Help with any of the questions would be welcomed

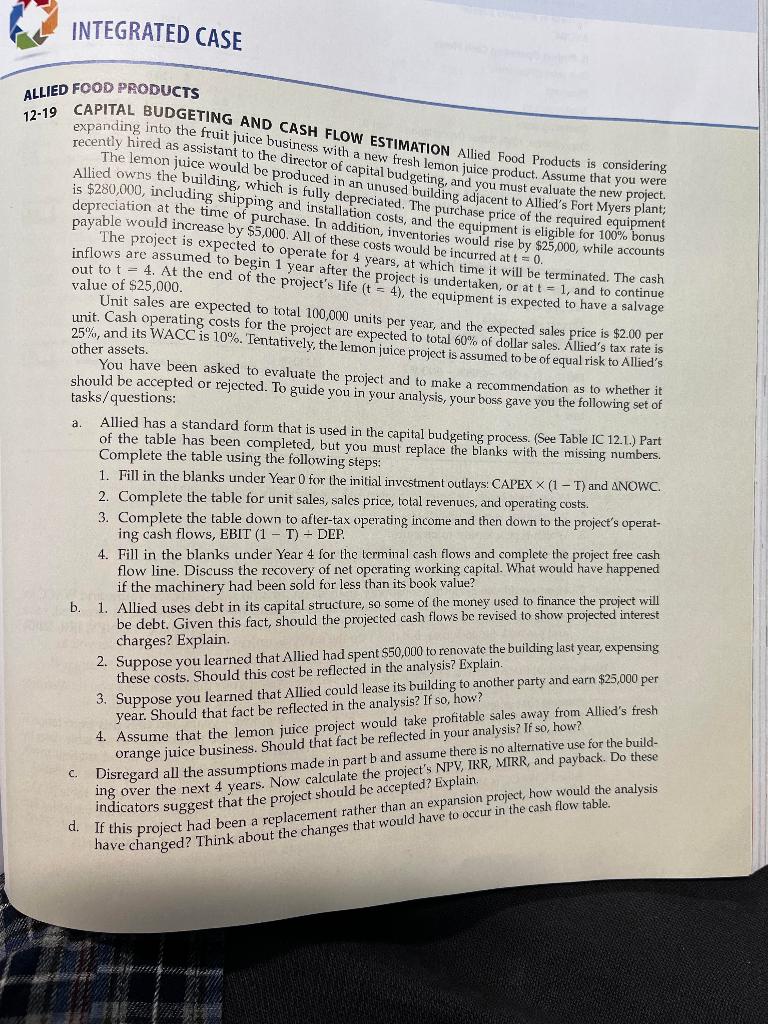

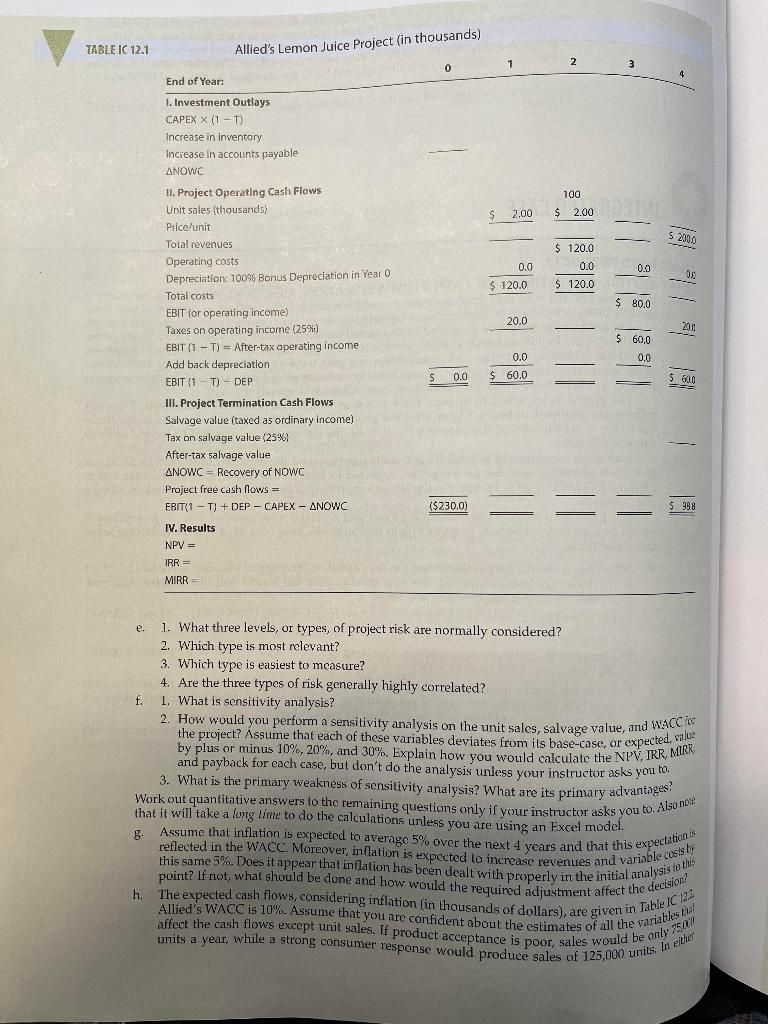

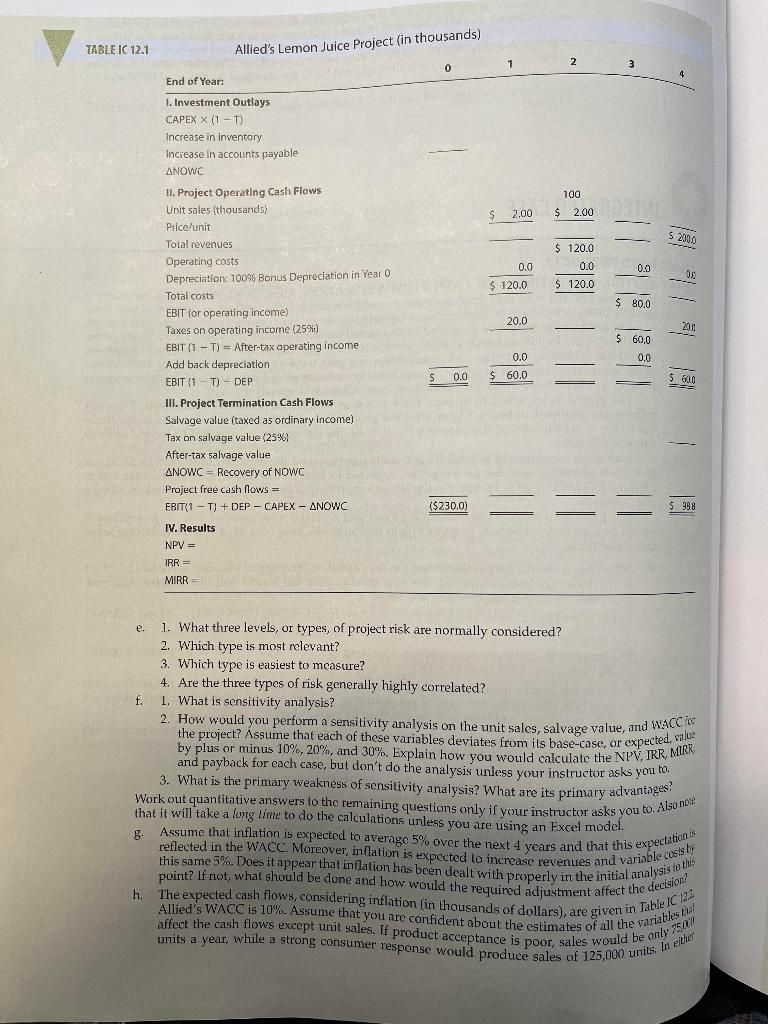

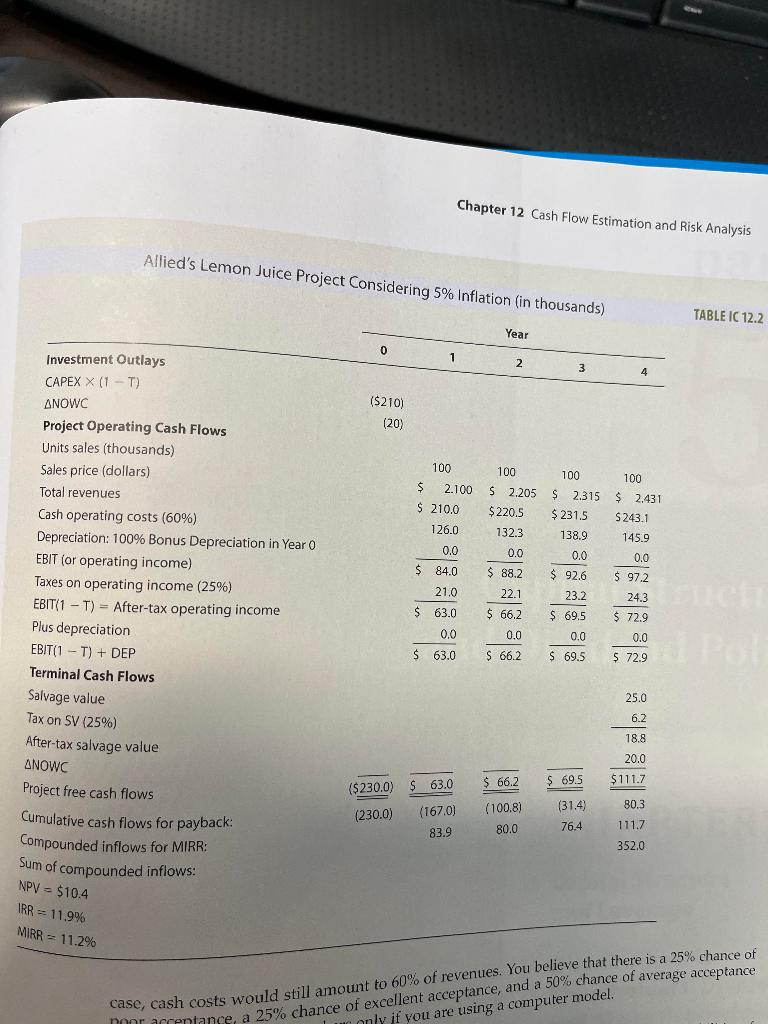

expanding into the fruit juicD CASH FLOW ESTIMATION Allied Food Products is considering recently hired as assistant to the director of capital budgeting, and you product. Assume that you were Allied owns the building, which is fully in an unused building adjacent to Allied's Fort Myers plant; is $280,000, including shipping and installation costs, The purchase price of the required equipment payable would increase by $5,000. All In addition, inventories equipment is eligible for 100% bonus The project is expected to All of these costs would be inould rise by $25,000, while accounts inflows are assumed to begin 1 perate for 4 years, at which incurred at t=0. out to t=4. At the end of the 1 year after the project is underime it will be terminated. The cash value of $25,000. fe (t=4), the equipment is expected to have a salvage unit. Cash operating costs for the projet anits per year, and the expected sales price is $2.00 per 25%, and its WACC is 10%. Tentatively, the are expected to total 60% of dollar sales. Allied's tax rate is other assets. You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. To guide you in your analysis, your boss gave you the following set of tasks/questions: a. Allied has a standard form that is used in the capital budgeting process. (See Table IC 12.1.) Part of the table has been completed, but you must replace the blanks with the missing numbers. Complete the table using the following steps: 1. Fill in the blanks under Year 0 for the initial investment outlays: CAPEX (1T) and NOWC. 2. Complete the table for unit sales, sales price, total revenues, and operating costs. 3. Complete the table down to after-tax operating income and then down to the project's operating cash flows, EBIT (1T) - DEP. 4. Fill in the blanks under Year 4 for the terminal cash flows and complete the project free cash flow line. Discuss the recovery of net operating working capital. What would have happened if the machinery had been sold for less than its book value? b. 1. Allied uses debt in its capital structure, so some of the money used to finance the project will be debt. Given this fact, should the projected cash flows be revised to show projected interest charges? Explain. 2. Suppose you learned that Allied had spent $50,000 to renovate the building last year, expensing these costs. Should this cost be reflected in the analysis? Explain. 