Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help solve this Question 1 : You and your team are concerned that the model is based on only one sales growth rate and one

Help solve this

| Question 1: You and your team are concerned that the model is based on only one sales growth rate and one tax rate. Fill in the table below based on manually changing the key inputs to the model. (Be sure to change the key inputs back to formulas after answering this question). | ||||||||||

| Case Analysis | ||||||||||

| Tax Rate | Sales Growth YOY (%) | Earnings Per Share Basic 2026E | ||||||||

| Weak Case | 15% | 1.5% | ||||||||

| Steady State | 17% | 3.5% | ||||||||

| Strong State | 17% | 5.5% | ||||||||

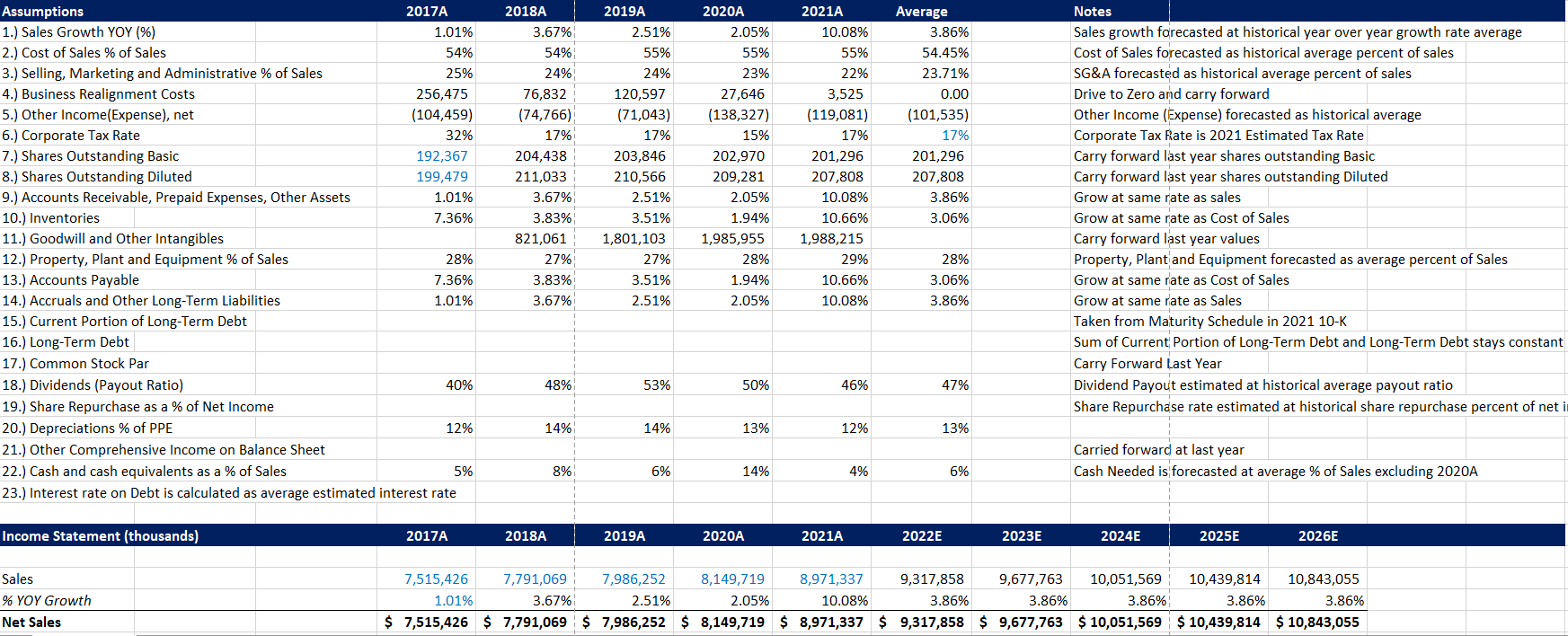

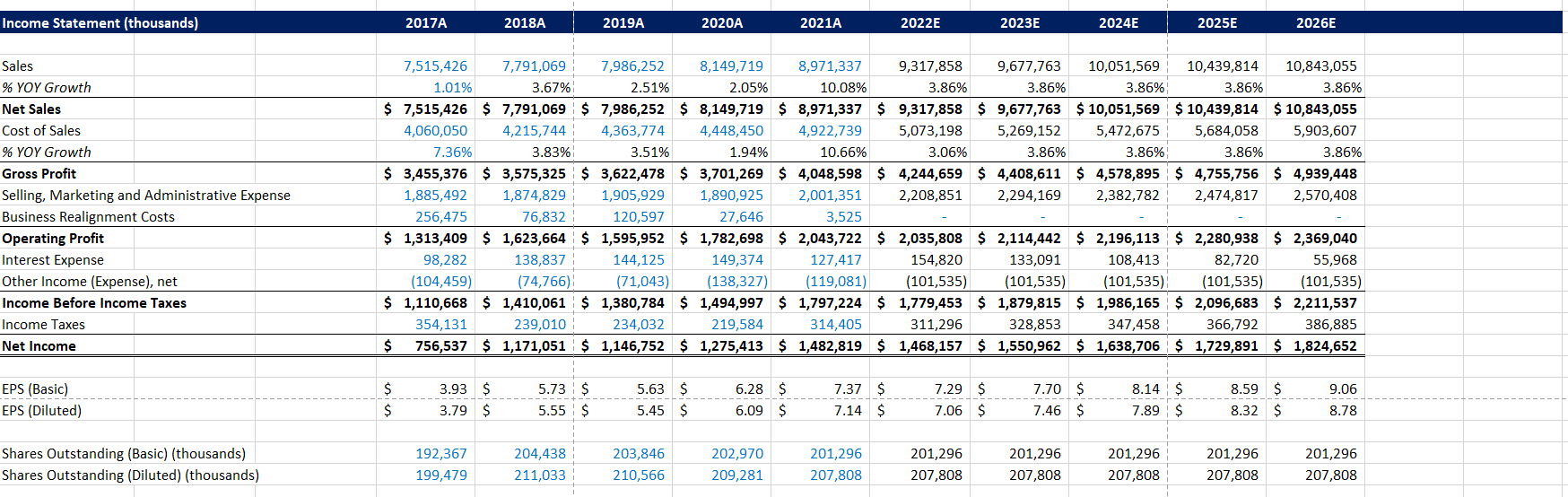

2017A Assumptions Notes 1.) Sales Growth YOY (%) 1.01% Sales growth forecasted at historical year over year growth rate average Cost of Sales forecasted as historical average percent of sales 2.) Cost of Sales % of Sales 54% 25% 3.) Selling, Marketing and Administrative % of Sales SG&A forecasted as historical average percent of sales Drive to Zero and carry forward 4.) Business Realignment Costs 5.) Other Income (Expense), net 256,475 (104,459) 32% Other Income (Expense) forecasted as historical average Corporate Tax Rate is 2021 Estimated Tax Rate 6.) Corporate Tax Rate 7.) Shares Outstanding Basic 192,367 199,479 Carry forward last year shares outstanding Basic Carry forward last year shares outstanding Diluted 8.) Shares Outstanding Diluted 9.) Accounts Receivable, Prepaid Expenses, Other Assets Grow at same rate as sales 1.01% 7.36% 10.) Inventories Grow at same rate as Cost of Sales 11.) Goodwill and Other Intangibles Carry forward last year values 12.) Property, Plant and Equipment % of Sales Property, Plant and Equipment forecasted as average percent of Sales 28% 7.36% 13.) Accounts Payable Grow at same rate as Cost of Sales 14.) Accruals and Other Long-Term Liabilities 1.01% Grow at same rate as Sales 15.) Current Portion of Long-Term Debt Taken from Maturity Schedule in 2021 10-K 16.) Long-Term Debt Sum of Current Portion of Long-Term