Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help Shirley, a recent college graduate, excitedly described to her older sister the $1,800 sofa, table, and chairs she found today. However, when asked she

help

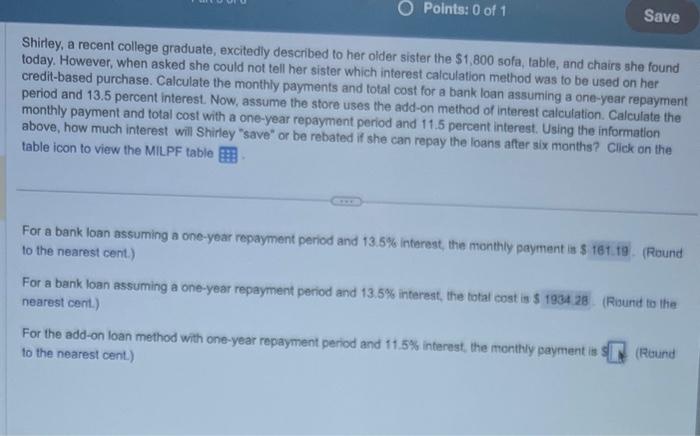

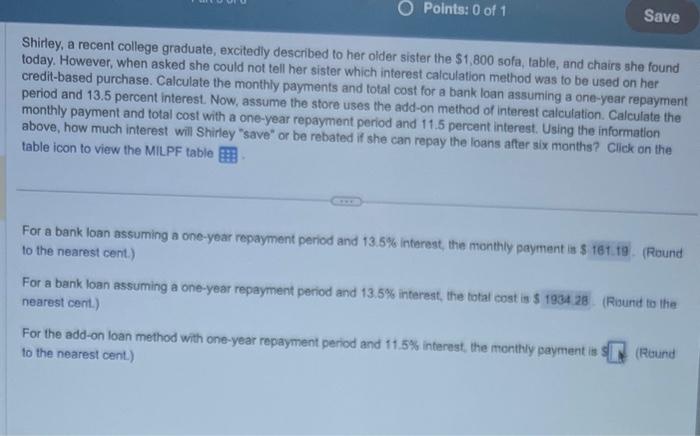

Shirley, a recent college graduate, excitedly described to her older sister the $1,800 sofa, table, and chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 13.5 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 11.5 percent interest. Using the information above, how much interest will Shirley "save" or be rebated if she can repay the loans after six months? Click on the table icon to view the MiLPF table For a bank loan assuming a one-year repayment period and 13.5% interest, the monthly payment is \& (Round to the nearest cent.) For a bank loan assuming a one-year repayment period and 13.5% interest, the total cost is $ (Round to the nearest cent.) For the add-on loan method with one-year repayment period and 11.5% interest, the monthly payment is s to the nearest cent.) Shirley, a recent college graduate, excitedly described to her older sister the $1,800 sofa, table, and chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 13.5 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 11.5 percent interest. Using the information above, how much interest will Shirley "save" or be rebated if she can repay the loans after six months? Click on the table icon to view the MiLPF table For a bank loan assuming a one-year repayment period and 13.5% interest, the monthly payment is \& (Round to the nearest cent.) For a bank loan assuming a one-year repayment period and 13.5% interest, the total cost is $ (Round to the nearest cent.) For the add-on loan method with one-year repayment period and 11.5% interest, the monthly payment is s to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started