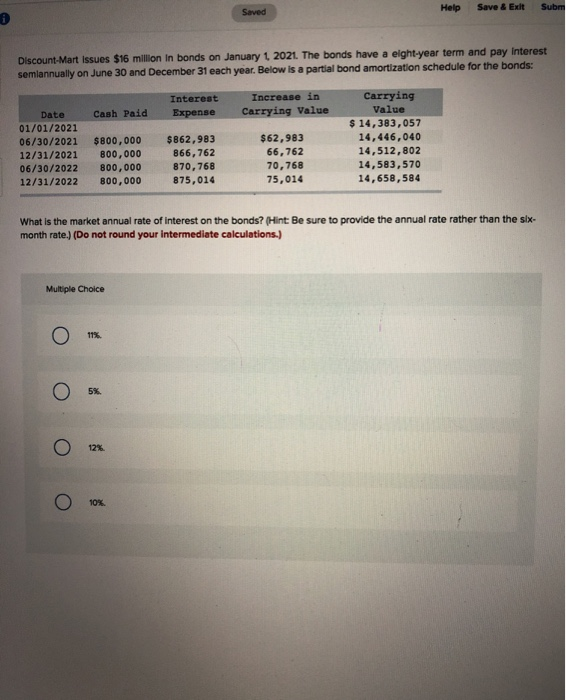

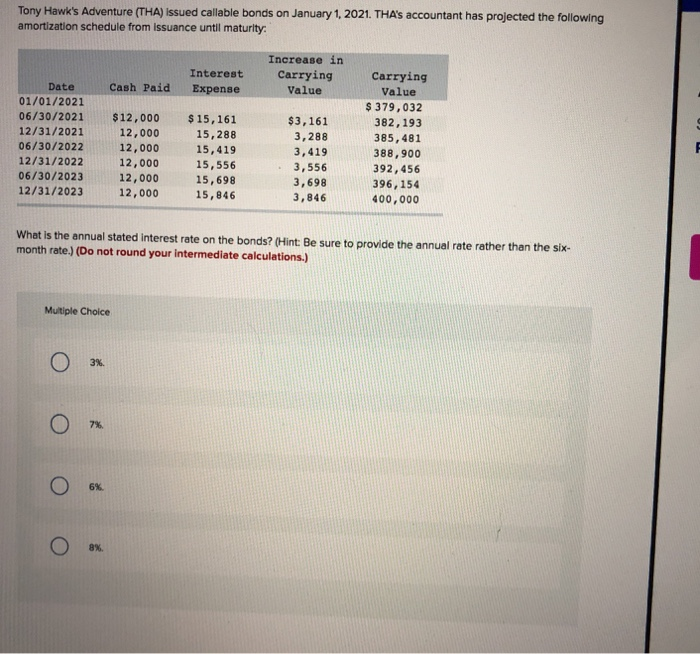

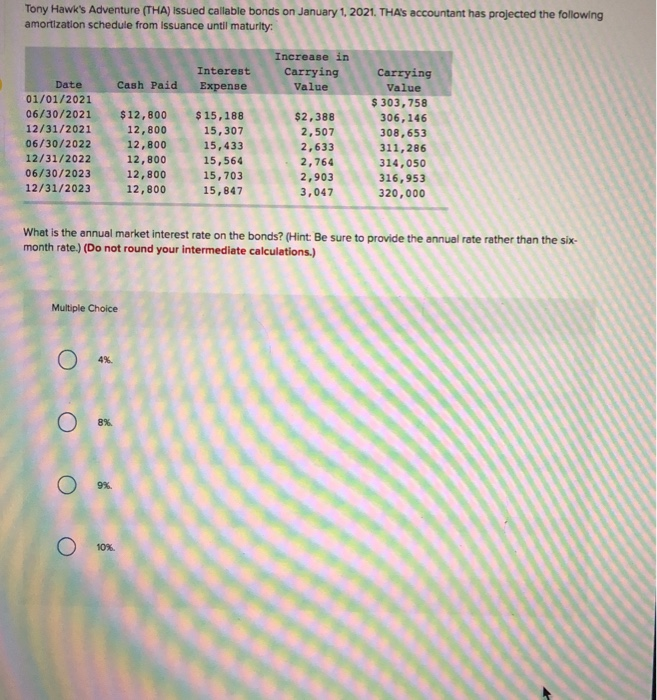

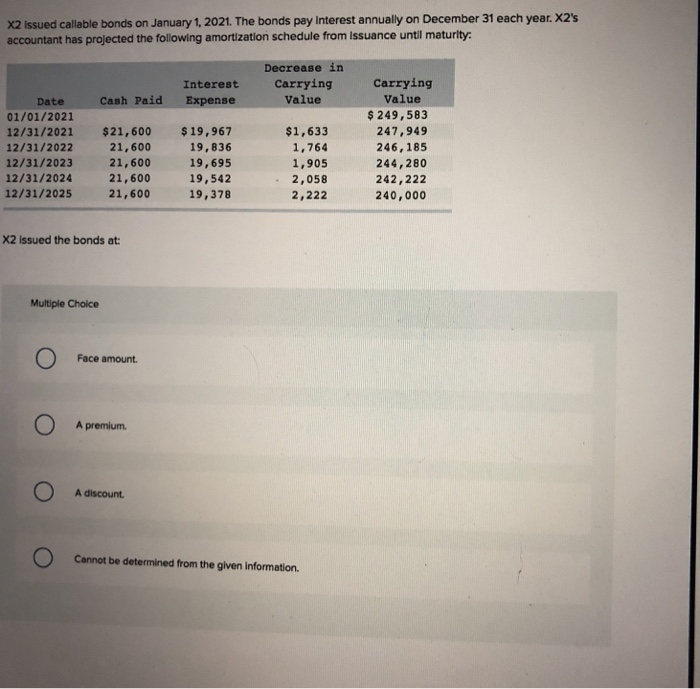

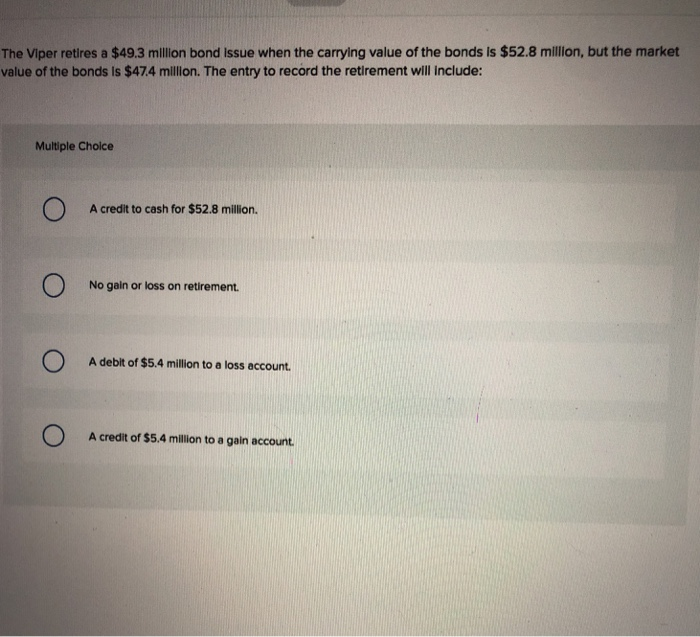

Help Save& Exit Subm Saved Discount-Mart issues $16 million In bonds on January 1 2021. The bonds have a eight-year term and pay interest semlannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds: Carrying Value 14,383,057 14,446,040 14,512,802 14,583,570 14,658,584 Interest Increase in Date Cash Paid Expense Carrying Value 01/01/2021 06/30/2021 $800,000 $862,983 12/31/2021 800,000 06/30/2022 800,000870,768 12/31/2022 800,000 875,014 $62,983 66,762 70,768 75,014 866, 762 What is the market annual rate of interest on the bonds? (Hint Be sure to provide the annual rate rather than the six- month rate.) (Do not round your intermediate calculations.) Multiple Choice 11%. 05% 12% 10%. Tony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THAs accountant has projected the following amortization schedule from issuance until maturlty Increase in Carrying Value Carrying Value 379,032 382,193 385,481 388,900 392,456 396, 154 400,000 Interest Date Cash Paid Expense 01/01/2021 06/30/2021 $12,000 15,161 15,288 12,000 15,419 15,556 15,698 12/31/2023 12,000 15,846 12/31/202112,000 06/30/2022 12/31/2022 12,000 06/30/2023 $3,161 3,288 3,419 3,556 3,698 3,846 12,000 What is the annual stated interest rate on the bonds? Hint Be sure to provide the annual rate rather than the six- month rate) (Do not round your intermediate calculations.) Mutiple Choice 3% 7% 6%. 