help

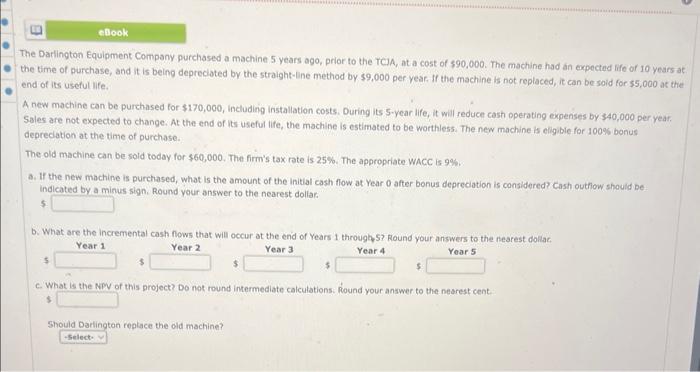

The Darlington Equipment Company purchased a machine 5 years ago, prior to the TC.A, at a cost of 590,000. The machine had an expected lifo of 10 years at. the time of purchase, and it is being deprecioted by the straight-line method by $9,000 per year, If the machine is not replaced, it can be soid for 35,000 at the end of its usetul life. A new machine can be purchased for $170,000, including installation costs. During its 5 -year life, it will reduce cast operating expenses by $40,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 1009 bonus depreciation at the time of purchase. The old machine can be sold today for $50,000. The firm's tax rate is 25%. The appropriate. WACC is 9%. a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outhiow shouid be indicated by a minus sign. Round your answer to the nearest dollar. b. What are the incremental cash fows that will occur at the end of Years 1 throughy? Round your answers to the flearest dollac Year 1 Year 2 Year 3 Year 4 Year 5 5 5 5 5 5 c. What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nesrest cent. 5 Should Darlington replace the old machine? The Darlington Equipment Company purchased a machine 5 years ago, prior to the TC.A, at a cost of 590,000. The machine had an expected lifo of 10 years at. the time of purchase, and it is being deprecioted by the straight-line method by $9,000 per year, If the machine is not replaced, it can be soid for 35,000 at the end of its usetul life. A new machine can be purchased for $170,000, including installation costs. During its 5 -year life, it will reduce cast operating expenses by $40,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 1009 bonus depreciation at the time of purchase. The old machine can be sold today for $50,000. The firm's tax rate is 25%. The appropriate. WACC is 9%. a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outhiow shouid be indicated by a minus sign. Round your answer to the nearest dollar. b. What are the incremental cash fows that will occur at the end of Years 1 throughy? Round your answers to the flearest dollac Year 1 Year 2 Year 3 Year 4 Year 5 5 5 5 5 5 c. What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nesrest cent. 5 Should Darlington replace the old machine