Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP with J only!! G=72.3095 H= 872.3095 I=1056.310764 Part JUsing your answers in Parts G/H and I, determine the percentage change (per year) in the

HELP with J only!!

HELP with J only!!

G=72.3095

H= 872.3095

I=1056.310764

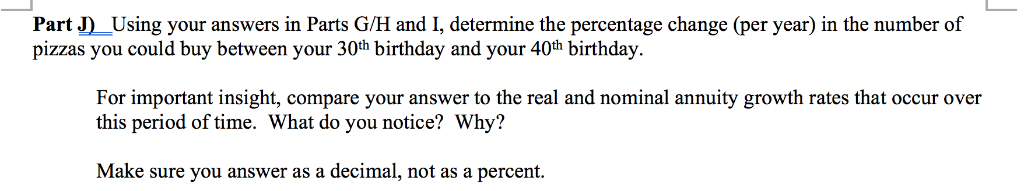

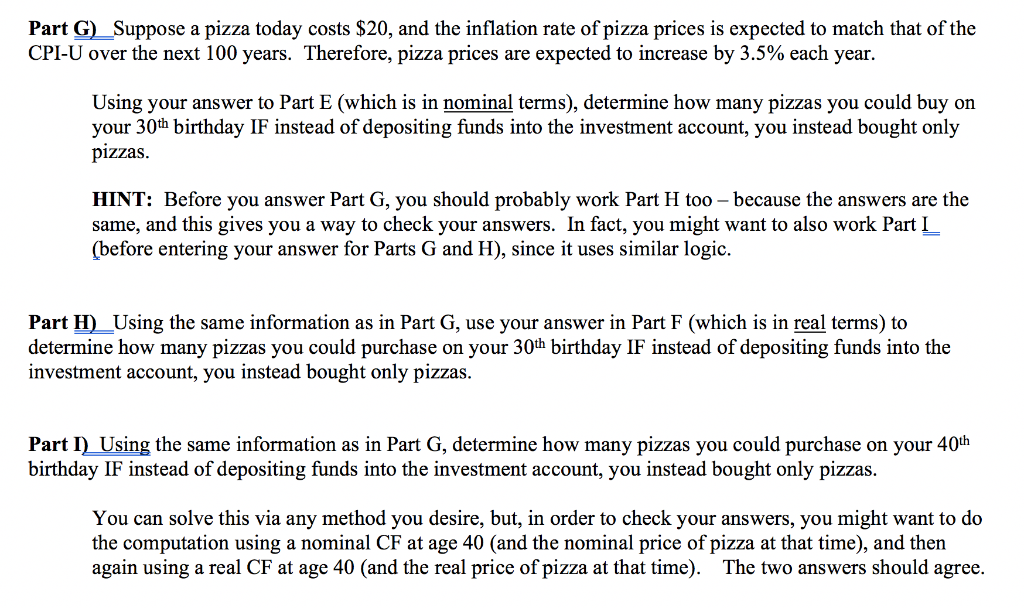

Part JUsing your answers in Parts G/H and I, determine the percentage change (per year) in the number of pizzas you could buy between your 30th birthday and your 40th birthday. For important insight, compare your answer to the real and nominal annuity growth rates that occur over this period of time. What do you notice? Why? Make sure you answer as a decimal, not as a percent. Part G) Suppose a pizza today costs $20, and the inflation rate of pizza prices is expected to match that of the CPI-U over the next 100 years. Therefore, pizza prices are expected to increase by 3.5% each year. Using your answer to Part E (which is in nominal terms), determine how many pizzas you could buy on your 30h birthday IF instead of depositing funds into the investment account, you instead bought only pizzas. HINT: Before you answer Part G, you should probably work Part H too -because the answers are the same, and this gives you a way to check your answers. In fact, you might want to also work Par L (before entering your answer for Parts G and H), since it uses similar logic. Part H) Using the same information as in Part G, use your answer in Part F (which is in real terms) to determine how many pizzas you could purchase on your 30th birthday IF instead of depositing funds into the investment account, you instead bought only pizzas Part I Using the same information as in Part G, determine how many pizzas you could purchase on your 40h birthday IF instead of depositing funds into the investment account, you instead bought only pizzas. You can solve this via any method you desire, but, in order to check your answers, you might want to do the computation using a nominal CF at age 40 (and the nominal price of pizza at that time), and then again using a real CF at age 40 (and the real price of pizza at that time). The two answers should agree Part JUsing your answers in Parts G/H and I, determine the percentage change (per year) in the number of pizzas you could buy between your 30th birthday and your 40th birthday. For important insight, compare your answer to the real and nominal annuity growth rates that occur over this period of time. What do you notice? Why? Make sure you answer as a decimal, not as a percent. Part G) Suppose a pizza today costs $20, and the inflation rate of pizza prices is expected to match that of the CPI-U over the next 100 years. Therefore, pizza prices are expected to increase by 3.5% each year. Using your answer to Part E (which is in nominal terms), determine how many pizzas you could buy on your 30h birthday IF instead of depositing funds into the investment account, you instead bought only pizzas. HINT: Before you answer Part G, you should probably work Part H too -because the answers are the same, and this gives you a way to check your answers. In fact, you might want to also work Par L (before entering your answer for Parts G and H), since it uses similar logic. Part H) Using the same information as in Part G, use your answer in Part F (which is in real terms) to determine how many pizzas you could purchase on your 30th birthday IF instead of depositing funds into the investment account, you instead bought only pizzas Part I Using the same information as in Part G, determine how many pizzas you could purchase on your 40h birthday IF instead of depositing funds into the investment account, you instead bought only pizzas. You can solve this via any method you desire, but, in order to check your answers, you might want to do the computation using a nominal CF at age 40 (and the nominal price of pizza at that time), and then again using a real CF at age 40 (and the real price of pizza at that time). The two answers should agree

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started