Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help thanks Question C1 Alyssa, aged thirty-five, is a working woman with 2 children. She now earns an annual income of around HK$420,000. Alyssa has

help thanks

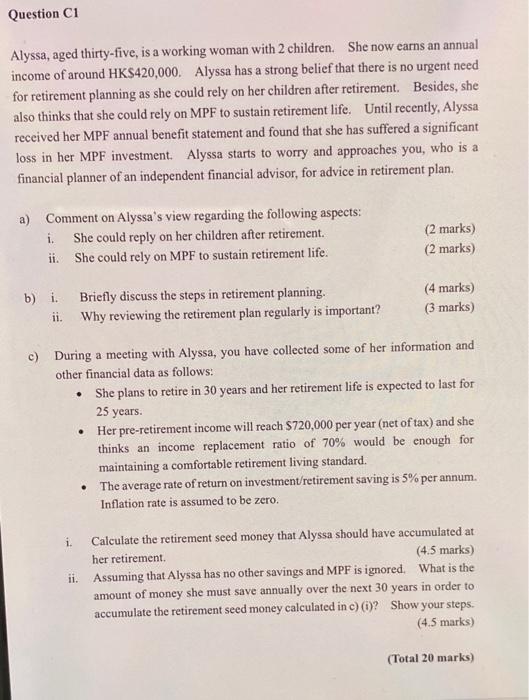

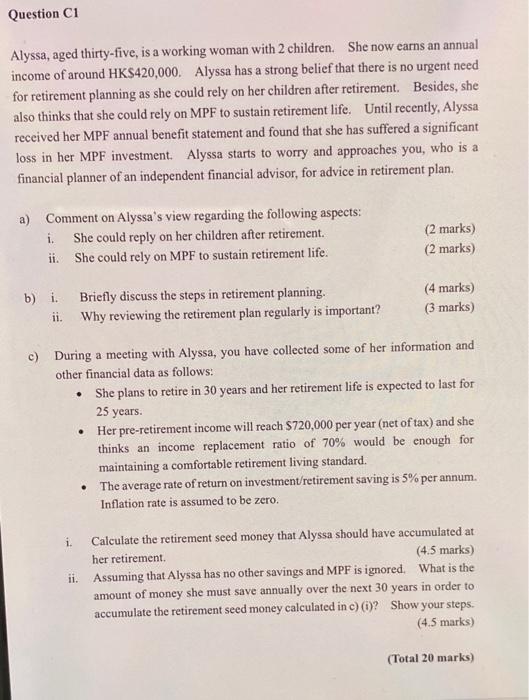

Question C1 Alyssa, aged thirty-five, is a working woman with 2 children. She now earns an annual income of around HK$420,000. Alyssa has a strong belief that there is no urgent need for retirement planning as she could rely on her children after retirement. Besides, she also thinks that she could rely on MPF to sustain retirement life. Until recently, Alyssa received her MPF annual benefit statement and found that she has suffered a significant loss in her MPF investment. Alyssa starts to worry and approaches you, who is a financial planner of an independent financial advisor, for advice in retirement plan. a) Comment on Alyssa's view regarding the following aspects: i. She could reply on her children after retirement. ii. She could rely on MPF to sustain retirement life. (2 marks) (2 marks) b) i. Briefly discuss the steps in retirement planning. ii. Why reviewing the retirement plan regularly is important? (4 marks) (3 marks) c) During a meeting with Alyssa, you have collected some of her information and other financial data as follows: She plans to retire in 30 years and her retirement life is expected to last for 25 years. Her pre-retirement income will reach $720,000 per year (net of tax) and she thinks an income replacement ratio of 70% would be enough for maintaining a comfortable retirement living standard. The average rate of return on investment/retirement saving is 5% per annum. Inflation rate is assumed to be zero. i. Calculate the retirement seed money that Alyssa should have accumulated at her retirement (4.5 marks) ii. Assuming that Alyssa has no other savings and MPF is ignored. What is the amount of money she must save annually over the next 30 years in order to accumulate the retirement seed money calculated in c) 0)? Show your steps. (4.5 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started