Debt and Long-Term Debt stays constant Carry Forward Last Year 17.) Common Stock Par 18.) Dividends (Payout Ratio) 40% Dividend Payout estimated at historical average payout ratio 19.) Share Repurchase as a % of Net Income Share Repurchase rate estimated at historical share repurchase percent of net i 20.) Depreciations % of PPE 12% 21.) Other Comprehensive Income on Balance Sheet Carried forward at last year 22.) Cash and cash equivalents as a % of Sales 5% Cash Needed is forecasted at average % of Sales excluding 2020A 23.) Interest rate on Debt is calculated as average estimated interest rate Income Statement (thousands) 2017A 2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E Sales 7,515,426 7,791,069 7,986,252 8,149,719 8,971,337 1.01% 3.67% 2.51% 2.05% 10.08% $ 7,515,426 $ 7,791,069 $ 7,986,252 $ 8,149,719 $ 8,971,337 $ 9,317,858 $ 9,677,763 $ 10,051,569 $ 10,439,814 $10,843,055 9,317,858 9,677,763 10,051,569 10,439,814 3.86% 3.86% 3.86% 3.86% 10,843,055 3.86% % YOY Growth Net Sales 2021A 10.08% 3.67% 2.51% 2.05% 54% 55% 55% 23% 24% 76,832 (74,766) 17% 204,438 211,033 24% 120,597 27,646 (71,043) (138,327) 15% 202,970 209,281 55% 22% 3,525 (119,081) 17% 201,296 207,808 17% 203,846 210,566 3.67% 2.51% 2.05% 10.08% 3.83% 3.51% 1.94% 10.66% 821,061 1,801,103 1,985,955 1,988,215 27% 27% 28% 29% 3.83% 3.51% 1.94% 10.66% 2.51% 2.05% 10.08% 3.67% 48% 53% 50% 46% 14% 14% 13% 12% 8% 6% 14% 4% 2018A 2019A 2020A Average 3.86% 54.45% 23.71% 0.00 (101,535) 17% 201,296 207,808 3.86% 3.06% 28% 3.06% 3.86% 47% 13% 6% Income Statement (thousands) 2017A 2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E Sales % YOY Growth Net Sales Cost of Sales % YOY Growth Gross Profit Selling, Marketing and Administrative Expense Business Realignment Costs Operating Profit Interest Expense Other Income (Expense), net Income Before Income Taxes Income Taxes Net Income 7,515,426 7,791,069 7,986,252 8,149,719 8,971,337 9,317,858 9,677,763 10,051,569 10,439,814 10,843,055 1.01% 3.67% 2.51% 2.05% 10.08% 3.86% 3.86% 3.86% 3.86% 3.86% $ 7,515,426 $ 7,791,069 $ 7,986,252 $ 8,149,719 $ 8,971,337 $ 9,317,858 $ 9,677,763 $ 10,051,569 $ 10,439,814 $ 10,843,055 4,060,050 4,215,744 4,363,774 4,448,450 4,922,739 5,073,198 5,269,152 5,472,675 5,684,058 5,903,607 7.36% 3.83% 3.51% 1.94% 10.66% 3.06% 3.86% 3.86% 3.86% 3.86% $ 3,455,376 $ 3,575,325 $ 3,622,478 $ 3,701,269 $ 4,048,598 $ 4,244,659 $ 4,408,611 $ 4,578,895 $ 4,755,756 $ 4,939,448 1,885,492 1,874,829 1,905,929 1,890,925 2,001,351 2,208,851 2,294,169 2,382,782 2,474,817 2,570,408 256,475 76,832 120,597 27,646 3,525 $ 1,313,409 $ 1,623,664 $ 1,595,952 $ 1,782,698 $ 2,043,722 $ 2,035,808 $ 2,114,442 $ 2,196,113 $ 2,280,938 $ 2,369,040 98,282 138,837 144,125 149,374 127,417 154,820 133,091 108,413 82,720 55,968 (104,459) (74,766) (71,043) (138,327) (119,081) (101,535) (101,535) (101,535) (101,535) (101,535) $ 1,110,668 $ 1,410,061 $ 1,380,784 $ 1,494,997 $ 1,797,224 $ 1,779,453 $ 1,879,815 $ 1,986,165 $ 2,096,683 $ 2,211,537 354,131 239,010 234,032 219,584 314,405 311,296 328,853 347,458 366,792 386,885 $ 756,537 $ 1,171,051 $ 1,146,752 $ 1,275,413 $ 1,482,819 $ 1,468,157 $1,550,962 $ 1,638,706 $ 1,729,891 $ 1,824,652 3.93 $ 9.06 EPS (Basic) EPS (Diluted) $ $ 5.73 $ 5.55 : $ 5.63 $ 5.45 $ 6.28 $ 6.09 $ 7.37 $ 7.14 $ 7.29 $ 7.06 $ 7.70 $ 7.46 $ 8.14 $ 7.89 $ 8.59 $ 8.32 $ 3.79 $ 8.78 Shares Outstanding (Basic) (thousands) Shares Outstanding (Diluted) (thousands) 192,367 199,479 204,438 211,033 203,846 210,566 202,970 209,281 201,296 207,808 201,296 207,808 201,296 207,808 201,296 207,808 201,296 207,808 201,296 207,808 2017A Assumptions Notes 1.) Sales Growth YOY (%) 1.01% Sales growth forecasted at historical year over year growth rate average Cost of Sales forecasted as historical average percent of sales 2.) Cost of Sales % of Sales 54% 25% 3.) Selling, Marketing and Administrative % of Sales SG&A forecasted as historical average percent of sales Drive to Zero and carry forward 4.) Business Realignment Costs 5.) Other Income (Expense), net 256,475 (104,459) 32% Other Income (Expense) forecasted as historical average Corporate Tax Rate is 2021 Estimated Tax Rate 6.) Corporate Tax Rate 7.) Shares Outstanding Basic 192,367 199,479 Carry forward last year shares outstanding Basic Carry forward last year shares outstanding