Help with A, B, C, D1, and D2.

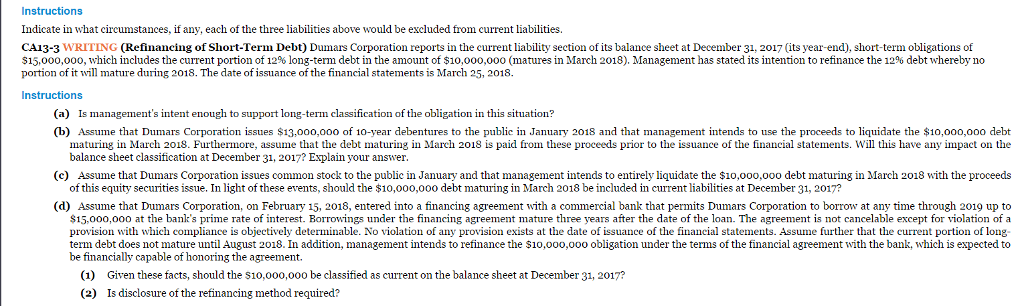

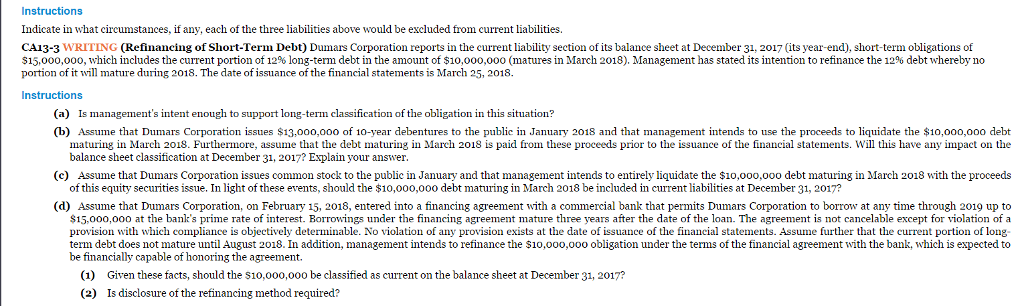

Indicate in what circumstances. if any. each of the three liabilities above would be excluded from current liabilities. Dumars Corporation reports in the current liability section of its balance sheet at December 31.2017 (its year-end). short-term obligations of $15,000,000. which includes the current portion of 12% long-term debt in the amount of $10,000,000 (matures in March 2018). Management has stated its intention to refinance the 12% debt whereby no portion of it will mature during 2018. The date of issuance of the financial statements is March 25, 2018. Is management's intent enough to support long-term classification of the obligation in this situation? Assume that Dumars Corporation issues $13,000.000 of l0-year debentures to the public in January 2018 and that management intends to use the proceeds to liquidate the $10,000,000 debt maturing in March 2018. Furthermore, assume that the debt maturing in March 2018 is paid from these proceeds prior to the issuance of the financial statements. Will this have any impact on the balance sheet classification at December 31.2017? Explain your answer. Assume that Dumars Corporation issues common stock to the public in January and that management intends to entirely liquidate the $10,000,000 debt maturing in March 2018 with the proceeds of this equity securities issue. In light of these events. should the $10,000,000 debt maturing in March 2018 be included in current liabilities at December 31, 2017? Assume that Dumars Corporation, on February 15, 2018. entered into a financing agreement with a commercial bank that permits Dumars Corporation to borrow at any time through 2019 up to $13,000,000 at the bank's prime rate of interest. Borrowings under the financing agreement mature three years after the date of the loan. The agreement is not cancelable except for violation of a provision with which compliance is objectively determinable. No violation of any provision exists at the date of issuance of the financial statements. Assume further that the current portion of long term debt does not mature until August 2018. In addition, management intends to refinance the $100,000,000 obligation under the terms of the financial agreement with the bank, which is expected to be financially capable of honoring the agreement. Given these facts, should the $100,000,000 be classified as current on the balance sheet at December 31, 2017? Is disclosure of the refinancing method required