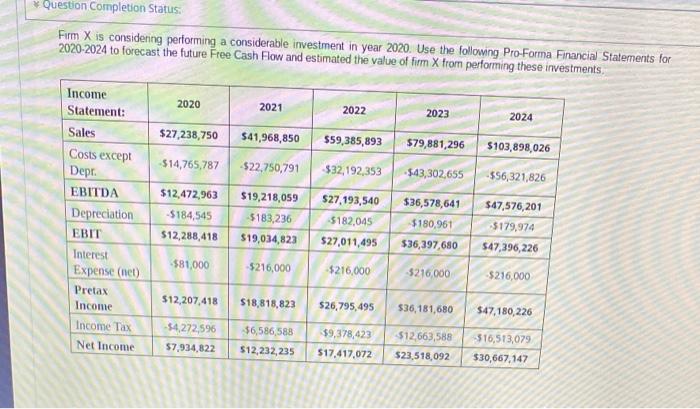

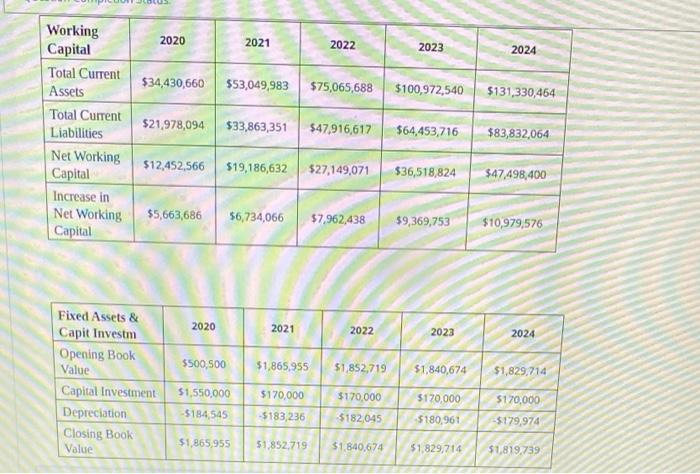

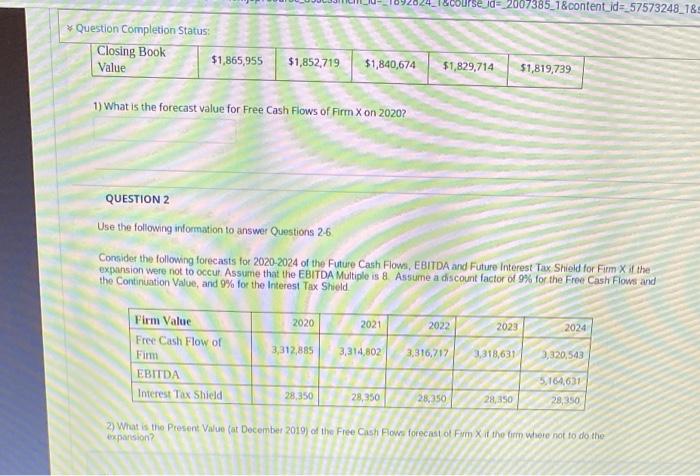

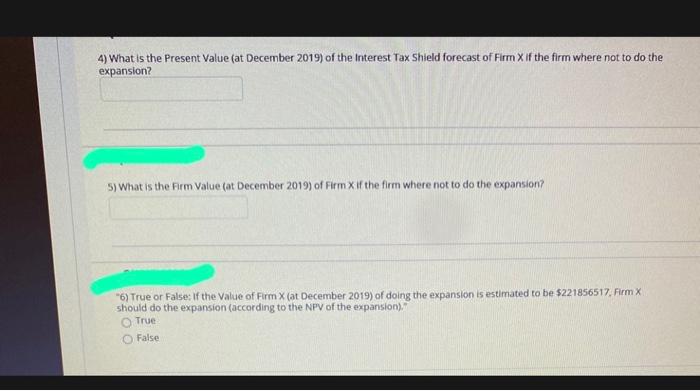

Help QUESTION 1 sales for year 2030 3315 or for the cost of the precum was the value of deprecation is the value of sales and test of USD Ache income tax for the company that sales are expected to increase and the experience at the 2020 levels what the company's forecast for come in 2021.rs presa de olyuran Strictly humical 10 pointe Question Completion Status Firm X is considering performing a considerable investment in year 2020. Use the following Pro Forma Financial Statements for 2020-2024 to forecast the future Free Cash Flow and estimated the value of firm X from performing these investments, 2020 2021 2022 2023 2024 $27,238,750 $41,968,850 $59,385,893 $79,881,296 5103,898,026 $14,765,787 -$22,750,791 $32,192,353 543,302,655 $56,321,826 Income Statement: Sales Costs except Depr. EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income $12,472,963 -$184,545 $12,288,418 $19,218,059 $183,236 $19,034,823 $27.193,540 5182,045 $27,011,495 $36,578,641 $180,961 $36,397,680 $47,576,201 $179,974 547,396,226 581,000 $216,000 $216,000 5216,000 $216,000 $12,207,418 $18.818,823 $26,795,495 $36,181,680 $47,180, 226 -54,272,596 $7.934,822 $6,586,588 $12,232, 235 $12,663,588 59,378,423 517,417,072 516,513,079 $30,667,147 $23,518,092 COCO 2020 2021 2022 2023 2024 $34,430,660 $53,049,983 $75,065,688 $100,972,540 $131,330,464 Working Capital Total Current Assets Total Current Liabilities Net Working Capital Increase in Net Working Capital $21.978,094 $33,863,351 $47.916,617 564,453,716 $83,832,064 $12,452,566 $19,186,632 $27,149,071 $36,518,824 $47,498,400 $5,663,686 $6,734,066 $7.962,438 $9,369,753 $10,979,576 2020 2021 2022 2023 2024 $500,500 $1,865,955 $1,852,719 $1,840,674 $1,829,714 Fixed Assets & Capit Investm Opening Book Value Capital Investment Depreciation Closing Book Value $170,000 $170,000 $1,550,000 -$184,545 5170,000 -5183 236 $170,000 $180,961 5182,045 $179,974 $1,865,955 $1,852.719 $1.840,674 $1,829,714 $1,819,739 course de 20073857&content_id=_57573248_185 * Question Completion Status: Closing Book $1,865,955 Value $1,852,719 $1,840,674 $1,829,714 $1,819,739 1) What is the forecast value for Free Cash Flows of Firm X on 2020? QUESTION 2 Use the following information to answer Questions 26 Consider the following forecasts for 2020-2024 of the Future Cash Flows, EBITDA and Future Interest Tax Shield for Firm Xil the expansion were not to occut Assume