Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Save & EX Check my Rodriguez Company pays $379,080 for real estate with land, land improvements, and a building. Land is appraised at $270,000,

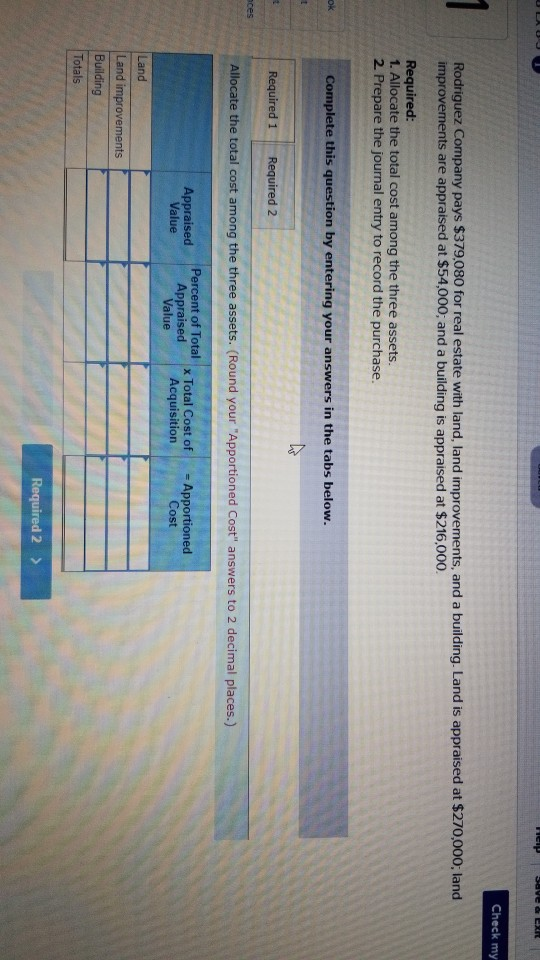

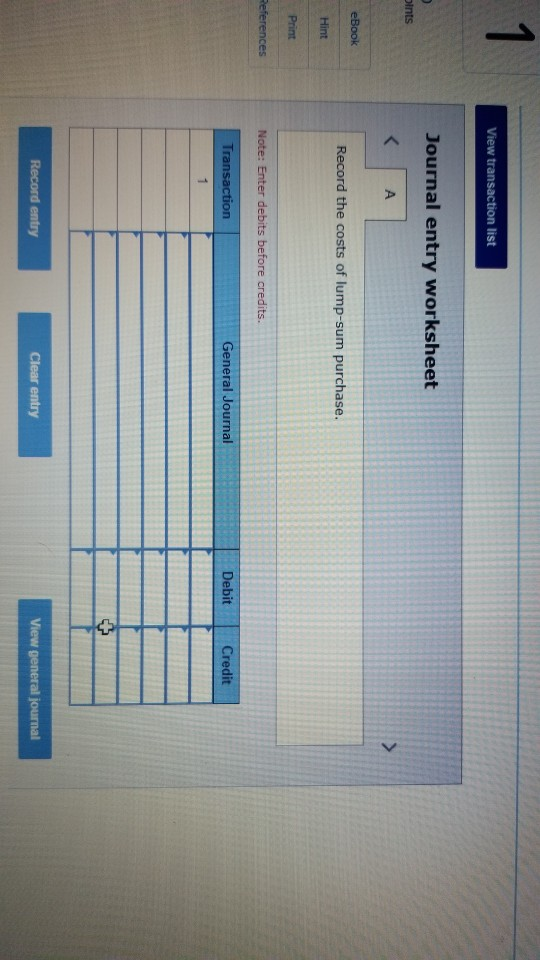

Help Save & EX Check my Rodriguez Company pays $379,080 for real estate with land, land improvements, and a building. Land is appraised at $270,000, land improvements are appraised at $54,000, and a building is appraised at $216,000. Required: 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 aces Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Appraised Value Percent of Total Appraised Total cost of Acquisition = Apportioned C ost Value Land Land improvements Building Totals Required 2 > 1 View transaction list Journal entry worksheet oints eBook Record the costs of lump-sum purchase. Hint Print References Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started