Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with both for thumbs up (1 point) Suppose that for retirement purposes, over the course of 29 years, you make monthly deposits of $390.00

help with both for thumbs up

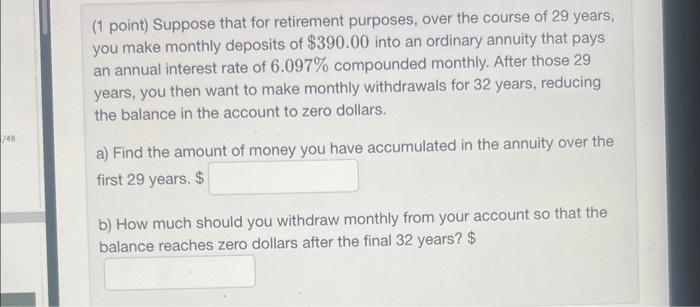

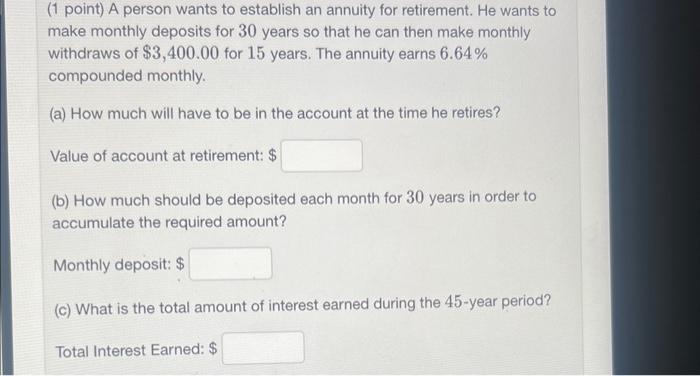

(1 point) Suppose that for retirement purposes, over the course of 29 years, you make monthly deposits of $390.00 into an ordinary annuity that pays an annual interest rate of 6.097% compounded monthly. After those 29 years, you then want to make monthly withdrawals for 32 years, reducing the balance in the account to zero dollars. a) Find the amount of money you have accumulated in the annuity over the first 29 years. $ b) How much should you withdraw monthly from your account so that the balance reaches zero dollars after the final 32 years? \$ (1 point) A person wants to establish an annuity for retirement. He wants to make monthly deposits for 30 years so that he can then make monthly withdraws of $3,400.00 for 15 years. The annuity earns 6.64% compounded monthly. (a) How much will have to be in the account at the time he retires? Value of account at retirement: $ (b) How much should be deposited each month for 30 years in order to accumulate the required amount? Monthly deposit: \$ (c) What is the total amount of interest earned during the 45-year period? Total Interest Earned: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started