that the EBITDA Multiple is 8. Assume a discount factor of 9% for the Free Cash Flows and the Continuation Value, and 9% for the Interest Tax Shield 2020 2021 2022 2023 2024 3,312,885 3,314,802 Firm Value Free Cash Flow of Fimm EBITDA Interest Tax Shield 3.316,712 3,318,631 3,320,543 5,164,631 28,350 28,350 28,250 28,350 29,350 2) What is the present Value (at December 2019) of the Free Cash Flows forecast of Fm X if the whose not to do the expansion? 3) What is the Present Value (at December 2019) of the Continuation Value forecast of Firm xif the firm where not to do the expansion 10 points Save Answer 4) What is the Present Value (at December 2013 of the Interest Tax Shield forecast of Firm Xif the fire where not to do the expansion 10 points 5) What is the firm Value (at December 2013 of Form the firm whare not to do the expansion Com 10 What would them Wow D . 2 4 5 6 7 r b t u w Y O f 8 d h K 1 V z X 7 1 b n m . Curl 4) What is the Present Value (at December 2019) of the Interest Tax Shield forecast of Firm X If the firm where not to do the expansion? 5) What is the firm Value (at December 2019) of Firm Xif the firm where not to do the expansion "6) True or False: If the value of Firm X (at December 2019) of doing the expansion is estimated to be $221856517. Firm should do the expansion (according to the NPV of the expansion). True False Help QUESTION 1 sales for year 2030 3315 or for the cost of the precum was the value of deprecation is the value of sales and test of USD Ache income tax for the company that sales are expected to increase and the experience at the 2020 levels what the company's forecast for come in 2021.rs presa de olyuran Strictly humical 10 pointe Question Completion Status Firm X is considering performing a considerable investment in year 2020. Use the following Pro Forma Financial Statements for 2020-2024 to forecast the future Free Cash Flow and estimated the value of firm X from performing these investments, 2020 2021 2022 2023 2024 $27,238,750 $41,968,850 $59,385,893 $79,881,296 5103,898,026 $14,765,787 -$22,750,791 $32,192,353 543,302,655 $56,321,826 Income Statement: Sales Costs except Depr. EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income $12,472,963 -$184,545 $12,288,418 $19,218,059 $183,236 $19,034,823 $27.193,540 5182,045 $27,011,495 $36,578,641 $180,961 $36,397,680 $47,576,201 $179,974 547,396,226 581,000 $216,000 $216,000 5216,000 $216,000 $12,207,418 $18.818,823 $26,795,495 $36,181,680 $47,180, 226 -54,272,596 $7.934,822 $6,586,588 $12,232, 235 $12,663,588 59,378,423 