Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Save & Exit Sut 3 2-30:45 . Use the following information for Questions 21 - 25 You have been asked to calculate a firm's

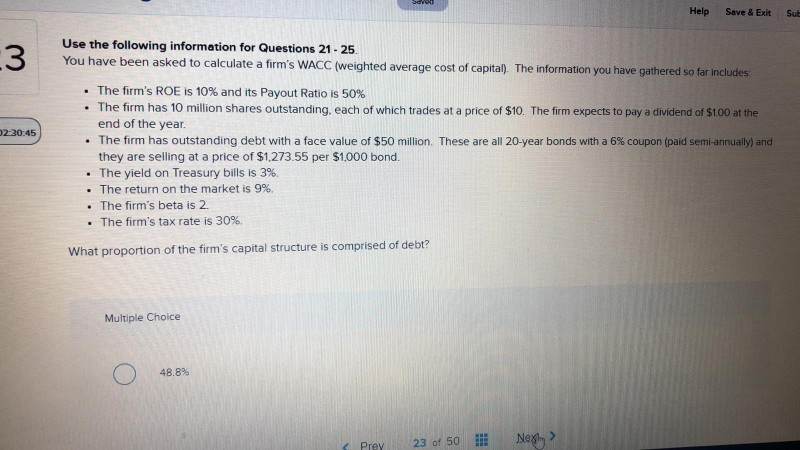

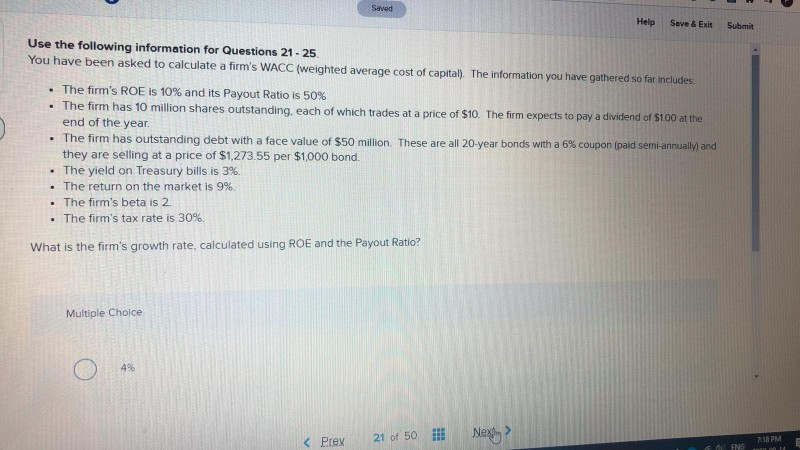

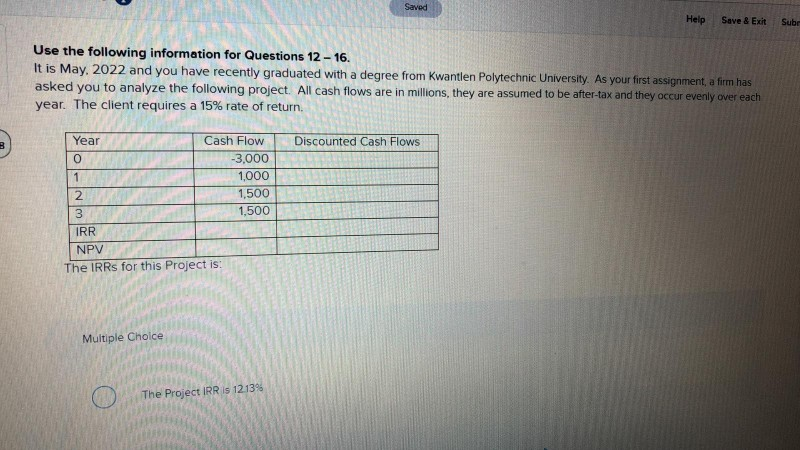

Help Save & Exit Sut 3 2-30:45 . Use the following information for Questions 21 - 25 You have been asked to calculate a firm's WACC (weighted average cost of capital). The information you have gathered so far Includes: . The firm's ROE is 10% and its Payout Ratio is 50% . The firm has 10 million shares outstanding, each of which trades at a price of $10. The firm expects to pay a dividend of $100 at the end of the year. The firm has outstanding debt with a face value of $50 million. These are all 20-year bonds with a 6% coupon (paid semi-annually) and they are selling at a price of $1,273.55 per $1.000 bond. The yield on Treasury bills is 3% The return on the market is 9% The firm's beta is 2. The firm's tax rate is 30%, What proportion of the firm's capital structure is comprised of debt? . Multiple Choice 48.8% RE 23 of 50 Prey Next Saved Help Save & Exit Submit Use the following information for Questions 21 - 25 You have been asked to calculate a firm's WACC (weighted average cost of capital). The information you have gathered so far includes: The firm's ROE is 10% and its Payout Ratio is 50% The firm has 10 million shares outstanding, each of which trades at a price of $10. The firm expects to pay a dividend of $100 at the end of the year The firm has outstanding debt with a face value of $50 million. These are all 20-year bonds with a 6% coupon (paid semi-annually and they are selling at a price of $1,273.55 per $1,000 bond. The yield on Treasury bills is 3%. The return on the market is 9% The firm's beta is 2. The firm's tax rate is 30% . . What is the firm's growth rate, calculated using ROE and the Payout Ratio? Multiple Choice 49 7:18 PM ENS Saved Help Save & Exit Subr Use the following information for Questions 12 - 16. It is May, 2022 and you have recently graduated with a degree from Kwantlen Polytechnic University. As your first assignment, a firm has asked you to analyze the following project. All cash flows are in millions, they are assumed to be after-tax and they occur evenly over each year. The client requires a 15% rate of return B Discounted Cash Flows Year Cash Flow 0 -3,000 1 1,000 2 1,500 3 1,500 IRR NPV The IRRs for this project is: Multiple Choice The Project IRR is 12139

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started