Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with 1-3, and bottom excel page preparation 1. Make adjusting entries in the journal (rounding to the nearest dollar) using the information below: A

help with 1-3, and bottom excel page preparation

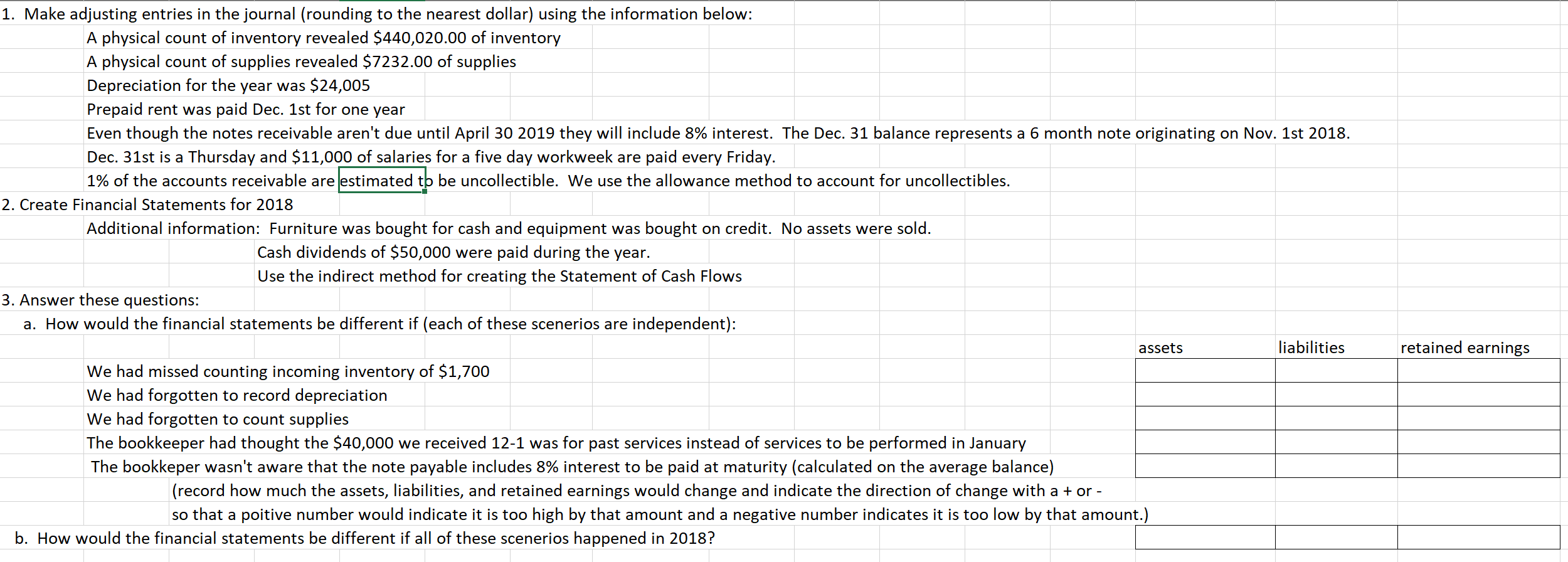

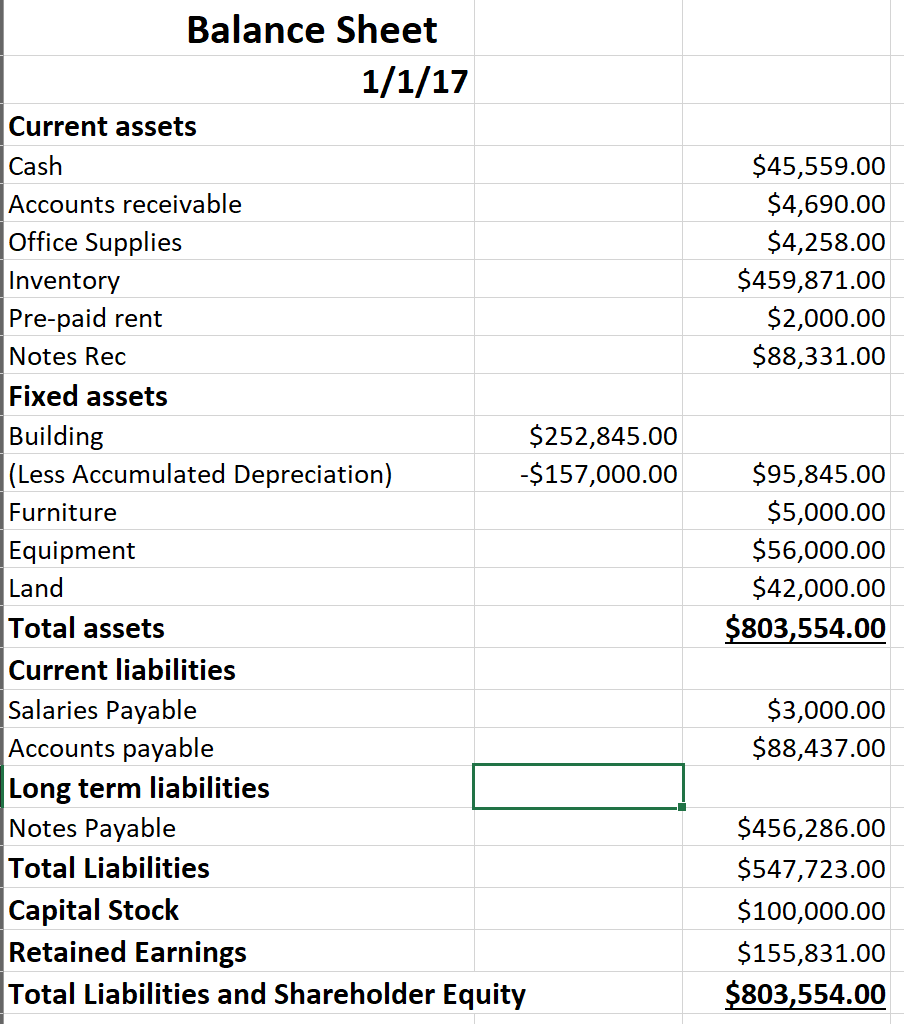

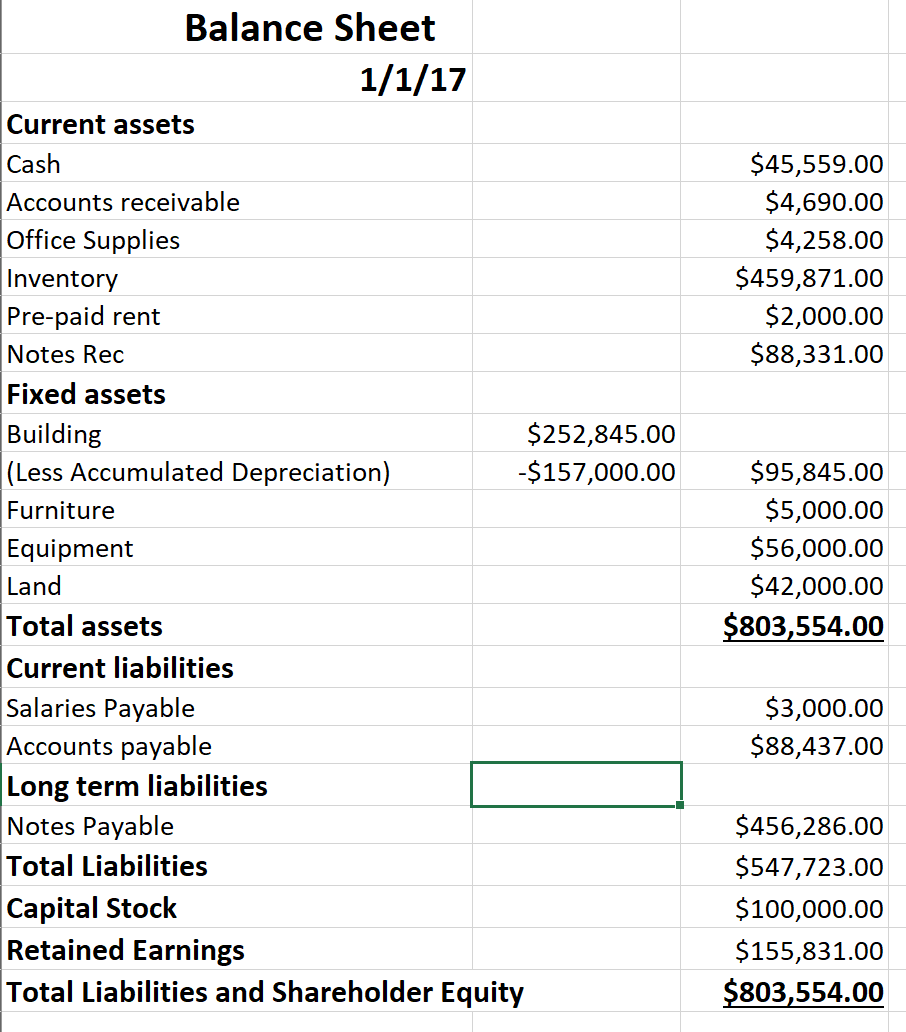

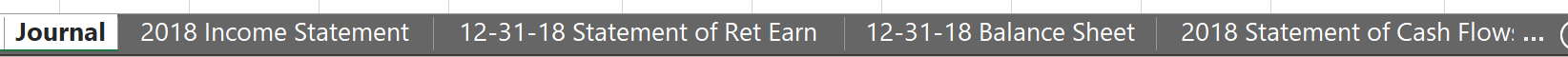

1. Make adjusting entries in the journal (rounding to the nearest dollar) using the information below: A physical count of inventory revealed $440,020.00 of inventory A physical count of supplies revealed $7232.00 of supplies Depreciation for the year was $24,005 Prepaid rent was paid Dec. 1st for one year Even though the notes receivable aren't due until April 30 2019 they will include 8% interest. The Dec. 31 balance represents a 6 month note originating on Nov. 1st 2018. Dec. 31st is a Thursday and $11,000 of salaries for a five day workweek are paid every Friday. 1% of the accounts receivable are estimated tb be uncollectible. We use the allowance method to account for uncollectibles. 2. Create Financial Statements for 2018 Additional information: Furniture was bought for cash and equipment was bought on credit. No assets were sold. Cash dividends of $50,000 were paid during the year. Use the indirect method for creating the Statement of Cash Flows 3. Answer these questions: a. How would the financial statements be different if (each of these scenerios are independent): assets liabilities We had missed counting incoming inventory of $1,700 We had forgotten to record depreciation We had forgotten to count supplies The bookkeeper had thought the $40,000 we received 12-1 was