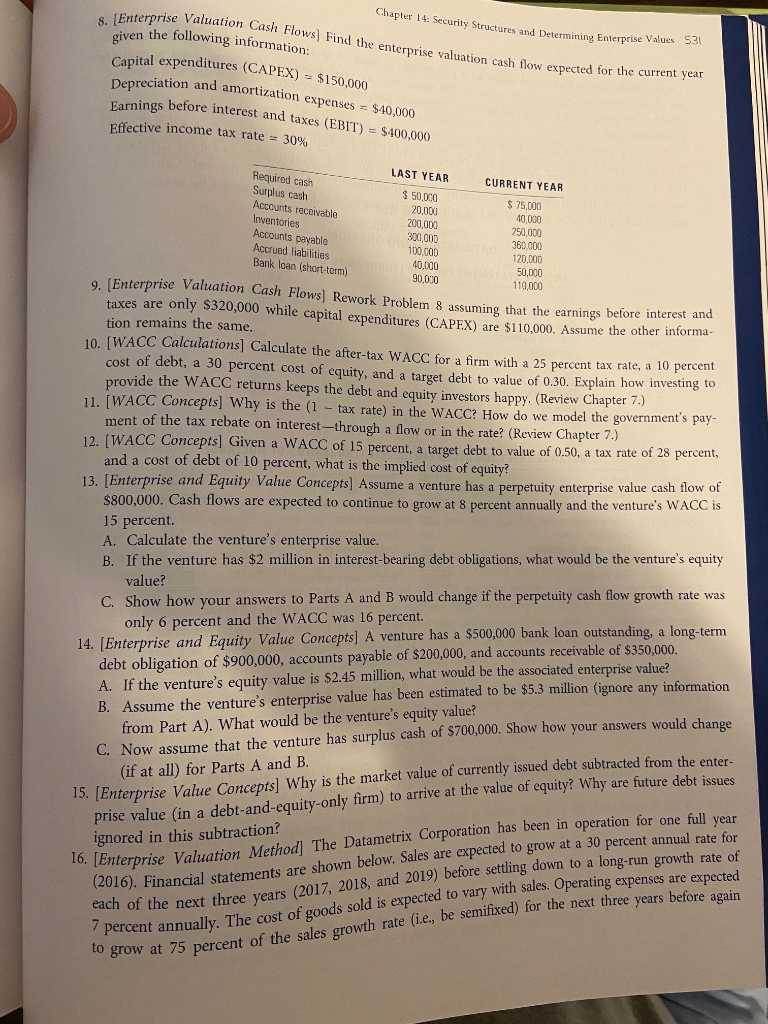

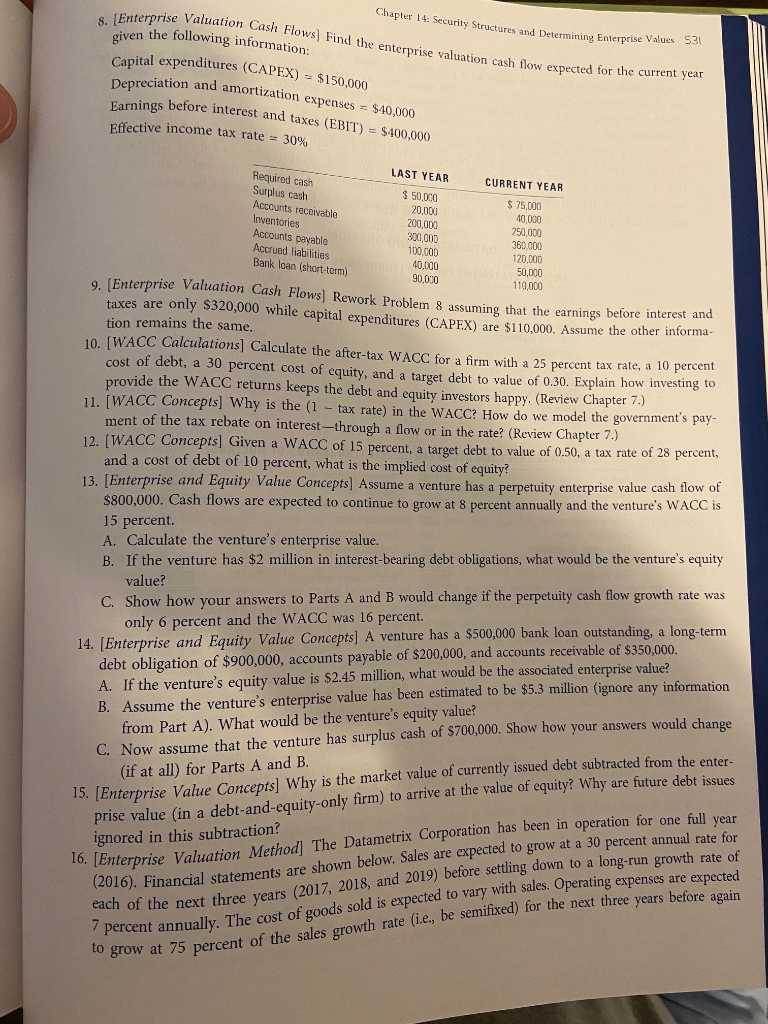

Help with #13?

Chapter 14: Security Structures and Determinine Enterprise Values 33 Required cash Surplus cash Accounts receivable Inventories Accounts payable Accrued liabilities Bank loan (short-term) prise Valuation Cash Flows) Find the enterprise valuation cash flow expected for the 8. (Enterprise Valuation given the following information: Capital expenditures (CAPEX) = $150 Depreciation and amortization expenses arnings before interest and taxes (EBIT) = $400,000 Effective income tax rate = 30% LAST YEAR CURRENT YEAR $ 50.000 $ 75,000 20,000 40.000 200,000 250,000 300,000 360,000 100,000 120.000 40,000 50,000 90,000 110,000 Enterprise Valuation Cash Flows Rework Problem 8 assuming that the earnings before me taxes are only $320,000 while capital e while capital expenditures (CAPEX) are $110,000. Assume the other informa- tion remains the same. WACC Calculations Calculate the after-tax WACC for a firm with a 25 percent tax rate, a 10 percen cost of debt, a 30 percent cost of equity, and a target debt to value of 0.30. Explain how investing to srovide the WACC returns keeps the debt and equity investors happy. (Review Chapter 7.) 11. WACC Concepts] Why is the (1 - tax rate) in the WACC? How do we model the governments pays ment of the tax rebate on interest--through a flow or in the rate? (Review Chapter 7.) 12. IWACC Concepts] Given a WACC of 15 percent, a target debt to value of 0.50, a tax rate of 28 percent, and a cost of debt of 10 percent, what is the implied cost of equity? 