Help with b) i ii iii and c)

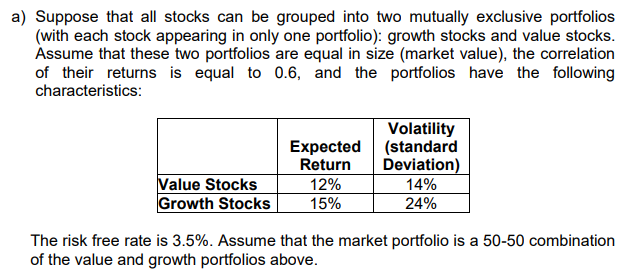

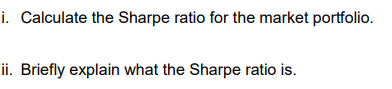

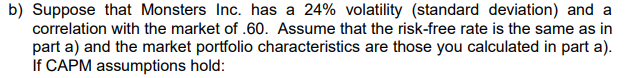

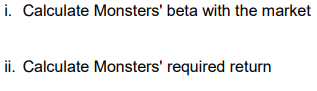

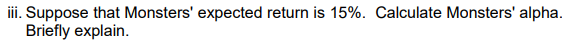

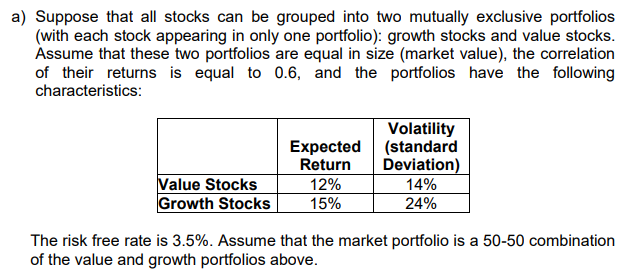

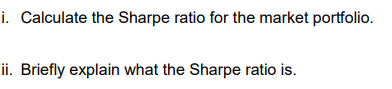

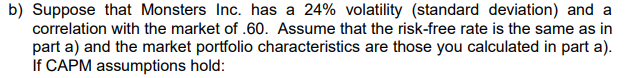

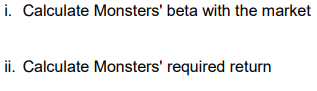

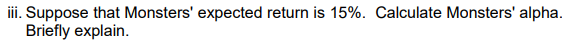

a) Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio): growth stocks and value stocks. Assume that these two portfolios are equal in size (market value), the correlation of their returns is equal to 0.6, and the portfolios have the following characteristics Volatility Expected(standard Value Stocks Growth Stocks | 12% 15% 24% The risk free rate is 3.5%. Assume that the market portfolio is a 50-50 combination of the value and growth portfolios above. i. Calculate the Sharpe ratio for the market portfolio. ii. Briefly explain what the Sharpe ratio is. b) Suppose that Monsters Inc. has a 24% volatility (standard deviation) and a correlation with the market of.60. Assume that the risk-free rate is the same as in part a) and the market portfolio characteristics are those you calculated in part a). If CAPM assumptions hold: i. Calculate Monsters' beta with the market ii. Calculate Monsters' required return iii. Suppose that Monsters' expected return is 15%. Calculate Monsters' alpha. Briefly explain. c) Describe the CAPM assumptions a) Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio): growth stocks and value stocks. Assume that these two portfolios are equal in size (market value), the correlation of their returns is equal to 0.6, and the portfolios have the following characteristics Volatility Expected(standard Value Stocks Growth Stocks | 12% 15% 24% The risk free rate is 3.5%. Assume that the market portfolio is a 50-50 combination of the value and growth portfolios above. i. Calculate the Sharpe ratio for the market portfolio. ii. Briefly explain what the Sharpe ratio is. b) Suppose that Monsters Inc. has a 24% volatility (standard deviation) and a correlation with the market of.60. Assume that the risk-free rate is the same as in part a) and the market portfolio characteristics are those you calculated in part a). If CAPM assumptions hold: i. Calculate Monsters' beta with the market ii. Calculate Monsters' required return iii. Suppose that Monsters' expected return is 15%. Calculate Monsters' alpha. Briefly explain. c) Describe the CAPM assumptions