Help with #12?

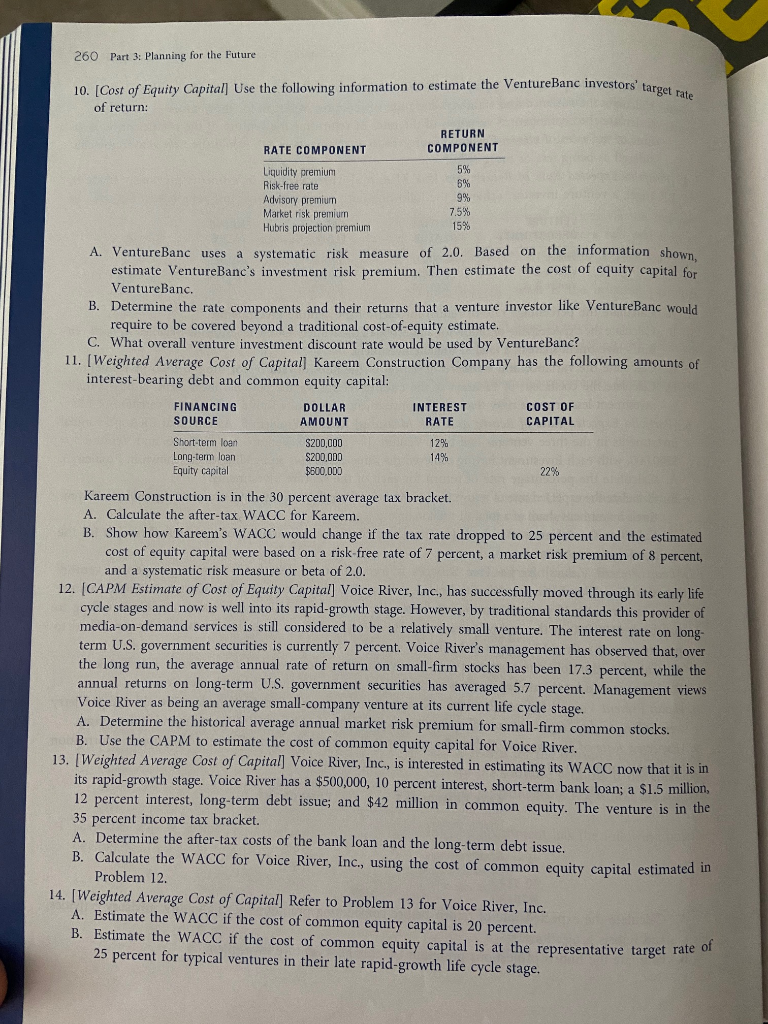

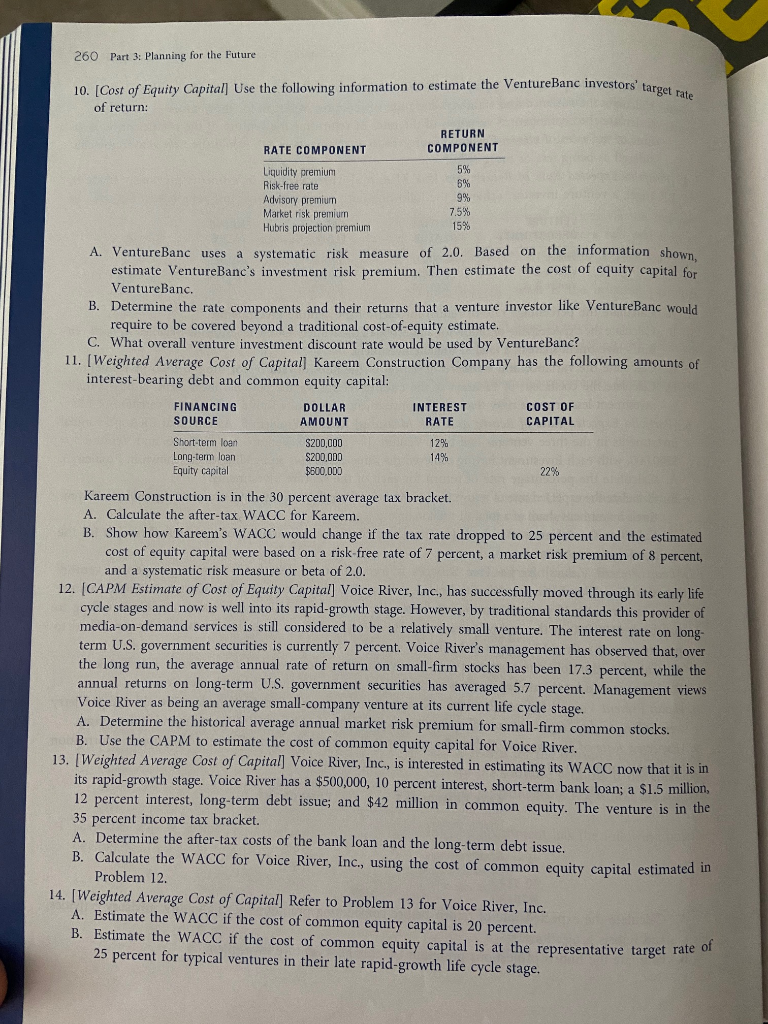

260 Part 3: Planning for the Future investors' target rate 10. (Cost of Equity Capital) Use the following information to estimate the VentureBanc investors'tar of return: RETURN COMPONENT RATE COMPONENT 5% Liquidity premium Risk-free rate Advisory premium Market risk premium Hubris projection premium 6% 99 7.5% 15% A. VentureBanc uses a systematic risk measure of 2.0. Based on the information shown estimate VentureBanc's investment risk premium. Then estimate the cost of equity capital for VentureBanc. B. Determine the rate components and their returns that a venture investor like VentureBanc would require to be covered beyond a traditional cost-of-equity estimate. C. What overall venture investment discount rate would be used by VentureBanc? 11. [Weighted Average Cost of Capital] Kareem Construction Company has the following amounts of interest-bearing debt and common equity capital: FINANCING DOLLAR INTEREST COST OF SOURCE AMOUNT RATE CAPITAL Short-term loan S200,000 12% Long-term loan S200,00D 14% Equity capital $600,000 22% Kareem Construction is in the 30 percent average tax bracket. A. Calculate the after-tax WACC for Kareem. B. Show how Kareem's WACC would change if the tax rate dropped to 25 percent and the estimated cost of equity capital were based on a risk-free rate of 7 percent, a market risk premium of 8 percent, and a systematic risk measure or beta of 2.0. 