-3A Computing merchandising amounts and formatting income statements LO C2, P4 Volley Company's adjusted trial balance on August 31, 2017, its fiscal year-end, follows. Debit Credit Merchandise inventory $ 40,000 Other (non inventory) assets 160,000 Total liabilities $ 46,200 K. Valley, Capital 131,567 K. Valley, Withdrawals 8,000 Sales 273,600 Sales discounts 4,186 Sales returns and allowances 18,058 Cost of goods sold 185,665 Sales salaries expense 37,483 Rent expense-Selling space 12,859 Store supplies expense 3,283 Advertising expense 23, 256 Office salaries expense 34,200 Rent expense-office space 3,283 Office supplies expense 1,094 Totals $451,367 $451, 367 On August 31, 2016, merchandise inventory was $32,280. Supplementary records of merchandising activities for the year ended August 31, 2017, reveal the following itemized costs. Invoice cost of merchandise purchases $117,600 Purchases discounts received 2,470 Purchases returns and allowances 5,645 Costs of transportation-in 3,900 Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year, 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. wa MTUM Required 1 Required 2 Required 3 Required 4 Prepare a multiple-step income statement that begins with net sales and includes separate categories for: cost of goods sold, selling expenses, and general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Sales Less: Sales discounts 105,665 $ 251,356 105,665 145,691 145,691 Gross profit Expense Selling expenses Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense OO 37.483 12,859 3,283 23,256 76,881 Total selling expenses General and administrative expenses Office salaries expense Rent expense Office space Office supplies expense 34,200 3,283 1,094 38,577 Total general and administrative expenses Total expenses Net income 115,458 30,233 $ Answer is not complete. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Prepare a single-step Income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. $ 251,356 VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Net sales Expenses Selling expenses $ (76,881) General and administrative expenses 38,577 Cost of goods sold (105,665) K. Valley, Capital 145,691 Total expenses Net Income 1,722 30,233 $ Prepare a single-step income statement that includes these expense categorie general and administrative expenses. $ 251,356 VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Net sales Expenses Selling expenses (76,881) General and administrative expenses 38,577 Cost of goods sold (105,665) K. Valley, Capital 145,691 1,722 30.233 $ Cost of goods sold General and administrative expenses K. Valley, Capital K. Valley, Withdrawals Merchandise inventory Required 3 Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started