Answered step by step

Verified Expert Solution

Question

1 Approved Answer

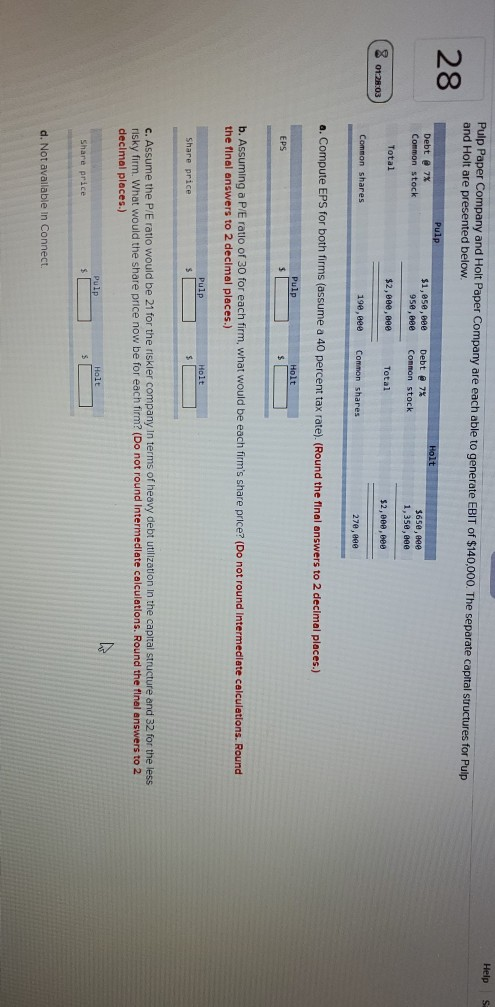

Help Pulp Paper Company and Holt Paper Company are each able to generate EBIT of $140,000. The separate capital structures for Pulp and Holt are

Help Pulp Paper Company and Holt Paper Company are each able to generate EBIT of $140,000. The separate capital structures for Pulp and Holt are presented below. 28 Pulp Holt Debt @ 7X Common stock $1,05e, Bee 95e, Bee Debt @ 7% Common stock $650,000 1,350, eee Total $2,090, eee 8 0128.03 Total $2,eee, eee Common shares 190,eee Common shares 27e, eee a. Compute EPS for both firms (assume a 40 percent tax rate). (Round the final answers to 2 decimal places.) Pulp Holt EPS b. Assuming a P/E ratio of 30 for each firm, what would be each firm's share price? (Do not round Intermediate calculations. Round the final answers to 2 decimal places.) Pulp Holt Share price C. Assume the P/E ratio would be 21 for the riskler company in terms of heavy debt utilization in the capital structure and 32 for the less risky firm. What would the share price now be for each firm? (Do not round Intermediate calculations. Round the final answers to 2 decimal places.) Holt Pulp $ Share price d. Not available in Connect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started