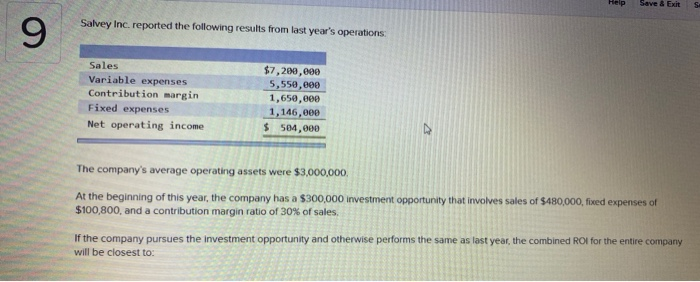

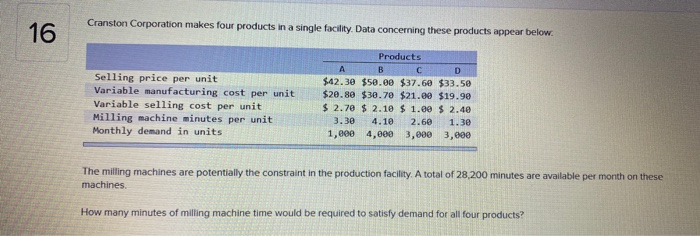

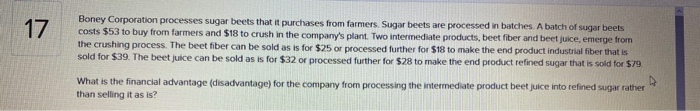

Help Save & Exit Salvey Inc. reported the following results from last year's operations 9 Sales Variable expenses Contribution margin Fixed expenses Net operating income $7,200,000 5,550,000 1,650,000 1,146,eee $ 504,000 The company's average operating assets were $3,000,000, At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to: 9 Multiple Choice O 16.6% O 1.3% O 18.2% o 15.3% Cranston Corporation makes four products in a single facility. Data concerning these products appear below. 16 Selling price per unit Variable manufacturing cost per unit Variable selling cost per unit Milling machine minutes per unit Monthly demand in units Products A B D $42.30 $50.00 $37.60 $33.50 $20.80 $30.70 $21.99 $19.90 $ 2.70 $ 2.19 $ 1.00 $ 2.40 3.30 4.10 2.60 1.30 1, eee 4,000 3,000 3,000 The milling machines are potentially the constraint in the production facility. A total of 28,200 minutes are available per month on these machines How many minutes of milling machine time would be required to satisfy demand for all four products? 16 Multiple Choice 11,000 28,200 23,500 O 31,400 17 Boney Corporation processes sugar beets that it purchases from farmers Sugar beets are processed in batches. A batch of sugar beets costs $53 to buy from farmers and $18 to crush in the company's plant. Two intermediate products, beet fiber and beetjuice, emerge from the crushing process. The beet fiber can be sold as is for $25 or processed further for $18 to make the end product industrial fiber that is sold for $39. The beet juice can be sold as is for $32 or processed further for $28 to make the end product refined sugar that is sold for $79 What is the financial advantage (disadvantage) for the company from processing the intermediate product beetjuice into refined sugar rather than selling it as is? 17 Multiple Choice $1 per batch ($17) per batch $19 per batch O ($52) per batch