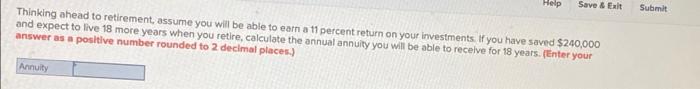

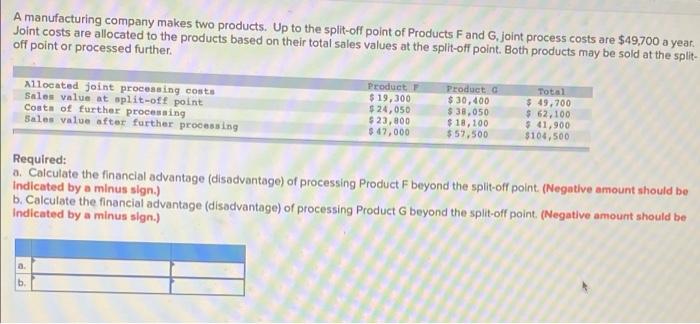

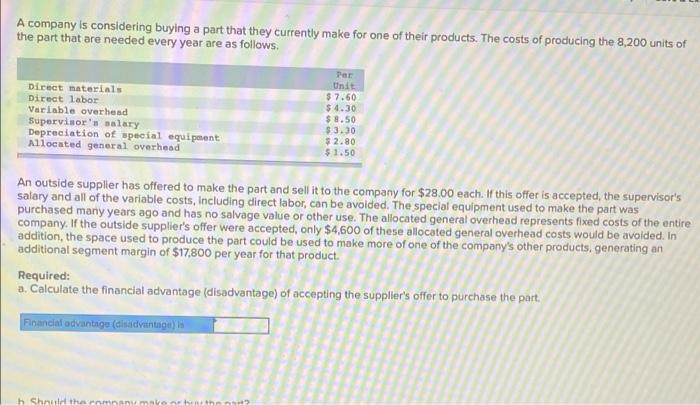

Help Save & Exit Submit Thinking ahead to retirement, assume you will be able to earn a 11 percent return on your investments if you have saved $240,000 and expect to live 18 more years when you retire, calculate the annual annuity you will be able to receive for 18 years. (Enter your answer as a positive number rounded to 2 decimal places.) Annuity A manufacturing company makes two products. Up to the split-off point of Products Fand G, joint process costs are $49,700 a year. Joint costs are allocated to the products based on their total sales values at the split-off point. Both products may be sold at the split- off point or processed further. Allocated joint processing costs Sales value at split-ott point Costs of further processing Sales value after further processing Product $ 19,300 $ 24,050 $ 23,800 $ 47,000 Producto $ 30,400 $ 38,050 $18, 100 $57,500 Total 5.49.700 $ 62,100 541,900 $104,500 Required: a. Calculate the financial advantage (disadvantage) of processing Product F beyond the split-off point. (Negative amount should be Indicated by a minus sign.) b. Calculate the financial advantage (disadvantage) of processing Product G beyond the split-off point (Negative amount should be Indicated by a minus sign.) . a b A company is considering buying a part that they currently make for one of their products. The costs of producing the 8,200 units of the part that are needed every year are as follows. Direct materials Direct Labor Variable overhead Supervisor's salary Depreciation of special equipment Allocated general overhead Per Unit $7.50 $4.30 $8.50 $3.30 $ 2.80 $1.50 An outside supplier has offered to make the part and sell it to the company for $28.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,600 of these allocated general overhead costs would be avoided. In addition, the space used to produce the part could be used to make more of one of the company's other products, generating an additional segment margin of $17,800 per year for that product Required: a. Calculate the financial advantage (disadvantage) of accepting the supplier's offer to purchase the part. Financial advantage (altadvantage h Should therm b. Should the company make or buy the part? The company should the part