Diluted 8.) Shares Outstanding Diluted 9.) Accounts Receivable, Prepaid Expenses, Other Assets Grow at same rate as sales 1.01% 7.36% 10.) Inventories Grow at same rate as Cost of Sales 11.) Goodwill and Other Intangibles Carry forward last year values 12.) Property, Plant and Equipment % of Sales Property, Plant and Equipment forecasted as average percent of Sales 28% 7.36% 13.) Accounts Payable Grow at same rate as Cost of Sales 14.) Accruals and Other Long-Term Liabilities 1.01% Grow at same rate as Sales 15.) Current Portion of Long-Term Debt Taken from Maturity Schedule in 2021 10-K 16.) Long-Term Debt Sum of Current Portion of Long-Term Debt and Long-Term Debt stays constant Carry Forward Last Year 17.) Common Stock Par 18.) Dividends (Payout Ratio) 40% Dividend Payout estimated at historical average payout ratio 19.) Share Repurchase as a % of Net Income Share Repurchase rate estimated at historical share repurchase percent of net i 20.) Depreciations % of PPE 12% 21.) Other Comprehensive Income on Balance Sheet Carried forward at last year 22.) Cash and cash equivalents as a % of Sales 5% Cash Needed is forecasted at average % of Sales excluding 2020A 23.) Interest rate on Debt is calculated as average estimated interest rate Income Statement (thousands) 2017A 2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E Sales 7,515,426 7,791,069 7,986,252 8,149,719 8,971,337 1.01% 3.67% 2.51% 2.05% 10.08% $ 7,515,426 $ 7,791,069 $ 7,986,252 $ 8,149,719 $ 8,971,337 $ 9,317,858 $ 9,677,763 $ 10,051,569 $ 10,439,814 $10,843,055 9,317,858 9,677,763 10,051,569 10,439,814 3.86% 3.86% 3.86% 3.86% 10,843,055 3.86% % YOY Growth Net Sales 2021A 10.08% 3.67% 2.51% 2.05% 54% 55% 55% 23% 24% 76,832 (74,766) 17% 204,438 211,033 24% 120,597 27,646 (71,043) (138,327) 15% 202,970 209,281 55% 22% 3,525 (119,081) 17% 201,296 207,808 17% 203,846 210,566 3.67% 2.51% 2.05% 10.08% 3.83% 3.51% 1.94% 10.66% 821,061 1,801,103 1,985,955 1,988,215 27% 27% 28% 29% 3.83% 3.51% 1.94% 10.66% 2.51% 2.05% 10.08% 3.67% 48% 53% 50% 46% 14% 14% 13% 12% 8% 6% 14% 4% 2018A 2019A 2020A Average 3.86% 54.45% 23.71% 0.00 (101,535) 17% 201,296 207,808 3.86% 