13 Enterprise and Equity Value Concepts) Assume a venture has a perpetuity enterprise value cash flow of $800,000. Cash flows are expected to continue to grow at 8 percent annually and the venture's WACC is 15 percent. A. Calculate the venture's enterprise value. B. If the venture has $2 million in interest-bearing debt obligations, what would be the venture's equity value? C. Show how your answers to Parts A and B would change if the perpetuity cash flow growth rate was only 6 percent and the WACC was 16 percent. 14. [Enterprise and Equity Value Concepts] A venture has a $500,000 bank loan outstanding, a long-term debt obligation of $900,000, accounts payable of $200,000, and accounts receivable of $350,000. A. If the venture's equity value is $2.45 million, what would be the associated enterprise value? B. Assume the venture's enterprise value has been estimated to be $5.3 million (ignore any information a change from Part A). What would be the venture's equity value? C. Now assume that the venture has surplus cash of $700,000. Show how your answers would change (if at all) for Parts A and B. 15. (Enterprise Value Concepts) Why is the market value of currently issued debt subtracted from the er prise value in a debt-and-equity-only firm) to arrive at the value of equity? Why are future debt issu ignored in this subtraction? 10. [Enterprise Valuation Method] The Datametrix Corporation has been in operation for one full vear (2016). Financial statements are shown be e are shown below. Sales are expected to grow at a 30 percent annual rate for each of the next three years (2017, 7 2018. and 2019) before settling down to a long-run growth rate of Id is expected to vary with sales. Operating expenses are expected 7 percent annually. The cost of goods sold is e ) for the next three years before again grow at 75 percent of the sales growth rate (l.e., De sene