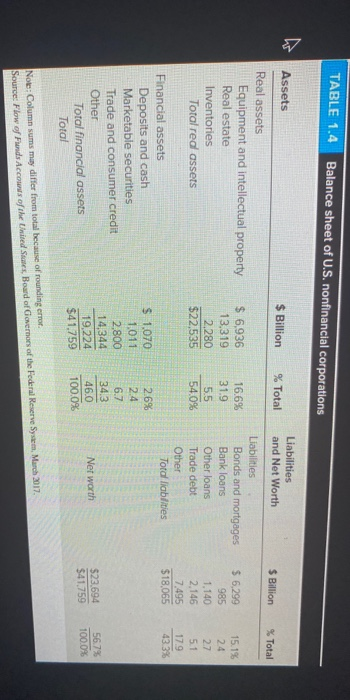

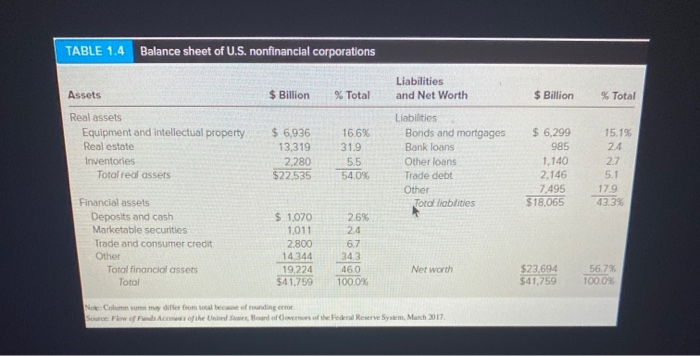

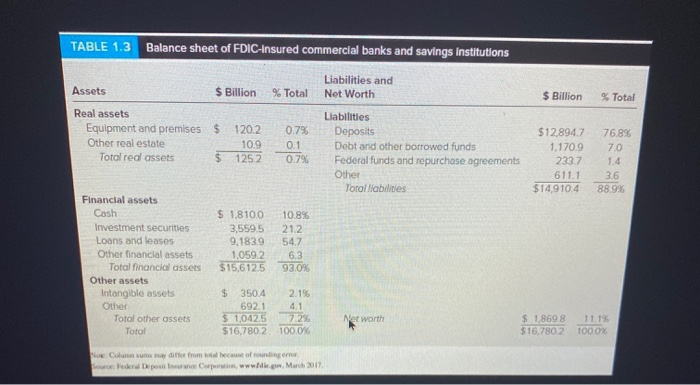

Help Save & E Examine the balance sheets given in Table 1.3. a. What is the ratio of real assets to total assets for commercial banks? (Round your answer to 4 decimal places.) Ratio of real to total assets L 0.7461 b. Assuming that the listed intangible assets are not real, what is that ratio for nonfinancial firms? (Table 1.41 (Round your answer to 4 decimal places.) The ratio for nonfinancial firms TABLE 1.4 Balance sheet of U.S. nonfinancial corporations $ Billion % Total Liabilities and Net Worth $ Billion % Total Assets Real assets Equipment and intellectual property Real estate Inventories Total red assets 16.6% 15.1% $ 6,936 13,319 2.280 $22.535 Liabilities Bonds and mortgages Bank loans Other loans Trade debt Other Total liabilities 27 $ 6,299 985 1.140 2.146 7.495 $18,065 5.1 179 43.39 Financial assets Deposits and cash Marketable securities Trade and consumer credit Other Total financial assets Total $ 1,070 1,011 2.800 14,344 19,224 $41,759 Net worth $23.694 $41.759 56.7% 100.0% Note: Column sums may differ from total because of rounding error Source: Flow of Funds Accounts of the United States Board of Governors of the Federal Reserve System March 2017 Saved Help Save & Examine the balance sheets given in Table 13. a. What is the ratio of real assets to total assets for commercial banks? (Round your answer to 4 decimal places.) Ratio of real to total assets 0.7461 0:18:01 b. Assuming that the listed intangible assets are not real, what is that ratio for nonfinancial firms? Table 14(Round your answer to 4 decimal places.) The ratio for nonfinancial firms TABLE 1.4 Balance sheet of U.S. nonfinancial corporations Assets $ Billion Liabilities and Net Worth % Total $ Billion % Total 16.6% 15.19 Real assets Equipment and intellectual property Real estate Inventories Total real assets $6,936 13,319 2,280 $22.535 5.5 Liabilities Bonds and mortgages Bank loans Other loans Trade debt Other Total liabilities $ 6,299 985 1.140 2.146 7.495 $18,065 5408 179 4339 26% Financial assets Deposits and cash Marketable securities Trade and consumer credit Other Total financial assets Total $ 1.070 1.011 2.800 14344 19,224 $41.759 Net worth 460 100.0% $23,694 $41,759 5678 100.0% Note: Column su Source: Fw of may differ from oualem c ofthed of rounding error e, Hard of Govers of the dead Rune System, March 2017 TABLE 1.3 Balance sheet of FDIC Insured commercial banks and savings institutions Assets $ Billion % Total $ Billion % Total $ 120.2 0.7% Real assets Equipment and premises Other real estate Total red assets Liabilities and Net Worth Liabilities Deposits Debt and other borrowed funds Federal funds and repurchase agreements Other Total liabilities 51252 $12,894.7 1.170.9 233.7 611.1 $14,910.4 76.8% 70 1.4 36 88.9% Financial assets Cash Investment securities Loans and leases Other financial assets Total financial assets Other assets Intangible assets Other Total other assets $ 1.8100 3,5595 9.183.9 1,059.2 $15,6125 10.89 212 54.7 6.3 93.0% $ 350.4 6921 $ 1,0425 516,780 2 2.156 4.1 72% 100.0% Net worth $ 1,8698 11.19 $16.7802 1000% Total de D e porti, www .g. March 2011