3. Suppose you learned that Allied could lease its building to another party and earn $25,000 per year. Should that fact be reflected in the analysis? If so, how? 4. Assume that the lemon juice project would take profitable sales away from Allicd's fresh orange juice business. Should that fact be reflected in your analysis? If so, how? c. Disregard all the assumptions made in part b and assume there is no alternative use for the building over the next 4 years. Now calculate the project's NPV, IRR, MIRR, and payback. Do these indicators suggest that the project should be accepted? Explain. d. If this project had been a replacement rather than an expansion project, how would the analysis have changed? Think about the changes that would have to occur in the cash flow table. IC 12.1 allind'c Lamnn luice Project (in thousands) e. 1. What three levels, or types, of project risk are normally considered? 2. Which type is most relevant? 3. Which type is easiest to measure? 4. Are the three types of risk generally highly correlated? f. 1. What is sensitivity analysis? 2. How would you perform a sensitivity analysis on the unit sales, salvage value, and waCC it the project? Assume that each of these variables deviates from its base-case, or expected, sallo? by plus or minus 10%,20%, and 30%. Explain how you would calculate the NPV, IRR, MTRR. and payback for each case, but don't do the analysis urless your instructor asks you to. 3. What is the primary weakness of sensitivity analysis? What are its primary advantages? Work out quantitative answers to the remaining questions only ir your instructor asks you to. Also noe that it will take a long lime to do the calculations unless you are using an Excel model. g. Assume that inflation is expected to average 5% over the next 4 years and that this expectatien is reflected in the WACC. Moreover, inflation is expected to increase revenues and variable cosis bi h. The expected cash flows, considering inflation (in thousands of dollars), are given in Tabie 12 Allied's WACC is 10%. Assume that you are confident about the estimates of all the variatbes affect the cash flows except unit sales. If product acceptance is poor, sales would be only units a year, while a strong consumer response would produce sales of 125,00n units. !n e the Chapter 12 Cash Flow Estimation and Risk Analysis Allied's Lemon Juice Project Considering 5% Inflatinn LE IC 12.2 (o 60% of revenues. You believe that there is a 