517,417,072 516,513,079 $30,667,147 $23,518,092 COCO 2020 2021 2022 2023 2024 $34,430,660 $53,049,983 $75,065,688 $100,972,540 $131,330,464 Working Capital Total Current Assets Total Current Liabilities Net Working Capital Increase in Net Working Capital $21.978,094 $33,863,351 $47.916,617 564,453,716 $83,832,064 $12,452,566 $19,186,632 $27,149,071 $36,518,824 $47,498,400 $5,663,686 $6,734,066 $7.962,438 $9,369,753 $10,979,576 2020 2021 2022 2023 2024 $500,500 $1,865,955 $1,852,719 $1,840,674 $1,829,714 Fixed Assets & Capit Investm Opening Book Value Capital Investment Depreciation Closing Book Value $170,000 $170,000 $1,550,000 -$184,545 5170,000 -5183 236 $170,000 $180,961 5182,045 $179,974 $1,865,955 $1,852.719 $1.840,674 $1,829,714 $1,819,739 course de 20073857&content_id=_57573248_185 * Question Completion Status: Closing Book $1,865,955 Value $1,852,719 $1,840,674 $1,829,714 $1,819,739 1) What is the forecast value for Free Cash Flows of Firm X on 2020? QUESTION 2 Use the following information to answer Questions 26 Consider the following forecasts for 2020-2024 of the Future Cash Flows, EBITDA and Future Interest Tax Shield for Firm Xil the expansion were not to occut Assume that the EBITDA Multiple is 8. Assume a discount factor of 9% for the Free Cash Flows and the Continuation Value, and 9% for the Interest Tax Shield 2020 2021 2022 2023 2024 3,312,885 3,314,802 Firm Value Free Cash Flow of Fimm EBITDA Interest Tax Shield 3.316,712 3,318,631 3,320,543 5,164,631 28,350 28,350 28,250 28,350 29,350 2) What is the present Value (at December 2019) of the Free Cash Flows forecast of Fm X if the whose not to do the expansion? 3) What is the Present Value (at December 2019) of the Continuation Value forecast of Firm xif the firm where not to do the expansion 10 points Save Answer 4) What is the Present Value (at December 2013 of the Interest Tax Shield forecast of Firm Xif the fire where not to do the expansion 10 points 5) What is the firm Value (at December 2013 of Form the firm whare not to do the expansion Com 10 What would them Wow D . 2 4 5 6 7 r b t u w Y O f 8 d h K 1 V z X 7 1 b n m . Curl 4) What is the Present Value (at December 2019) of the Interest Tax Shield forecast of Firm X If the firm where not to do the expansion? 5) What is the firm Value (at December 2019) of Firm Xif the firm where not to do the expansion "6) True or False: If the value of Firm X (at December 2019) of doing the expansion is estimated to be $221856517. Firm should do the expansion (according to the NPV of the expansion). True False