for past services instead of services to be performed in January The bookkeper wasn't aware that the note payable includes 8% interest to be paid at maturity (calculated on the average balance) (record how much the assets, liabilities, and retained earnings would change and indicate the direction of change with a + or - so that a poitive number would indicate it is too high by that amount and a negative number indicates it is too low by that amount.) b. How would the financial statements be different if all of these scenerios happened in 2018? retained earnings $45,559.00 $4,690.00 $4,258.00 $459,871.00 $2,000.00 $88,331.00 Balance Sheet 1/1/17 Current assets Cash Accounts receivable Office Supplies Inventory Pre-paid rent Notes Rec Fixed assets Building $252,845.00 (Less Accumulated Depreciation) -$157,000.00 Furniture Equipment Land Total assets Current liabilities Salaries Payable Accounts payable Long term liabilities Notes Payable Total Liabilities Capital Stock Retained Earnings Total Liabilities and Shareholder Equity $95,845.00 $5,000.00 $56,000.00 $42,000.00 $803,554.00 $3,000.00 $88,437.00 $456,286.00 $547,723.00 $100,000.00 $155,831.00 $803,554.00 $45,559.00 $4,690.00 $4,258.00 $459,871.00 $2,000.00 $88,331.00 Balance Sheet 1/1/17 Current assets Cash Accounts receivable Office Supplies Inventory Pre-paid rent Notes Rec Fixed assets Building $252,845.00 (Less Accumulated Depreciation) $157,000.00 Furniture Equipment Land Total assets Current liabilities Salaries Payable Accounts payable Long term liabilities Notes Payable Total Liabilities Capital Stock Retained Earnings Total Liabilities and Shareholder Equity $95,845.00 $5,000.00 $56,000.00 $42,000.00 $803,554.00 $3,000.00 $88,437.00 $456,286.00 $547,723.00 $100,000.00 $155,831.00 $803,554.00 Journal 2018 Income Statement 12-31-18 Statement of Ret Earn 12-31-18 Balance Sheet 2018 Statement of Cash Flow: ... 