25% chance of cash costs would still amount to 60% excellent acceptance, and a 50% chance of average acceptance expanding into the fruit juicD CASH FLOW ESTIMATION Allied Food Products is considering recently hired as assistant to the director of capital budgeting, and you product. Assume that you were Allied owns the building, which is fully in an unused building adjacent to Allied's Fort Myers plant; is $280,000, including shipping and installation costs, The purchase price of the required equipment payable would increase by $5,000. All In addition, inventories equipment is eligible for 100% bonus The project is expected to All of these costs would be inould rise by $25,000, while accounts inflows are assumed to begin 1 perate for 4 years, at which incurred at t=0. out to t=4. At the end of the 1 year after the project is underime it will be terminated. The cash value of $25,000. fe (t=4), the equipment is expected to have a salvage unit. Cash operating costs for the projet anits per year, and the expected sales price is $2.00 per 25%, and its WACC is 10%. Tentatively, the are expected to total 60% of dollar sales. Allied's tax rate is other assets. You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. To guide you in your analysis, your boss gave you the following set of tasks/questions: a. Allied has a standard form that is used in the capital budgeting process. (See Table IC 12.1.) Part of the table has been completed, but you must replace the blanks with the missing numbers. Complete the table using the following steps: 1. Fill in the blanks under Year 0 for the initial investment outlays: CAPEX (1T) and NOWC. 2. Complete the table for unit sales, sales price, total revenues, and operating costs. 3. Complete the table down to after-tax operating income and then down to the project's operating cash flows, EBIT (1T) - DEP. 4. Fill in the blanks under Year 4 for the terminal cash flows and complete the project free cash flow line. Discuss the recovery of net operating working capital. What would have happened if the machinery had been sold for less than its book value? b. 1. Allied uses debt in its capital structure, so some of the money used to finance the project will be debt. Given this fact, should the projected cash flows be revised to show projected interest charges? Explain. 2. Suppose you learned that Allied had spent $50,000 to renovate the building last year, expensing these costs. Should this cost be reflected in the analysis? Explain. 