Answered step by step

Verified Expert Solution

Question

1 Approved Answer

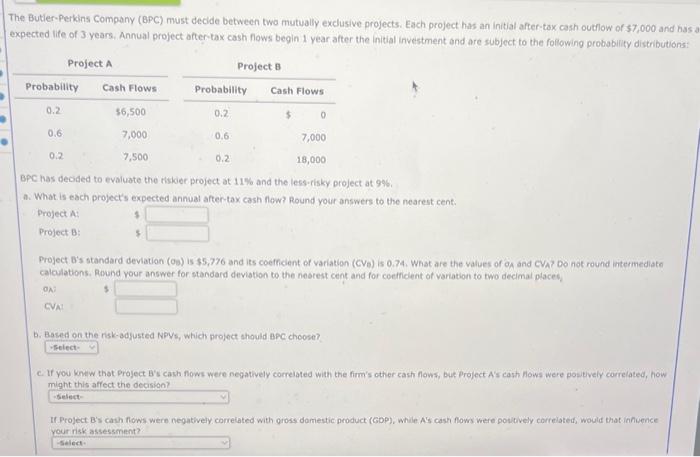

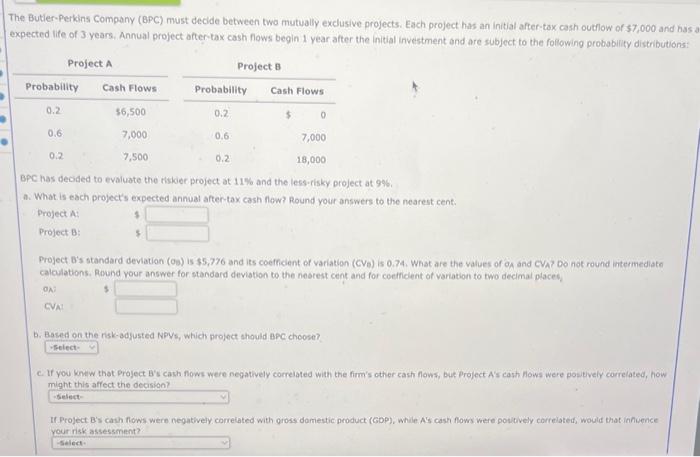

help The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an initial after-tax cash outflow of s7, ooo and has

help

The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an initial after-tax cash outflow of s7, ooo and has expected life of 3 years. Annual project aftertax cash flows begin 1 year after the initial investment and are subject to the foliowing probabirity distributions: BpC has decied to evaluate the tisiber project at 11% and the less-risky project at 996 . a. What is each project's expected annual aftertax cash flew? Round your answers to the nearest cent. Project At Project B; Project Bs standard deviation (OB) is $5,776 and its coefficlent of variation (CV) ) is 0.74 . What are the values of of and CVA? Do not round intermediate calculations. Rosnd vour answer for standard deviation to the nesrest cent and for coeficlent of variation to two decimal places. 0x CVM B. Based on the risk-adyusted Nevs, which project thould BAc choose? c. If you kntw that Project B's cash fows were negatively correlated with the firm's other cash flows, but Project A's cash Aows were postively correlated, how miaht this affect the decision? If Project B's cash flows were negatively correiated with gross domestic product (GDP), while A's cash flows Were poutively correlated, would that inhuence vourinsk assessment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started