1. Make adjusting entries in the journal (rounding to the nearest dollar) using the information below: A physical count of inventory revealed $440,020.00 of inventory A physical count of supplies revealed $7232.00 of supplies Depreciation for the year was $24,005 Prepaid rent was paid Dec. 1st for one year Even though the notes receivable aren't due until April 30 2019 they will include 8% interest. The Dec. 31 balance represents a 6 month note originating on Nov. 1st 2018. Dec. 31st is a Thursday and $11,000 of salaries for a five day workweek are paid every Friday. 1% of the accounts receivable are estimated tb be uncollectible. We use the allowance method to account for uncollectibles. 2. Create Financial Statements for 2018 Additional information: Furniture was bought for cash and equipment was bought on credit. No assets were sold. Cash dividends of $50,000 were paid during the year. Use the indirect method for creating the Statement of Cash Flows 3. Answer these questions: a. How would the financial statements be different if (each of these scenerios are independent): assets liabilities We had missed counting incoming inventory of $1,700 We had forgotten to record depreciation We had forgotten to count supplies The bookkeeper had thought the $40,000 we received 12-1 was for past services instead of services to be performed in January The bookkeper wasn't aware that the note payable includes 8% interest to be paid at maturity (calculated on the average balance) (record how much the assets, liabilities, and