12. (CAPM Estimate of Cost of Equity Capital] Voice River, Inc., has successfully moved through its early life cycle stages and now is well into its rapid-growth stage. However, by traditional standards this provider of media-on-demand services is still considered to be a relatively small venture. The interest rate on long- term U.S. government securities is currently 7 percent. Voice River's management has observed that, over the long run, the average annual rate of return on small-firm stocks has been 17.3 percent, while the annual returns on long-term U.S. government securities has averaged 5.7 percent. Management views Voice River as being an average small-company venture at its current life cycle stage. A. Determine the historical average annual market risk premium for small-firm common stocks. B. Use the CAPM to estimate the cost of common equity capital for Voice River. 13. [Weighted Average Cost of Capital] Voice River, Inc., is interested in estimating its WACC now that it is in its rapid-growth stage. Voice River has a $500,000, 10 percent interest, short-term bank loan; a $1.5 million, 12 percent interest, long-term debt issue; and $42 million in common equity. The venture is in the 35 percent income tax bracket. A. Determine the after-tax costs of the bank loan and the long-term debt issue. B. Calculate the WACC for Voice River, Inc., using the cost of common equity capital estimated in Problem 12. 14. [Weighted Average Cost of Capital] Refer to Problem 13 for Voice River, Inc. A. Estimate the WACC if the cost of common equity capital is 20 percent. B. Estimate the WACC if the cost of common equity capital is at the representative target rate or 25 percent for typical ventures in their late rapid-growth life cycle stage