Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with #4 1) You have been asked to prepare a proforma capitalization table for your company. You ano your co-founder had each put a

help with #4

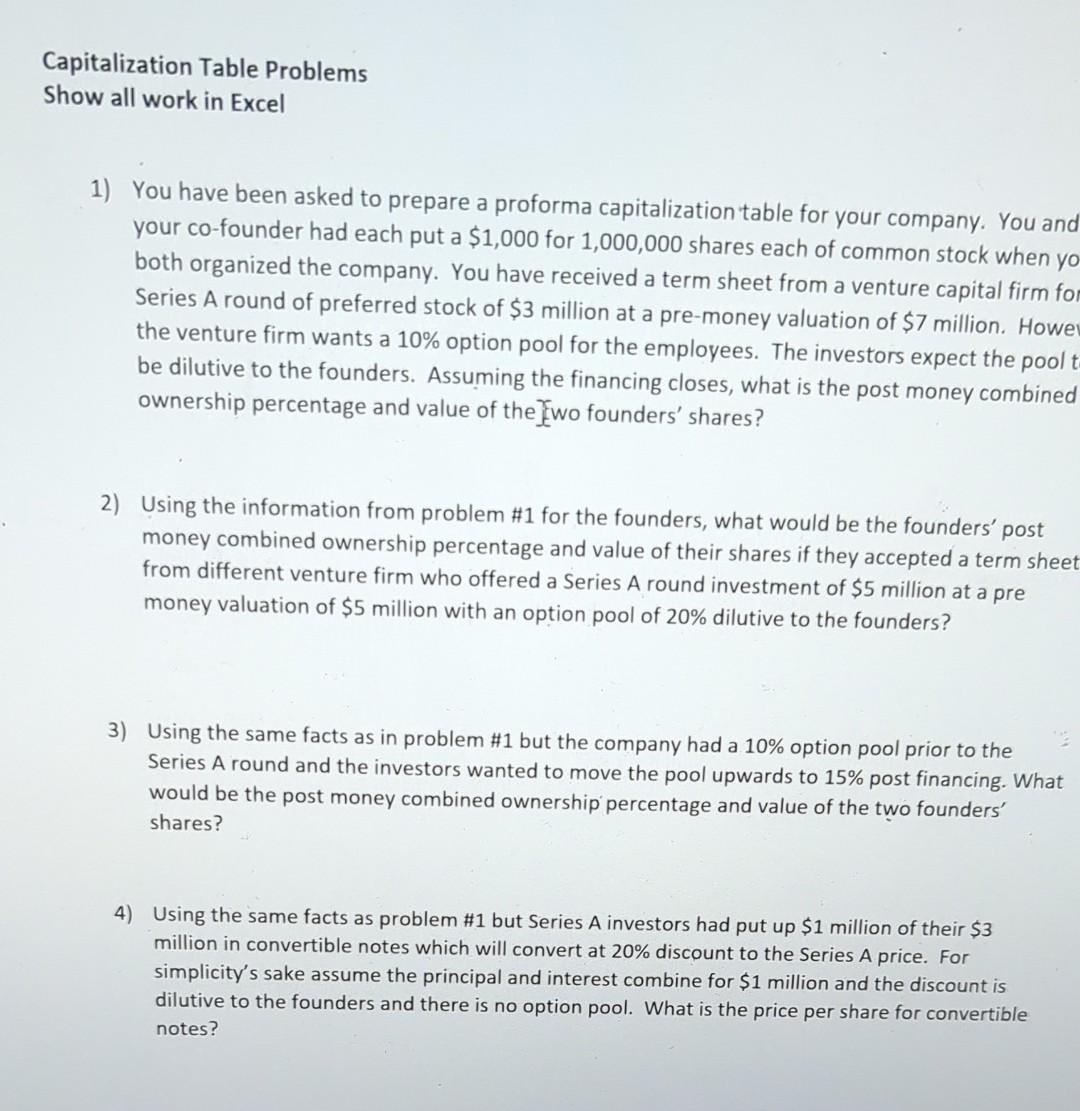

1) You have been asked to prepare a proforma capitalization table for your company. You ano your co-founder had each put a $1,000 for 1,000,000 shares each of common stock when yc both organized the company. You have received a term sheet from a venture capital firm fo Series A round of preferred stock of $3 million at a pre-money valuation of $7 million. Howe the venture firm wants a 10% option pool for the employees. The investors expect the pool be dilutive to the founders. Assuming the financing closes, what is the post money combined ownership percentage and value of the Ewo founders' shares? 2) Using the information from problem \#1 for the founders, what would be the founders' post money combined ownership percentage and value of their shares if they accepted a term shee from different venture firm who offered a Series A round investment of $5 million at a pre money valuation of $5 million with an option pool of 20% dilutive to the founders? 3) Using the same facts as in problem \#1 but the company had a 10% option pool prior to the Series A round and the investors wanted to move the pool upwards to 15% post financing. What would be the post money combined ownership percentage and value of the two founders' shares? 4) Using the same facts as problem \#1 but Series A investors had put up $1 million of their $3 million in convertible notes which will convert at 20% discount to the Series A price. For simplicity's sake assume the principal and interest combine for $1 million and the discount is dilutive to the founders and there is no option pool. What is the price per share for convertible notesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started