Answered step by step

Verified Expert Solution

Question

1 Approved Answer

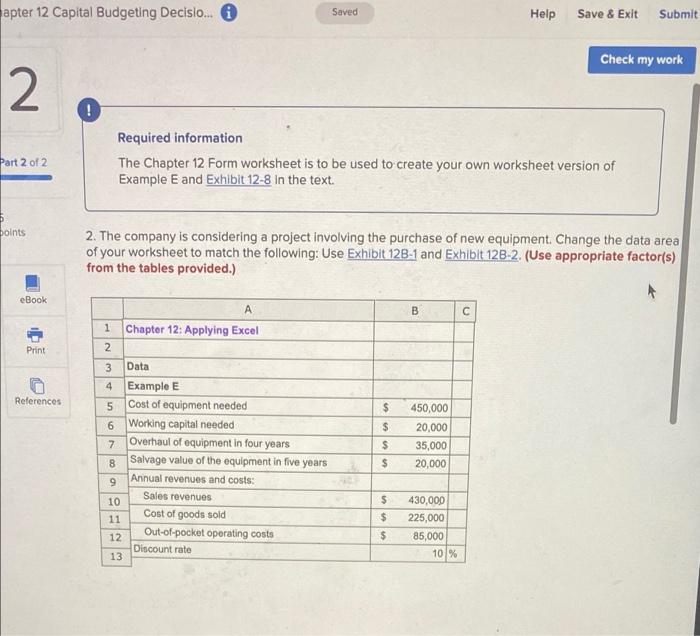

help w/ b and c pleaseee apter 12 Capital Budgeting Decisio... i Saved Help Save & Exit Submit Check my work 2 ! Part 2

