Help with 7?

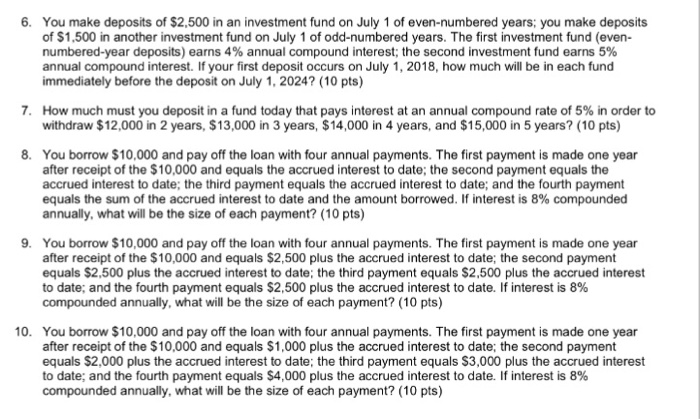

You make deposits of $2,500 in an investment fund on July 1 of even-numbered years: you make deposits of $1,500 in another investment fund on July 1 of odd-numbered years. The first investment fund (even- numbered-year deposits) earns 4% annual compound interest: the second investment fund earns 5% annual compound interest. If your first deposit occurs on July 1, 2018, how much will be in each fund immediately before the deposit on July 1, 2024? How much must you deposit in a fund today that pays interest at an annual compound rate of 5% in order to withdraw $12,000 in 2 years, $13,000 in 3 years, $14,000 in 4 years, and $15,000 in 5 years? You borrow $10,000 and pay off the loan with four annual payments. The first payment is made one year after receipt of the $10,000 and equals the accrued interest to date: the second payment equals the accrued interest to date: the third payment equals the accrued interest to date: and the fourth payment equals the sum of the accrued interest to date and the amount borrowed. If interest is 8% compounded annually, what will be the size of each payment? You borrow $10,000 and pay off the loan with four annual payments. The first payment is made one year after receipt of the $10,000 and equals $2,500 plus the accrued interest to date: the second payment equals $2,500 plus the accrued interest to date: the third payment equals $2,500 plus the accrued interest to date: and the fourth payment equals $2,500 plus the accrued interest to date. If interest is 8% compounded annually, what will be the size of each payment? You borrow $10,000 and pay off the loan with four annual payments. The first payment is made one year after receipt of the $10,000 and equals $1,000 plus the accrued interest to date: the second payment equals $2,000 plus the accrued interest to date: the third payment equals $3,000 plus the accrued interest to date, and the fourth payment equals $4,000 plus the accrued interest to date. If interest is 8% compounded annually, what will be the size of each payment

Help with 7?

Help with 7?