retained earnings would change and indicate the direction of change with a + or - so that a poitive number would indicate it is too high by that amount and a negative number indicates it is too low by that amount.) b. How would the financial statements be different if all of these scenerios happened in 2018? retained earnings $45,559.00 $4,690.00 $4,258.00 $459,871.00 $2,000.00 $88,331.00 Balance Sheet 1/1/17 Current assets Cash Accounts receivable Office Supplies Inventory Pre-paid rent Notes Rec Fixed assets Building $252,845.00 (Less Accumulated Depreciation) -$157,000.00 Furniture Equipment Land Total assets Current liabilities Salaries Payable Accounts payable Long term liabilities Notes Payable Total Liabilities Capital Stock Retained Earnings Total Liabilities and Shareholder Equity $95,845.00 $5,000.00 $56,000.00 $42,000.00 $803,554.00 $3,000.00 $88,437.00 $456,286.00 $547,723.00 $100,000.00 $155,831.00 $803,554.00 $45,559.00 $4,690.00 $4,258.00 $459,871.00 $2,000.00 $88,331.00 Balance Sheet 1/1/17 Current assets Cash Accounts receivable Office Supplies Inventory Pre-paid rent Notes Rec Fixed assets Building $252,845.00 (Less Accumulated Depreciation) $157,000.00 Furniture Equipment Land Total assets Current liabilities Salaries Payable Accounts payable Long term liabilities Notes Payable Total Liabilities Capital Stock Retained Earnings Total Liabilities and Shareholder Equity $95,845.00 $5,000.00 $56,000.00 $42,000.00 $803,554.00 $3,000.00 $88,437.00 $456,286.00 $547,723.00 $100,000.00 $155,831.00 $803,554.00 Journal 2018 Income Statement 12-31-18 Statement of Ret Earn 12-31-18 Balance Sheet 2018 Statement of Cash FlowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started