3.06% 28% 3.06% 3.86% 47% 13% 6% Income Statement (thousands) 2017A 2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E Sales % YOY Growth Net Sales Cost of Sales % YOY Growth Gross Profit Selling, Marketing and Administrative Expense Business Realignment Costs Operating Profit Interest Expense Other Income (Expense), net Income Before Income Taxes Income Taxes Net Income 7,515,426 7,791,069 7,986,252 8,149,719 8,971,337 9,317,858 9,677,763 10,051,569 10,439,814 10,843,055 1.01% 3.67% 2.51% 2.05% 10.08% 3.86% 3.86% 3.86% 3.86% 3.86% $ 7,515,426 $ 7,791,069 $ 7,986,252 $ 8,149,719 $ 8,971,337 $ 9,317,858 $ 9,677,763 $ 10,051,569 $ 10,439,814 $ 10,843,055 4,060,050 4,215,744 4,363,774 4,448,450 4,922,739 5,073,198 5,269,152 5,472,675 5,684,058 5,903,607 7.36% 3.83% 3.51% 1.94% 10.66% 3.06% 3.86% 3.86% 3.86% 3.86% $ 3,455,376 $ 3,575,325 $ 3,622,478 $ 3,701,269 $ 4,048,598 $ 4,244,659 $ 4,408,611 $ 4,578,895 $ 4,755,756 $ 4,939,448 1,885,492 1,874,829 1,905,929 1,890,925 2,001,351 2,208,851 2,294,169 2,382,782 2,474,817 2,570,408 256,475 76,832 120,597 27,646 3,525 $ 1,313,409 $ 1,623,664 $ 1,595,952 $ 1,782,698 $ 2,043,722 $ 2,035,808 $ 2,114,442 $ 2,196,113 $ 2,280,938 $ 2,369,040 98,282 138,837 144,125 149,374 127,417 154,820 133,091 108,413 82,720 55,968 (104,459) (74,766) (71,043) (138,327) (119,081) (101,535) (101,535) (101,535) (101,535) (101,535) $ 1,110,668 $ 1,410,061 $ 1,380,784 $ 1,494,997 $ 1,797,224 $ 1,779,453 $ 1,879,815 $ 1,986,165 $ 2,096,683 $ 2,211,537 354,131 239,010 234,032 219,584 314,405 311,296 328,853 347,458 366,792 386,885 $ 756,537 $ 1,171,051 $ 1,146,752 $ 1,275,413 $ 1,482,819 $ 1,468,157 $1,550,962 $ 1,638,706 $ 1,729,891 $ 1,824,652 3.93 $ 9.06 EPS (Basic) EPS (Diluted) $ $ 5.73 $ 5.55 : $ 5.63 $ 5.45 $ 6.28 $ 6.09 $ 7.37 $ 7.14 $ 7.29 $ 7.06 $ 7.70 $ 7.46 $ 8.14 $ 7.89 $ 8.59 $ 8.32 $ 3.79 $ 8.78 Shares Outstanding (Basic) (thousands) Shares Outstanding (Diluted) (thousands) 192,367 199,479 204,438 211,033 203,846 210,566 202,970 209,281 201,296 207,808 201,296 207,808 201,296 207,808 201,296 207,808 201,296 207,808 201,296 207,808

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started