3. Suppose you learned that Allied could lease its building to another party and earn $25,000 per year. Should that fact be reflected in the analysis? If so, how? 4. Assume that the lemon juice project would take profitable sales away from Allicd's fresh orange juice business. Should that fact be reflected in your analysis? If so, how? c. Disregard all the assumptions made in part b and assume there is no alternative use for the building over the next 4 years. Now calculate the project's NPV, IRR, MIRR, and payback. Do these indicators suggest that the project should be accepted? Explain. d. If this project had been a replacement rather than an expansion project, how would the analysis have changed? Think about the changes that would have to occur in the cash flow table. IC 12.1 allind'c Lamnn luice Project (in thousands) e. 1. What three levels, or types, of project risk are normally considered? 2. Which type is most relevant? 3. Which type is easiest to measure? 4. Are the three types of risk generally highly correlated? f. 1. What is sensitivity analysis? 2. How would you perform a sensitivity analysis on the unit sales, salvage value, and waCC it the project? Assume that each of these variables deviates from its base-case, or expected, sallo? by plus or minus 10%,20%, and 30%. Explain how you would calculate the NPV, IRR, MTRR. and payback for each case, but don't do the analysis urless your instructor asks you to. 3. What is the primary weakness of sensitivity analysis? What are its primary advantages? Work out quantitative answers to the remaining questions only ir your instructor asks you to. Also noe that it will take a long lime to do the calculations unless you are using an Excel model. g. Assume that inflation is expected to average 5% over the next 4 years and that this expectatien is reflected in the WACC. Moreover, inflation is expected to increase revenues and variable cosis bi h. The expected cash flows, considering inflation (in thousands of dollars), are given in Tabie 12 Allied's WACC is 10%. Assume that you are confident about the estimates of all the variatbes affect the cash flows except unit sales. If product acceptance is poor, sales would be only units a year, while a strong consumer response would produce sales of 125,00n units. !n e the Chapter 12 Cash Flow Estimation and Risk Analysis Allied's Lemon Juice Project Considering 5% Inflatinn LE IC 12.2 (o 60% of revenues. You believe that there is a 25% chance of cash costs would still amount to 60% excellent acceptance, and a 50% chance of average acceptance