Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with full question 2 plz Question 2 (June Supp 2012) Hotel Thule is developing a cost accounting system. Initially it has been decided to

help with full question 2 plz

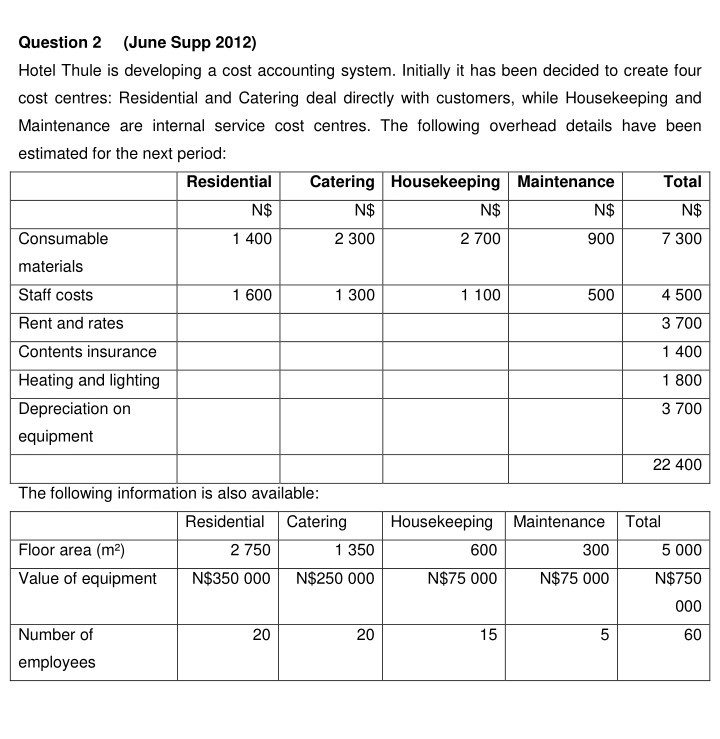

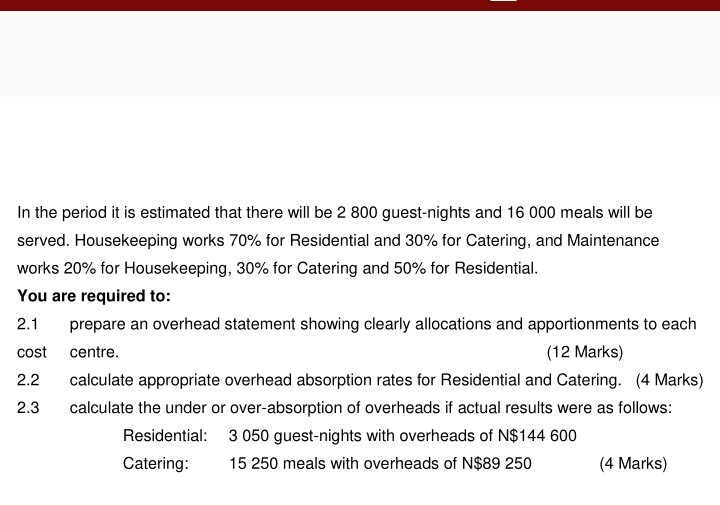

Question 2 (June Supp 2012) Hotel Thule is developing a cost accounting system. Initially it has been decided to create four cost centres: Residential and Catering deal directly with customers, while Housekeeping and Maintenance are internal service cost centres. The following overhead details have been estimated for the next period: Residential Catering Housekeeping Maintenance Total N$ N$ N$ N$ N$ Consumable 1 400 2 300 2 700 900 7 300 materials Staff costs 1 600 1 300 1 100 500 4 500 Rent and rates 3 700 Contents insurance 1 400 Heating and lighting 1 800 Depreciation on 3 700 equipment 22 400 The following information is also available: Residential Catering Housekeeping Maintenance Total Floor area (m2) 2 750 1 350 600 300 5 000 Value of equipment N$350 000 N$250 000 N$75 000 N$75 000 N$750 000 20 20 15 5 60 Number of employees In the period it is estimated that there will be 2 800 guest-nights and 16 000 meals will be served. Housekeeping works 70% for Residential and 30% for Catering, and Maintenance works 20% for Housekeeping, 30% for Catering and 50% for Residential. You are required to: 2.1 prepare an overhead statement showing clearly allocations and apportionments to each cost centre. (12 Marks) 2.2 calculate appropriate overhead absorption rates for Residential and Catering. (4 Marks) 2.3 calculate the under or over-absorption of overheads if actual results were as follows: Residential: 3 050 guest-nights with overheads of N$144 600 Catering: 15 250 meals with overheads of N$89 250 (4 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started