Answered step by step

Verified Expert Solution

Question

1 Approved Answer

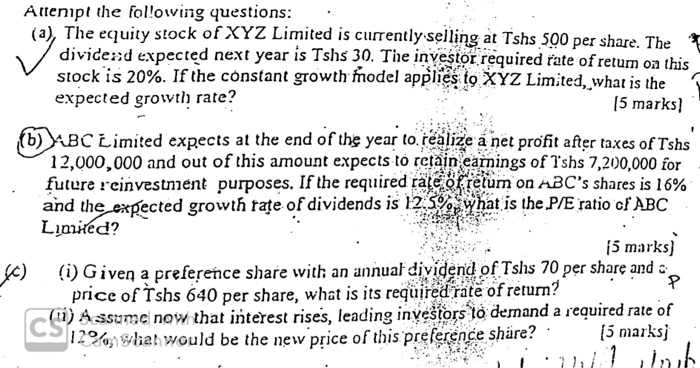

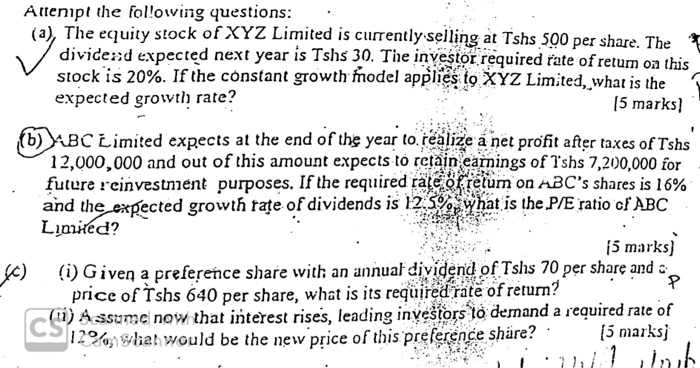

help solution Attenipt the following questions: . (a), The equity stock of XYZ Limited is currently selling at Tshs 500 per share. The divided expected

help solution

Attenipt the following questions: . (a), The equity stock of XYZ Limited is currently selling at Tshs 500 per share. The divided expected next year is Tshs 30. The investor required rate of retum oa this stock is 20%. If the constant growth frodel applies to XYZ Limited, what is the expected growth rate? 15 marks) (b) ABC Limited expects at the end of the year to realize a net profit after taxes of Tshs 12,000,000 and out of this amount expects to retain earnings of 'shs 7,200,000 for future reinvestnient purposes. If the required tale of retum on ABC's shares is 16% and the expected growth rate of dividends is 12.5% what is the P/E ratio of ABC. Limited? 15 marks) fo) () Given a preference share with an annual dividend of Tshs 70 per share and price of Tshs 640 per share, what is its required rate of return? c s sume now that interest rises, leading investors to demand a required rate of 112 ,9hat would be the new price of this preference share? (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started