08% Tony Hawk's Adventure (THA) Issued callable bonds on January 1,2021. THA's accountant has projected the following amortization schedule from Issuance until maturity: Increase in Carryingcarrying Interest Paid Expense Date Cash Value 01/01/2021 06/30/2021 $12,800 $15,188 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 12,800 15,307 12,800 12,800 12,800 15,703 12,800 $2,388 2,507 2,633 2,764 2,903 3,047 Value $303,758 306,146 308,653 311,286 314,050 16,953 320,000 15,433 15,564 15,847 What is the annual market interest rate on the bonds? (Hint month rate ) (Do not round your intermediate calculations.) Be sure to provide the annual rate rather then the six Multiple Choice 04% 8%. 9% 00%. X2 issued callable bonds on January 1, 2021. The bonds pay Interest annually on December 31 each year. X2's accountant has projected the following amortization schedule from Issuance until maturity: Decrease in Interest Carrying Carrying Value Value 249,583 247,949 246,185 244,280 242,222 240,000 Date Cash Paid Expense 21,600 12/31/2023 21,600 21,600 12/31/202521,600 01/01/2021 12/31/2022 12/31/2024 12/31/2021 $21,600 $19,967 19,836 19,695 19,542 19,378 $1,633 1,764 1,905 2,058 2,222 X2 issued the bonds at Multiple Choice Face amount. A premium A discount Cannot be determined from the given information. The Viper retires a $49.3 million bond Issue when the carrylng value of the bonds is $52.8 milllon, but the market value of the bonds Is $47.4 million. The entry to record the retirement will Include: Multiple Choice A credit to cash for $52.8 million. No gain or loss on retirement. A debit of $5.4 million to a loss account A credit of $5.4 million to a gain account