help w/ b and c pleaseee

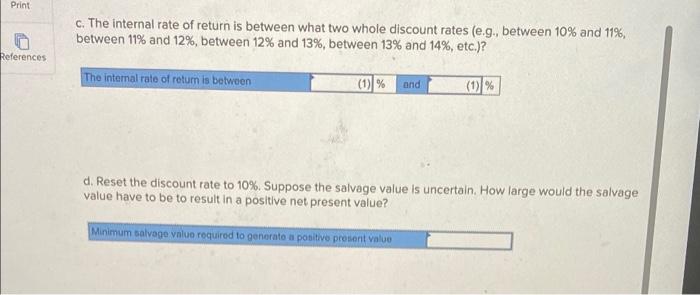

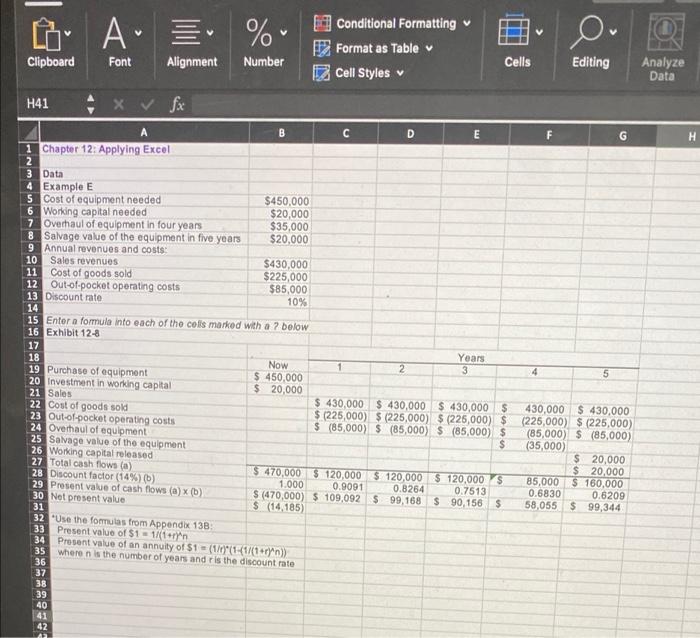

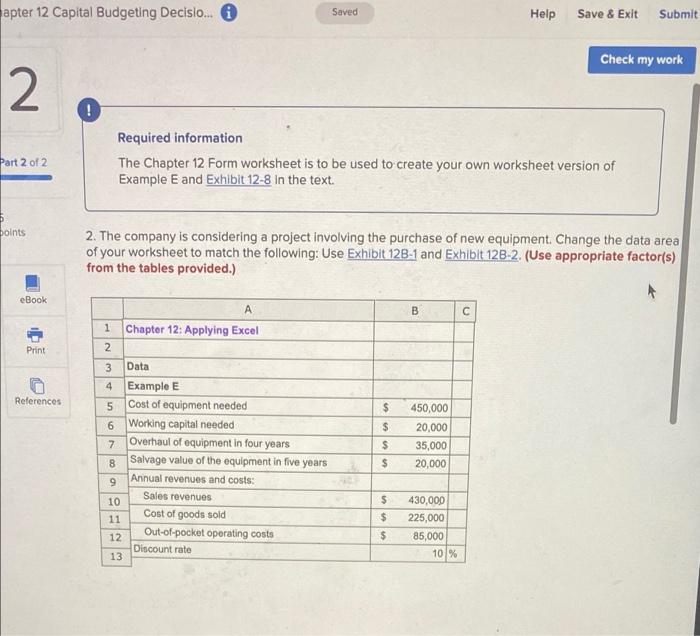

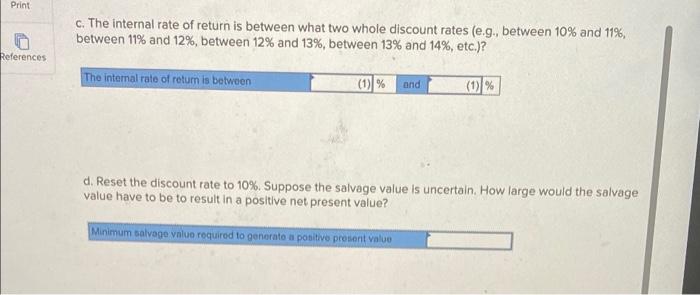

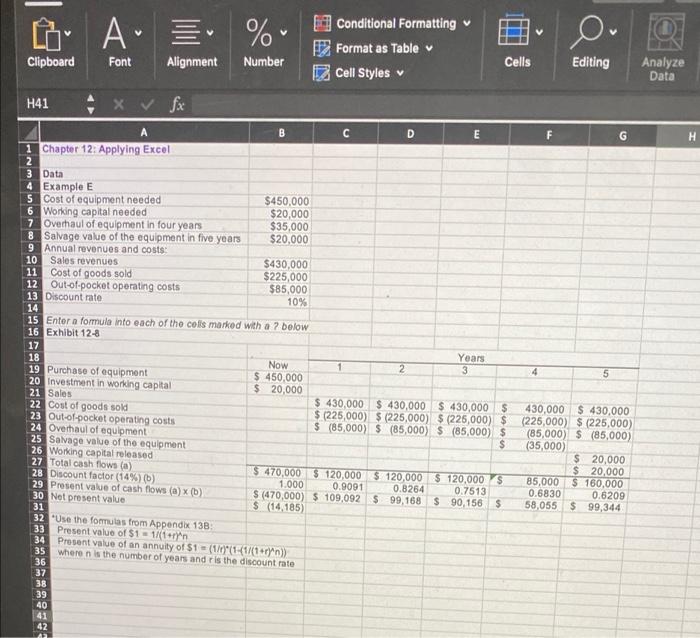

apter 12 Capital Budgeting Decisio... i Saved Help Save & Exit Submit Check my work 2 ! Part 2 of 2 Required information The Chapter 12 Form worksheet is to be used to create your own worksheet version of Example E and Exhibit 12-8 in the text. points 2. The company is considering a project involving the purchase of new equipment Change the data area of your worksheet to match the following: Use Exhibit 12B-1 and Exhibit 12B-2. (Use appropriate factor(s) from the tables provided.) eBook A B 2. Print References $ $ 1 Chapter 12: Applying Excel 2 3 Data 4 Example E 5 Cost of equipment needed 6 Working capital needed 7 Overhaul of equipment in four years 8 Salvage value of the equipment in five years Annual revenues and costs: Sales revenues 10 11 Cost of goods sold 12 Out-of-pocket operating costs Discount rate 13 450,000 20,000 35,000 20.000 $ $ 00 $ $ 430,000 225,000 85,000 10% $ Print c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? References The internal rate of retum is between (1) % and (1) % d. Reset the discount rate to 10%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? Minimum salvage value required to generato a positive prosent value V A. % Conditional Formatting Format as Table Cell Styles O Clipboard Font Alignment Number Cells Editing Analyze Data F G H 10% H41 x fx A B D E 1 Chapter 12: Applying Excel 2 3 Data 4 Example E 5 Cost of equipment needed $450,000 6 Working capital needed $20,000 7 Overhaul of equipment in four years $35,000 8 Salvage value of the equipment in five years $20,000 9 Annual revenues and costs: 10 Sales revenues $430,000 11 Cost of goods sold $225,000 12 Out-of-pocket operating costs $85,000 13 Discount rate 14 15 Enter a formula into each of the cells marked with a 7 below 16 Exhibit 12-8 17 Years 18 Now 2 19 Purchase of equipment 3 $ 450,000 20 Investment in working capital $ 20,000 21 Sales 22 Cost of goods sold $ 430,000 $430,000 $430,000 $ 23 Out-of-pocket operating costs $ (225,000) S (225,000) $ (225,000) $ 24 Overhaul of equipment $ 85,000) $ (85,000) $ (85,000) $ 25 Savage value of the equipment $ 26 Working capital released 27 Total cash flows (a) 28 Discount factor (14%) (b) $ 470,000 $ 120,000 $ 120,000 $120.000 29 Present value of cash flows (a) (b) 1.000 0.9091 0.8264 0.7513 30 Not present value S (470,000) $ 109,092 $ 99,168 $ 90,156 $ 31 $ (14, 185) 32 Use the formulas from Appendix 13B 33 Present value of $1 = 1/(tern 34 Present value of an annuity of $1 = (1/4-1/(t+ryn)) 35 where is the number of years and ris the discount rate 36 37 38 39 40 41 42 4 5 430,000 $430,000 (225,000) $ (225,000) (85,000) $ (85,000) (35,000) $ 20,000 $ 20,000 85,000 $ 160,000 0.6830 0.6209 58,055 $ 99,344

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started